Saturday, December 20, 2008, 02:03 AM

Hope is a good breakfast but a bad supper.

-- Sir Francis Bacon

He that lives upon hope will die fasting.

-- Benjamin Franklin"

In any moment of decision, the best thing you can do is the right thing, the next best thing is the wrong thing, and the worst thing you can do is nothing."

-- Theodore Roosevelt

Charts and Table Zup @ www.joefacer.com

We were all given a huge opportunity when we gained control over part of our retirement savings with the advent of the 401a. Then we were lied to about how easy it would be and how much better we would be if we just left it in the hands of and to the judgement of others. We were left hoping it would work out OK. We were told patience was the best strategy, and we were told to fear doing anything since it might be wrong. We were left with the "Deer In The Headlight"(DIH) strategy to fall back on...

IT DOES NOT HAVE TO BE THAT WAY.

You could do what I do instead. I stay informed of the big picture and time the market off the macro news, you know, the headlines. Oh. And I do peek around the corner of the curtain now and then to see what the man behind the curtain is REALLY doin'.

Check dis out....

CLICKIT!!!

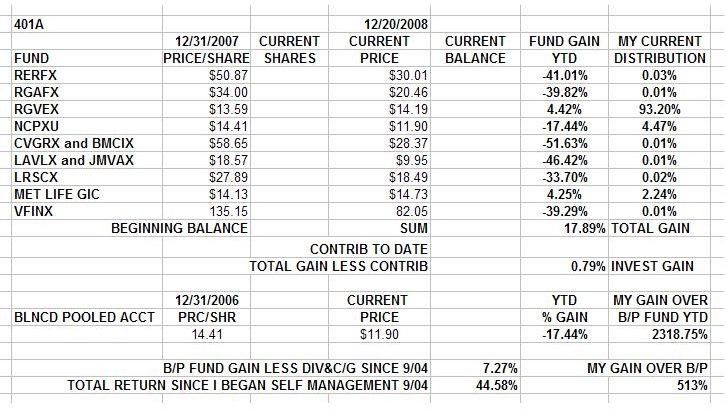

This is my 401a account. If you check the charts on my website, you see that we've hit A bottom in stocks, but prolly not THE bottom. The bounce has been 10% and maybe there is some more to come. You'd think that'd help our returns. But the numbers on the table for the individual stock funds look really terrible regardless of the bounce.

My numbers on the other hand look pretty good. Coupla things of note. I'm showing a 17% TOTAL GAIN for the year and a .79% INVESTment GAIN. The 17% overall gain comes from me contributing near the max for most of the year. I'm old and I gotta save while I can still earn. AND, I save big time on the 401a tax break. I avoid the huge income tax hit. There is NO PLACE ELSE where I can make this much money this easily. Works for me. I have 17% more money at the end of the year than I had at the beginning of the year. Ignore the plus 2300% over the Balanced Pooled Fund. When the difference is this huge, a horrible loss versus a tiny gain, percentages are meaningless. Suffice it to say that it looks like I'll finish the year having not lost any money on my 401a investments and even having made a little on my investing.

The .79% investment gain comes in two parts. First, a small loss comes from staying in stocks too long early in the year, trying to find someplace where money was still being made. When I couldn't make money in stocks anywhere in the 401a, I cut my losses. That put me into the GIC in late spring, a hand full of percentage points in the red. I made a few dollars in the GIC during the summer and clawed back a point or two while things deteriorated all over the world. When things REALLY got bad, I became concerned about MET LIFE and its ability to pay on the GIC. I bailed on MET in early October and went to the FEDS in RGVEX. I got there first and bought in in the first weeks of October. In November, everyone else in the world woke up and followed me into Treasuries, driving up the prices beyond all reason or even imagination. That really worked well. I got back to positive for the year

I'VE MADE 4% IN 6 WEEKS!!! ON HALF TREASURIES AND HALF MORTGAGE BONDS!!!!

This is good.

I can use the money.

THIS IS ALSO VERY BAD!!!

This means smart money is paying $1.05 or $1.10 now to get a 99 cents back later in the year or next year. Either they are in a huge blind reasonless panic, making this a huge opportunity for me... Or, they see something awful beyond comprehension coming up over the horizon. Either the risk/reward of big money panicing is awesome and a godsend especially for this time of the year.... or maybe it's time to relearn how to grow and can food.

Bottom Line; The huge opportunity in the 401a is currently in place and it can be taken advantage of. I've averaged 11% a year return since we've gotten funds in the 401a worth investing in. I've kept my gains through a time period rivaling the depression for investors misery. While our defined benefit fund was stuck on the tracks watching losses come down the line at 100 MPH, destroying the value of the defined benefit pension fund, participants in the 401a could seek a safe haven for their defined contribution pension money. Pretty Kool....

Stay tooned.

http://www.youtube.com/watch?v=90ELleCQvew

more to follow....

Comments are not available for this entry.