I've spent years and years in a single day waiting to get out of school when I was in 5th grade and about an hour between my 59th and 60th birthdays. The Relativity Of Time Becomes Clearer As I Age....

Saturday, November 13, 2010, 04:32 PM

"...in an information-rich world, the wealth of information means a dearth of something else: a scarcity of whatever it is that information consumes. What information consumes is rather obvious: it consumes the attention of its recipients. Hence a wealth of information creates a poverty of attention and a need to allocate that attention efficiently among the overabundance of information sources that might consume it"

-- Herbert Simon

This always went along whenever somebody got experienced for the first time.....

http://www.youtube.com/watch?v=oxpcZrQQM-4

Tough week. End o' the year levitation vs too far too fast, China's coolin' inflation down and domestic reality setting in.

You gotta front row seat (in the cage) on the cage match between these dead economists...

http://www.ritholtz.com/blog/2010/01/fe ... ap-anthem/

http://www.bloomberg.com/news/2010-11-1 ... ate1-.html

http://www.stratfor.com/analysis/201011 ... r_and_g_20

http://www.msnbc.msn.com/id/40136417/ns ... l_finance/

http://redtape.msnbc.com/2010/11/in-new ... html#posts

http://www.bloomberg.com/news/2010-11-1 ... kfire.html

http://www.bloomberg.com/news/2010-11-1 ... egion.html

http://www.bloomberg.com/news/2010-11-1 ... -says.html

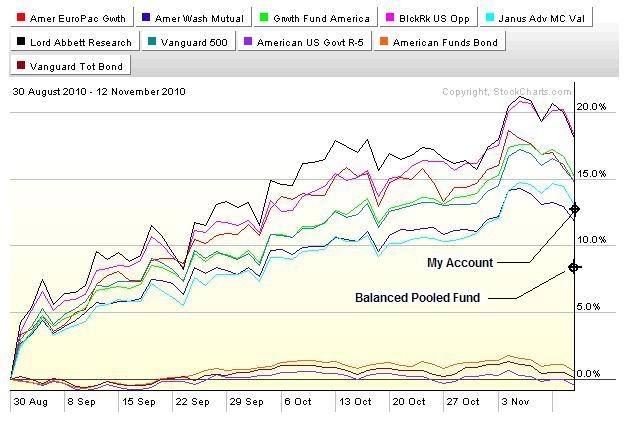

Bloody week in and of itself....in perspective, not so much. I've got friends still 100% inna GIC because they can't deal with the volatility of the markets once they get some serious balances in their 401a. Weekly gains can be overwhelmed and forgotten by serious down days. It can be breathtaking. No knock on them. If you haven't experienced it, you haven't got a glimpse down inta the abyss. Stocks go up on the escalator and can go down like falling down the elevator shaft.....

That said....This week was not good and Friday was a bloody nose. But it was on top of a good two months gains... correction and digestion before the next leg up or change in trend and the start of the markets rolling over?

Now... Don't fight the FED vs domestic reality vs China's interest rate bumps vs end of the year Wall Street money manager contract renewals, vs Holiday spirits vs get the last of what's on the table cuz it's been good so far and more is better vs declare victory and leave the table a guaranteed winner. This ain't an easy choice... Stay long and strong and make some more or lose most or all of what I've made, take half off the table and get 50% of the gains but risk only half losses? Or leave the table and call 12% return a pretty good year, which it really is?

I just don't think the year's highs for the market are in....although they might be. Monday will tell the tale. Standing pat, ready to react, and waiting for the market to tell me what it's gonna do and what I should do...

http://www.ritholtz.com/blog/2010/11/ro ... eposition/

http://www.ritholtz.com/blog/2010/11/fi ... r-the-bar/

http://www.msnbc.msn.com/id/40182444/ns ... l_finance/

Monday night....

TUESDAY

70+% cash and bonds, getting smaller in stocks tomorrow. Locking in profits....reducing risk....

Comments are not available for this entry.

Calendar

Calendar