“The average long-term experience in investing is never surprising, but the short term experience is always surprising. We now know to focus not on rate of return, but on the informed management of risk”

- Charles Ellis

IF YOUR A FIRST TIMER TO THE BLOG, CLICK HERE...

http://joefacer.com/pblog/static.php?pa ... 729-141334

http://www.businessinsider.com/andrew-b ... ss-2014-12

http://www.businessinsider.com/howard-m ... il-2014-12

http://www.vox.com/2014/12/18/7413229/n ... -hack-sony

http://www.calculatedriskblog.com/2014/ ... 35-in.html

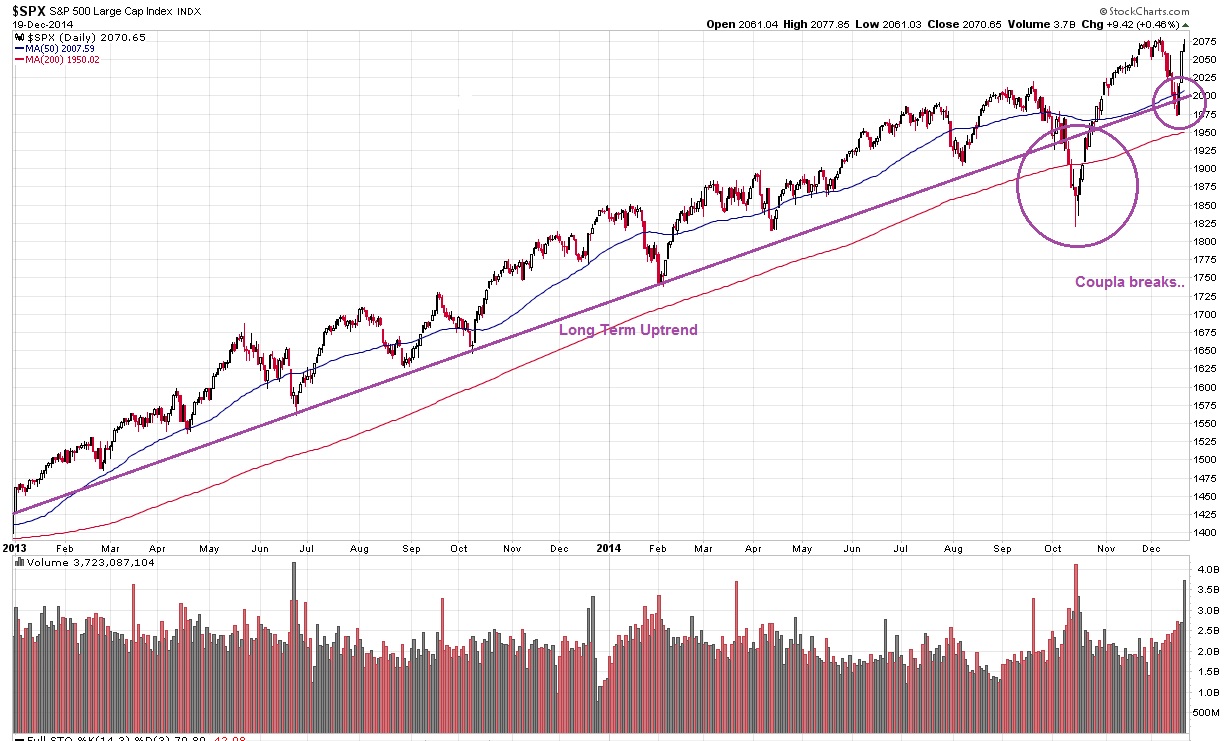

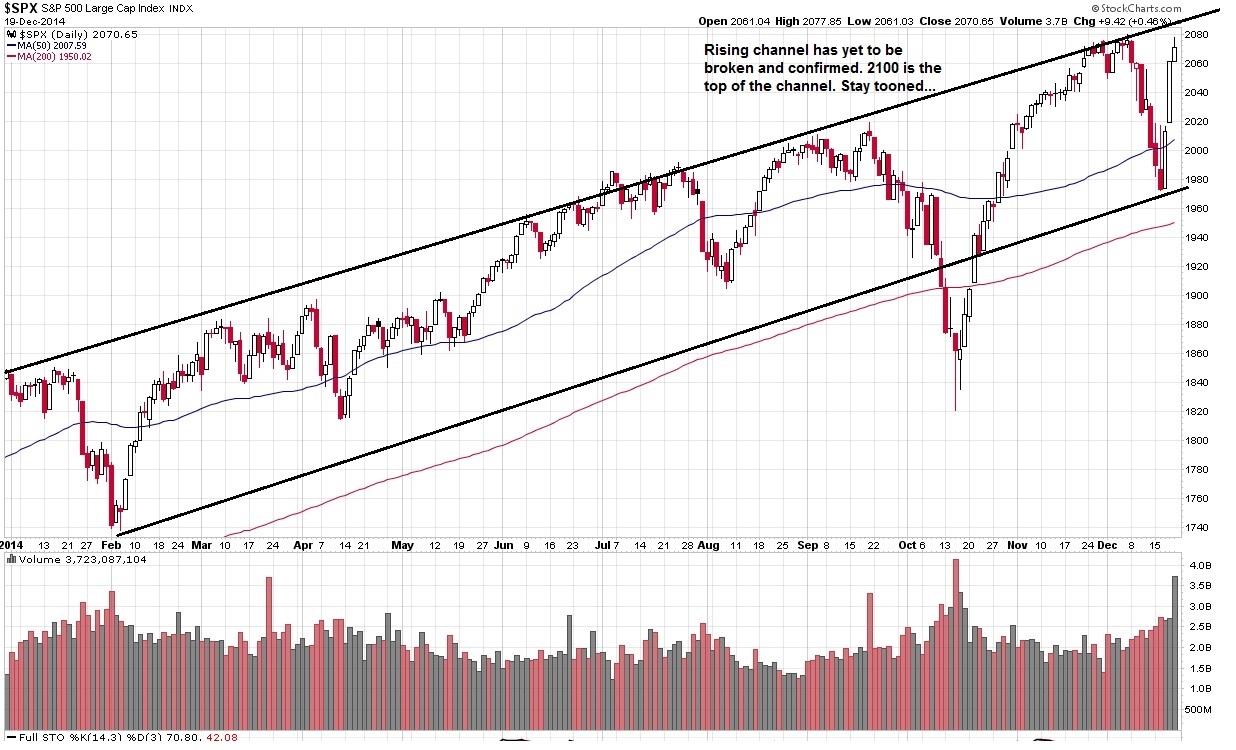

The S&P 500 are large caps. Solid large conservative co's. Somewhat unexciting... Stocks in the S&P 500 won't double in 2 years unless it's out of a crash like 2008.

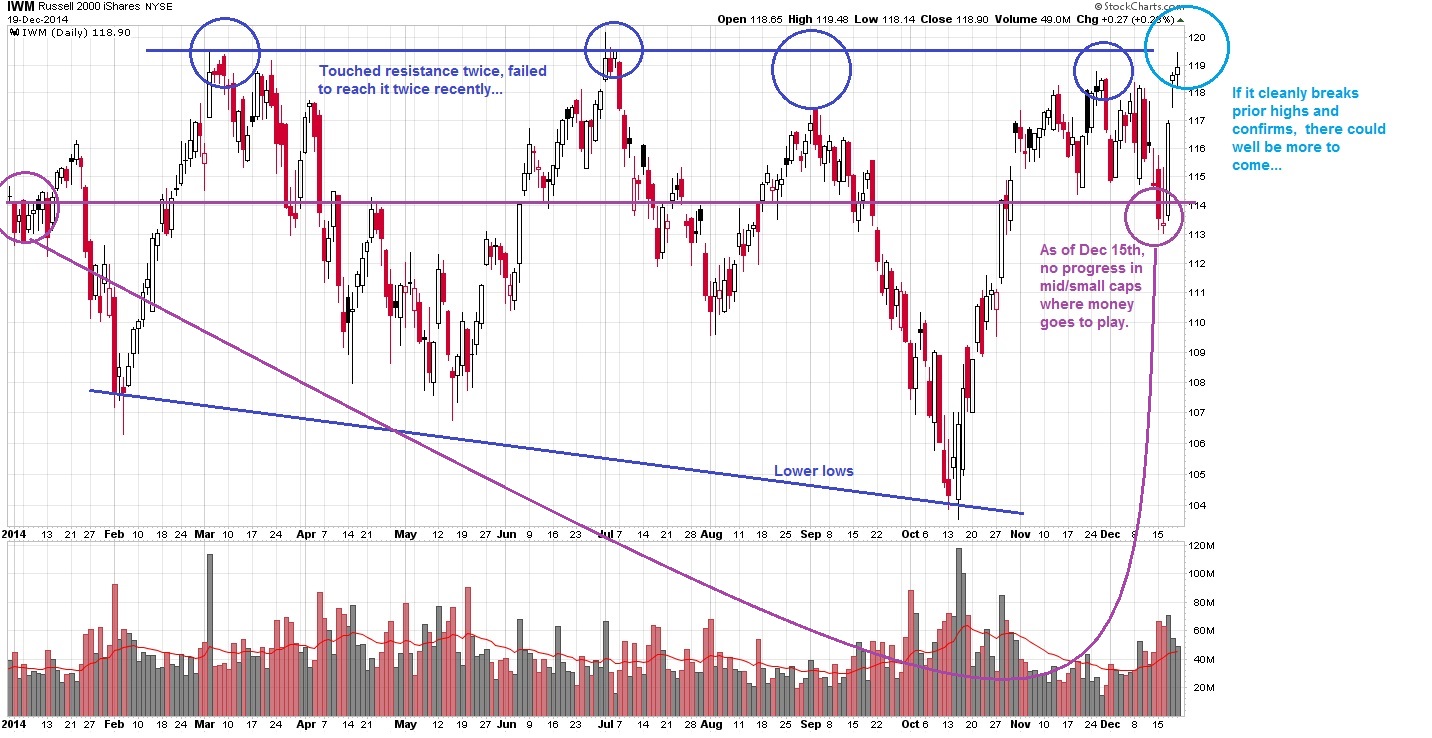

The IWM is mid and small caps. Money goes to play there when things are good. And runs for the hills rather than get caught there if there is a rumor of the possibility of things going bad. But they can double every two years after a good year, or in a day on a buyout.

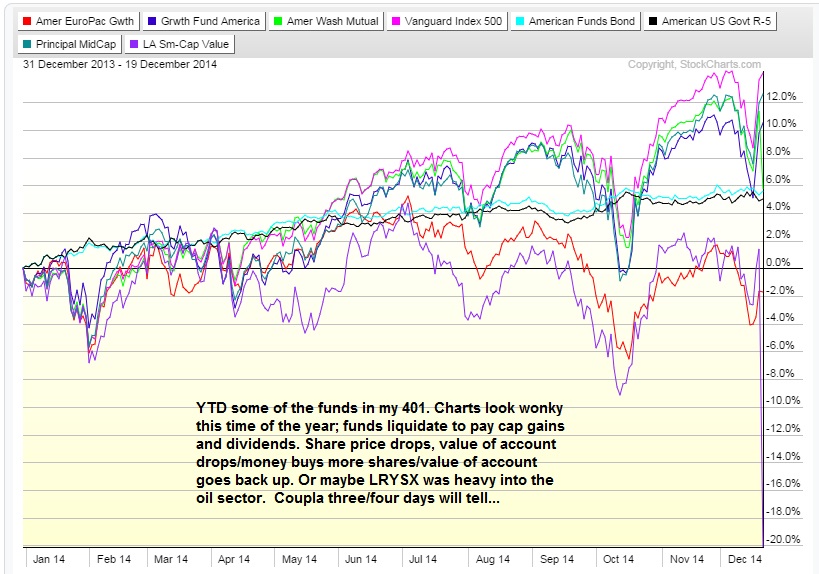

My 401 has mutual funds, which are diverified. It mutes the successes AND the failures. And mostly follows the big trends. EuroPacific and Small Cap fund is down this year. No surprize. But Midcaps is up... Why the different directions? Gotta think about this...

SunDay...

http://www.washingtonpost.com/business/ ... p;hpid=z14

http://www.businessinsider.com/what-the ... ng-2014-12

http://vimeo.com/115120657

Monday...

http://25iq.com/2014/12/19/a-dozen-thin ... s-of-life/

http://csen.tumblr.com/post/10570009038 ... nk-about-a

http://pragcap.com/what-do-passive-inve ... -investing

Tuesday.... Been There, Grew Up During That....

http://www.businessinsider.com/john-sch ... 15-2014-12

http://joefacer.com/pblog/static.php?pa ... 729-141334

http://vimeo.com/115120657

Monday...

http://25iq.com/2014/12/19/a-dozen-thin ... s-of-life/

http://csen.tumblr.com/post/10570009038 ... nk-about-a

http://pragcap.com/what-do-passive-inve ... -investing

Tuesday.... Been There, Grew Up During That....

http://www.businessinsider.com/john-sch ... 15-2014-12

Calendar

Calendar