Tick Tick Tick..... Earning Season Starts Inna Middle O' Da Week. Is My Strategy Deer Inna Headlights? A Rational Approach To A Critical Juncture Of Risk And Reward? Or The Result Of Random Neural Output From The Brain Of An Old Broken Down Pipefitter With Too Many Nights Of Sex, Drugs, And Rock 'n Roll And Too Many Days Of Twistin' The Wrist An' Chasin' Down The Racer Ahead And Runnin' From The Racer Behind...?

Saturday, October 10, 2009, 04:52 PM

It's all fun and games until someone gets hurt.

-- Mom

We are half a week from a fulcrum point. Think of a hallway with a door at each end. Ya open the door, walk through to the other door , open it, and walk through. Now think of the hallways set up in haunted mansions as death traps. Hinged in the middle, they are as solid as can be for step after step, until you take the first step past the middle. Then you are fucked. Think of Wednesday as getting close to the middle of the hallway. There are three hinges on the far door. Is there one inna middle of the floor?

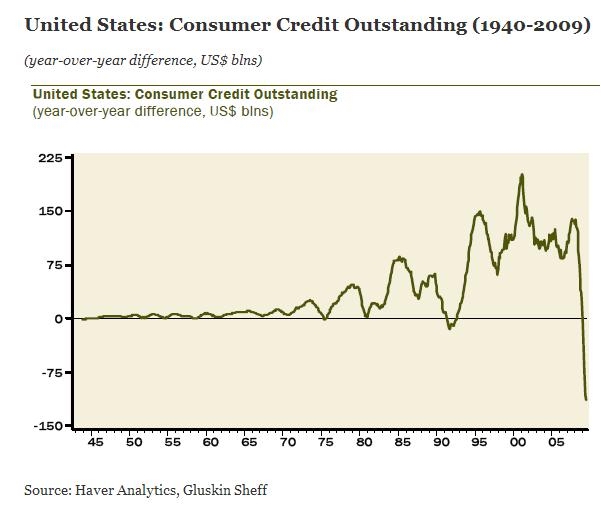

Alcoa made 4 cents a share last quarter instead of the 9 cents a share loss that the street expected. The revenue was higher that Wall Street expected by 1.5%. But it was still down by 33% from a year ago. So the profit was made by grinding suppliers, closing plants, and laying people off. There is demand and there is a worldwide recovery under way. China is the difference. There will be more profits and more business done. Demand and prices will rise for raw materials and finished goods. The question is, will there be a national recovery here too and will future business and profits support the current US stock prices? It's a consumer economy (70%) in this country. Do you see a recovery ahead?

What it means here.... http://www.ritholtz.com/blog/2009/10/on ... ntraction/

The writers I read have given up on rationality. It looks like the internet and housing bubble to them. The thoughts are that this will end badly. Or maybe not. Things looked great at the start of 2000 and 2005 and looked like hell in March of 2009. How it looks to you today depends. The question is, is it 1998 or 2000? Is it 2002 or 2006? How long until employment launches skyward or stock prices implode? What would you do if you knew the answer? What would you do if you didn't?

Solid Gold Place To Start For The 401a Participant. http://www.thestreet.com/story/10608336 ... riend.html

http://www2.debka.com/headline.php?hid=6313

http://www.bloomberg.com/apps/news?pid= ... ZfOLKO2Zpk

http://www.msnbc.msn.com/id/33212991/ns ... d_economy/

http://www.cnas.org/blogs/abumuqawama

http://www.jconline.com/article/2009100 ... /910070345

http://www.msnbc.msn.com/id/33157665/ns ... vironment/

http://money.cnn.com/2009/10/08/news/ec ... /index.htm

Pretty much describes where my head is at....

http://www.ritholtz.com/blog/2009/10/th ... t-history/

Extremely thought provoking for the buy and hold 401a participant. It is not without holes, but I've read this book before and I can fill some of them in myself and interpret my way past others.

http://www.ritholtz.com/blog/2009/10/ho ... more-39371

Tick Tick Tick...

http://www.bloomberg.com/apps/news?pid= ... p2WcXs3fP4

http://www.bloomberg.com/apps/news?pid= ... z0hsBTTR4A

http://www.youtube.com/watch?v=wtIJ017J ... re=related

http://online.wsj.com/article/SB125530360128479161.html

Main St vs Wall Street

http://www.ritholtz.com/blog/2009/10/li ... nightmare/

I'm watching and waiting....

I've moved my 401a to an outsized position in cash for safety during a potentially very volatile time and for quick deployment back to stocks if an end of year run up starts. I have a smaller proportion in bonds for safety and income. I'm about 1/8 in EuroAsia as a weak dollar/commodity/growth play, and a tag end in small cap cuz I stopped one or two exchanges short. My Website has details to 4 decimal places.

Waiting....

FULCRUM DAY

You better be conservative or ready to turn onna dime.

http://www.ritholtz.com/blog/2009/10/getting-better/

It might be that things "Have Got To Get Better Inna Little While". If so there will be plenty of time for me to get way long then.

WED AM

Intel and JPM report good quarters and good/mixed forecasts. Economically, it is not ragingly bullish. But markets spike up. Fifty percent of S&P 500 revenues come from overseas. There will be profits and revenue. But domestic jobs, government spending, and housing are not going to move strongly in the right direction for a while. I think that realization has yet to be fully appreciated by investors. If the rest of the world raises interest rates or we have a lousy Christmas economy/housing drops another increment when rising rates make the FED/Treasury stop printing money, we could see a serious dip down. The near/long term upside is limited. Downside is less limited. It's about potentials, not imperatives. Listening to what the markets say and being ready to react to protect what you have today is as important as ever. I'm thinking about what to do with the 401a later today.

WED Afternoon....

Definitely feels toppish.

That said, I'm leaning toward tossin' in some 401a

money on the year end run up...

Stay tooned. To be continued....

Comments are not available for this entry.

Calendar

Calendar