Thank God I Grew Up When Honesty Demanded That You Call Them Sugar Pops And Sugar Smacks And Sugar Frosted Flakes. And It Was OK That Quakers Made Puffed Rice And Puffed Wheat For Kids That Were Shot From Guns ....

Friday, April 22, 2011, 03:27 PM

The more you know, the harder it is to take decisive action. Once you become informed, you start seeing complexities and shades of gray. You realize that nothing is as clear and simple as it first appears. Ultimately, knowledge is paralyzing. Being a man of action, I can’t afford to take that risk.

– Calvin

Usually there is some rock 'n roll with a personal link to my life linked here. Here's some radio of a different sort....

http://www.dylanratigan.com/2011/04/22/ ... e-dylan-2/

There are times that I realize just how outa place I am today

http://www.youtube.com/watch?v=zGpS6LHeBC0

"When the facts change, I change my mind. What do you do, sir?" --John Maynard Keynes

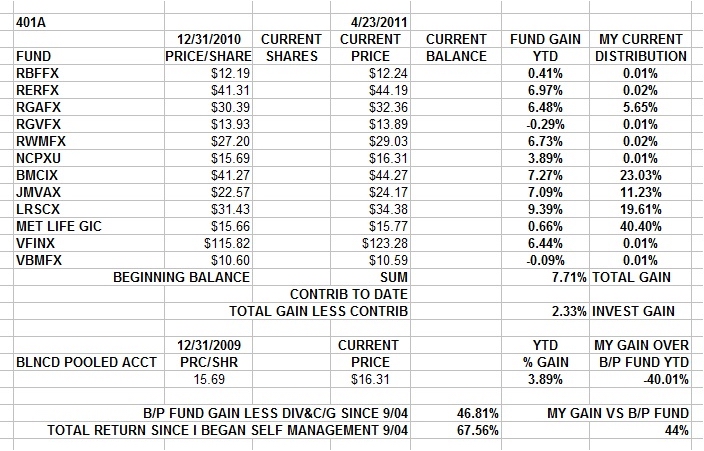

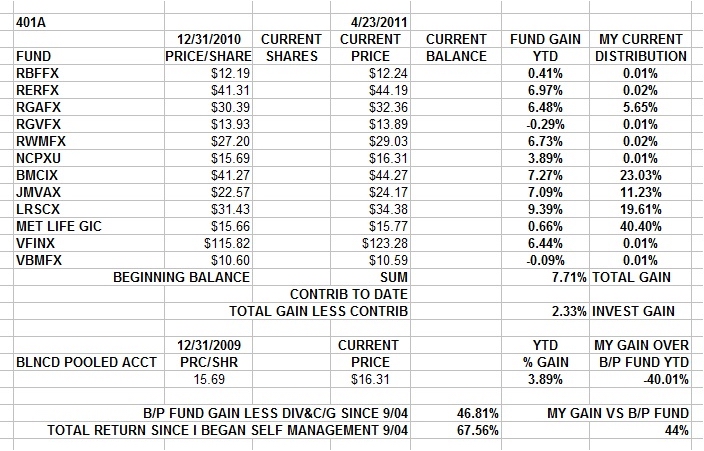

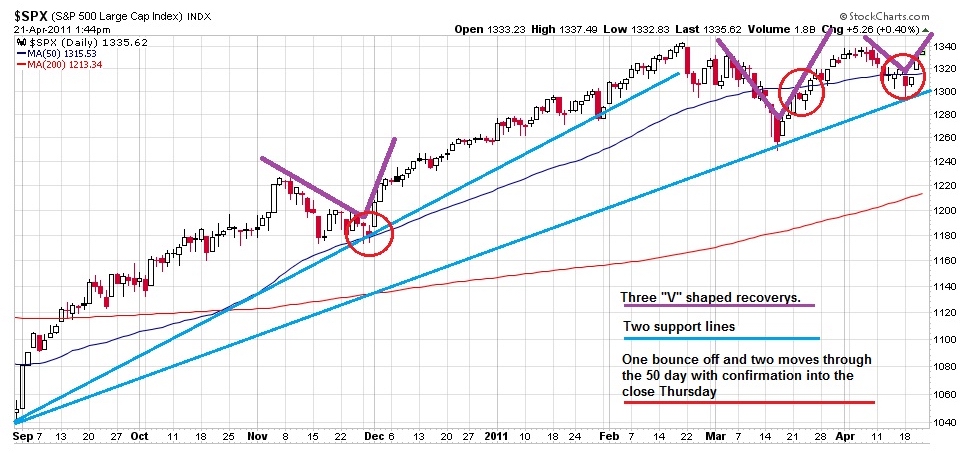

Wednesday (4/20) Action looked good. I changed my mind about risk and added to my stock position at the end of the day.....

Here's where I stood Thurs AM allocationwise....

I picked up a few bucks onna day and I'm nicely set up for Monday....If the bottom doesn't fall out.

I may go deeper into stocks Monday. Here's why.

My risk management and capital preservation has cost me money every time I've gotten anxious and lightened up since the bottom in 2009. I've gotten back in some distance behind the "close yer eyes and hang on" crowd, but.... It ain't a sin to be wrong, everybody makes mistakes. It IS a sin to stay wrong. So I don't. Of course, my caution allowed me to actually make money in my 401a in 2008 when everybody else was bleeding from the eyeballs. One day it'll save my donkey again. I just gotta keep fear matched against greed an' get the balance right.....

I'm going deeper into stocks on Friday afternoon.

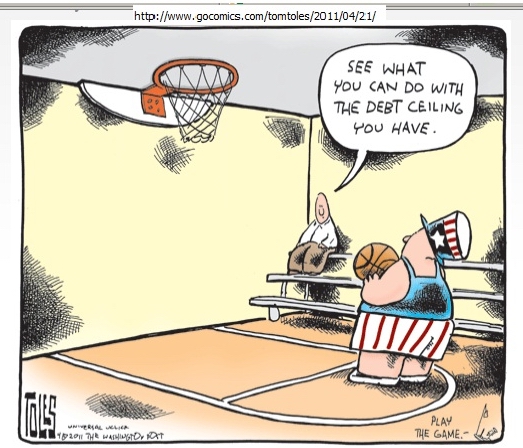

“The Fed is still your friend if you are invested in cyclical stocks , commodities, and foreign currencies. If you eat food and run your car on gasoline, the Fed will continue to hurt you. If you are looking for a job, you may be wondering why it is still so hard to find ond despite all the money the Fed has spent so far on QE2.0. If you are retired and living on interest from your CDs, then you are getting really squeezed between rising food and fuel prices and the Fed’s zero interest rate policy. In other words, the Fed seems to be doing everything to widen the gap between the Haves and Have Nots than to lower unemployment and boost economic growth, which remains “moderate” according to yesterday’s FOMC statement.”

-- Ed Yardini

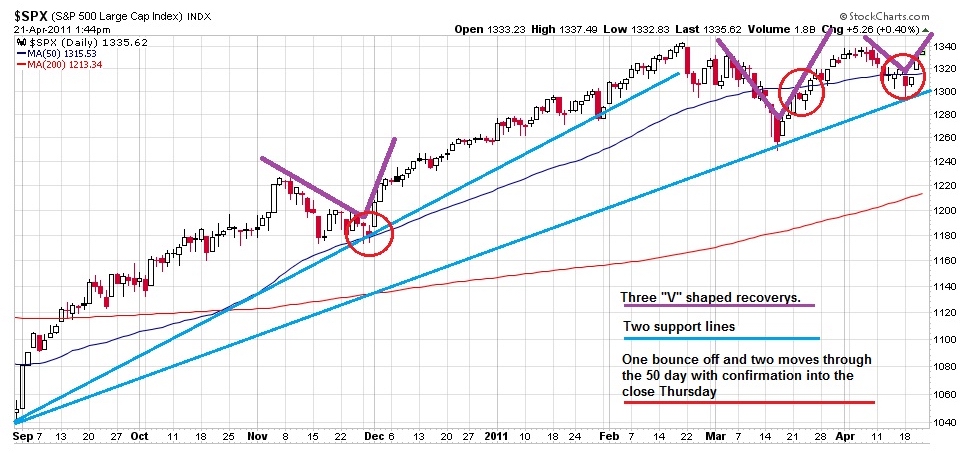

Cup And Handle. Bullish Pattern. The Market Is Soaring For Exactly The Wrong Reason. But They Don't Put Asterisk On Gains. A Dollar Gained Is A Retirement Dollar For Me And My Family Whether I Hated The Economic Conditions That Made It For Me Or Not. So I'm Way Long And Not Liking It.

Stay tooned.....

Comments are not available for this entry.

Calendar

Calendar