There Is No Point To Making Money In The 401 If After Every Rip, I Give It Right Back On The Next Dip. "Deer In The Headlights" And Passive Acceptance Are Not My Preferred Modes Of Operation....

Saturday, May 19, 2012, 01:07 PM

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort.

--Herm Albright

Sometimes ya turn yer back onna favorite burger shake and fries and go for some duck breast tangerine ginger Marsala and scallops poached in butter, garlic, and shallots.

http://www.youtube.com/watch?v=p4IMMaF7 ... re=related

http://www.youtube.com/watch?v=Jeq-BTGbJKE

http://www.bloomberg.com/news/2012-05-1 ... ising.html

The more I think about the events of the last two weeks, the more I think that we're simply at an all-time low. The meltdown in Europe, the quick 8% savaging of US stocks after a fairy tale Q1, the utter failure of Facebook's IPO to do a single fucking thing for the markets or the retail investing public...it's all just garbage.

J. Brown http://www.thereformedbroker.com/2012/0 ... -time-low/

Useful input. Valuable with a pull date and a limited area of use. No more. To be looked at through the lens of time and experience accepting that we are in a multi variant reality where reality is a process and value is time and personal space variant.

http://www.forbes.com/sites/philjohnson ... bookstore/

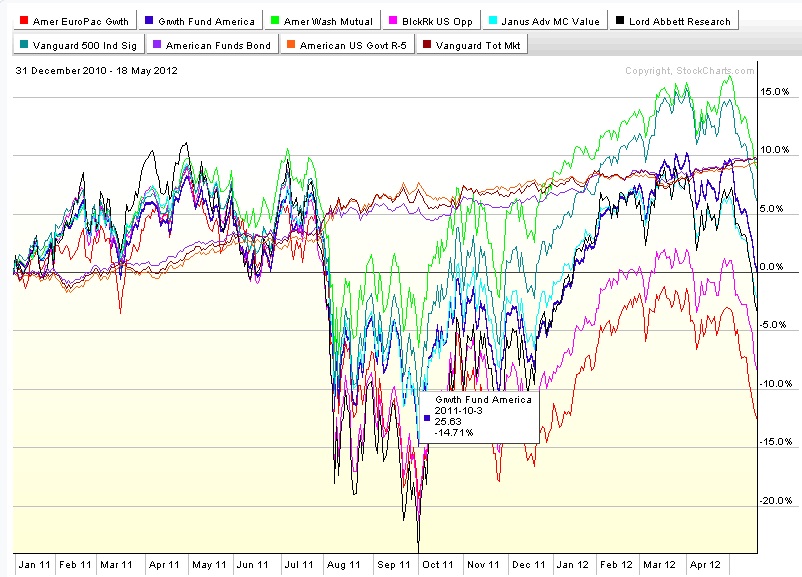

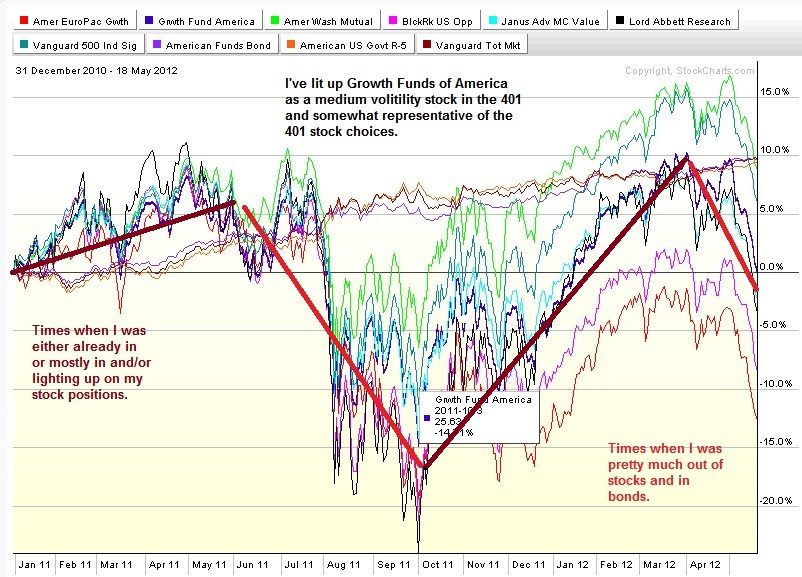

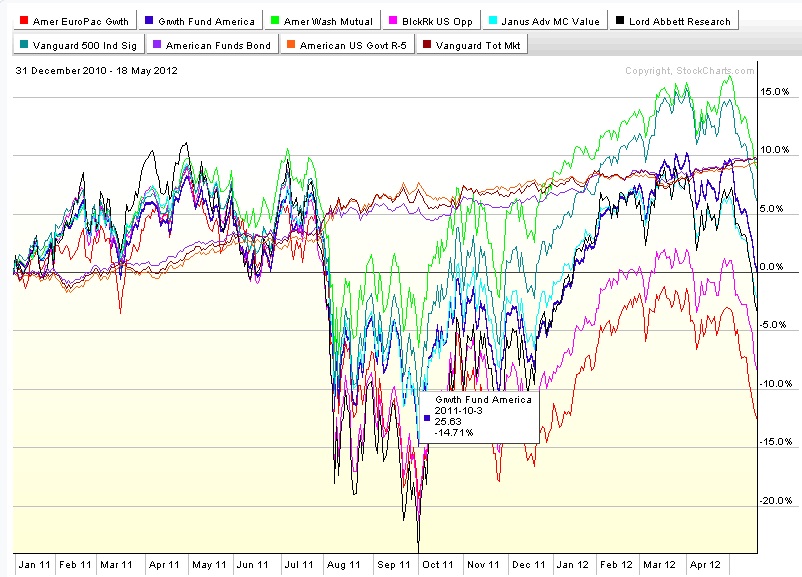

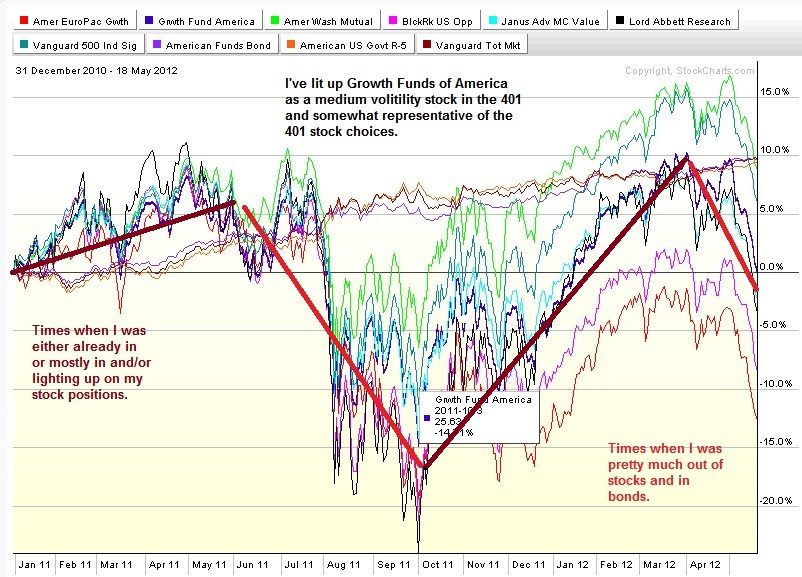

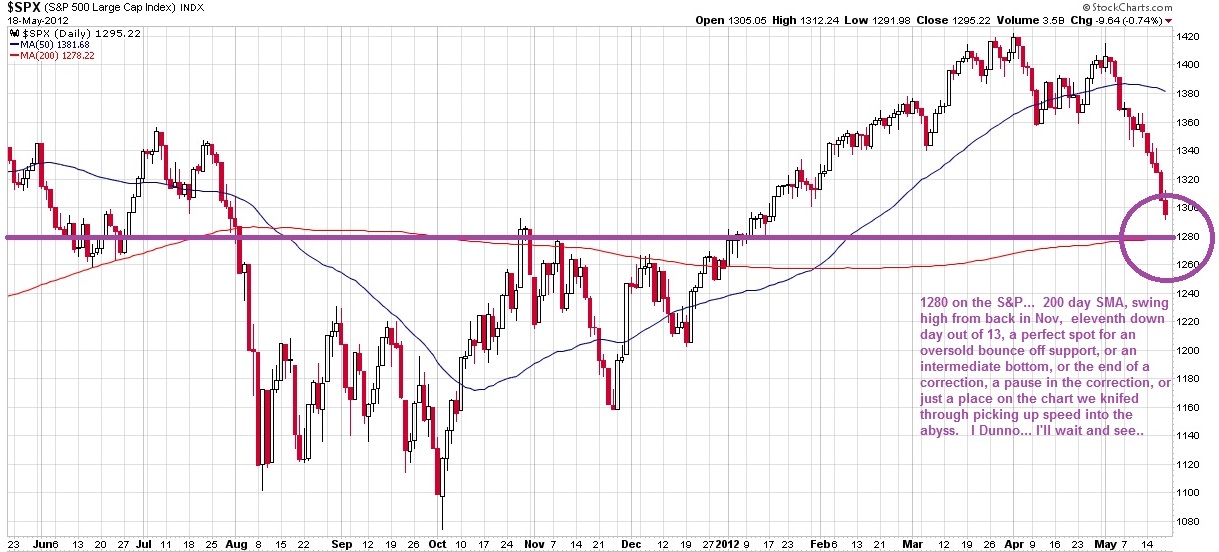

I'm not as good nor is it as easy as it looks. I watch for trends to develop and as Rev Shark says, "You try to catch most of the move." Playing the major trends and ignoring the meaningless noise costs me the start and finish of the major moves while I wait to make sure they are for real. The rapid trading restrictions puts me in partial positions for the start of the up trend as I try to reallocate responsibly within the restrictions, and it makes me way too heavy while I try to get out during the down trend. Still, over the last 17 months, I caught part of a 5% up move, avoided most of a down 20% move, caught part of an up 20% move, and I'm holding 10% stocks and going lighter during the current down trend. It's work, but what was scrambling for pennies in front of a steam roller years ago has now morphed into keeping a significant part of my retirement retirement money from taking a substantial hit on these swoosh downs.

"It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong."

-- George Soros

Comments are not available for this entry.

Calendar

Calendar