FROM THE COFGBLOG: MAY-JUNE/2006

FPA PARAMOUNT

I want to talk about Bill Sams and the FPA Paramount Fund (FPRAX). My

buddy Jack Kenny at Investment Investigators turned me on to Bill Sams and FPRAX back in '82. A mutual fund's charter

is its foundation. Bill's charter at FPA Paramount was pretty cool and relatively unusual; he was allowed to hold

up to 50% cash and typically held 10% to 30% in cash. He was a deep value investor, eclectic and conservative. He had

some ideas he believed in and he wasn't interested in having more money than ideas; his fund was closed to new investors

for a good proportion of the 80's and 90's. Owning FPRAX made investing a no brainer. Look what Bill did for

me.

It was big time fun from '82 until '98. When the market was hot, I was pretty much fully

invested. When things went bad, I was sizeable in cash. All this happened without any action on my part. My money septupled

between '84 and '98 while I watched.

For the early 90's, the challenge to anybody

who thought he had it together was "Oh Yeah? Well, how'dja do in '87, Smart Guy??" Here's how

the S&P500 did;

Bill was heavy in cash in October of '87, I believe he was carrying the full 50%. He got hit like everyone

else, but only half as hard. Then he turned the cash into stocks and rode the rebound. He and I finished the year up 23%.

I got a very good return with a lot of safety and absolutely no work. I'd had a 15 year run riding with a hot hand and

the future looked so bright, I hadda wear shades. FPA Paramount had turned a few thousand dollars in a 1984 investment into

a very nice down payment for a really nice house in SF while I just watched the money grow. There was no rush to buy a house; I

was making money with Bill. Then came 1998. All of a sudden, every week I had significantly less money. I'd had

draw downs before, but not like this. This was unrelenting, continuous, and painful with no relief in sight. Between mid '98

to mid '99, I lost enough money in FPA to put me back where I was back in '94. I'd thought my rate of return had

been pretty good, but if I stopped losing money and went back to my previous rate of return, it'd be 2005 before I'd get

back to where I was in 1999 and then I'd still be 6 years behind where I wanted to be. About then real estate

prices started rising as fast as my money was going away. Then our landlord started getting wonky about selling

the house we were renting. The future didn't look nearly as bright. Whereas hanging on and waiting out the bad stretches

had always been the best answer before, it was killing me now. How could I sell what had made me so much money in the past?

How could I sell something that was so far down and admit/accept/lock in the loss? What if it came back after I sold it? What

if it came back but it put me 6 years in the hole? WHAT IF IT KEPT GOING DOWN? Then I noticed something very

interesting. Maybe the answer to all these questions had been right under my nose all the time.

Idex JCC Growth

Every so often, I'd asked Jack if he had any other names like Bill Sams and Paramount.

He'd give me the name of a different fund in a different sector, a quality fund from a well known investment house, and

I'd put some money in. They'd do OK, Bill'd do as well, they'd have a so-so stretch and I'd put the money

back in Paramount. The latest fund was IDEX JCC Growth (IDETX). Suddenly, the money there had doubled. Click on the picture

below.

Between '96 and '98, IDETX had doubled the small amount I'd placed with them. I

took everything out of Paramount and put it in IDEX JCC Growth. Between 1998 and the first quarter of 2000, IDEX made back

the money lost in FPRAX and then some; it doubled again. In the meantime I'd read an article called "New Paradigm

or Mean Reversion?" by Jeremy Grantham & Jack Gray. Sep/Oct 1999; Investment Policy Magazine. Go ahead and Google

it. It's archived and still available and free besides. The article predicted the mechanism of the downfall and end of

the dot com era. I'd been around long enough to have witnessed the 1980's end of the energy and real estate/savings

and loan eras and I knew that it was only a matter of time until the same thing happened again to the dot coms. Obviously

the JCC advisors of the IDEX Fund were smart guys and they would ride the bubble to the top and step off the elevator when

it started to go down. (I love to sprinkle mixed metaphors willy skelter here and yon...) Here's what happened to my investment

in the IDEX JCC Growth Fund,

My wife and I took some of the FPRAX/IDETX money and bought our house in mid 2000 on the first leg down of the collapse

of the Dot Com bubble. We got a really lucky break on a house and we had the money thanks to IDETX and we moved on it. We

weren't about to let that opportunity go away. I rode the rest of the IDETX money part way down and AGAIN

I bailed out of a one time winning mutual fund that was now in the process of destroying my savings. Again, I

got outa there alive, but AGAIN, I left too much money on the table. Now I was REALLY

pissed. There was something going on that was giving me excellent gains and then taking them away and I didn't understand

why. So I got busy and figured it out.

IT AIN'T ROCKET SCIENCE...

"Buy and hold", "Be patient, it'll always come back, it always does",

"These are world class quality American companies, stay with them, you can't go wrong in the long run," is horse

exhaust.

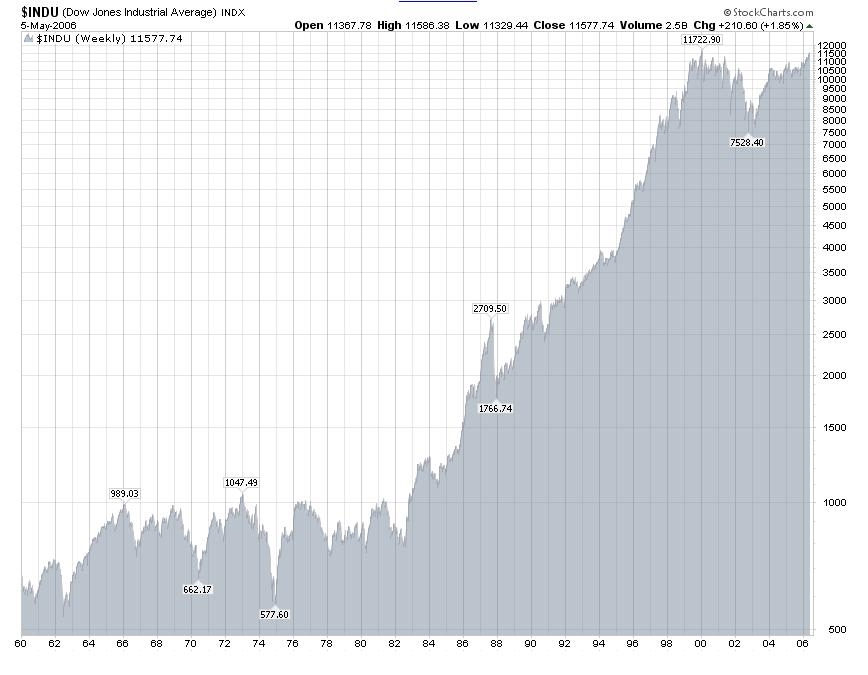

Check this out. Above are the Dow Industrials; 30 of the Great American Companies. Over the long run the trend

is up. Check the chart. Forty six years of "in the long run" progress is shown. Of course, in the long run we're

all dead. What matters to us is the portion of the long run during which we are earning and investing and the portion

of the long run during which we are retired and drawing on the returns of our saving and investing.

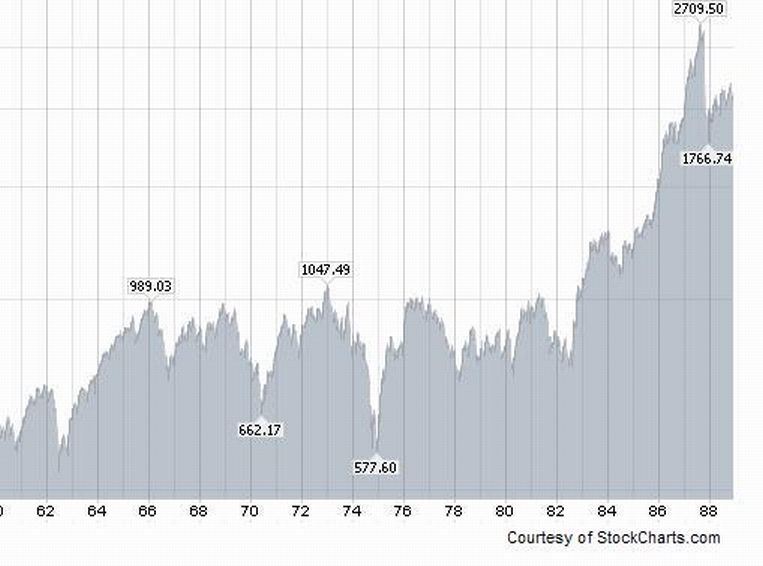

Now check this out. Above is the Dow between '62 and '88. Check out '66 to '83. In 1983 you had

held for the long run and were breaking even for the fifth time in 17 years. Not much to show for buy and hold and having

patience for almost two decades. You'd shouldered a lot more risk than a passbook account during that time and didn't

have the performance to justify it. Of course if you sold a little on the highs and bought a little on the lows,

I.E. traded the account, you did better. Still...

Now we're currently in another period

where we have had flat performance;six years and counting... We'll undoubtedly get back to even in the long run. It helps

to be 22 years old and have 40 years to go if buying and holding until you get back to even is what floats your boat. But

it sucks to be 55 and already thinking about taking the first step out the door to retirement. Six to seventeen years of flat

performance after the dot com crash? That is way too much of a long run...especially given where I'm coming from

and going to. If not buy and hold, then what? Bonds? Think the safety of bonds is the answer to preparing

for and living off of, once you get close to retirement? Check the charts on our bond funds against what fuel/housing/food

and medical care inflation have been. So....if not buy and hold or all bonds all the time, What?

What worked so

well for me when Bill Sams was running my money in FPRAX was that he was trading stocks. He ran a small fund, some where about

$50-$150 Mil when I started with him in '82 and around $700 Mil in '98, IIRC. In '82 interest rates were sky high.

He kept a lot of funds in cash and made a good return on it in the 80's. He had maximum flexibility to roll the money

between stocks and cash. He bought when stocks were down and he saw an opportunity and he sold when they went up to where

the upside was limited. Then he did it again. You always had to take into account that he was doing very well considering

his performance was accomplished with a significant cash cushion. It was especially good performance once interest rates came

down. If stocks went to zero, he'd still have had cash to return to investors. Most other mutual funds are 100% invested

and theoretically could lose it all. Bill Sams also had the ability to bail out of either a winning or a losing position quickly

because he carried relatively small positions; no bleeding a huge position into the market for many long months along with

all the other giant mutual funds, trying to get out as fast as possible without destroying the stock price. He was playing

a value game, looking for diamonds in the dirt. He bought stocks that were going down or already down and were going to go

up. He was right for years. Then he was not.

Due to the Thailand baht crisis, the Asian Contagion, the Long Term

Capital crisis, the Russian bond crisis and other financial crises of the 90's, the Fed flooded the market with dollars

and lowered rates. Bill saw inflation on the way and set up for it in gold, commodity stocks, and other defensive positions

and stayed the course, regardless. Instead of driving gold and oil up, the money went into the "new economy", dot

coms, telecoms, etc and it was FPRAX that blew up. There came a time for me to trade the trader. Whether or not Bill Sams

was right in the long run was meaningless. He was costing me big time right then and there. Nobody calls it right to the day

for a whole career. But being years early is being wrong and being wrong can put you in a hole you will not climb

out of in your lifetime.

"It is not how right or how wrong you are that matters,

but how much money you make when right and how much you do not lose when wrong."

George Soros

So I stopped the losses. I moved on. I had bought and so I sold. I got impatient. I got short runnish. Bill stayed the course,

sure he was right. He was. Ultimately, gold, oil and metals soared, starting in 2003 and really taking off more recently.

Bill Sams was "retired" shortly after I was out of FPRAX, in 2000, but long before he was proven right and long

after FPRAX had lost a ton of money and most of its investors. Management of FPRAX was given to the managers of FPA

Perennial Fund FPPFX, a fund that was/is run similarly to FPRAX. Hell, Bill may have trained his replacements. Regardless,

the market stayed irrational longer than Bill Sams could stay employed and far longer than I was willing to lose money.

Check this out. Pretty good performance since 2000, right? And, last I looked, both FPPFX and

FPRAX were carrying about 30% cash. So...FPRAX was right, then it was wrong, and now it's right. What does it mean?

FPRAX LESSONS

YOU CAN'T LOOK AWAY

FROM YOUR MONEY. IT'LL GO AWAY IF YOU DO SO LONG ENOUGH.

No money manager is always right. No system works all the time under all circumstances.

No money manager is above regular review and everyone is subject to replacement if the performance isn't there. It all

falls back onto the individual who invested the money. You can't expect a money manager to fire himself because he's

been losing you a lot of money and doesn't intend to change what he's doing because he thinks he is right. That's

your job. There are times when they don't even admit that they've been wrong. Been there. Listened to that on the

phone. It's about understanding that it is NEVER a no brainer to give your money to someone else to manage. You have to

understand what he is doing, and whether or not it is working. If you get lazy about it, you can end up being the no brainer

if/when your money goes away.

Can this even be done? Isn't this a huge amount of work?

Don't you have to know what your money managers are holding every single day? Don't you have to trade every day? Isn't

it a huge risk? I think so. No. No. No. I don't think so. In that order

I think

that I can successfully manage my 401a right here with the tools I've got on this site and a little reading up on the

market and economy. Bill Sams was responsible for making me a dollar. That was very good. Teaching me that it is my responsibility

to see that I kept the dollar, with enough of a cushion to stay in the game while I learned the lessons, that was great.

IDETX LESSONS

Monetary policy had been loose in the late 90's; cash was there to be had, but the rates were going higher. The market

as a whole was not doing well at the end of the nineties. Much of the economy was suffering under the high rates, but most

of the loose cash had run downhill and was piling up in the corner that held telecom, tech, and the internet where a good

old fashioned stock bubble was underway. So there was this money management company called Janus and one of their funds was

called Janus Twenty Fund. It was/is a hard charging, concentrated, high risk fund. It held twenty or thirty of the hottest

stocks. No safety in diversification, but a lot of horsepower if they got it right. When the market narrowed radically in

the late 90's and fewer and fewer stock went higher and higher, they were right there in those stocks and only in those

stocks and WOW, they were RIGHT.

Other funds in the Janus family saw what was going on and bought into the same scenario and

the same stocks. Other funds in other fund families did likewise. During the last stages of the bubble, it was amazing where

you could find those same hot stocks. Sector funds totally away from tech etc held these stocks (very quietly) because it

was the only way to show any performance and without performance, the client's money went away. These stocks were bought

and bought and bought. Many funds acquired outsized positions because these stocks worked, money came in, and it was a no

brainer move to buy more of what got ya there. Enter my position in IDETX. The Idex Fund family runs a lot of funds and contracts

with outside advisors. My alternate fund to FPRAX was IDEX JCC Growth (IDETX). The "J" stood for Janus. I had traded

in my value fund for a ride with the Hired Hand Janus Hot Money Boyz in a momentum fund, without a clue as to what was

going on.

I rode Idex and their Janus hot money clone fund up to the top along with everyone else who held the same

hot money stocks. When we all hit the top as per "New Paradigm or Mean Reversion?" by Jeremy Grantham &

Jack Gray, I figured that the Idex managers would step off at the top just as the elevator started to go down. Sell the top,

book the profits, and I'd live happily ever after. It didn't happen. Instead, the managers at Idex actually were only

hired hands who owned the same stocks big time back at the ranch. Actually almost everybody on the Street owned the same stocks

and the doorway out was not wide enough to let everybody out all at once. I coulda sold my IDETX in the time it took to get

a letter with a signature guaranty downtown. Instead I hung on for part of the ride down as everybody bled their positions

into the market, driving the prices lower over more than a year.

The

Conclusion of "My Most Gnarley Mutual Fund Adventure"

So, to sum up the FPRAX/IDETX

affair:

1) No game goes on forever. If you buy, you are almost guaranteed to

have to/want to sell at some time. It was 12 years for FPRAX and 12 months for IDETX for me. When the game is over, you need

to leave the table and go somewhere else or lose what you've gained.

2) It's the manager, not

the fund. Or it's the era, not the fund. Or the economy. Or the world economy. Or national politics. Or world politics.

Or whatever. Good funds practicing a particular discipline can be totally wrong at any given time for a number of reasons.

When things change, you change. Or you pay the price. Then you change back. Or not. It depends on what is happening.

You need to know.

3) Price and trend are what's important to you. Every day something happens

somewhere that can meaningfully affect your investment. Often it can, but it doesn't. Price and trend will always tell

you what is really going on. It's the only unequivocal, direct, and elemental information that you can get. Unfortunately,

it is about the past and not the future. No one said that this was easy. But if it is really a

trend, it is something that can be used.

4) You need to direct a self directed plan and

you need information to do that. Given that there are pro's in place at the funds applying their knowlege, experience,

and judgement on your behalf, you still are making a decision every day or every week or every month as to whether or not

they will continue to do so.

IS WHAT THEY ARE

DOING WORKING? GO BACK AND LOOK AT THE CHART PAGES OF THIS WEBSITE IF YOU HAVE ANY DOUBT THAT YOU CAN NOT AFFORD NOT TO KNOW THAT ANSWER!!

There's always something you need to know. You need to learn how and where to get the information and

apply it. Get used to it.

5) No one cares about your money the way you do. The investment industry

cares that your money shows up and stays so that it generates the fees to pay their salary. The legal authorities care that

laws about managing your money are not broken. Or not. HAS ANYBODY GONE TO JAIL OVER THE CRIMINAL ACTS OF THE MORTGAGE MELTDOWN?

There is no law that says it is illegal for you to lose your money in bad investments or for fees and piss poor management

to fritter away your future. The financial markets don't care about your money, your hopes, or your dreams. It doesn't

care about anything, whatsoever, period. You are the only one who REALLY cares about your hard earned money

and the return it should earn you. And only you will make the hard choices that need to be made when the time comes. Do you

really expect a money manager to fire himself because stopping you from losing money is more important than him keeping

his job?

6) It's not a sin to be wrong. That's why there are erasers and whiteout openly for

sale and not hidden behind the counter. I screw up, the President screws up, surgeons and street sweepers screw up, everybody

screws up. But it IS a sin to STAY wrong. It cost Bill Sams his job and FPRAX and IDETX

my money. That's why McMorgan no longer is our only pension fund advisor. Don't let the possibility of being wrong

paralyze you. But the idea of being wrong and staying wrong should cause you to break out in a cold sweat. When I look back

at the McMorgan era of 342's pension plans, the sweat pours down and I hate that it lasted as long as it did...

7) The investment industry will tell you to stay fully invested at all times; you might miss a money making

opportunity and cost them some fees if you don't. Notice how nothing is ever said about missing out on falling into a hole

and not losing most of your investment by not being fully invested when it all turns to shit? That would cost the money managers

some fees. They get the fees win or lose. Besides, you probably may most likely do kinda OK if you stay long and are lucky

and things work out and anyway, they get their fees that way. And besides, they can't charge you fees and take your money

if you don't stay the course. Because it's all about the fees, see...the fees.

8) What comes around, goes around. Nothing stays right forever or wrong forever

and you've got to be flexible. What was right and now is wrong can be right again and probably will be when you least

expect it. It is never as easy as making one decision and being set for life. It is about making more decisions

right and fewer wrong in a constantly shifting environment.

For me, it's all about returns.

I got no problem with it all being about fees for the investment industry. That's how their familys are fed.

Returns on my money are what is important to my family. That's what'll keep a roof over my head and food on the table

when I retire. So it's the returns... That's what I'm talkin' about, it's the returns. Know what I mean,

Vern?