I've had, depending on the fund, 50% to 100% returns in a 3 year period...But markets are cyclical in nature....So, this rough period is the other side of the coin....It's not just what you make...it's what you keep

Sunday, January 20, 2008, 11:42 PM

IT'S 9:00 PM MONDAY EVENING AND THE INTERNET

NEWS AND FINANCIAL SITES ARE TALKING EITHER A

MAJOR DOWNDRAFT OR A WORLD WIDE CRASH IN

THE MORNING. I'M 93% CASH AND NOT BY ACCIDENT.

STAY TOONED.

"It is not the critic who counts, not the man who points out how the strong man stumbles or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood, who strives valiantly, who errs and comes up short again and again because there is no effort without error and shortcomings, who knows the great devotion, who spends himself in a worthy cause, who at the best knows in the end the high achievement of triumph and who at worst, if he fails while daring greatly, knows his place shall never be with those timid and cold souls who know neither victory nor defeat"

Theodore Roosevelt

Charts and Table Zup.

I've put my money where my mouth is since mid 2001. You know how that came to pass from reading my website. For the last six years I've spent my money and time learning the important lessons about how to plan and invest for my future. I feel I've I've earned the right to value highly my opinion on what to do with my 401a. If you value my opinion and want it for a damn sight less than it cost me, stay tooned.

I never hesitate to tell a man that I am bullish or bearish. But I do not tell people to buy or sell any particular stock. In a bear market, all stocks go down and in a bull market, they go up.

Jesse Livermore

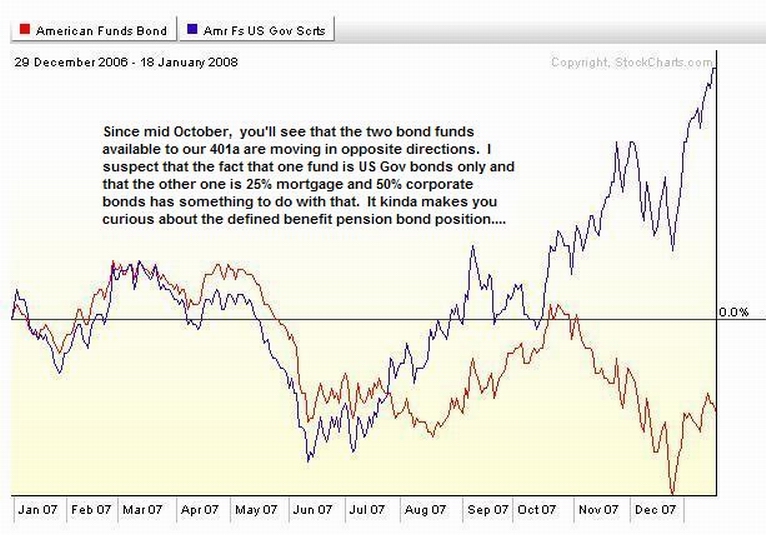

The short version is that I'm over 90% in the GIC (Met Life) and as little in stocks as the rules allow. I'm also staying out of bonds, although I may start to build a position in one of the bond funds while avoiding the other; see below, and CLICKONNIT!!!!

Charts and tables are up later than usual this week and commentary will be posted as time allows. like now....

http://www.nytimes.com/2008/01/12/busin ... ref=slogin

http://bigpicture.typepad.com/comments/ ... ecess.html

http://www.bloomberg.com/apps/news?pid= ... fer=invest

http://www.nytimes.com/2008/01/20/magaz ... gewanted=1

Check out page 8, eighth paragraph. and Cramer @ http://www.youtube.com/watch?v=rOVXh4xM-Ww

I took a trip to Bass lake with my family down Highway 99 through the newly built up Central Valley. I saw auctions for homes and cars on billboards along the way. People don't lose homes without losing their cars and maxing out their home equity and credit cards on the way down. See prior posts on the COFGBLOG on foreign banks/hedge funds cratering on MBS's. I've been through these things since the 70's and the internet allows me to be much better informed this time around.

http://www.nytimes.com/2008/01/20/busin ... oref=login This time the nightmare is real. It's not selling the rubes what only they will buy (Japanese and Rockerfeller Center and Pebble Beach and the yen), this time it is the Chinese and oil exporters and our dollars. Get used to it.

http://bigpicture.typepad.com/comments/ ... rty-r.html

Pay attention to Barry's "Apprentice Investor" series on his blog. His is one of the few blog links on my blog and he has an open invitation for a ride up the coast on his next trip out west. His concerns for the economy are mine.

http://www.bloomberg.com/apps/news?pid= ... 61sYU&

A glimpse behind the cutain... but not behind the curtain behind the curtain.....

http://www.reuters.com/article/reutersE ... 4420071106

If Muni bonds go down, is my pension fund(s) and it's investments somewhere in the chain reaction?

http://www.nakedcapitalism.com/2008/01/ ... lking.html

http://bigpicture.typepad.com/comments/ ... heeee.html

http://www.bloomberg.com/apps/news?pid= ... Z8wwg&

Only 43% of the retail space destined to come online this year is justified?

http://www.mises.org/story/1568

It was a grandkids kinda weekend, ya know. Ya gotta have priorities. See ya at the track.

Comments are not available for this entry.

Calendar

Calendar