ďThe market does reflect the available information, as the professors tell us. But just as the funhouse mirrors donít always accurately reflect your weight, the markets donít always accurately reflect that information. Usually they are too pessimistic when itís bad, and too optimistic when itís good.

- Bill Miller

IF YOUR A FIRST TIMER TO THE BLOG, CLICK HERE...

http://joefacer.com/pblog/static.php?pa ... 729-141334

Suave, Smooth, Sophisticated Music In The Classic Friday Night Genre;

https://www.youtube.com/watch?v=0MCLPtTKKgQ

https://www.youtube.com/watch?v=4eIifUAXDn4

https://www.youtube.com/watch?v=OZ7raU-o7AE

https://www.youtube.com/watch?v=HJ_hMe7LQ_o

https://www.youtube.com/watch?v=mBP7jPFtmRk

https://www.youtube.com/watch?v=OZ7raU-o7AE

It's important to read stuff like this. And to act on it. Or not. Because there is what may happen, what the reaction may be, what the right thing to do may be, whether or not the right thing to do is appropriate for me, and whether or not the opportunity arises to do the rightest thing or just a mostly right thing. Or not. Stay tooned.

http://www.businessinsider.com/stock-ma ... sh-2014-12

http://www.bloombergview.com/articles/2 ... -of-growth

That said, here's where I am this week....

http://thereformedbroker.com/2014/12/12 ... is-period/

UPDATED

http://www.ritholtz.com/blog/2014/12/oil-as-a-weapon/

http://www.calculatedriskblog.com/2014/ ... rices.html

http://www.telegraph.co.uk/finance/oilp ... ashes.html

How much do you really know and what is it worth?

http://www.businessinsider.com/apple-ve ... ns-2014-12

http://www.washingtonpost.com/sf/busine ... s-is-lost/

http://pragcap.com/answering-common-que ... ional-debt

Bummer...

http://www.businessinsider.com/the-demo ... pe-2014-12

Another view...

http://www.businessinsider.com/energy-i ... dp-2014-12

More crazynesses...

http://www.businessinsider.com/putins-p ... ct-2014-12

http://www.businessinsider.com/ted-cruz ... cs-2014-12

The key to happiness...

http://oliveremberton.com/2014/the-prob ... -fairness/

http://vimeo.com/114490835

Chessnwine; I buy his caution call in that I'll not add outa cash into stock. But I'm not going outa stocks either. Caution is the word. Action to follow or not as calls are confirmed or undercut...

Jeff is Always must read...

http://dashofinsight.com/weighing-week- ... ds-course/

Monday...

http://www.businessinsider.com/the-new- ... ed-2014-12

http://www.npr.org/2014/12/15/370844724 ... nt-in-2008

Tuesday...

See UPDATED above...

http://theirrelevantinvestor.tumblr.com ... g-we-often

Wednesdday...

http://www.theguardian.com/cities/2014/ ... tion-china

http://www.businessweek.com/articles/20 ... opecs-neck

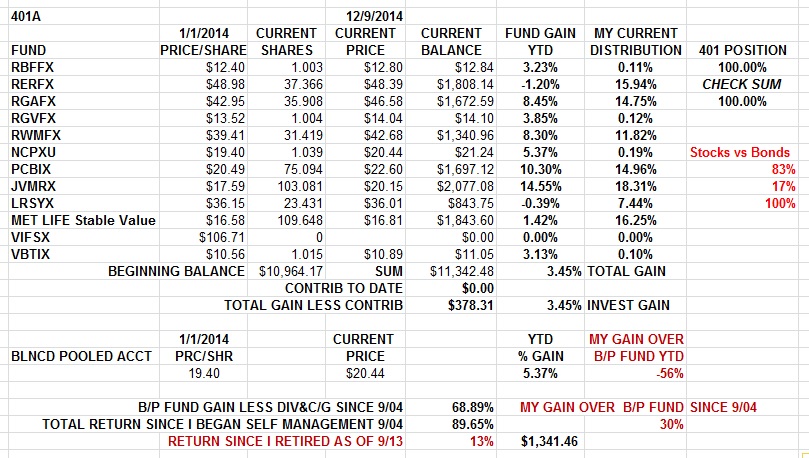

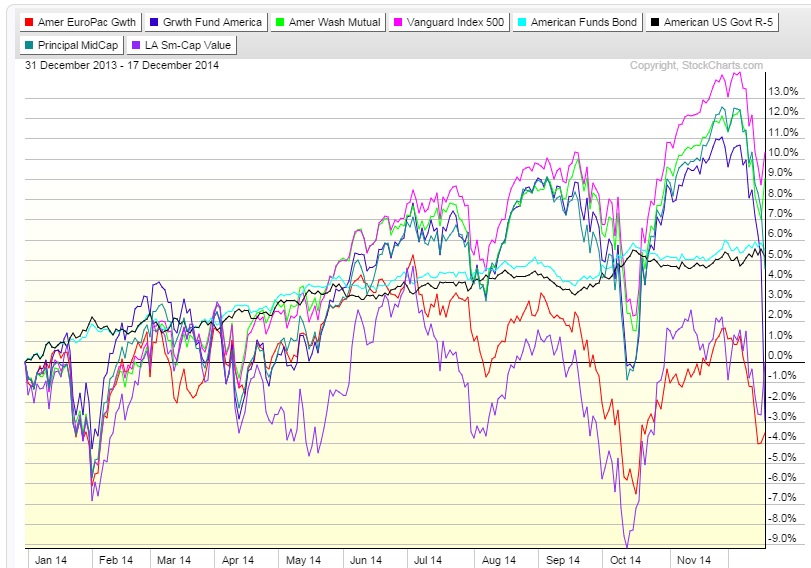

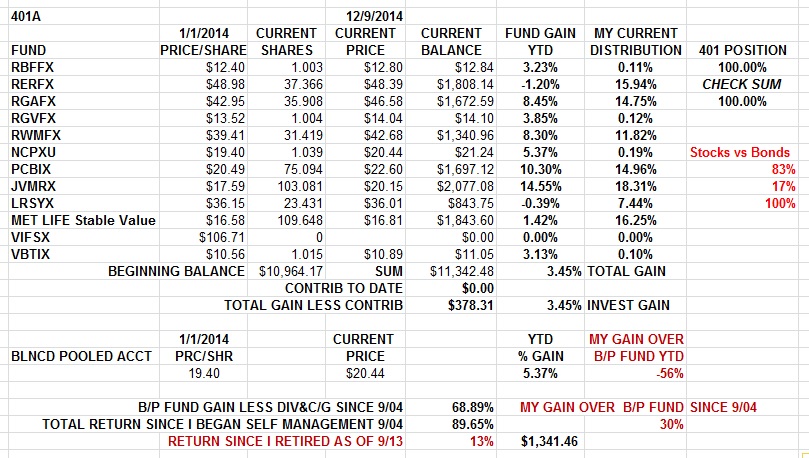

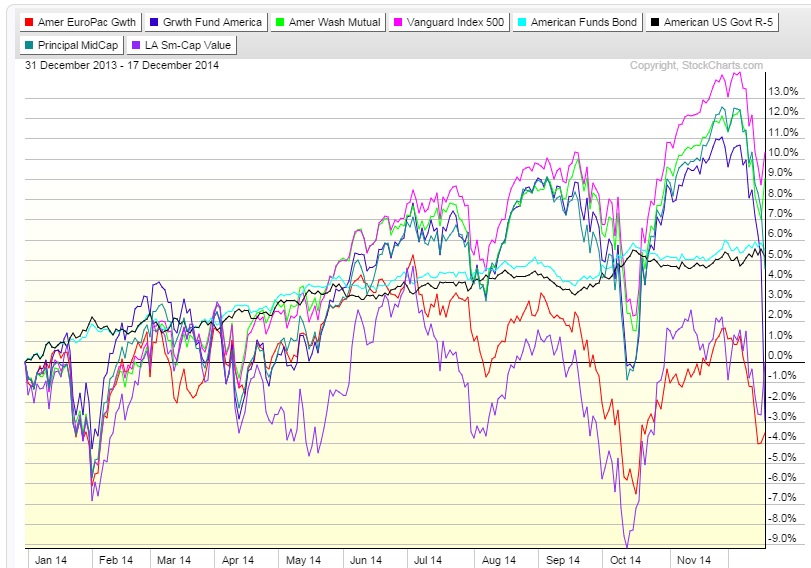

The funds available in my 401 and how they've done year to date (YTD). This chart looks worse than the one from the weekend above. Rough three days. How much I got and where are shown in the table above from the weekend... Coupla thoughts...

The S&P 500 looks better than our managed funds... It happens.

Small Caps and EuroPacific showed nothing. That happens too.

Bonds were amazing. I held none, wish I'd held more.

Holding stocks from 1st quarter of 2009 to September of this years was easy money. Sometimes it's not easy. Like this year.

I'm still long and strong. I've done well since 2004 and I think there's more to go here. There'll be volatility.... but in 2008, I ran for the hills because it made sense. Here, I think I'll hold on through the rough spots. I don't see a huge crash or bear market that'd make the timing easier.

So I'll stick with what's working for now.... the long term trend...

I think about as much of Josh as I do of anybody...

http://thereformedbroker.com/2014/12/17 ... ike-to-me/

That said, Ya gotchur Flash Crashes and Yer Bear Markets. The time scale is different.

http://thereformedbroker.com/2014/12/17 ... ar-market/

I stuck w/ Bill Sams (Mutual Fund Investing @ www.joefacer.com)

in Oct '87 and I bailed 3/2009 in my 401. Different animals/different reality. I'call '87, '98, Dec 2014 crashes and too hard/too late to time, I'm staying put. For now... 2009 was a bear market....

http://pragcap.com/chart-of-the-day-hello-deflation

Chessnwine...

http://vimeo.com/114815542

Thursday...

"Literally, we are in the realm of beyond stupid with this."

http://motherboard.vice.com/read/reacti ... -of-stupid

http://www.bloomberg.com/news/2014-12-1 ... -lose.html

http://www.stratfor.com/weekly/viewing- ... z3MDWegJch

http://joefacer.com/pblog/static.php?pa ... 729-141334

It's important to read stuff like this. And to act on it. Or not. Because there is what may happen, what the reaction may be, what the right thing to do may be, whether or not the right thing to do is appropriate for me, and whether or not the opportunity arises to do the rightest thing or just a mostly right thing. Or not. Stay tooned.

http://www.businessinsider.com/stock-ma ... sh-2014-12

http://www.bloombergview.com/articles/2 ... -of-growth

That said, here's where I am this week....

http://thereformedbroker.com/2014/12/12 ... is-period/

UPDATED

http://www.ritholtz.com/blog/2014/12/oil-as-a-weapon/

http://www.calculatedriskblog.com/2014/ ... rices.html

http://www.telegraph.co.uk/finance/oilp ... ashes.html

How much do you really know and what is it worth?

http://www.businessinsider.com/apple-ve ... ns-2014-12

http://www.washingtonpost.com/sf/busine ... s-is-lost/

http://pragcap.com/answering-common-que ... ional-debt

Bummer...

http://www.businessinsider.com/the-demo ... pe-2014-12

Another view...

http://www.businessinsider.com/energy-i ... dp-2014-12

More crazynesses...

http://www.businessinsider.com/putins-p ... ct-2014-12

http://www.businessinsider.com/ted-cruz ... cs-2014-12

The key to happiness...

http://oliveremberton.com/2014/the-prob ... -fairness/

http://vimeo.com/114490835

Chessnwine; I buy his caution call in that I'll not add outa cash into stock. But I'm not going outa stocks either. Caution is the word. Action to follow or not as calls are confirmed or undercut...

Jeff is Always must read...

http://dashofinsight.com/weighing-week- ... ds-course/

Monday...

http://www.businessinsider.com/the-new- ... ed-2014-12

http://www.npr.org/2014/12/15/370844724 ... nt-in-2008

Tuesday...

See UPDATED above...

http://theirrelevantinvestor.tumblr.com ... g-we-often

Wednesdday...

http://www.theguardian.com/cities/2014/ ... tion-china

http://www.businessweek.com/articles/20 ... opecs-neck

The funds available in my 401 and how they've done year to date (YTD). This chart looks worse than the one from the weekend above. Rough three days. How much I got and where are shown in the table above from the weekend... Coupla thoughts...

The S&P 500 looks better than our managed funds... It happens.

Small Caps and EuroPacific showed nothing. That happens too.

Bonds were amazing. I held none, wish I'd held more.

Holding stocks from 1st quarter of 2009 to September of this years was easy money. Sometimes it's not easy. Like this year.

I'm still long and strong. I've done well since 2004 and I think there's more to go here. There'll be volatility.... but in 2008, I ran for the hills because it made sense. Here, I think I'll hold on through the rough spots. I don't see a huge crash or bear market that'd make the timing easier.

So I'll stick with what's working for now.... the long term trend...

I think about as much of Josh as I do of anybody...

http://thereformedbroker.com/2014/12/17 ... ike-to-me/

That said, Ya gotchur Flash Crashes and Yer Bear Markets. The time scale is different.

http://thereformedbroker.com/2014/12/17 ... ar-market/

I stuck w/ Bill Sams (Mutual Fund Investing @ www.joefacer.com)

in Oct '87 and I bailed 3/2009 in my 401. Different animals/different reality. I'call '87, '98, Dec 2014 crashes and too hard/too late to time, I'm staying put. For now... 2009 was a bear market....

http://pragcap.com/chart-of-the-day-hello-deflation

Chessnwine...

http://vimeo.com/114815542

Thursday...

"Literally, we are in the realm of beyond stupid with this."

http://motherboard.vice.com/read/reacti ... -of-stupid

http://www.bloomberg.com/news/2014-12-1 ... -lose.html

http://www.stratfor.com/weekly/viewing- ... z3MDWegJch

Calendar

Calendar