| |

Well....That Didn't Turn Out As Nearly As Well As I Hoped It Would......

Saturday, April 18, 2009, 02:17 PM

"No one that ever lived has ever had enough power, prestige, or knowledge to overcome the basic condition of all life -- you win some and you lose some."

-- Ken Keyes, Jr.

Chartz and Table Zup @ www.joefacer.com

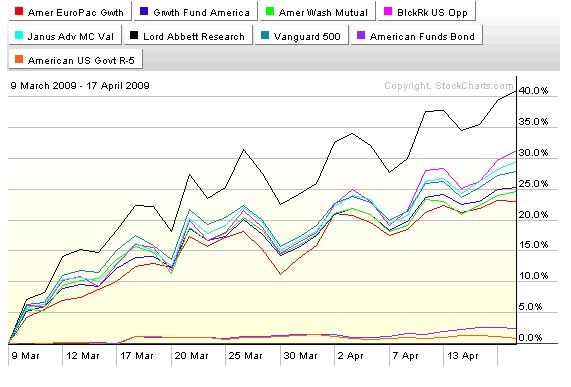

Here's the dilemma; Big Time Caution was big time right onna way down. At some point, that caution would have/ will need to be tempered with aggressiveness, and at some point, my typically overconfident insanely aggressive nature will would have/ will need to be unleashed. In a perfect world, I'd a' gone WFO to the long side on 3/9 to date. Lookie here...

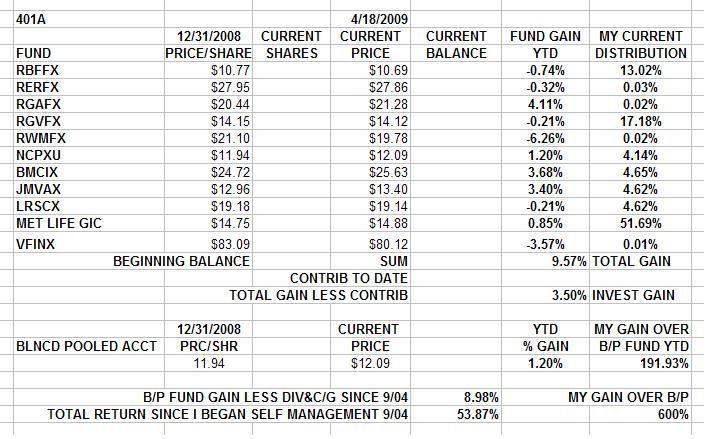

Instead, I was a week late to the party, only partially there and I left at least a coupla weeks early. I got some, but not nearly as much as I'd have liked. On the one hand, that's a little whiney coming from a guy with over 50% returns in his 401a over the last five years. On the other hand, I'm in position to take advantage of some serious compounding of returns and I don't like to watch potential returns fade away into the distance after doing this much work.

So.... 20% to 40% gains is many years worth of very good returns. That happened in 6 weeks. Is the party over? Am I coming out of the kitchen just as the cops come in the front and the flash mob comes in through the back door?

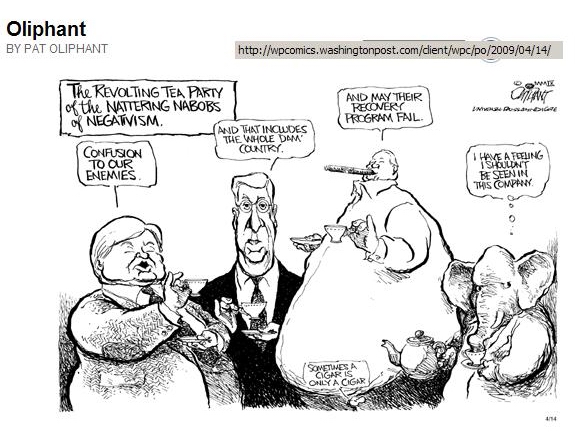

There is a huge amount of institutional managed cash out there that exhibited a lot more caution than I did and managers could be hearing from clients asking "WTF am I paying you fees for when the market is up 50% and I'm not innit??" There's money available on the sidelines to chase the market higher. Will it? Will it chase before or after a correction? Or two? How long will the disconnect between the market and the economy last and how will it resolve? Is this the mother of all bull traps? How much risk is left in a market that's down 50%? Why is everybody getting jiggy over fewer than expected foreclosures when the administration has been beating "voluntary" moratoriums out of the mortgage holders. Why is the administration getting stiff armed on the PPIP? (Hint...'cuz the banks see an "end around" that works better)

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://online.wsj.com/article/SB124016633014432579.html

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.msnbc.msn.com/id/30293461/

http://www.ritholtz.com/blog/2009/04/fo ... ts-ending/

http://www.pbs.org/wgbh/pages/frontline/meltdown/

http://www.ritholtz.com/blog/2009/04/su ... ales-fall/

http://www.ritholtz.com/blog/2009/04/fo ... urnaround/

http://www.ritholtz.com/blog/2009/04/fingering-aig/

http://www.ritholtz.com/blog/2009/04/bo ... t-selling/

http://www.ritholtz.com/blog/2009/04/ar ... reopening/

http://www.ritholtz.com/blog/2009/04/st ... e-summers/

http://www.ritholtz.com/blog/2009/04/gr ... r-suckers/

http://www.ritholtz.com/blog/2009/04/fo ... igh-in-q1/

http://www.ritholtz.com/blog/2009/04/se ... oversight/

http://www.ritholtz.com/blog/2009/04/be ... t-rally-4/

http://www.ritholtz.com/blog/2009/04/sa ... o-frannie/

http://www.ritholtz.com/blog/2009/04/fm ... ve-public/

http://www.ritholtz.com/blog/2009/04/ho ... chs-style/

http://www.ritholtz.com/blog/2009/04/ho ... the-world/

http://www.ritholtz.com/blog/2009/04/wo ... t-decline/

I changed my 401a allocation Friday. What was I thinking?

I was thinking of getting some exposure to the action, late or not, whatever direction it may be. It is DANGEROUS to chase stocks big time after a 25% or 50% move. That is not how the game is played. The last one in is invariably an innocent or a fool. Who'd we sell Rockefeller Center and Pebble Beach to at the top in the late 80's? The Japanese. We quoted the price in yen and it was cheap by Tokyo standards. Who bought PALM at $800 and Enron at $100 in 2000 and rode them down to a dollar or two in 2001? People who planned on selling when it doubled and then waited to get back to even... )Of course, we're not AT a top. And I'm neither an innocent or a fool. And stocks will at some time, go up.

That said.... If ya wanna find darkness and despair, ya can with lookin' too hard. Check out the last 6 weeks links. Eighteen percent unemployment in Elkhart ID. Don't look it as a high paid union worker legacy problem. Most of the RV and industrial shops that have gone down were non union. Jobs didn't go to where labor was cheaper... they ceased to exist. White collar GM employees (clerks and managers) facing losing pensions or reduced pensions. money out of the economy. Seniors scrabbling after Micky D's jobs in competition with the teeny boppers. Autos and real estate and financial and retail and muni and manufacturing jobs gone away. There has been a bounce the last month or so....but last year /first of this year the economy looked down into the abyss. Everyone slammed production and employment and orders down to less than maintenance levels. And like in the 80's, when we had 12% unemployment (apples and oranges, they've since jiggered the numbers) when you subtracted the unemployed from the employed, you still has people with jobs and income to buy with. So we've bounced. Sales and production have picked up and the loss of jobs have slowed. But the direction of the economy is still down. The economy can and will get worse, and there are still jobs and money to be lost and written down.

But the market discounts the present and buys the future. If investors think they see the bottom, or the slope lessening as we approach the bottom, they will look across the valley bottom to the upward slope of the other side. The market CAN go up as things get worse. Or not.

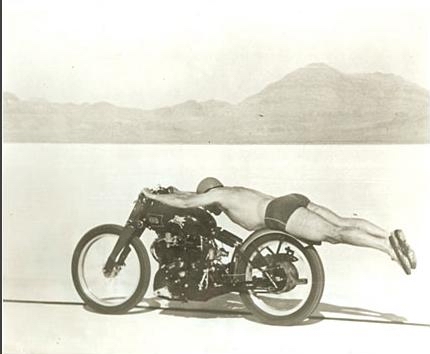

So I've taken a single step into the action. If there is still action to the upside, I'm there. If it shows legs, I can take a second step. If the market does a 100 MPH faceplant well below this years lows, I'm only a step away from the door, and 85% intact for the ride up off the real bottom whenever it happens.

Call it a calculated risk...and make no mistake, the emphasis is on risk.

Stay toooned.....

I think of myself as aggressive and focused and I've seen 145 MPH and still accelerating on my street bike running toward Turn One at Thunderhill, and I've run my race bike there even harder .... but DAMN, some of them old guys....hangin' on at 150 MPH through the measured mile after the bike has topped out on a very long run up!!!!!

http://en.wikipedia.org/wiki/Rollie_Free

Comments

Comments are not available for this entry.

|

|