Bear Markets Scare Out The Timid And Wear Out The Tough. The Object Of The Exercise Is To Show Courage And Be Among The Last Still Standing With Plenty Of Capital To Participate In The Next Bull Market. The Rev Is Right. Getting Back To Even Is A Tremendous Waste Of Time And Resources.

The best minds are not in government. If any were, business would hire them away.

-- Ronald Reagan

UPDATED ALL DAY EVERYWHERE 11/23

UPDATED THANKSGIVING (FORGOT TO INCLUDE ONE OF MY FAVORITE YOUTOOBZ)

http://www.ritholtz.com/blog/2008/10/whassup/

Chartz and Table Zup @ www.joefacer.com.

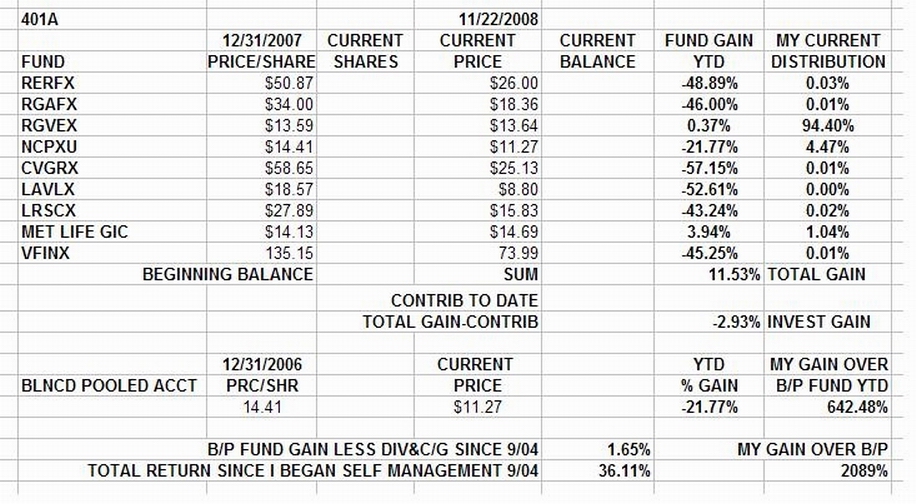

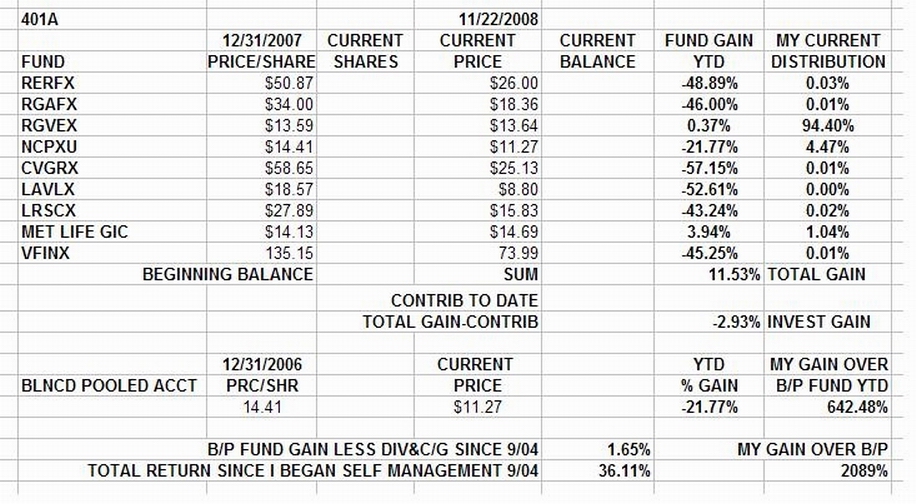

I'm up over 600% Year To Date over the Balanced Pooled Fund and up over 2000% over the B/P Fund since the Trustees provided us with more than one fund to work with as of 9/04.

I was not expecting to do this well, but neither was it an accident. It was/is avoiding an all risk/no gain stupid dangerous market. One hundred fifty plus MPH toward Turn One is big time fun dangerous. I'm down wid' dat. Watching my hard earned retirement money go up in flames hoping it all comes back as fast as it went away is hoping a forest fire burns backward and leaves the forest untouched. That's big time stoopid dangerous.

You can't expect to succeed with a self directed plan unless you actually direct it..... And that doesn't mean flailing away at every twist and turn anymore than it means ignoring everything all the time because someone told you it was at all times and everywhere safe and easy and that trusting everything and everyone and doing nothing was the smart thing to do. Think of it as keeping track of the calender and playing the seasonal weather. I was almost all stocks all the time from 9/04 to 3/08. (A Financial Spring, Summer, and Fall) I've been GIC or gov and gov agency bonds since then.(Financial Winter) I'll be back to stocks when the current financial nuclear winter is over and it's springtime again. (Who knows when? I'll have to keep checking.) It's as simple as THIS:

CLICKIT!!!

Congratulations to those who followed along or did better on their own.

IN THE MEANTIME....

Some old favorites....

http://www.youtube.com/watch?v=90ELleCQvew

http://www.ritholtz.com/blog/2008/11/fo ... ng-hitler/

http://www.youtube.com/watch?v=KycZk1M7g24

http://www.youtube.com/watch?v=1aS3jC_nKW4&NR=1

http://politicalhumor.about.com/gi/dyna ... en/805381/

http://politicalhumor.about.com/gi/dyna ... en/805381/

http://www.collegehumor.com/video:1788161

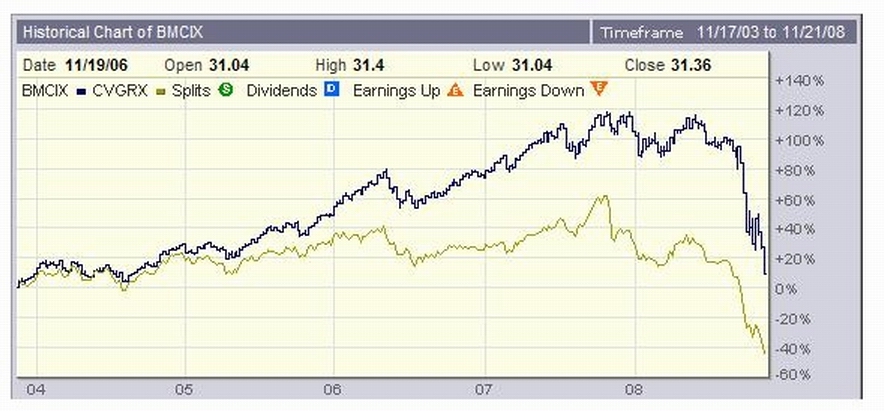

The Board of Trustees are dropping two fundz and replacing them w/ two other fundz. Calamos Growth(CVGRX) is being replaced by Blackrock US Opportunities(BMCIX).

My look at the two fundz on WWW.STOCKCHARTS.COM Perfect Charts shows BMCIX to be the far superior fund. But the Perfect Chart only goes back five years. Lets see what WWW.BIGCHARTS.COM sez.

CLICKIT!!!!

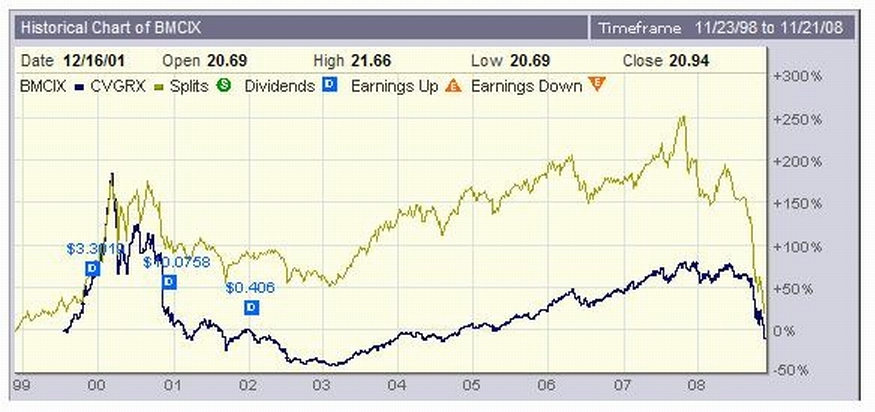

I use BIGCHARTS.COM when and because they offer me options unavailable on my preferred STOCKCHARTS.COM. (Links for both up above.) BIGCHARTS shows me that the picture is a lot less clear if you go back 10 years. Buy and holding in 1999 shows that CVGRX is the far superior fund from '99 up until '08. Buying in '04 and selling at the end of '07 shows that BMCIX is the far superior fund. Either of these fundz will/would've work/worked well with a reasonable investment and money management strategy. I'm ready w/ both.

IT DRIVES ME UP THE WALL WHEN SOMEONE ASKS ME ABOUT A ONE DECISION FUND FOR THEIR 401A. THE 401A IS A HUGE OPPORTUNITY IF YOU FUND IT AGGRESSIVELY TO TAKE ADVANTAGE OF THE TAX SAVINGS AND A HUGELY DANGEROUS THING TO IGNORE ONCE YOU HAVE ANY SORT OF MEANINGFUL BALANCE. YOU HAVE TO MANAGE YOUR 401A TO SOME DEGREE IF YOU WANT TO AVOID THE RISK OF MAJOR BIGTIME GRIEF. THIS YEAR DEMONSTRATES THAT CONCLUSIVELY.

Links

http://www.ritholtz.com/blog/2008/11/gl ... te-ratios/

http://www.ritholtz.com/blog/2008/11/ev ... ost-money/

http://www.ritholtz.com/blog/2008/11/br ... ica-dream/

http://www.ritholtz.com/blog/2008/11/ho ... ome-owers/

http://www.nytimes.com/2008/11/18/busin ... .html?_r=1

http://www.ritholtz.com/blog/2008/11/re ... king-data/

http://www.thetruthaboutcars.com/catego ... out-watch/

http://www.ritholtz.com/blog/2008/11/11 ... lout-plan/

HOW I RUN MY 401A TO RESUME AFTER THANKSGIVING.....

I'm up over 600% Year To Date over the Balanced Pooled Fund and up over 2000% over the B/P Fund since the Trustees provided us with more than one fund to work with as of 9/04.

I was not expecting to do this well, but neither was it an accident. It was/is avoiding an all risk/no gain stupid dangerous market. One hundred fifty plus MPH toward Turn One is big time fun dangerous. I'm down wid' dat. Watching my hard earned retirement money go up in flames hoping it all comes back as fast as it went away is hoping a forest fire burns backward and leaves the forest untouched. That's big time stoopid dangerous.

You can't expect to succeed with a self directed plan unless you actually direct it..... And that doesn't mean flailing away at every twist and turn anymore than it means ignoring everything all the time because someone told you it was at all times and everywhere safe and easy and that trusting everything and everyone and doing nothing was the smart thing to do. Think of it as keeping track of the calender and playing the seasonal weather. I was almost all stocks all the time from 9/04 to 3/08. (A Financial Spring, Summer, and Fall) I've been GIC or gov and gov agency bonds since then.(Financial Winter) I'll be back to stocks when the current financial nuclear winter is over and it's springtime again. (Who knows when? I'll have to keep checking.) It's as simple as THIS:

Congratulations to those who followed along or did better on their own.

IN THE MEANTIME....

Some old favorites....

http://www.youtube.com/watch?v=90ELleCQvew

http://www.ritholtz.com/blog/2008/11/fo ... ng-hitler/

http://www.youtube.com/watch?v=KycZk1M7g24

http://www.youtube.com/watch?v=1aS3jC_nKW4&NR=1

http://politicalhumor.about.com/gi/dyna ... en/805381/

http://politicalhumor.about.com/gi/dyna ... en/805381/

http://www.collegehumor.com/video:1788161

The Board of Trustees are dropping two fundz and replacing them w/ two other fundz. Calamos Growth(CVGRX) is being replaced by Blackrock US Opportunities(BMCIX).

My look at the two fundz on WWW.STOCKCHARTS.COM Perfect Charts shows BMCIX to be the far superior fund. But the Perfect Chart only goes back five years. Lets see what WWW.BIGCHARTS.COM sez.

CLICKIT!!!!

I use BIGCHARTS.COM when and because they offer me options unavailable on my preferred STOCKCHARTS.COM. (Links for both up above.) BIGCHARTS shows me that the picture is a lot less clear if you go back 10 years. Buy and holding in 1999 shows that CVGRX is the far superior fund from '99 up until '08. Buying in '04 and selling at the end of '07 shows that BMCIX is the far superior fund. Either of these fundz will/would've work/worked well with a reasonable investment and money management strategy. I'm ready w/ both.

IT DRIVES ME UP THE WALL WHEN SOMEONE ASKS ME ABOUT A ONE DECISION FUND FOR THEIR 401A. THE 401A IS A HUGE OPPORTUNITY IF YOU FUND IT AGGRESSIVELY TO TAKE ADVANTAGE OF THE TAX SAVINGS AND A HUGELY DANGEROUS THING TO IGNORE ONCE YOU HAVE ANY SORT OF MEANINGFUL BALANCE. YOU HAVE TO MANAGE YOUR 401A TO SOME DEGREE IF YOU WANT TO AVOID THE RISK OF MAJOR BIGTIME GRIEF. THIS YEAR DEMONSTRATES THAT CONCLUSIVELY.

Links

http://www.ritholtz.com/blog/2008/11/gl ... te-ratios/

http://www.ritholtz.com/blog/2008/11/ev ... ost-money/

http://www.ritholtz.com/blog/2008/11/br ... ica-dream/

http://www.ritholtz.com/blog/2008/11/ho ... ome-owers/

http://www.nytimes.com/2008/11/18/busin ... .html?_r=1

http://www.ritholtz.com/blog/2008/11/re ... king-data/

http://www.thetruthaboutcars.com/catego ... out-watch/

http://www.ritholtz.com/blog/2008/11/11 ... lout-plan/

HOW I RUN MY 401A TO RESUME AFTER THANKSGIVING.....

Calendar

Calendar