|

|

|

|

PBGC; THE

LEAKY LIFEBOAT

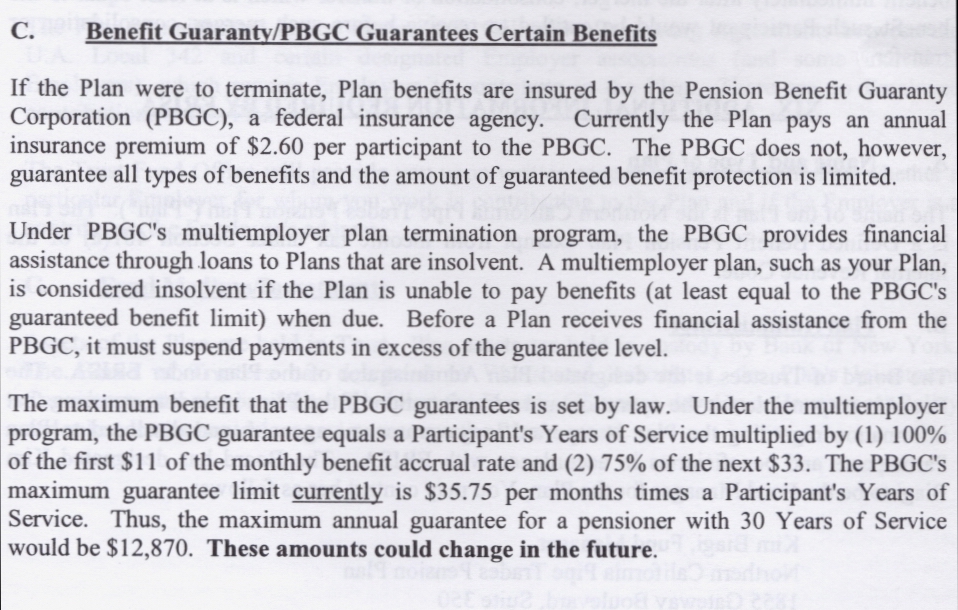

The quick and dirty read of this is that when a company such as United or GM declares bankruptcy and offloads

their pension liabilities on the PBGC, the pensioner's income gets immediately dropped to a capped amount. For a fitter like

me, figure a 50% reduction in the defined benefit is pretty close and 100% reduction in any non cash benefit . If

a pension fund were to fail under inadequate funding without a bankruptcy, the pension fund would have had to cut

down future benefits to apply the cash flow to meet existing reduced benefits and then failed to meet them for the

PBGC to step in. The PBGC would maintain that level, less nonmonetary benefits such as health coverages, through

loans to the pension plan... LOANS, NOT GRANTS, MIND YOU! Think of it as fire insurance with a 50% deductable,

you put the fire out before anybody shows up, no coverage of contents, you have to pay the living expenses back once

you've rebuilt, and you rebuild on your dime. And the insurance company watches over your family finances in the meantime.

Pretty cold comfort and piss poor protection...you just gotta make sure you never need to use it.

SLOGANS AND HOMILIES

"The market always comes back." "Hold on for the long run."

"Just be patient, you'll do OK" "Ya gotta be in the market at all times to do well ." "You can't time the market."

"If you sell now, you'll be out when the market turns up." "Chasing performance is a sure way to underperform."

"If you sell now, you'll lock in the losses." "Let the professionals make the decisions, they're a lot smarter

than you are."

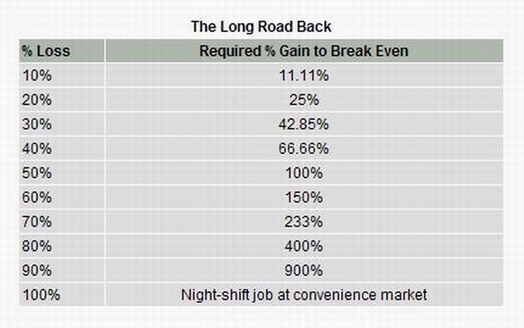

Above are a lot of the slogans and homilys given to you to to justify sticking with an investment

decision, regardless of how poorly it may do. The table below gives you a damn good set of reasons to sell out of a position

that goes bad as quickly as you can determine that it isn't working for you. Think of the 2000 to 2002 losses to my pension

plans shown on the CHARTS page. A 40% loss over two years requires a 66% gain to get back to even. Assuming the

fund resumes its prior rate of appreciation, that could require 4 to 6 years just to get back to where you were 6 to

8 years prior. Don't fall in the hole in the first place and you won't spend the rest of your life climbing out....

|

| Courtesy of Dan Fitzpatrick and TheStreet.com/RealMoney.com |

Important Links

KandG.COM

The Defined Contribution Fund management site. TheStreet.com

A lotta good information. The Big Picture

Check out the Apprenticed Investor Series. There are diamonds

lying on the ground if you just look.

FundAlarm.com

To Sell Or Not To Sell.... That Is The Question....

Stockcharts.com

Pretty charts in pretty colors.....

Morningstar.com

Type The Fund Name Or Symbol In The Quote Box

|

|

|

This is my 401a BLOG, the COFGBLOG. Click Here...

For those not familiar with this part of the Internet, a

blog is a WE(B log). Think of it as an online diary/column/whatever. This is where I try to lay it down so

it stays there and you try to pick it up and run with it. The pictures, charts, and tables on the joefacer.com

site tell you something. But a picture is only worth a thousand words. And you can't communicate much about

a complex subject in a thousand words. So this is where I try to fix that. I intend to post at least once a week,

by Sunday evening at the latest... or by Saturday midmorning if it goes the way I hope... or whenever it happens if

it goes that way. I'd bet on Sunday evening for the weekly account maintenance and more often when things get volatile...

An RSS reader makes the whole thing a lot easier to deal with.... You automatically

pick up new posts to the blog, including unexpected middle of the night/week stuff. That's what I'd do....

|

|

|

|

|

|

|

|

|

|

|

|

If you want to comment on this or request more information, use the form below for Email direct to me.

See ya at the Hall....

|

|

|

|