The three great lies: "Of course I'll respect you in the morning,' 'The check is in the mail,' and "I'm from the government, and I'm here to help you."

--Herschel Chicowitz

On Monday, rates for a 30 year fixed dropped from the mid six percent range to the mid/upper 5% range. Time to think about refi'ing....

http://bigpicture.typepad.com/comments/ ... fanni.html

http://www.bloomberg.com/apps/news?pid= ... refer=home

"The art of investment is the art of selling. Buying is a lesser skill and holding requires no skill at all."

-- Harry Schultz

Holy Shit!!!!

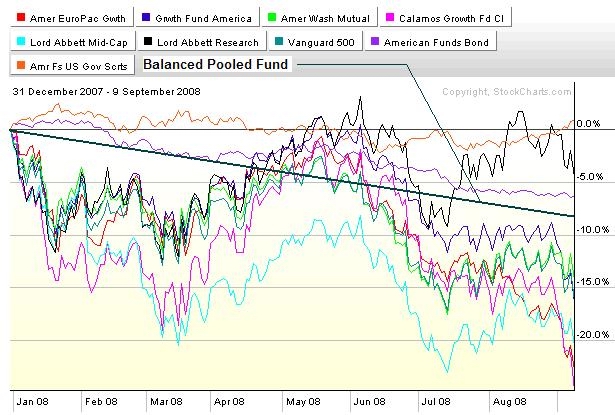

Click the SOB to get a GOOD look...

RERFX which made me some money over the last few years is down 22% for the year. Calamos, which also made me some jack over the last few years is down 24%. CHECK OUT THE NON GOV BONDS!!!! DOWN OVER 6% YTD!!!! Balanced Pooled Fund down 7% plus. I can see why the 401a advisor says to look at this no more often than once a year. Kinda like he hopes it'll be back up to even then.

HEY!!

There is nothing that will benefit your portfolio more than avoiding losses when the market is acting poorly. If you can keep from incurring losses in your portfolio as the market falls, you avoid the very unproductive task of recouping losses once the market is more favorable.

James “Reverend Shark” DePorre

Scope out your losses for the year to date and figure out how much you have to lose and how much you can keep with a little effort.

I'm maxed out in cash. Have been. Shoulda been a coupla months sooner.... I can live with that. I earned it when I could and kept most of what I made....

More to follow.....

There is nothing that will benefit your portfolio more than avoiding losses when the market is acting poorly. If you can keep from incurring losses in your portfolio as the market falls, you avoid the very unproductive task of recouping losses once the market is more favorable.

James “Reverend Shark” DePorre

Scope out your losses for the year to date and figure out how much you have to lose and how much you can keep with a little effort.

I'm maxed out in cash. Have been. Shoulda been a coupla months sooner.... I can live with that. I earned it when I could and kept most of what I made....

Calendar

Calendar