This a BLOG about my Union 401 Defined Contribution Plan.

Ahm jes' anudder ol' broked down retahrd union pipefitter.

I retahrd in September of 2013 after 40 years in the trade, five years after this picture was taken. At the time, there was only one retired pig inna pichur. Now there would be two...

I had started actively managing my 401 in 2004, after leaving it untended and with the minimum contribution since its inception in 1991. I was too busy raising a family, building America, and riding, racing and writing about motorcycles to pay any attention to saving for retirement. After all I had my Defined Benefit Plan and an IRA or two. What more could I need? Big mistake. I had contributed the minimum amount to the Defined Contribution Plan and left the funds in the default Balanced Pooled Fund. But between 2000 to 2003, I had to straighten out a coupla my IRA's after the dotcom-9/11 financial crash had crushed them, and as an afterthought, I then applied the same kind of evaluation to my 401 account and to my defined benefit pension fund. I found both to be in desperate straights. I was able to help turn both around. The story of both my IRA's and 401 are in part on my website. www.joefacer.com

Once I was able to get decent returns from my 401, I increased my contributions until I was maxed out and started to save some serious coin and to make serious returns for my retirement. It worked out really well... So far.

I have a nice income from my defined benefit pension plan and Social Security. Today. But my pension plan has no cost of living adjustment.

Only 30% of my pension income, the Social Security part, adjusts for inflation. Add my wife's pension and Social Security into the mix and we're a little short of 50% of our pension income being inflation protected. The continued wellbeing of my wife and I is dependent on how I handle my retirement savings.

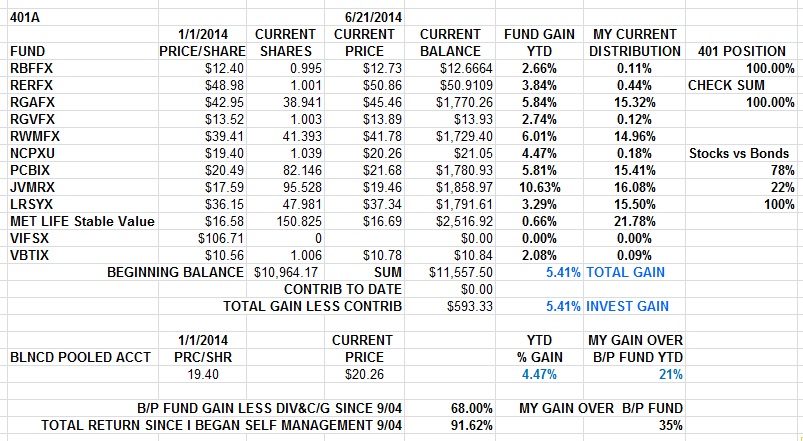

Since retirement, I've given almost all of my 401/IRA balance over to professionals. But not all. I've kept $10K in my Union 401 account to provide a benchmark for the professionals and to keep the 401 account open should I decide to take management of the funds back. Here's where I have the money allocated, how I've done this year and since I started managing my 401(table), and how I've done since I started managing my 401 post retirement in 2013 (chart).

Note that this is my personal 401 account, managed for and by me, as I see fit, for Where my head is at and my perceived needs. I have Social Security and a defined benefit pension for regular income and I am looking to generate serious returns on my retirement savings for future use when my fixed pension income falls seriously behind my cost of living inflated needs. I am aggressive in nature but with three generations (wife and I, kids, and grandkids) to think about, I gotta make the right moves. I can stand the volatility of this approach, the gains are proven, and it is a plan. It's my plan..

I've made a copy of the Excel spreadsheet I use to track and manage my 401 available to download on my website. If you are not in my Local, the spreadsheet can be adapted to other 401s and other mutual funds by someone with a modicum of Excel experience.

I post here what I read that I find of significance or interest. I allocate funds within the 401 between aggressive and conservative allocations as circumstance and inclination require based on what I read and some professional level subscription data. Running the blog keeps me honest with myself. Putting it in writing makes sure I really have a grip on the handle.

Part Two

Every so often, I find myself thinking that I've got something to say. Things like the "Mutual Fund Investing" ( www.joefacer.com/id18.html ) riff on my web page. And 'jes Annuder Old Broked Down Pipefitter" on the blog here. "Easy Now?" part of this post, looks like more of the same.

�Buy the ticket, take the ride."

-- Hunter S. Thompson

I've Been Getting Some Serious Work Done On My Retirement... this last week or two. Yeah, I retired the first of Sept 2013. But therein lies the story alluded to, above.

I've got this spreadsheet... I've had it for a while. It was my touchstone regarding my retirement for the last coupla three/four years. It was in large part an automated matrix of Years/Age x Sources Of Income. I had started a small business back in the 80's just as the IBM Personal Computer was introduced...

NERD ALERT!!! Seriously... Skip This Part.... There were a coupla local stores that would have sold me a PC if they had one. No one did. Hell, one store had one blank floppy disk and everybody else was outa stock. So I bopped down to the IBM corporate headquarters where this eye candy model in a business suit next to a spotlit display of a single nonoperational computer on a pedestal tried to send me up to the 12th floor to sign up with a Corporate New Account Representative. Not likely. (NTFL) So I went home and bought by mail order, a new IBM PC with the latest motherboard (256K bytes memory), dual double sided half height 360K floppy drives, the latest DOS (2.01) and one of the new amber CRT monitors, a dot matrix printer with tractor feed, and a daisy wheel printer, etc... Later, I went back to the local store and convinced the guy onna floor to sell me the only blank floppy disk available in the city since I could use it, and he might as well have no floppies as one. From there, within a coupla years I was using a word processor and Lotus 123 to create my own automated business software.

...so my spreadsheet was set up to automatically tally my prospective post retirement income for current and future years, by monthly cash pension and Social Security payments, and by theoretical income from my investments/savings. I also had a table of my W-2 incomes for the last 10 years set off to the side to give me a reference for the monthly and yearly income, and the matrix was done multiple times on the page with various rates of return on my savings. The whole spreadsheet was interactive and linked to my personal financial spreadsheets, allowing me to update it instantly and track it real time.

The end result was that when I was no longer able to work in 2013, my spreadsheet told me that my pension/Social Security income would give me a livable income and that given a 4% return on my savings, if I withdrew only the income, I could get all the way to what I'd earned in 2010, paying the bills, allowing some discretionary spending, and allowing me to draw principal as required for some inflation protection...

Kool. It was not like I had a choice. Regardless, I was set. I retired. But I was only sure about the here and now.... Where would I stand as the years went by? Would my wife and I be living in a cardboard box in ten or twenty or thirty years? Would I be able to leave the kids anything? Should my wife or I die well before the other one did, how would the survivor get by?

My Union pension is fixed. What about inflation? How fast would my Union pension's contribution to my income shrink? How much other income would be required to replace it and how soon? Can I spend a dollar on fun stuff today with a clear conscience, or will every dollar spent hasten the arrival of the day that I try to convince myself that living with the kids was my plan for my wife and I all along? Will I have to speed up my rehab from my latest knee surgery so I can get a job? Am I doomed to a future with an orange apron in it?

Passive acceptance is not my preferred mode of operation, finding out what's going on and dealing with it is. So I started to get some answers. I began with this table...

http://www.ssa.gov/oact/STATS/table4c6.html

As per the Actuarial Life Table for 2009 from the Social Security Administration, if ya started with a theoretical 100K males, by the time you get to 63 years, my age at my retirement, you'd have 82.6K men left standing. The nominal life expectancy at 63 is 19 years. That gives an average mortality at 82 years old. But that also means that of the 82K men standing with me when I was 63, 41K of them are expected to still be standing when we all hit 82. Hopefully I'll be one of the ones standing. If I am, I'll still need income and with hopefully a lotta good years to go I'll need a handfull. Let's say that my health and luck are good. If so, I have a 1 in 4 chance of still being alive at 89 and still needing income. That's not an outlandish bet. Running out of money and needing to get a job in my 90's worrys me a lot more than leaving my kids with more to inherit than I expected to leave them if I die in my late 70's. So I have to plan for a 30 year long retirement without a brick wall at 92, just in case I make 100 plus years old.

Next I needed an income and expense matrix, including pension income, assets, investment income, taxes, inflation, expenses, a discretionary budget, a bequest number, and all this by a timetable. And I need it in a format that will allow me to track it so I can see if it is working, and give me direction as to what to do to keep it working in the face of the unexpected. If I had this, then I would have a plan.

Well, as per noted elsewhere in my blog, I've sought out investment professionals to handle part of my retirement income and they've been busy doin' what they do. Such as working up the plan I just described. I've been grinding on the finer details for a week...

I'll stop here for now. Mostly. So Far, So Good. I'm retired and the near future is well in hand. And, I've got what I need to evaluate whether I can continue to live comfortably in my current lifestyle, do some fun retired type things, help the kids out along the way, leave them something, and not have to move us old folks in with them for the last decade or two. Hell, my wife and I barely survived the first go round of living with the kids when they were teenagers. The good news is that I can do all that good stuff above. The bad news is that It's not a slam dunk. My pension covers about 55% of our expenses this year. Given historically based projections of inflation, my expenses will be multiplied by about 2.3 times by the time I'm 82. My pension is projected to be 26% of our income at that point, without counting for increased medical coverage costs. If I hit 90, I'll be needing 3 times today's income to maintain my standard of living and my pension is projected to cover only 19% of that cost, again not counting for increased medical coverage cost. The numbers are surprising... and the base reality is not encouraging. My Union Pension is fixed, my medical coverage comes out of the gross sum, and medical costs will grow, reducing my monthly pension payment. Currently only about half our our pension income will be adjusted for inflation. On top of that, Social Security is motivated to fudge on the cost of living adjustment so as to delay going broke, leaving everyone falling slowly behind every year. And, just to pile on when I'm down, my wife's pension's cost of living adjustment is based on the first year's number. That number, (a neglible amount) will follow her to the end of her days... A VERY tricky bit of fine print! And on top of that, she has not yet drawn her Social Security. When she does, her Social Security will be reduced over what she should get because she has a state pension rather than a private one. Bummer. So I'm going to have to do the heavy lifting of our retirement income cost of living adjustments myself. The good news is it looks like I can do it with my savings and investments. I like this plan they came up with. I can make this work.

But It Was A MAJOR Slap Upside The Head to see the numbers and see how much the future will rely on sucessful financial planning and investments.

Uhhh. You got this under control for yourself...right?

Part Three

STAY TOONED.

Part Two

Calendar

Calendar