Jes' Annuder Ol' Broked Down Retahrd Union Pipefitter And His 401 Defined Contribution Plan....

Friday, December 26, 2014, 01:01 PM

“You can’t develop a portfolio strategy around endless possibilities. You wouldn’t even get out of bed if you considered everything that could possibly happen….. you can use history as one tool for shaping reasonable probabilities. Then, you look at the world of economic, sentiment and political drivers to determine what’s most likely to happen—while always knowing you can be and will be wrong a lot.”

- Ken Fisher

Friday...

http://pragcap.com/three-things-i-think ... ed-in-2014

Saturday

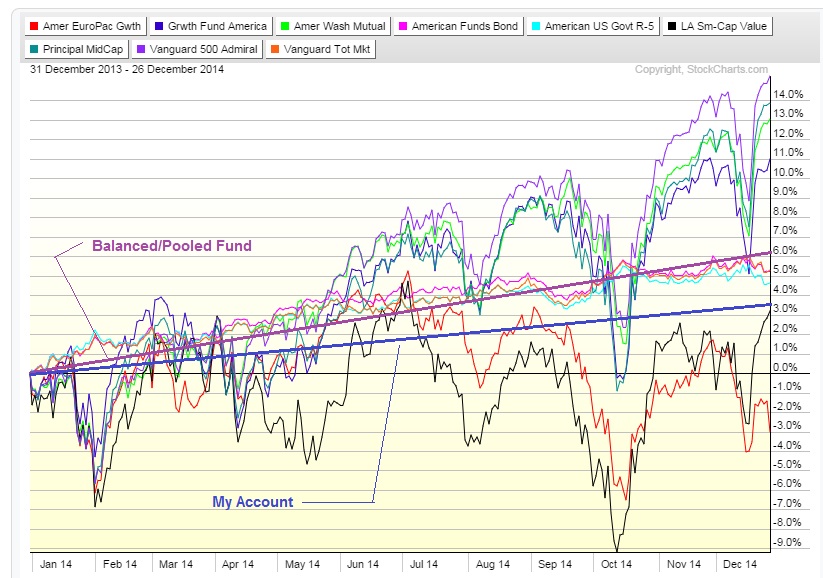

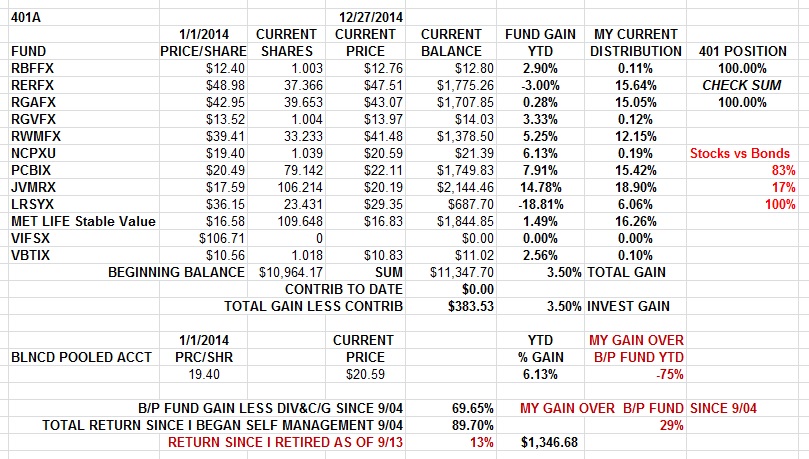

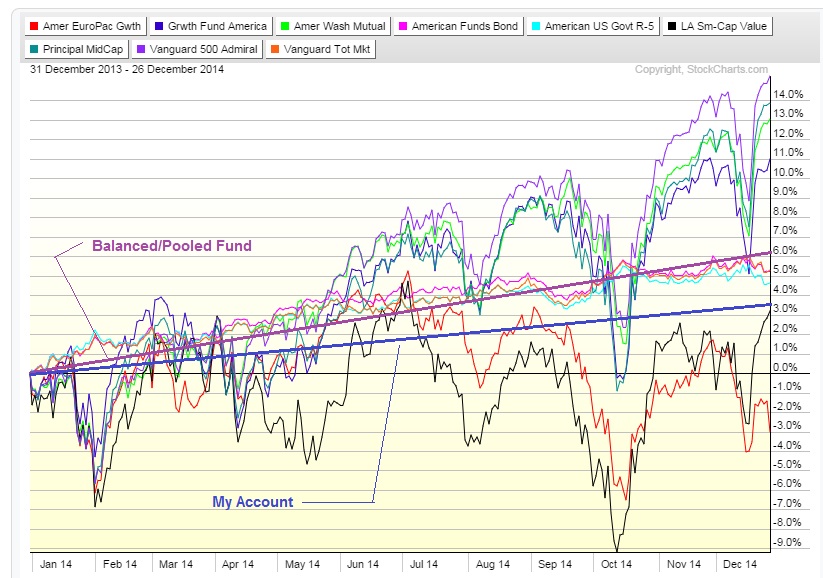

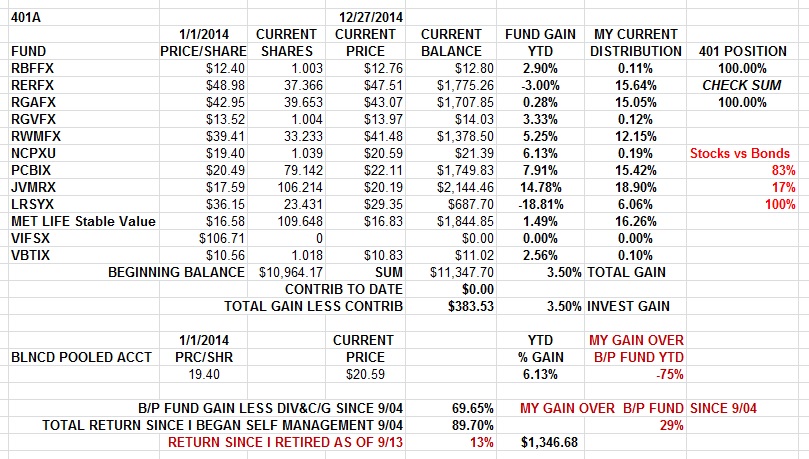

Coupla three four things here.... It's been a busy year for me for all the wrong reasons. There have been health issues in the family and this is in part why I've spun off the bulk of my retirement funds to some pro's; so I could look away if I had to or wanted to. I have mostly looked away from those accounts and that is all right... as long as I still keep an eye on them in some measure. I'm still an active trader and that account absorbs a fair amount of my time. The result has been less time spent on my 401 than usual since it is now a small portion of my retirement funds. But that has resulted in my being slow to move on two outstanding issues in the account; the American Funds EuroPac and Lord Abbot small cap funds.

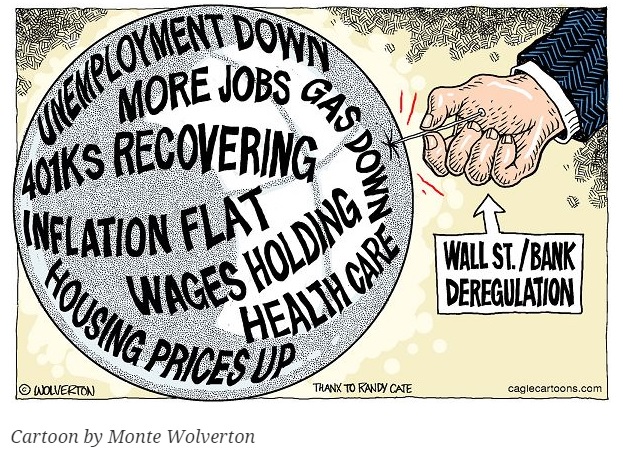

Overseas has pretty much lagged domestic big time and the American Funds are huge funds that have a lot of money to place. It is hard for them to invest in small pockets of value in down markets. They have lagged the domestic funds and despite having lightened up there, I probably should have lighter there than I was. One of the three funds in the small/mid cap area has been awful. The other two have been fine. Again, I would have liked to have been lighter faster there than I was. It cost me some gains. I'd rather have been in the other stock funds, but even the bond mutual funds, which were supposed to be horrible this year but weren't, would have been a better place to be than the two poorly performing stock funds... The Stable Value fund has been a worse place to be than the bond funds. Not tracking reality vs expections cost me some performance here when I sought safety at various times this year. Lesson noted...

This is a new year and time to change some things. This year, I'm going to keep a closer watch on the 401 funds.

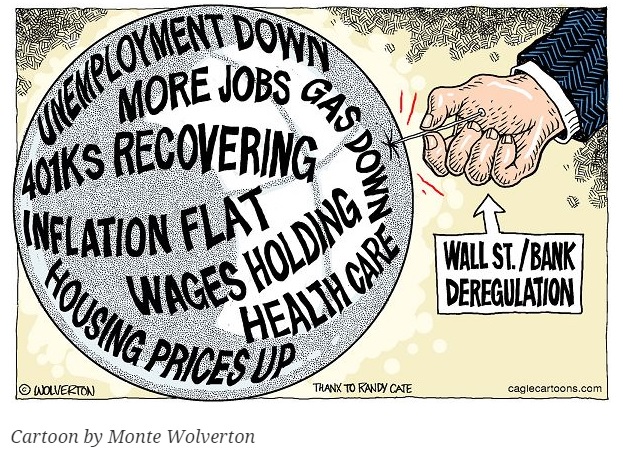

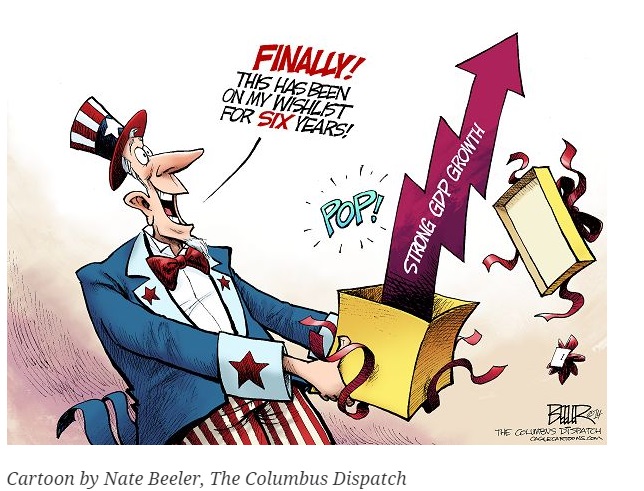

At some point, there will be a serious market correction. It'll sting. But you can ride out corrections. What you don't want to ride out are bear markets. I expect the first but not the second. For now, I'm staying heavy in stocks.

At some point in the future, Europe will have to do a QE like we did. It will get exceedingly ugly politically and that may make it ineffectual and delay the recovery and protract it way beyond the time it should have taken. But if it works like it did here, the stock market will lead big time whatever recovery they do have, so I'm staying equal weighted in the American EuroPac funds for now.

At some point the yelling that is undoubtedly taking place at Lord Abbett will have an effect and the fund will start to perform again. I can't hurt the fund's feelings by ignoring it, and they will not make up the losses out of their pocket, but performance is performance. So I got a small portion of my portfolio in a "tracking position". At some point I'll boost that up into a full position.

Or not. I will keep a closer eye on this portfolio and work it harder...

For now..... Stay Tooned....

Fewer things to feel comfortable about...

http://www.stratfor.com/weekly/end-cons ... z3MeJSHaqC

http://www.businessinsider.com/russia-i ... it-2014-12

Think about the Olympics. There is no mystery in running, jumping, diving, gymnastics, etc. Everyone knows what perfection looks like. It's just basics. And the very best competitors in the world get the very best coaches in the world to work incessently with them on basics as long as they hope to excell.....

http://www.ritholtz.com/blog/2014/12/th ... investing/

http://thereformedbroker.com/2014/12/27 ... one-loves/

http://priceonomics.com/stepping-off-th ... te-bridge/

Sunday...

Sounds like a union to me.....

http://www.nytimes.com/2014/04/25/busin ... .html?_r=1

World War Two brought my mom to San Francisco from Colorado because there were jobs here. Four brothers, including my dad, chose California as the final destination when they were discharged from the armed forces post WW II and gravitated to the Bay Area instead of going back to Utah... That's how I came to be a San Franciscan.

http://techcrunch.com/2014/04/14/sf-housing/

Long but worth the read.... If you've got 20 hours...

http://www.businessweek.com/features/20 ... ousy-list/

http://www.businessinsider.com/illinois ... is-2014-12

http://vimeo.com/115525761

http://www.calculatedriskblog.com/2014/ ... es_28.html

Monday...

http://thereformedbroker.com/2014/12/29/buy-europe/

Tuesday...

http://www.ritholtz.com/blog/2014/12/oi ... bad-spain/

Comments are not available for this entry.

Calendar

Calendar