Juxtaposition A Descent Into Unemployment And Recession Hell For A Significant Portion Of The Country/World With The Holiday Cheer Of Those Still Well Off; So it Goes.....

"Every banker knows that if he has to prove that he is worthy of credit, however good may be his argument, in fact, his credit is gone."

Walter Bagehot

Chartz and Table Zup at www.joefacer.com

UPDATED 12/9

Part One of How I Run My 401a is Here: http://joefacer.com/pblog/index.php?m=1 ... 107-195005

Let's see if I can lay down Part Two so it stays there....

HOW I RUN MY 401A

PART 2

In Part One, I dissed the American Funds Bond Fund of America. I noted in passing that I considered the Met Life Guaranteed Income Contract (GIC) and the American Fundz Government Securities Fund (RGVEX) to be better choices for me. Is this what I consider to be an unalloyed, no brainer, never look back, believe it bigtime recommendation without reservation or qualification?

GIMME A BREAK!!!!

GIC participants give MET Life a wad of money. In return, MET promises to give it back in part or in total on demand and to pay gains based on what they hold at a guaranteed predetermined annual rate. They earn the gains through investing and keep any earnings that exceed the guaranteed rate. The guarantee is their stated intention to do what they say. No More, No Less.

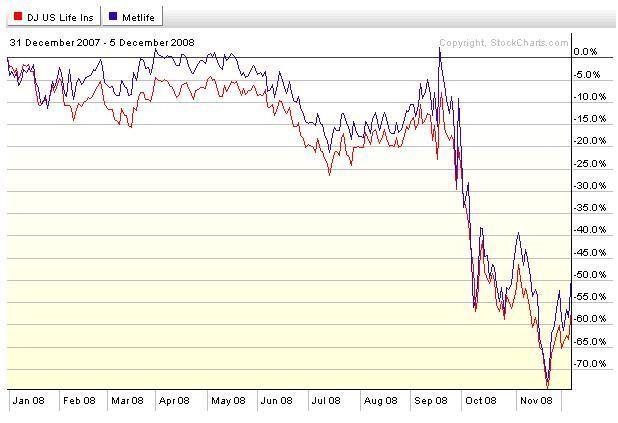

I like the GIC, in principal. The rate of return is attractive and automatic. If they hiccup, they dig into their wallet and make it good. In a normal environment, what's not to like? MET Life is a major player with a history and has economies of scale and is hopefully "Too Big To Fail". But the "Guarantee" is a promise, not insurance from someone with deeper pockets. In exceptional circumstances, the promise and the company can go away. So I carry the responsibility to make sure that they don't lose my money when I'm not looking. Speaking of not looking, here's what I don't not see when I DO look...

HOW I RUN MY 401A

PART 2

GIMME A BREAK!!!!

CLICKIT

I don't like what I see. Above is a chart of the Dow Jones Life Insurance index and MET Life. MET is in the toilet, so's the rest of the industry. These are pretty exceptional times. It does not appear that there is another company in the industry strong enough to buy out MET and if there were, there are other buyout choices all over the landscape. I don't care how much I like the casino; no matter how good the restaurants or how generous the tables or comps, if it is on fire, I'm out the door. The GIC is a portfolio of investments, probably diverse, prolly "best in class", prolly "good solid companies" and "safe, secure bonds" and maybe goin' down in flames. If it was just one portfolio and MET was going strong, I'd be more confident. But it is, it ain't, and I'm not. I could find out if the portfolio was all treasuries, but if MET Life went down what would happen to the GIC, treasuries or junk, whatever? If the portfolio was half stocks and half mortgage bonds, what then? I could hang around and figure it out, or.....I could bail out.

ADIOS

The GIC may be just fine. I really don't know. I just ain't gonna find out the hard way. I may put all my money back into the GIC in the near future. But that's another story that is being written even as I type. Stay tooned.

The bottom line is that ordinarily, I consider the GIC to be a good alternative to cash, better than bonds for return, and almost as secure ... but these ain't ordinary times. If we had a Federal money Market Fund available to the 401a, I'd be all in in a heartbeat. We should, but we don't. Talk to the Trustees about that.... So I'm elsewhere. And that's another story. Stay tooned.

So that leaves the American Funds Government Securities Fund (RGVEX). I went through some of what we're goin' troo before in the 80's. Chrysler was going belly up, real estate and Savings And Loans were going down in flames and Paul Volker, the same one who is Obama's advisor, had jacked up interest rates to where I was earning 18% in my money market fund and the Federal Government was paying me 12% to hold double tax free bonds. Money cost a fortune and the odds were good that the country would go broke because they couldn't afford to borrow any. I wanted a safe place to put my money. I found it in Franklin Funds Government Money Market Funds. They held T bills and notes and had an average maturity of under a week. An entity with a standing army, guns, tanks, submarines, the need to win elections and the right to tax and print money owed me short term money and was paying me good interest rates. It was far superior to having money buried in the back yard and every bit as safe.

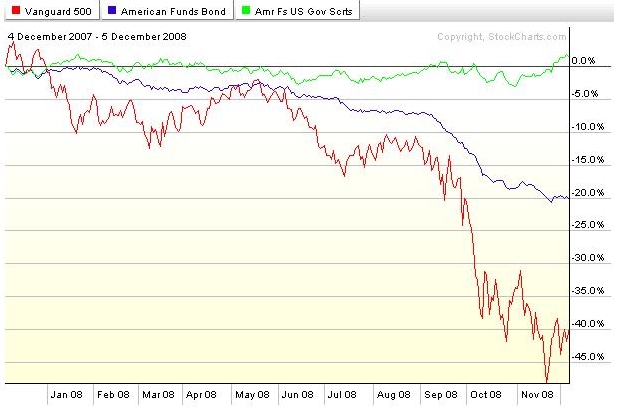

Then we have RGVEX. it is a Government bond fund. Here's a year of chart showing a stock market index fund (VFINX), a corporate bond fund (RBFFX) and RGVEX, all available in the 401a.

CLICKIT!!!!

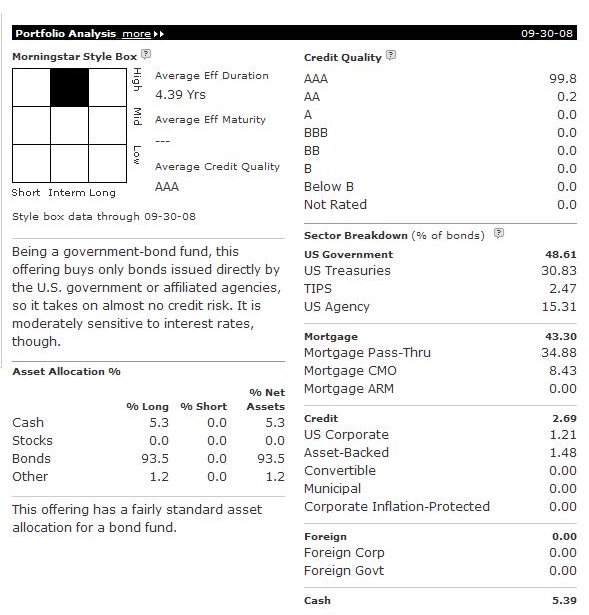

Here's what I find of interest at Morningstar regarding RGVEX

CLICKIT!!!!

and here's the link to the whole Morningstar page.

http://quicktake.morningstar.com/FundNe ... mbol=RGVEX

This is a far cry from my old Franklin Fund. It has almost as much in mortgage bonds as it does in treasuries and it has a little in corporate bonds, just to piss you off. This SUCKS!!

BUT

The FED sez that it will stand behind any and all bonds and bond like things like RMBS, CDO's and CMO's that it decides to and make it all good (except what it doesn't). And it will do so even if it has to create a huge pile of debt that will beggar our children and grandchildren.

Fair enuf.

It's not what I want. But I think that RGVEX and the FED look better than the MET GIC does here and now.... An' "Ya Can't Always Get What Ya Want. But If Ya Try Sometimes, Ya Get What Ya Need."

'Sides lookie here...

CLICKIT!!!!

The TLT has gone parabolic in the last 20 days. Two possibilities. People are bidding up the price of treasuries to where they are paying the face value of the bond AND some years of the interest that the bond will pay. This might mean since financial entities can't hold huge piles of cash in a back room and are scared to death that everything other than treasuries will probably become worthless, that they have to buy treasuries.

OR

The economy is going into such a deep hole without actually blowing up, that zero earnings will look mighty fine in two years compared to what stocks will do, even from these levels.

TUESDAY THE 9TH;

FOUR WEEK T BILLS YIELDING 0.00%

THREE MONTH T BILLS YIELD 0.005%

Smells like fear of a second leg down to me. HANG ON!!!!!!

What it means for me is that I've been in RGVEX for 40 days and I've made 3% in the last 20 days. I'd blow out of RGVEX and into the GIC to lock in the gain in a New York minute, except see above.

Never a dull moment. Stay tooned.

The GIC may be just fine. I really don't know. I just ain't gonna find out the hard way. I may put all my money back into the GIC in the near future. But that's another story that is being written even as I type. Stay tooned.

The bottom line is that ordinarily, I consider the GIC to be a good alternative to cash, better than bonds for return, and almost as secure ... but these ain't ordinary times. If we had a Federal money Market Fund available to the 401a, I'd be all in in a heartbeat. We should, but we don't. Talk to the Trustees about that.... So I'm elsewhere. And that's another story. Stay tooned.

So that leaves the American Funds Government Securities Fund (RGVEX). I went through some of what we're goin' troo before in the 80's. Chrysler was going belly up, real estate and Savings And Loans were going down in flames and Paul Volker, the same one who is Obama's advisor, had jacked up interest rates to where I was earning 18% in my money market fund and the Federal Government was paying me 12% to hold double tax free bonds. Money cost a fortune and the odds were good that the country would go broke because they couldn't afford to borrow any. I wanted a safe place to put my money. I found it in Franklin Funds Government Money Market Funds. They held T bills and notes and had an average maturity of under a week. An entity with a standing army, guns, tanks, submarines, the need to win elections and the right to tax and print money owed me short term money and was paying me good interest rates. It was far superior to having money buried in the back yard and every bit as safe.

Then we have RGVEX. it is a Government bond fund. Here's a year of chart showing a stock market index fund (VFINX), a corporate bond fund (RBFFX) and RGVEX, all available in the 401a.

CLICKIT!!!!

Here's what I find of interest at Morningstar regarding RGVEX

CLICKIT!!!!

and here's the link to the whole Morningstar page.

http://quicktake.morningstar.com/FundNe ... mbol=RGVEX

This is a far cry from my old Franklin Fund. It has almost as much in mortgage bonds as it does in treasuries and it has a little in corporate bonds, just to piss you off. This SUCKS!!

The FED sez that it will stand behind any and all bonds and bond like things like RMBS, CDO's and CMO's that it decides to and make it all good (except what it doesn't). And it will do so even if it has to create a huge pile of debt that will beggar our children and grandchildren.

Fair enuf.

It's not what I want. But I think that RGVEX and the FED look better than the MET GIC does here and now.... An' "Ya Can't Always Get What Ya Want. But If Ya Try Sometimes, Ya Get What Ya Need."

'Sides lookie here...

CLICKIT!!!!

The TLT has gone parabolic in the last 20 days. Two possibilities. People are bidding up the price of treasuries to where they are paying the face value of the bond AND some years of the interest that the bond will pay. This might mean since financial entities can't hold huge piles of cash in a back room and are scared to death that everything other than treasuries will probably become worthless, that they have to buy treasuries.

OR

The economy is going into such a deep hole without actually blowing up, that zero earnings will look mighty fine in two years compared to what stocks will do, even from these levels.

FOUR WEEK T BILLS YIELDING 0.00%

THREE MONTH T BILLS YIELD 0.005%

Smells like fear of a second leg down to me. HANG ON!!!!!!

What it means for me is that I've been in RGVEX for 40 days and I've made 3% in the last 20 days. I'd blow out of RGVEX and into the GIC to lock in the gain in a New York minute, except see above.

Never a dull moment. Stay tooned.

Calendar

Calendar