DOWNER; The Bailout Part 1 Was So Poorly Conceived And Executed That We May Not Have It Enough Money Left To Fix It All With Bailouts 2,3,4,5 an' 6,....UPPER; We Scrape Off Dubayuh In A Few Days..... We'll see how it goes on down the line.....

"Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirlpool of speculation. When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done."

—John Maynard Keynes

Chartz and Table Zup @ www.joefacer.com.

UPDATED 1/20/09

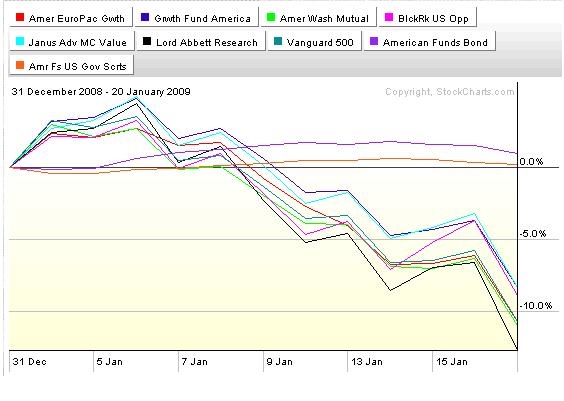

NEW YEAR, SAME DIRECTION....DOWN

We know that the FED and The Treasury are gonna spend every dollar that they can borrow and print to save everyone. What if it is not enough?

Excerpted From Setting the Bull Trap By Bennet Sedacca

Link to the complete article; http://www.investorsinsight.com/blogs/j ... -trap.aspx

Ever since 1995, the Federal Reserve and other authorities have been assisting in the birth of the largest debt bubble in our nation's history. Money supply has grown exponentially, weak businesses have been formed and failed, the consumer is leveraged up to their eyeballs, regulation is poor, and savings have dried up. Further, the brokerage/investment banking industry has been pummeled beyond recognition; lifelines have been given to everyone from poorly run banks to poorly run auto manufacturers. Esoteric securities have been relocated from the balance sheets of reckless banks and brokers to the U.S. Treasury, FDIC and Federal Reserve. Investors worldwide watched $30 trillion of stock market equity disappear in the past year while home prices have cratered by better than 25%. What other goodies do we have?

* Unemployment on every front is rising.

* Tax receipts are down and State Governments are suffering.

* The debt market, except that artificially supported by the Government is closed.

* Earnings estimates for the S&P 500 are down 60% year-over-year.

* Stocks (using the Dow as a proxy) are at the same level they were 10 years ago.

* Industrial Production around the globe is imploding.

[From the Fed]

The focus of the Committee's policy going forward will be to support the functioning of financial markets and stimulate the economy through open market operations and other measures that sustain the size of the Federal Reserve's balance sheet at a high level. As previously announced, over the next few quarters the Federal Reserve will purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand its purchases of agency debt and mortgage-backed securities as conditions warrant. The Committee is also evaluating the potential benefits of purchasing longer-term Treasury securities. Early next year, the Federal Reserve will also implement the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses. The Federal Reserve will continue to consider ways of using its balance sheet to further support credit markets and economic activity.

If you read the paragraph from the FOMC statement highlighted in red and add to that all of the new programs and bailouts paid for by "We the People", it leads me to the following questions.

* Shouldn't the consumer, after decades of over-consumption, be allowed to digest the over-indebtedness and save, rather than be encouraged to take risk?

* Shouldn't companies, no matter what state they reside in from a political point of view, if run poorly, be allowed to fail or forced to restructure?

* Should taxpayer money be used to make up for the mishaps at financial institutions or should we allow them to wallow in their own mistakes?

* Shouldn't free markets be free?

* When did Socialism make its way to our shores?

* How do we choose who is bailed out and who loses?

* Shouldn't we place blame on the politicians, bureaucrats and other "decision makers" and put skilled people in place that know how to run the businesses?

* Shouldn't investors, led blindly down the primrose path of "buy and hold, diversify and don't open your brokerage statement except once every 10 years" be allowed to follow the Prudent Man Rule?

Again, there are many questions to be asked, many with answers that no one wants to put in print. When will people stand up like in the movie Network when Howard Beale, played by Peter Finch, screams, "I'm mad as hell and I'm not going to take this anymore

Risk taking, in a laissez faire world should be replaced with risk aversion for a period of time. Consumers that over-consumed should be allowed to strengthen their balance sheets for the next cycle and increase their savings. Companies that have been kept afloat, bailed out, nationalized, stuck in conservatorship, have become part of my national portfolio whether I like it or not, unless it actually poses systemic risk (which I am not at all in favor of), should fail. Period. After all, where is MY bailout?

The picture above is of 30 year Fannie Mae 4 ˝% mortgage pools. Note the recent 13% spike as the Fed announced that they would be buying Mortgage Backed Securities in order to stabilize the mortgage market. In a free market, these securities would be many points lower, but because there is an artificial bid (yep, with our money) investors are forced to look elsewhere toward risky assets.

Yes folks, cash is now officially trash. If you buy 1 month Treasury Bills, you are rewarded with a yield of a gigantic 0.02% per year. That's right, 2 basis points per year. I suppose people with more than enough money can keep it invested for an entire year and make nothing or they can succumb to the pressure of, "I can't make zero forever if I want to retire."

Now, imagine that you are a professional money manager that is paid 1% a year to invest other people's money. If you feel that being prudent is to sit in cash, and attempt to charge a fee, the math is simple—0.02% per year minus any reasonable fee is a negative return. This is forcing many people out on the risk spectrum at precisely the wrong moment, when risks are the highest ever.

http://www.youtube.com/watch?v=QMBZDwf9 ... re=related

Excerpted from "Market Vertigo

by Cliff Draughn

http://www.investorsinsight.com/blogs/j ... rtigo.aspx

Whether it is financial services, autos, transportation, etc., the "top-down" approach of providing more and more taxpayer dollars to weak corporations is ill-advised. In my opinion, if you're using taxpayer dollars, then either nationalize the company or let it fail. And, if you nationalize the company then wipe out the bond holders and shareholders, replace the management and board, sell the good assets to qualified buyers, and then and only then, have the taxpayers eat the remaining deficit. With the current "bailout system" we are merely trying to sustain the status quo, which penalizes those banking institutions that did not make bad decisions while at the same time rewarding poorly managed institutions by handing them taxpayer money. Until you put the stimulus money back in the hands of the private sector (i.e., the individual) you're fighting today's housing/mortgage fires with a garden hose. The bailout funds need to be distributed to the homeowners, not the banking and lending institutions. Banks currently taking the government TARP money (our tax money) are adding it as capital to their balance sheets and then sitting on the funds in anticipation of further losses, rather than lending back into the system. Obama should follow the laws of nature: if you have a herd of animals and some become sick, get rid of the sick. Why continue sustaining the sick animals that will eventually die anyway and at the same time risk the entire herd? A prime example of propping up the status quo occurred in December of this year when Treasury Secretary Paulsen made the unilateral decision to guarantee $306 billion of CitiGroup's assets. The guarantee was in addition to the $25 billion Citi had already received in TARP funding. The $306 billion "guarantee" was not part of TARP and was extended without Congressional approval! $306 billion is equal to what our government spent in 2007 for the departments of Agriculture, Education, Energy, Homeland Security, Housing and Urban Development, and Transportation combined. (The Economist)

It's not hard for even an old broken down pipefitter to figure out that Citibank is has been undergoing an unannounced liquidation since this article was posted....

More from Mr Draughn;

One of the great sucker plays since the bear began in 2000 has been the "buy and hold for the long term" mantra that has been chanted by the sages of Wall Street. Simply look at the returns: from 12/31/99 to 12/31/08, if you invested in an S&P 500 index and held for "the long term," then your total return during this time would have been -28.13%, or an annualized rate of -3.6% per year. Small caps were better, with a total return of 11.66% or 1.23% annualized. If you expect to make money in the equity markets in 2009 going forward, then you must be willing to "trade" the volatility while also maintaining a high proportion of income-producing assets.

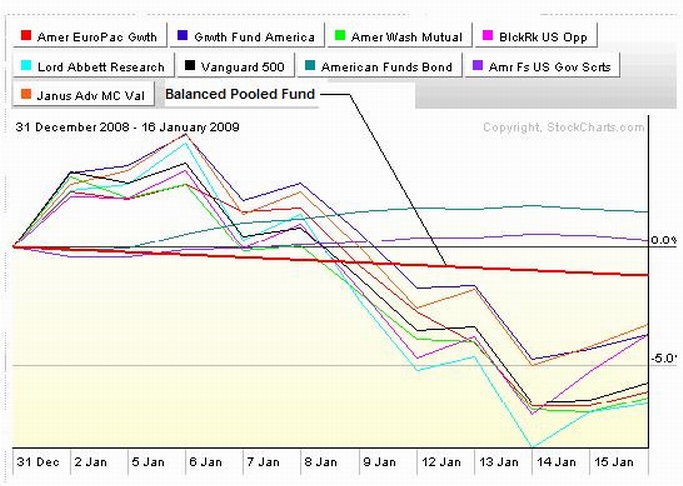

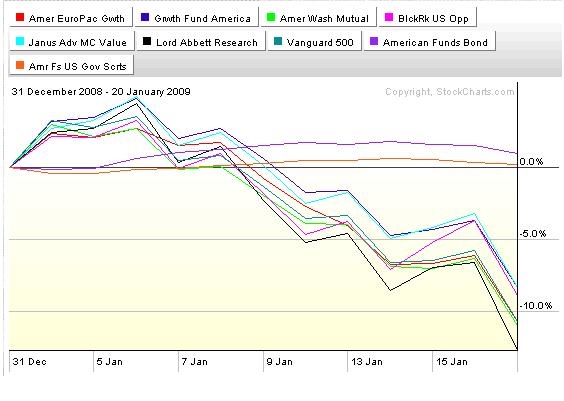

CHEEZUS H. RICE!!!! (Condoleeza's father) IS THERE ANYONE STILL OUT THERE SO NUMB AS TO STILL BE IN THE BALANCED POOLED FUND? DO YOU STILL BELIEVE THAT THE REASON THAT YOU WERE TOLD NOT TO LOOK AT YOUR 401A STATEMENT FOR 10 YEARS WAS BECAUSE IT WAS BEST FOR YOU????

Link to the complete article; http://www.investorsinsight.com/blogs/j ... -trap.aspx

Ever since 1995, the Federal Reserve and other authorities have been assisting in the birth of the largest debt bubble in our nation's history. Money supply has grown exponentially, weak businesses have been formed and failed, the consumer is leveraged up to their eyeballs, regulation is poor, and savings have dried up. Further, the brokerage/investment banking industry has been pummeled beyond recognition; lifelines have been given to everyone from poorly run banks to poorly run auto manufacturers. Esoteric securities have been relocated from the balance sheets of reckless banks and brokers to the U.S. Treasury, FDIC and Federal Reserve. Investors worldwide watched $30 trillion of stock market equity disappear in the past year while home prices have cratered by better than 25%. What other goodies do we have?

* Unemployment on every front is rising.

* Tax receipts are down and State Governments are suffering.

* The debt market, except that artificially supported by the Government is closed.

* Earnings estimates for the S&P 500 are down 60% year-over-year.

* Stocks (using the Dow as a proxy) are at the same level they were 10 years ago.

* Industrial Production around the globe is imploding.

[From the Fed]

The focus of the Committee's policy going forward will be to support the functioning of financial markets and stimulate the economy through open market operations and other measures that sustain the size of the Federal Reserve's balance sheet at a high level. As previously announced, over the next few quarters the Federal Reserve will purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand its purchases of agency debt and mortgage-backed securities as conditions warrant. The Committee is also evaluating the potential benefits of purchasing longer-term Treasury securities. Early next year, the Federal Reserve will also implement the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses. The Federal Reserve will continue to consider ways of using its balance sheet to further support credit markets and economic activity.

If you read the paragraph from the FOMC statement highlighted in red and add to that all of the new programs and bailouts paid for by "We the People", it leads me to the following questions.

* Shouldn't the consumer, after decades of over-consumption, be allowed to digest the over-indebtedness and save, rather than be encouraged to take risk?

* Shouldn't companies, no matter what state they reside in from a political point of view, if run poorly, be allowed to fail or forced to restructure?

* Should taxpayer money be used to make up for the mishaps at financial institutions or should we allow them to wallow in their own mistakes?

* Shouldn't free markets be free?

* When did Socialism make its way to our shores?

* How do we choose who is bailed out and who loses?

* Shouldn't we place blame on the politicians, bureaucrats and other "decision makers" and put skilled people in place that know how to run the businesses?

* Shouldn't investors, led blindly down the primrose path of "buy and hold, diversify and don't open your brokerage statement except once every 10 years" be allowed to follow the Prudent Man Rule?

Again, there are many questions to be asked, many with answers that no one wants to put in print. When will people stand up like in the movie Network when Howard Beale, played by Peter Finch, screams, "I'm mad as hell and I'm not going to take this anymore

Risk taking, in a laissez faire world should be replaced with risk aversion for a period of time. Consumers that over-consumed should be allowed to strengthen their balance sheets for the next cycle and increase their savings. Companies that have been kept afloat, bailed out, nationalized, stuck in conservatorship, have become part of my national portfolio whether I like it or not, unless it actually poses systemic risk (which I am not at all in favor of), should fail. Period. After all, where is MY bailout?

The picture above is of 30 year Fannie Mae 4 ˝% mortgage pools. Note the recent 13% spike as the Fed announced that they would be buying Mortgage Backed Securities in order to stabilize the mortgage market. In a free market, these securities would be many points lower, but because there is an artificial bid (yep, with our money) investors are forced to look elsewhere toward risky assets.

Yes folks, cash is now officially trash. If you buy 1 month Treasury Bills, you are rewarded with a yield of a gigantic 0.02% per year. That's right, 2 basis points per year. I suppose people with more than enough money can keep it invested for an entire year and make nothing or they can succumb to the pressure of, "I can't make zero forever if I want to retire."

Now, imagine that you are a professional money manager that is paid 1% a year to invest other people's money. If you feel that being prudent is to sit in cash, and attempt to charge a fee, the math is simple—0.02% per year minus any reasonable fee is a negative return. This is forcing many people out on the risk spectrum at precisely the wrong moment, when risks are the highest ever.

http://www.youtube.com/watch?v=QMBZDwf9 ... re=related

Excerpted from

"Market Vertigo

by Cliff Draughn

http://www.investorsinsight.com/blogs/j ... rtigo.aspx

Whether it is financial services, autos, transportation, etc., the "top-down" approach of providing more and more taxpayer dollars to weak corporations is ill-advised. In my opinion, if you're using taxpayer dollars, then either nationalize the company or let it fail. And, if you nationalize the company then wipe out the bond holders and shareholders, replace the management and board, sell the good assets to qualified buyers, and then and only then, have the taxpayers eat the remaining deficit. With the current "bailout system" we are merely trying to sustain the status quo, which penalizes those banking institutions that did not make bad decisions while at the same time rewarding poorly managed institutions by handing them taxpayer money. Until you put the stimulus money back in the hands of the private sector (i.e., the individual) you're fighting today's housing/mortgage fires with a garden hose. The bailout funds need to be distributed to the homeowners, not the banking and lending institutions. Banks currently taking the government TARP money (our tax money) are adding it as capital to their balance sheets and then sitting on the funds in anticipation of further losses, rather than lending back into the system. Obama should follow the laws of nature: if you have a herd of animals and some become sick, get rid of the sick. Why continue sustaining the sick animals that will eventually die anyway and at the same time risk the entire herd? A prime example of propping up the status quo occurred in December of this year when Treasury Secretary Paulsen made the unilateral decision to guarantee $306 billion of CitiGroup's assets. The guarantee was in addition to the $25 billion Citi had already received in TARP funding. The $306 billion "guarantee" was not part of TARP and was extended without Congressional approval! $306 billion is equal to what our government spent in 2007 for the departments of Agriculture, Education, Energy, Homeland Security, Housing and Urban Development, and Transportation combined. (The Economist)

It's not hard for even an old broken down pipefitter to figure out that Citibank is has been undergoing an unannounced liquidation since this article was posted....

More from Mr Draughn;

One of the great sucker plays since the bear began in 2000 has been the "buy and hold for the long term" mantra that has been chanted by the sages of Wall Street. Simply look at the returns: from 12/31/99 to 12/31/08, if you invested in an S&P 500 index and held for "the long term," then your total return during this time would have been -28.13%, or an annualized rate of -3.6% per year. Small caps were better, with a total return of 11.66% or 1.23% annualized. If you expect to make money in the equity markets in 2009 going forward, then you must be willing to "trade" the volatility while also maintaining a high proportion of income-producing assets.

CHEEZUS H. RICE!!!! (Condoleeza's father) IS THERE ANYONE STILL OUT THERE SO NUMB AS TO STILL BE IN THE BALANCED POOLED FUND? DO YOU STILL BELIEVE THAT THE REASON THAT YOU WERE TOLD NOT TO LOOK AT YOUR 401A STATEMENT FOR 10 YEARS WAS BECAUSE IT WAS BEST FOR YOU????

Whether it is financial services, autos, transportation, etc., the "top-down" approach of providing more and more taxpayer dollars to weak corporations is ill-advised. In my opinion, if you're using taxpayer dollars, then either nationalize the company or let it fail. And, if you nationalize the company then wipe out the bond holders and shareholders, replace the management and board, sell the good assets to qualified buyers, and then and only then, have the taxpayers eat the remaining deficit. With the current "bailout system" we are merely trying to sustain the status quo, which penalizes those banking institutions that did not make bad decisions while at the same time rewarding poorly managed institutions by handing them taxpayer money. Until you put the stimulus money back in the hands of the private sector (i.e., the individual) you're fighting today's housing/mortgage fires with a garden hose. The bailout funds need to be distributed to the homeowners, not the banking and lending institutions. Banks currently taking the government TARP money (our tax money) are adding it as capital to their balance sheets and then sitting on the funds in anticipation of further losses, rather than lending back into the system. Obama should follow the laws of nature: if you have a herd of animals and some become sick, get rid of the sick. Why continue sustaining the sick animals that will eventually die anyway and at the same time risk the entire herd? A prime example of propping up the status quo occurred in December of this year when Treasury Secretary Paulsen made the unilateral decision to guarantee $306 billion of CitiGroup's assets. The guarantee was in addition to the $25 billion Citi had already received in TARP funding. The $306 billion "guarantee" was not part of TARP and was extended without Congressional approval! $306 billion is equal to what our government spent in 2007 for the departments of Agriculture, Education, Energy, Homeland Security, Housing and Urban Development, and Transportation combined. (The Economist)

One of the great sucker plays since the bear began in 2000 has been the "buy and hold for the long term" mantra that has been chanted by the sages of Wall Street. Simply look at the returns: from 12/31/99 to 12/31/08, if you invested in an S&P 500 index and held for "the long term," then your total return during this time would have been -28.13%, or an annualized rate of -3.6% per year. Small caps were better, with a total return of 11.66% or 1.23% annualized. If you expect to make money in the equity markets in 2009 going forward, then you must be willing to "trade" the volatility while also maintaining a high proportion of income-producing assets.

Calendar

Calendar