One day I sat thinking, almost in despair; a hand fell on my shoulder and a voice said reassuringly, "Cheer up, things could get worse." So I cheered up and, sure enough, things got worse. -- James Hagerty

The budget should be balanced, the treasury should be refilled; public debt should be reduced; and the arrogance of public officials should be controlled.

- Cicero, 106-43 B.C.

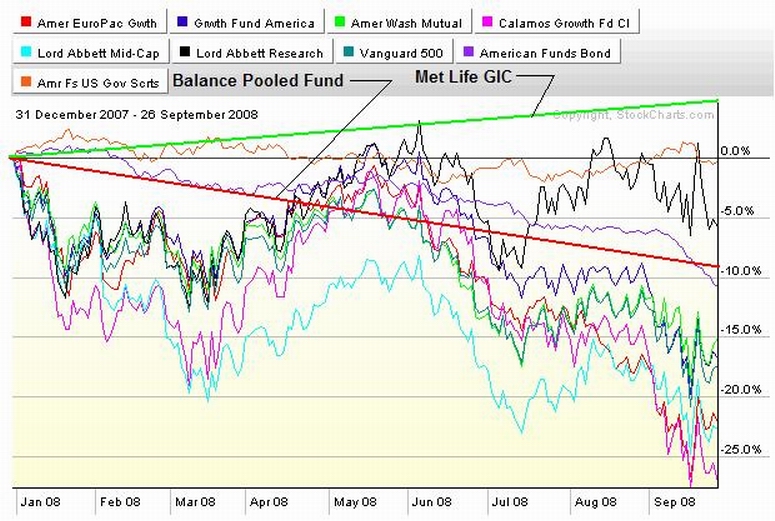

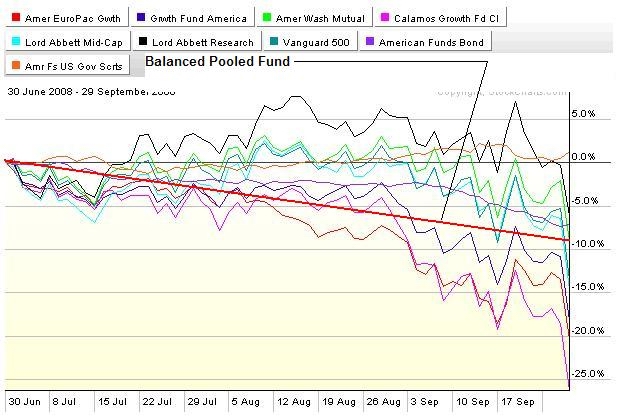

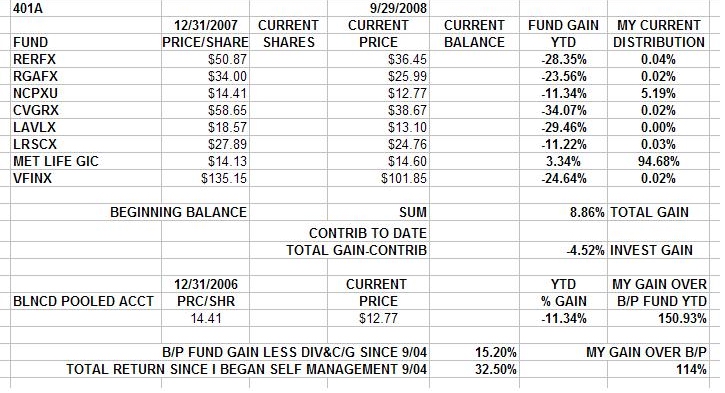

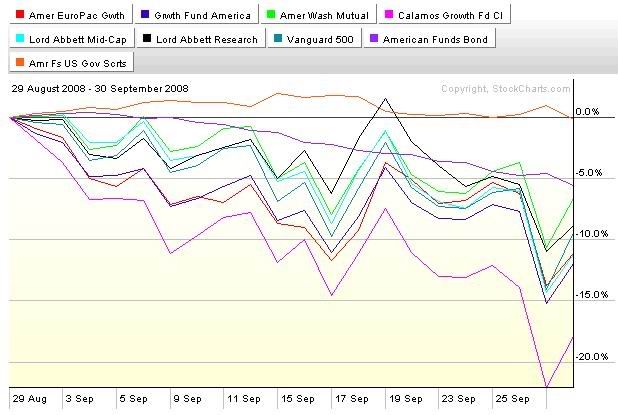

Charts and Table Zup on my website. There's gonna be a lot more here a for the weekend is over, But in the meantime, here's the moments' major personal concern, followed by some links... which are of incredible value for understanding what is and is not coming down this weekend...

UPDATED 10/2

CHECK IT OUT!!!!

Brothers and Sisters,

I'M CONCERNED AND NOT HAPPY

My 401a allocation;

ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GICALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GICALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GICALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC

AND THAT'S THE PROBLEM!

From the K and G website;

The MetLife Stable Value Fund provides a guarantee of both principal and interest for participant-initiated withdrawals.

AND

Guarantees are subject to MetLife's financial strength and claims paying ability.

Met Life's health is a matter of concern to knowledgeable individuals... See last week's COFGBLOG entry.

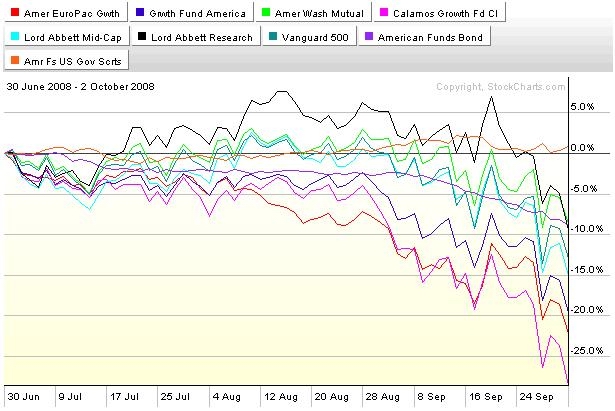

I've gone to "all cash" and it has been a very good move for me; See the charts on my web site. But I don't really have an insured cash balance like I should have. What I have is basically a solemn assurance from Met Life about the GIC. A qualified promise to pay unless circumstances intervene.

Met life is an insurance company, like AIG was. Is it too big to fail, like AIG? I don't want to find out. AIG has already failed and been rescued by the government and provided with $85 Billion of taxpayer funds. The public is in no mood to keep handing out money and the risk is Met Life might be allowed to fail as Lehman Bros was allowed to fail between the Bear Stearns rescue and the AIG rescue.

I'M CONCERNED.

My family IRA's and my trading account are all cash. As such, the cash balance is held in my broker's money market fund sweep account, where it is SIPC (Security Investors Protection Corporation) insured. The money in the bank savings account is FDIC (Federal Deposit Insurance Corporation) insured. The Federal government has stepped up to insure all the taxable money market funds after the Reserve Funds family "broke the buck". But...

My 401a "cash" is not insured.

But, I do however have a promise worth what a promise is always worth about getting my money back.....

I need an option in the 401a that is insured NOW, and I think you do too.

Call a Trust Fund Trustee in the morning and say so. Ask for an insured money market or insured deposit cash option in the 401a as quickly as possible.

If you agree with me, pass this on to other brothers and sisters in the local and spread the word. This is very important to me and I think it should be to you and all our Brothers and Sisters too.

If you have any questions, email me or check out www.joefacer.com.

Fraternally yours,

Joe Facer

Here's those links...

http://www.cnbc.com/id/15840232?video=868490137

http://bigpicture.typepad.com/comments/ ... he--3.html

http://bigpicture.typepad.com/comments/ ... e-ide.html

http://www.nytimes.com/2008/09/27/busin ... ref=slogin

http://bigpicture.typepad.com/comments/ ... age-c.html

http://www.cnbc.com/id/26888701

Merkel always make a ton of sense and plays in a much tighter, less forgiving kind of arena. This carries a lot of credibility with me...

http://alephblog.com/2008/09/26/let-the ... ilout-die/

An alternative to papering over the problem with our money.....

http://bigpicture.typepad.com/comments/ ... ative.html

Think about how close the FDIC might be to the edge...

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://debka.com/headline.php?hid=5613

Clickit!!!!!

"Careful. We don't want to learn from this."

--Calvin & Hobbes comic strip.

http://bigpicture.typepad.com/comments/ ... street.pdf

http://bigpicture.typepad.com/comments/ ... age-c.html

UPDATED 9/29

ONE MORE DAY LEFT IN THE QUARTER, THANK GAWD!!!!!

CLICKIT!!!!

I HAVE NO PATIENCE WITH "YOU CAN'T TIME THE MARKET".

I HAVE PROBLEMS WITH "THE LONG RUN" TOO.

I CAN'T AFFORD TO LOOK AWAY.

I WORKED HARD FOR THE MONEY.

NOW I WORK HARD TO KEEP IT.

I'VE SAVED MYSELF A LOT OF "CATCH UP".

EXACTLY WHAT DID I MISS BY BEING OUT OF THE MARKET?

CLICKIT!!!!!

9/30 BETTER, BUT NOT GOOD.......

CLICKIT!!!!!

10/2 STILL IN A DOWNTREND... THIS LOOKS LIKE AN UNCONTROLLABLE HEMMORAGE OF FUNDS LEFT IN STOCKS. ONE DAY THIS STUFF WILL BE CHEAP AND BUYABLE. BUT NOT TODAY. PROLLY NOT TOMORROW EITHER. I'LL POST RIGHT HERE WHEN THINK IT'S TIME TO PULL THE TRIGGER ON REINVESTING OUT OF CASH AND INTO STOCKS....

CLICKIT!!!!!

From the K and G website;

The MetLife Stable Value Fund provides a guarantee of both principal and interest for participant-initiated withdrawals.

Guarantees are subject to MetLife's financial strength and claims paying ability.

I'M CONCERNED.

My family IRA's and my trading account are all cash. As such, the cash balance is held in my broker's money market fund sweep account, where it is SIPC (Security Investors Protection Corporation) insured. The money in the bank savings account is FDIC (Federal Deposit Insurance Corporation) insured. The Federal government has stepped up to insure all the taxable money market funds after the Reserve Funds family "broke the buck". But...

My 401a "cash" is not insured.

But, I do however have a promise worth what a promise is always worth about getting my money back.....

I need an option in the 401a that is insured NOW, and I think you do too.

Call a Trust Fund Trustee in the morning and say so. Ask for an insured money market or insured deposit cash option in the 401a as quickly as possible.

If you agree with me, pass this on to other brothers and sisters in the local and spread the word. This is very important to me and I think it should be to you and all our Brothers and Sisters too.

If you have any questions, email me or check out www.joefacer.com.

Fraternally yours,

Joe Facer

Here's those links...

"Careful. We don't want to learn from this."

--Calvin & Hobbes comic strip.

ONE MORE DAY LEFT IN THE QUARTER, THANK GAWD!!!!!

CLICKIT!!!!

I HAVE NO PATIENCE WITH "YOU CAN'T TIME THE MARKET".

I HAVE PROBLEMS WITH "THE LONG RUN" TOO.

I CAN'T AFFORD TO LOOK AWAY.

I WORKED HARD FOR THE MONEY.

NOW I WORK HARD TO KEEP IT.

I'VE SAVED MYSELF A LOT OF "CATCH UP".

EXACTLY WHAT DID I MISS BY BEING OUT OF THE MARKET?

CLICKIT!!!!!

9/30 BETTER, BUT NOT GOOD.......

CLICKIT!!!!!

10/2 STILL IN A DOWNTREND... THIS LOOKS LIKE AN UNCONTROLLABLE HEMMORAGE OF FUNDS LEFT IN STOCKS. ONE DAY THIS STUFF WILL BE CHEAP AND BUYABLE. BUT NOT TODAY. PROLLY NOT TOMORROW EITHER. I'LL POST RIGHT HERE WHEN THINK IT'S TIME TO PULL THE TRIGGER ON REINVESTING OUT OF CASH AND INTO STOCKS....

CLICKIT!!!!!

Calendar

Calendar