REALLY NICE BEAR MARKET RALLY LAST WEEK.... On Declining Volume During An Inevitably Positive Post Election Season And End Of The Month... with no resolution, upside catalyst or even the wringing out of the last cycle's excess in sight. TRUST THIS RALLY AT YOUR PERIL...

I really don't want to hear about "values." It is meaningless to me if the price action doesn't confirm the fact that something is cheap and people recognize that fact. If a stock really is a good value, then it should start trading up. I don't care what the analysis might be. A stock is not a good value if it doesn't increase in price.

James “Rev Shark” DePorre

UPDATED 12/4

Chartz and Table Zup... Check out my Website.

I'm under the weather..Bleagh. Stay tooned,

In the mean while, check it out....

http://www.stratfor.com/analysis/200809 ... _landscape

http://money.cnn.com/2008/11/30/news/co ... /index.htm

As of Wed last week, there were only 13 stocks in the S&P 500 that were up for the year.

The cost of the bailout to date is between $5 and $7 billion.

The cost of WW II adjusted for inflation was a little over $3.5 billion

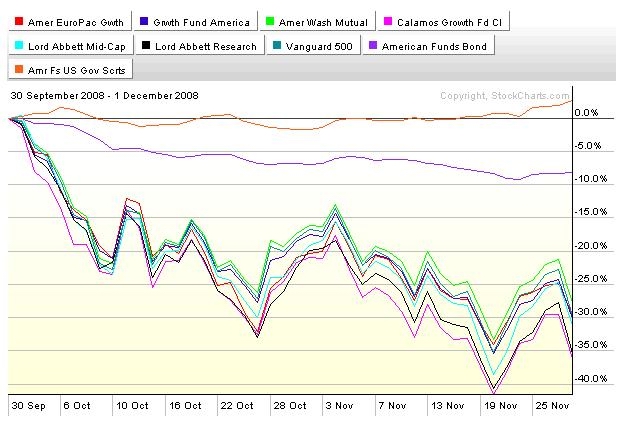

PRETTY GOOD CALL IN THE HEADER. BEING ALL CASH PRETTY MUCH TOOK THE STING OUT OF 12/1 IN THE 401A. BEING WAY LEVERED AND DOUBLE SHORT MADE IT GOOD IN THE TRADING ACCT....THIS IS A REALLY GHASTLY 2/3RDS OF A QUARTER.

CLICKIT!!!!

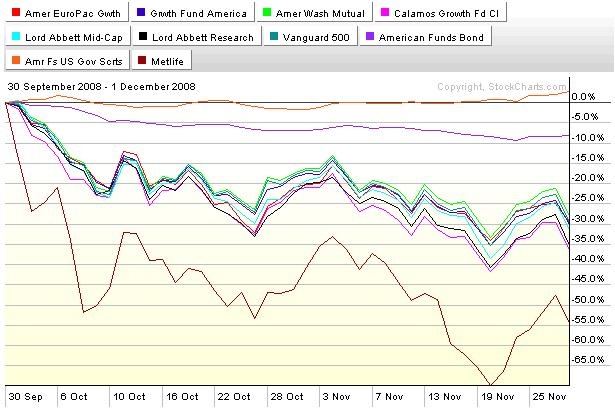

NOW LET'S ADD IN MET LIFE AND YOU BEGIN TO UNDERSTAND WHY I'M IN THE GOV SECURITY FUND AND NOT THE GIC...

CLICKIT!!!!

EVERYONE WAS HOPING THAT 10/27 AND 11/12 WERE A DOUBLE BOTTOM AND THAT NOV 20TH WAS A SUCCESSFUL IF ABERRATIONAL TEST OF THE BOTTOM.

HANG ON....WE'RE MAYBE GONNA GET TO FIND OUT IF THAT WAS THE REAL BOTTOM WHEN WE SMASH AGAINST IT AND BOUNCE BACK... OR BLOW RIGHT THROUGH IT....

THE BOARD OF TRUST IS REPLACING THE CALAMOS FUND (CVGRX) AND THE LORD ABBETT MID CAP FUND (LAVLX). CHECK OUT THE FUND ALARM PAGE ON MY WEBSITE. LOOK UP THE FUNDZ AND SEE WHAT YA THINK....

http://www.ritholtz.com/blog/2008/12/plan-what-plan/

Calendar

Calendar