Nothing Sharpens Your Appreciation Of Life And Clarifies The Difference Between Fear And Respect Like Looking Over The Edge. But That's A Third Beer Story....

Saturday, February 5, 2011, 02:29 PM

"Worry does not empty tomorrow of its sorrow; it empties today of its strength."

Corrie Ten Boom

Now For Something cOmPlEtElY dIfFeReNt....

http://www.youtube.com/watch?v=thWtzBsd ... re=related

Speaking of Fear and Respect...

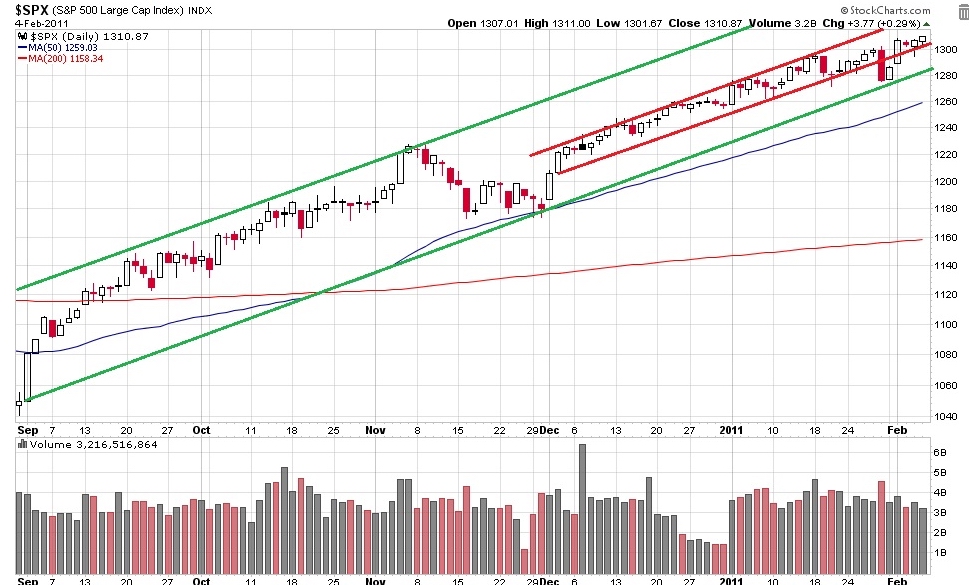

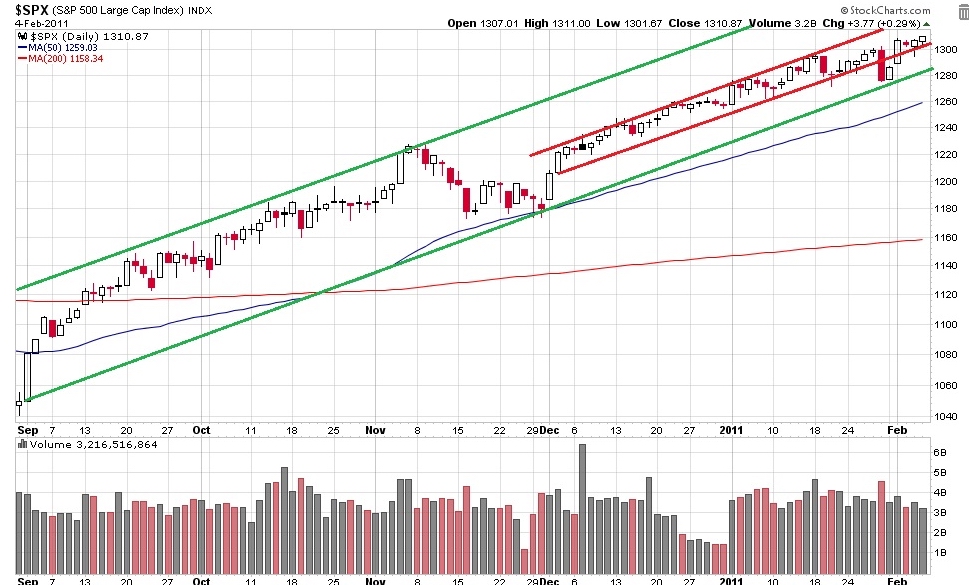

The Markets are always about the balance between Greed and Fear. Lately it is all about greed and the fear of losing out, not losses.

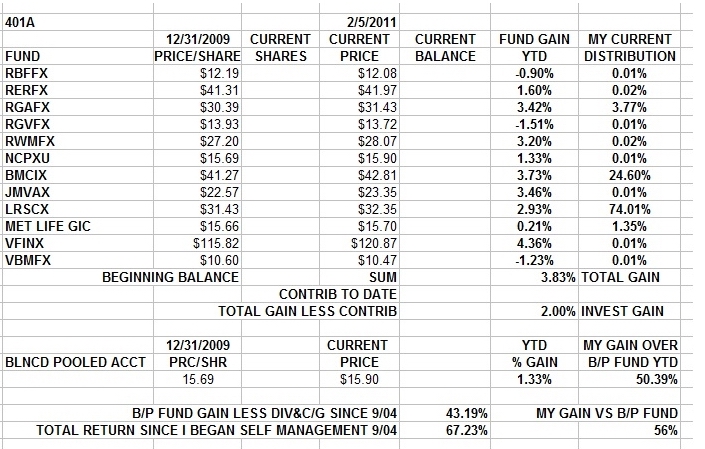

Wall Street always comes back to it's roots... which is Main Street. And Main Street ain't pretty lately. Especially compared to Wall Street. My asset allocation is all about taking what Wall Street offers with an I on the door. Will I get out in time?

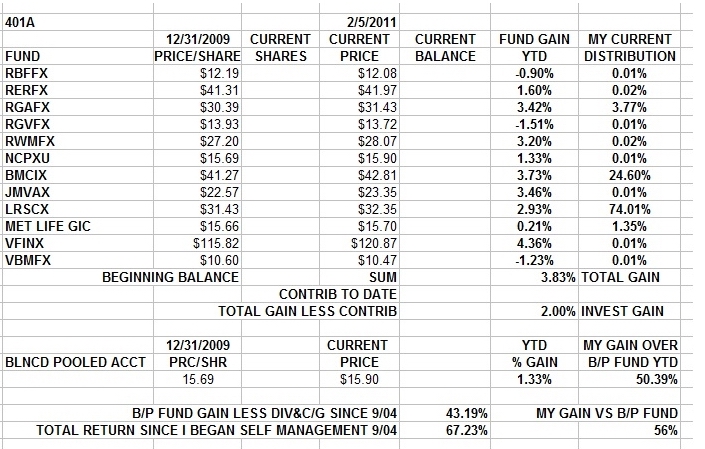

I upped my contributions inna 401a when we got some decent choices 6 years ago and that and good and aggressive asset allocation has got the balance and the daily volatility up to where the good days are party hearty and the bad days are like stepping onna rake in tall grass. If I'da had decent choices for the full 20 years of the 401a, now'd be all about nicking some bases on hits on good pitches and I'd have a lot of comfort about retiring is a coupla three or four weeks instead of three or four years after I've run it all the way out...

Oh Well. That's a different life. Somebody else's. So now I gotta get what I can outta what I got inna 401a. Come to think of it, I'm real comfortable with that. YMMV.

So Merrill Lynch’s coverage of Irish banking, before the crisis, was dead on. And they threw their analyst under the bus to whore for more banking fees. Cowards. Criminal toadies. Chickenshit pimps who would sell their mothers into forced prostitution for a buck. That is Merrill Lynch, and the fact that a single goddamned dollar of my tax money went to these spineless, money-grubbing parasites makes my stomach turn. If Goldman Sachs is a vampire squid, then Merrill Lynch is Escherichia coli of banking. Whatever they touch gets sick, and occasionally dies.

http://www.ritholtz.com/blog/2011/02/am ... -to-egypt/

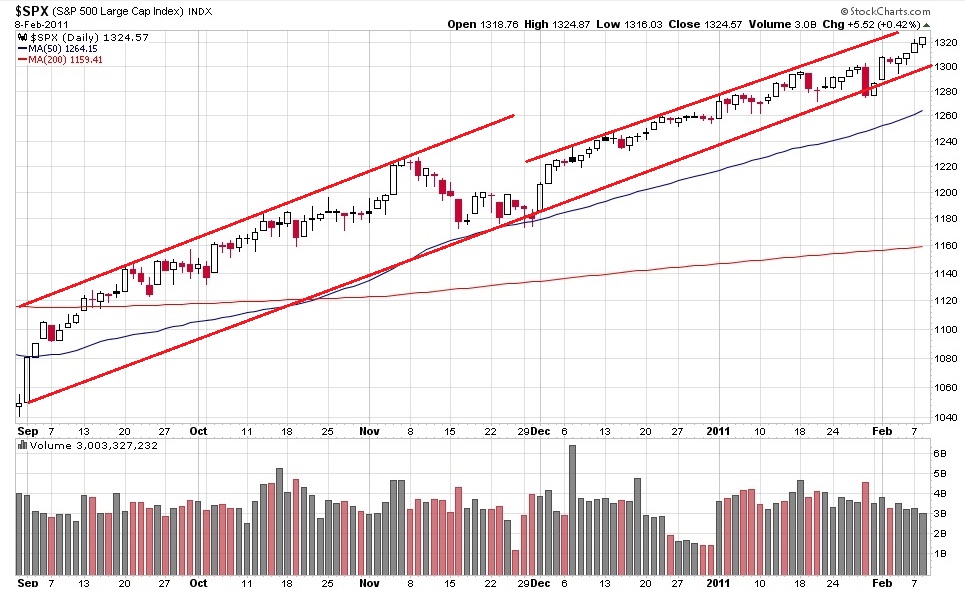

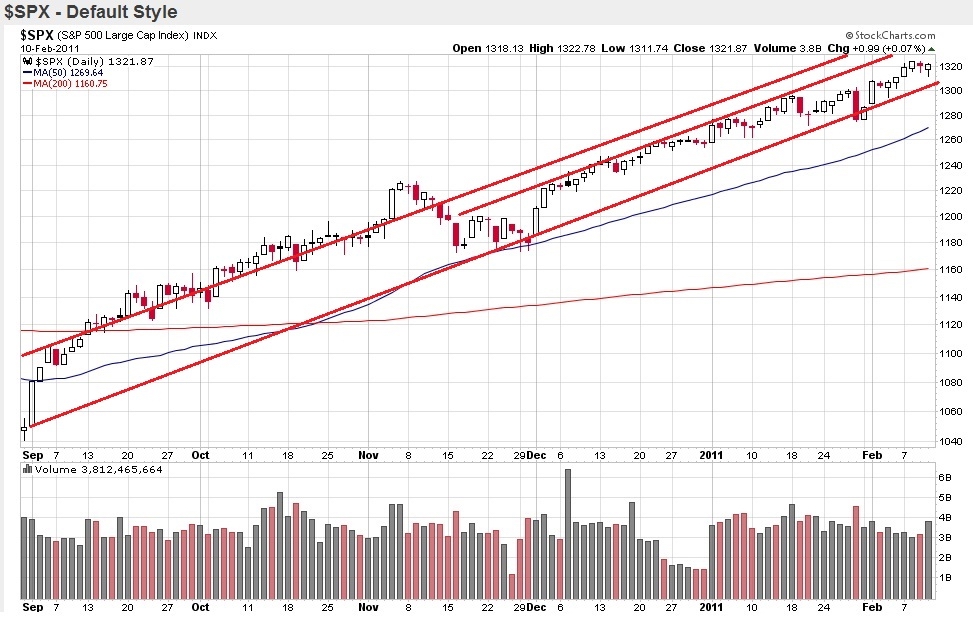

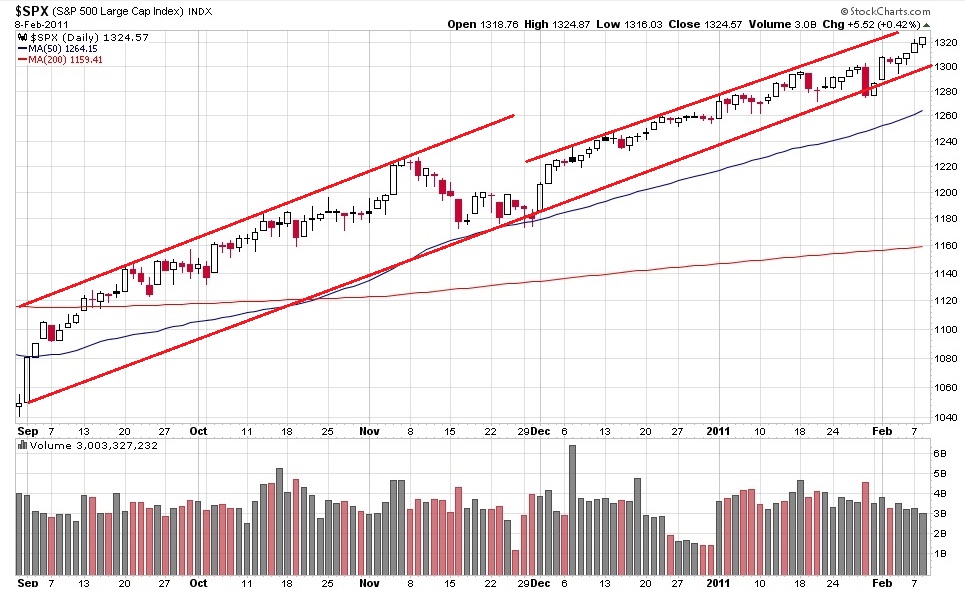

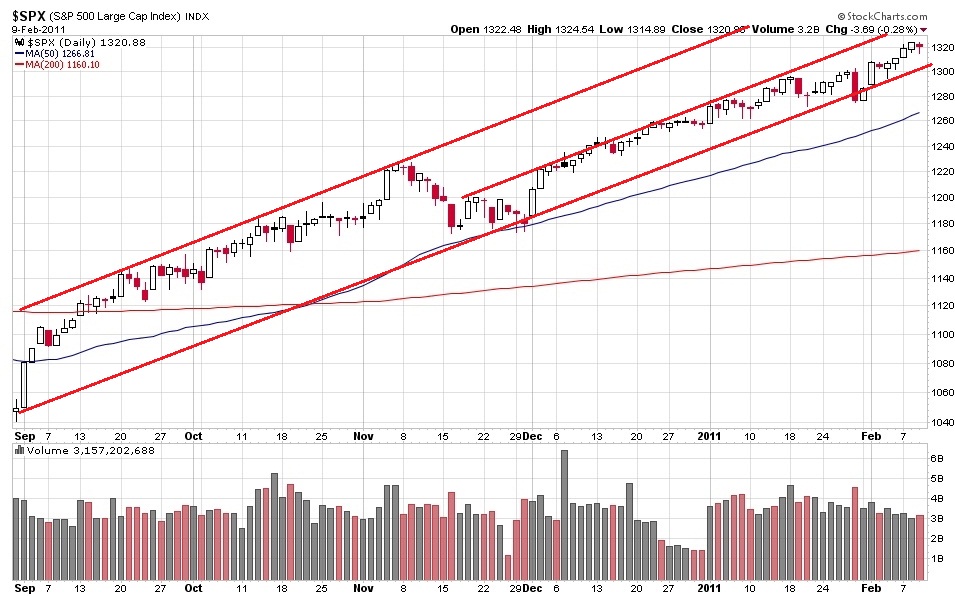

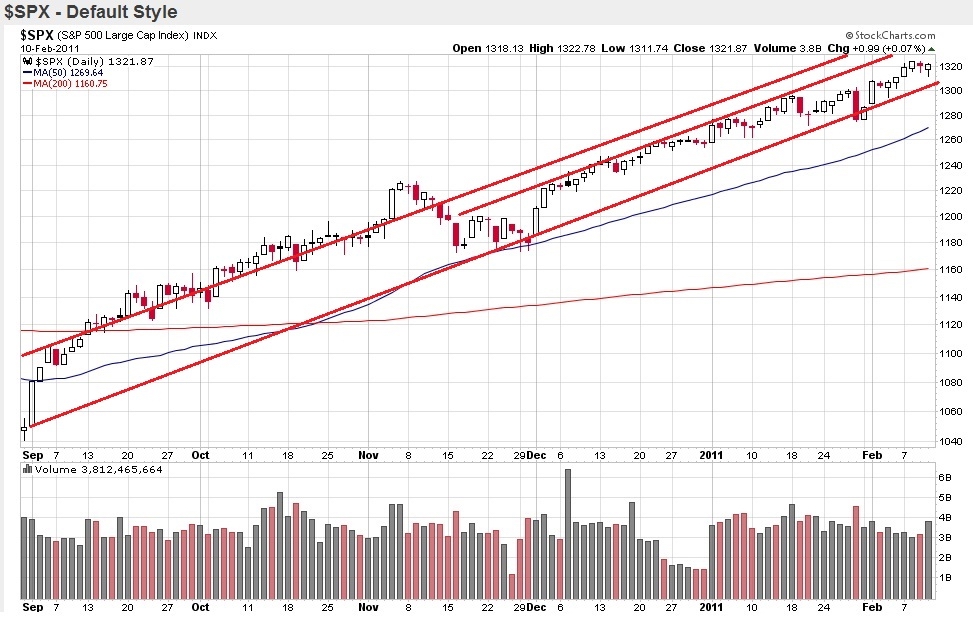

Still long, still concerned, still ready to bail. The broad market is up around 25% since Sept, never mind since March 09. I'm balancing the rapid trading restrictions, the trend, the need to book profits and avoid losses, and squirreliness of losing what has not come easy and won't be easily replaced. A correction of 4% to 10% would not be unexpected. A correction of 10% to 20% would not be beyond the pale. The thought of grinding hard to get back to even from an unexpected flash crash or downside panic is not welcome. Multi year bull markets are a lot more fun. Autopilot up day after day is low stress. Bear market rallys can be viciously explosive to the upside and can be exhilerating, but they can go down farther and faster than they went up too.

Still, I have all the the tools and info I need short of prescience, so WTF.

Monday Eve...

DAMN! One Gawddamn up day after another without surcease. How long can Wall Street dance to the stars in the face of Main Street doin' the Main Street Moan?

I'm Keepin' On Chooglin' with tight stops on the IRA's and Tradin' Account and ready to pull the rip chord on the 401a.

http://www.youtube.com/watch?v=mUzl7_OpVLA

http://www.washingtonpost.com/wp-dyn/co ... 00114.html

Tuesday

Another Day, Another Dollar Or Two.......

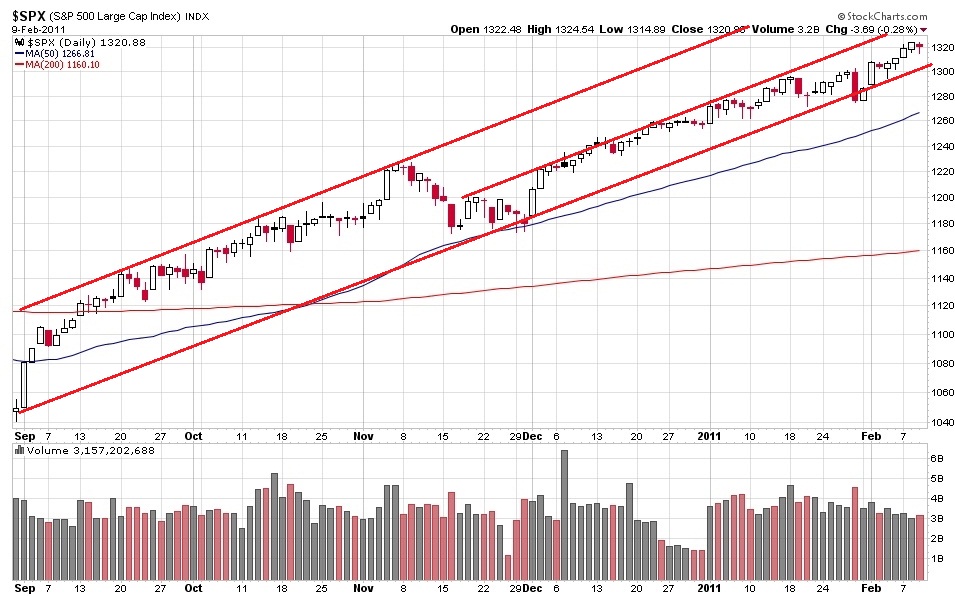

The longer it goes higher, the greater the rubber band is stretched, the more violent the snap back will be. The crazier the upside, the sweeter the gains, the greater the pains of giving a substantial chunk of it back.

I don't have a whole lotta fear. But I do have respect for consequences. That translates into a higher state of alertness and a determination to avoid giving ANY more back than what is absolutely unavoidable...

Wed Eve...

More O The Same... Tick, Tick, Tick.....

See Ya At The Hall

Thurs

Even More More Of The Same....

But Is It Rolling Over...?

Stay Tooned...

Comments are not available for this entry.

Calendar

Calendar