Seasons Greetings... A Festivus for the rest of us? Gimme a break and a gingerbread man and another egg nog while you're up.

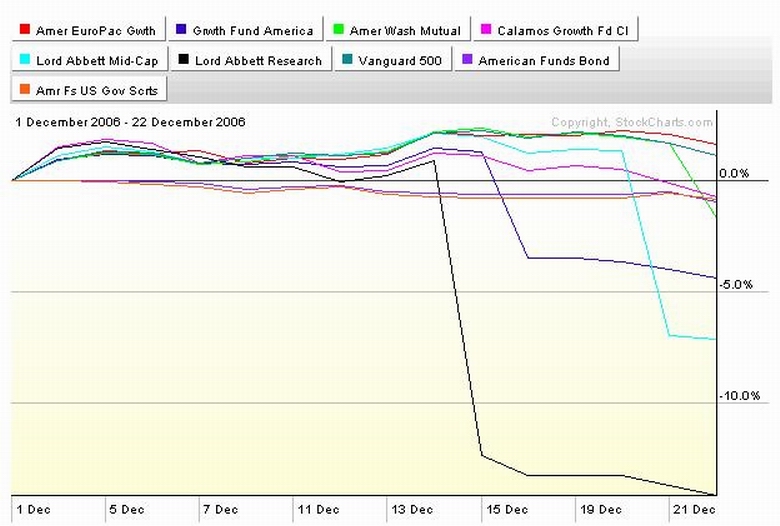

Here's what the current charts show for cap gains hiccups. It's a PITA, but better to have gains than not...Know what I mean,Vern?

Figure that the American Fund EuroPacific Fund does it's thing in the last days of the year, so there's more to come.

Charts and tables up. With qualifications... Some of the dividends and cap gains have been paid and the numbers are good. Some may be history but the numbers may not/don't reflect it yet. Complicating the whole ball o' wax is that the markets are a touch flakey right now. So are the down numbers cap gains or the market?

It's been a good, but a tough year. There was a huge whoosh down in May. If you were all guts and no brains, you bought back in in August and you look like a genius today for riding the whoosh back up. If you were smart, you waited to see that the re-launch upward of the market was for real and you waited for the first substantial pull back to get in at a reasonable price. That first substantial pull back happened last week. So you looked like an idiot for waiting for the next to last week of the year to make up for the previous 11-1/2 months. the longer you waited, the more you left on the table. This is why you stage the buys.

So this week, everybody not in a 401a (k) faced this dilemma... If you were brave (foolhardy), you look like a genius. Now you wait until January to sell and avoid the tax hit this year, assuming everybody else does too. Or if you were late to the party and have damn little to show for it, you wait to sell so what you did make looks as good as it can. Of course, if someone tries to beat the selling rush and sells late in December, they pay the taxes but they may avoid the next whoosh down. Or start the whoosh as everyone tries to crowd out the door first. So expect another whoosh down in January as everybody or only the people who left it until too late left lock in profits. Unless it happens in December. Of course if enough money pours in to the stock market due to the Santa Claus effect or the strong late year run, it may cause a very substantial bounce back from the December selling, if there is any, or swamp the January selling, which there will be some of. Or not. Either way. Most likely. Now if some of the money managers were able to hedge their portfolios with options, then they will be able to .... Nah, I think I'll go shopping instead.

If this was easy, everybody would be rich... So anyway, we'll have to wait for the statements to finally get the whole story... and wrestle with what to do about it...

I've moved a dollar or two around but I'm standing pretty pat other than bailing on RGAFX to try to game the Dec/Jan sales and putting another dollar back into LAVLX because they might be through with their recent spell of underperformance. We'll see. I'm getting my account balance up where I can't move much of a percentage around without triggering tading restrictions. I feel strongly about it both ways. Finally, there were some thing i was going to do as a Trustee if I got elected. I'm making a list and checking it twice to get started on it. Don't confuse lack of motion with nothing going on. Watch the site.

I bumped my contribution up for next year. Hopefully you did too. If you want to know what more there is to do to prepare for your future, get a fast connection, a large monitor, find out when I got a Saturday free, round up about ten other brothers and sisters, and rattle my cage about showing you what I do and why. Iff'n that don't happen........See ya at the hall.

Figure that the American Fund EuroPacific Fund does it's thing in the last days of the year, so there's more to come.

Charts and tables up. With qualifications... Some of the dividends and cap gains have been paid and the numbers are good. Some may be history but the numbers may not/don't reflect it yet. Complicating the whole ball o' wax is that the markets are a touch flakey right now. So are the down numbers cap gains or the market?

It's been a good, but a tough year. There was a huge whoosh down in May. If you were all guts and no brains, you bought back in in August and you look like a genius today for riding the whoosh back up. If you were smart, you waited to see that the re-launch upward of the market was for real and you waited for the first substantial pull back to get in at a reasonable price. That first substantial pull back happened last week. So you looked like an idiot for waiting for the next to last week of the year to make up for the previous 11-1/2 months. the longer you waited, the more you left on the table. This is why you stage the buys.

So this week, everybody not in a 401a (k) faced this dilemma... If you were brave (foolhardy), you look like a genius. Now you wait until January to sell and avoid the tax hit this year, assuming everybody else does too. Or if you were late to the party and have damn little to show for it, you wait to sell so what you did make looks as good as it can. Of course, if someone tries to beat the selling rush and sells late in December, they pay the taxes but they may avoid the next whoosh down. Or start the whoosh as everyone tries to crowd out the door first. So expect another whoosh down in January as everybody or only the people who left it until too late left lock in profits. Unless it happens in December. Of course if enough money pours in to the stock market due to the Santa Claus effect or the strong late year run, it may cause a very substantial bounce back from the December selling, if there is any, or swamp the January selling, which there will be some of. Or not. Either way. Most likely. Now if some of the money managers were able to hedge their portfolios with options, then they will be able to .... Nah, I think I'll go shopping instead.

If this was easy, everybody would be rich... So anyway, we'll have to wait for the statements to finally get the whole story... and wrestle with what to do about it...

I've moved a dollar or two around but I'm standing pretty pat other than bailing on RGAFX to try to game the Dec/Jan sales and putting another dollar back into LAVLX because they might be through with their recent spell of underperformance. We'll see. I'm getting my account balance up where I can't move much of a percentage around without triggering tading restrictions. I feel strongly about it both ways. Finally, there were some thing i was going to do as a Trustee if I got elected. I'm making a list and checking it twice to get started on it. Don't confuse lack of motion with nothing going on. Watch the site.

I bumped my contribution up for next year. Hopefully you did too. If you want to know what more there is to do to prepare for your future, get a fast connection, a large monitor, find out when I got a Saturday free, round up about ten other brothers and sisters, and rattle my cage about showing you what I do and why. Iff'n that don't happen........See ya at the hall.

Calendar

Calendar