Defined Benefit Pensions Plans In Trouble And Why Doin' The Smart Thing in my 401a Feels So Painful...

Saturday, February 28, 2009, 02:22 PM

Ninety percent of politics is deciding whom to blame.

-- Meg Greenfield

CHARTZ AND TABLE ZUP @ WWW.JOEFACER.COM

UPDATED CONSTANTLY....OR NOT. EDITS OF EXISTING POSTS NOT CALLED OUT.

LOOK FOR THE DAY OF THE WEEK FOR NEW ADDITIONS.

I talked this week with a friend who participates in the boilermakers' defined benefit pension plan . He said that he had received a letter recently from the pension fund announcing that all pensions were to be halved. This sounds like what would happen if the pension plan were to fall low enough in assets to trigger the Pension Benefit Guaranty Corp (PGBC) guaranty. As I understand it, when a pension plan's assets vs their liabilities fall enough, the PBGC steps in and cuts pension payouts by a complex formula that ballparks as roughly a 50% cut. All non monetary benefits are canceled and the PBGC loans the pension plan funds to meet its obligations until the plan can be funded adequately with more contributions. I have not seen the letter, but I consider him to be a reliable sources given that what I got was a conversational summary of the letter.

I also talked to a friend who attended a recent meeting at the electricians local who said he was told that if things did not change for the better, that the defined benefit pension plan would fall below critical funding requirements by 2014, requiring default. His pension plan had reduced the pension credit paid for last year and he was told that it would be cut this year by an additional 40%.

I received the usual yearly legally required letter from my defined benefit pension plan last year and it was noted that additional contributions would be required this year to maintain funding. This is not surprising, given the chaos in the financial markets, but it would be a damn good thing to have enough details to be understand what the situation is and to be able to plan and react appropriately.

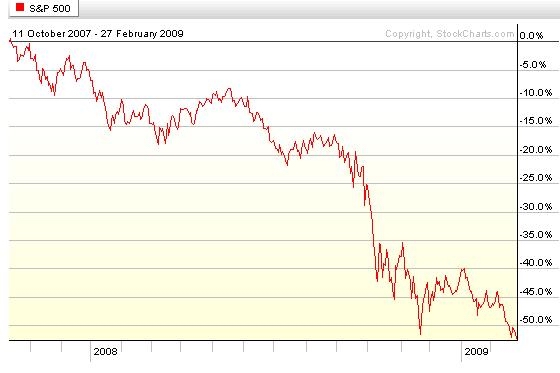

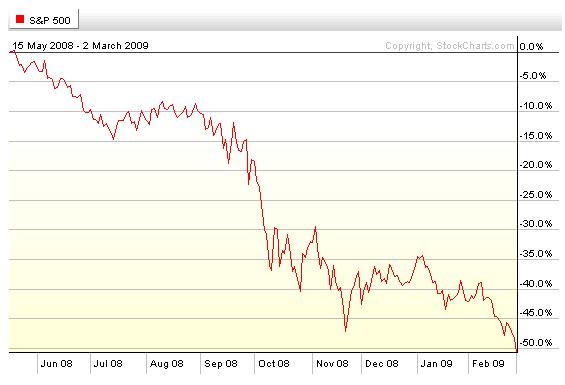

Last November was the point of maximum panic. The current hope for a recovery in the market has been the belief that November was THE LOW for this cycle. Now we are about to find out if this is true. We hit the low last week and we test the November low this week. The main difference this time is that it is not a "fire in the theater and only one exit" panic. It is more of a abandon all hope 'cuz not only is it REALLY REALLY bad, no matter how bad yesterday was, today's news just gets worse.

HANG ONNnnn!!!!!

MONDAY

Blew right through the prior low.

LOOK OUT BELOW!!!!!!!!!

TUESDAY

GAWD WHAT A CRUMMY TWO DAYS!!!!

'NUFF SAID

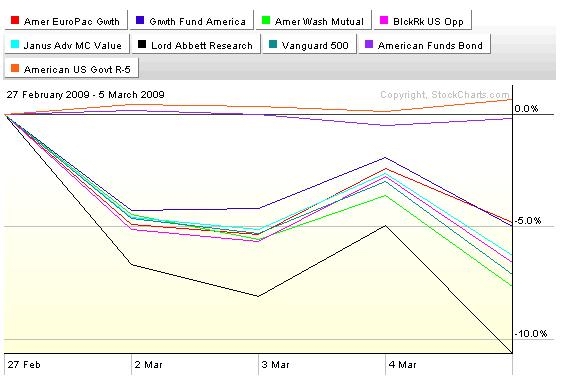

THURSDAY

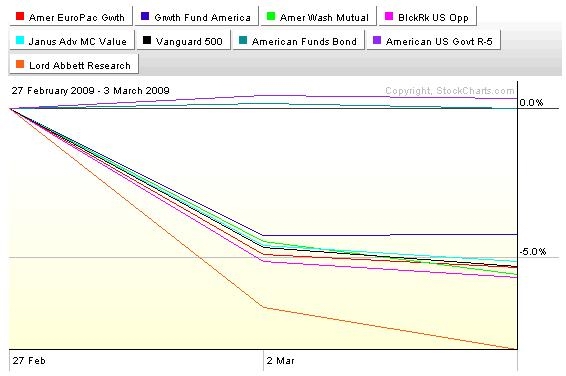

WAS IT TOO LATE TO SELL MONDAY?

NOPE. BETWEEN FRIDAY AFTERNOON AND THURSDAY AFTERNOON, I'D A LOST A PRETTY GOOD YEAR'S WORTH OF RETURNS IF I HAD STILL BEEN IN THE MARKET....

GAWD WHAT A CRUMMY 4 DAYS!!!!

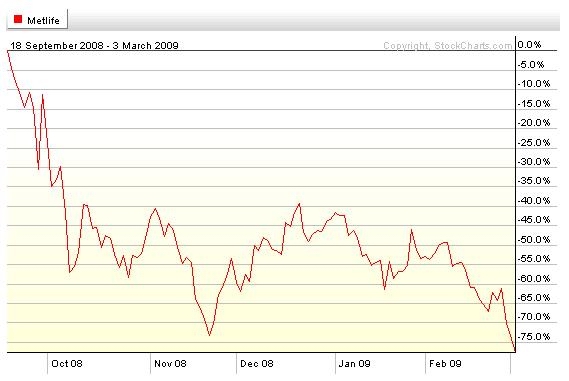

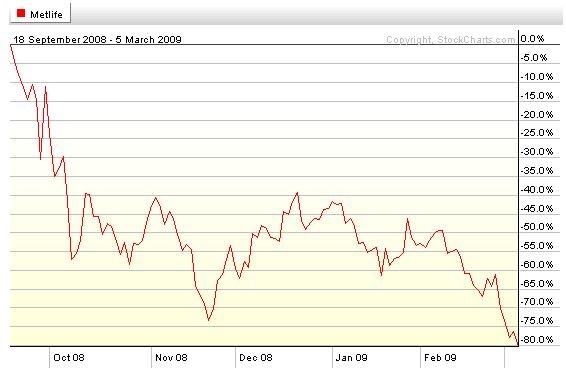

WOULD I BE WORRIED ABOUT HAVING MONEY IN MET LIFE? IF I HAD MONEY IN MET LIFE In THE FIRST PLACE? MORE THAN 'NUFF SAID...

Stay tooned...

Comments are not available for this entry.

Calendar

Calendar