"It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong."

George Soros

Charts and Tables Up. I want to talk about Bill Sams and the FPA Paramount Fund (FPRAX). My buddy Jack Kenny at Investment Investigators turned me on to Bill Sams and FPRAX back in '82. A mutual fund's charter is its foundation. Bill's charter at FPA Paramount was pretty kool and very unusual. He was allowed to hold up to 50% cash and typically held 10% to 30% cash. He was a deep value investor, eclectic and conservative. He had some ideas he believed in and he wasn't interested in having more money than ideas; his fund was closed to new investors for a good proportion of the 80's and 90's. The details and rationale for all this is REALLY important to me but I'm not going to write about it here at this time. The object is NOT to write a book here, so I won't. But I do cover the subject in depth during one of my presentations, so you can still hear about it. Get me a fast internet connection, and 5 to 20 union members and I'll do a two to three hour riff on a Saturday morning. Get hold of me by Email or at or through the Hall. There's a lot to cover that I think is very important to the financial future of our local and the personal finances of our members;

Meanwhile, back at the ranch.... Owning FPRAX made investing a no brainer. Look what Bill did for me.

CLICK IT! IT'S ALIVE!!

It was big time fun from '82 until '98. When the market was hot, I was pretty much fully invested. When things went bad, I was sizeable in cash. My money tripled between '90 and '98. For the early 90's, the challenge to anybody who thought he had it goin' on was "Oh Yeah? Well, how'dja do in '87, Smart Guy?? Here's how the S&P500 did;

THIS'S LIVE TOO. CLICK IT!

Bill was heavy in cash in October of '87, I think the full 50%. He got hit like everyone else, but only half as hard. Then he turned the cash into stocks and rode the rebound. He and I finished the year up 23%. I got a very good return with a lot of safety and absolutely no work. I'd had a 15 year run riding with a hot hand and the future looked so bright, I hadda wear shades. FPA Paramount had turned a $6K in 1982 investment into a very nice down payment for a really nice house in SF while I just watched the money grow. Then came 1998. All of a sudden, every week I had significantly less money. I'd had draw downs before, but not like this. This was unrelenting, continuous, and painful with no relief in sight. Between mid '98 to mid '99, I lost enough money in FPA to put me back where I was in '94. I'd thought my rate of return had been pretty good, but if I stopped losing money and went back to my previous rate of return, it'd be 2005 just to get back to even and 5 years in the hole at the same time. All of a sudden real estate prices started rising as fast and as hard as my money was going away. Then the landlord started getting wonky about selling the house we were renting. The future didn't look nearly as bright. Whereas hanging on had always been the best answer before, it was killing me now. How could I sell what had made me so much money in the past? How could I sell something that was so far down and admit/accept/lock in the loss? What if it came back after I sold it? What if it came back but it put me 6 years in the hole? WHAT IF IT KEPT GOING DOWN? Then I noticed something very interesting. Maybe the answer to all these questions had been right under my nose all the time. (To be continued.)

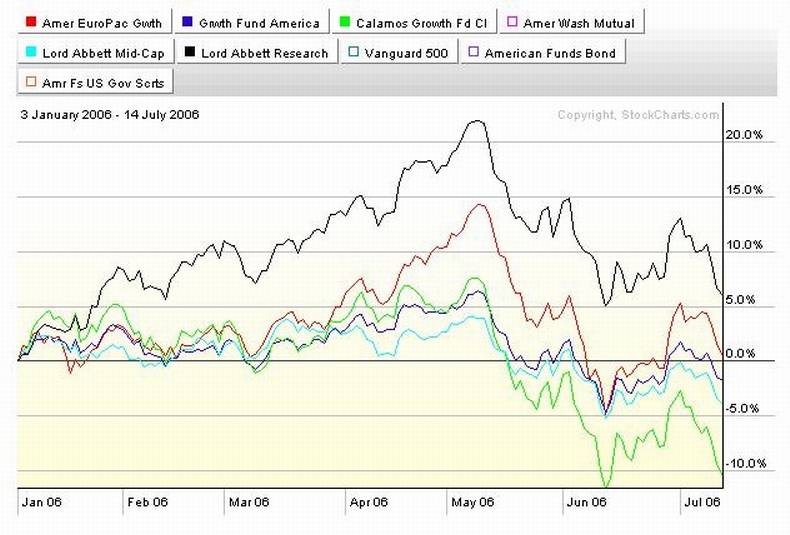

Here's a chart from elsewhere on my site. Stocks have bounced and so have the funds that are fully invested in them. Is this the all clear for me to pile back in? I dunno. There are always questions about the future and here's some of the ones that are bothering me now. The American Funds are huge. Does the sudden down draft indicate a change of leadership in the market? Can the large funds we have available to us respond quickly if the funds need to change direction? Is that why my two American Funds funds are 10% cash? Or will it take a year to bleed the out of style stocks from the portfolio and replace them with better performing stocks? Is this the beginning of a bear market and will we be faced with a year long erosion of stock prices? Or is/was this just a quick correction and moving stocks from weak hands to strong hands and are prices going back up? Will the government's useless rigged measures of inflation finally start to unwind and show inflation as bad as it truly is? Are interest rates about to spike up and then hang up there? Or not? How will politics affect the economy. I've got a 30% investment return in my 401 in less than two years. Do I really need to make a decision about what to do here and now for my 401a to stay on track? Finally a question I can answer here and now. Nope. The snap decison to sell big time was a good one. I think a carefully considered decision about when and where to reinvest will be a good one too. Stae tooned.

Oh yeah. American Funds, provider of some of the funds in our 401a plan , is materially involved in a class action lawsuit. I'll keep you posted about what I find out.

George Soros

Charts and Tables Up. I want to talk about Bill Sams and the FPA Paramount Fund (FPRAX). My buddy Jack Kenny at Investment Investigators turned me on to Bill Sams and FPRAX back in '82. A mutual fund's charter is its foundation. Bill's charter at FPA Paramount was pretty kool and very unusual. He was allowed to hold up to 50% cash and typically held 10% to 30% cash. He was a deep value investor, eclectic and conservative. He had some ideas he believed in and he wasn't interested in having more money than ideas; his fund was closed to new investors for a good proportion of the 80's and 90's. The details and rationale for all this is REALLY important to me but I'm not going to write about it here at this time. The object is NOT to write a book here, so I won't. But I do cover the subject in depth during one of my presentations, so you can still hear about it. Get me a fast internet connection, and 5 to 20 union members and I'll do a two to three hour riff on a Saturday morning. Get hold of me by Email or at or through the Hall. There's a lot to cover that I think is very important to the financial future of our local and the personal finances of our members;

Meanwhile, back at the ranch.... Owning FPRAX made investing a no brainer. Look what Bill did for me.

CLICK IT! IT'S ALIVE!!

It was big time fun from '82 until '98. When the market was hot, I was pretty much fully invested. When things went bad, I was sizeable in cash. My money tripled between '90 and '98. For the early 90's, the challenge to anybody who thought he had it goin' on was "Oh Yeah? Well, how'dja do in '87, Smart Guy?? Here's how the S&P500 did;

THIS'S LIVE TOO. CLICK IT!

Bill was heavy in cash in October of '87, I think the full 50%. He got hit like everyone else, but only half as hard. Then he turned the cash into stocks and rode the rebound. He and I finished the year up 23%. I got a very good return with a lot of safety and absolutely no work. I'd had a 15 year run riding with a hot hand and the future looked so bright, I hadda wear shades. FPA Paramount had turned a $6K in 1982 investment into a very nice down payment for a really nice house in SF while I just watched the money grow. Then came 1998. All of a sudden, every week I had significantly less money. I'd had draw downs before, but not like this. This was unrelenting, continuous, and painful with no relief in sight. Between mid '98 to mid '99, I lost enough money in FPA to put me back where I was in '94. I'd thought my rate of return had been pretty good, but if I stopped losing money and went back to my previous rate of return, it'd be 2005 just to get back to even and 5 years in the hole at the same time. All of a sudden real estate prices started rising as fast and as hard as my money was going away. Then the landlord started getting wonky about selling the house we were renting. The future didn't look nearly as bright. Whereas hanging on had always been the best answer before, it was killing me now. How could I sell what had made me so much money in the past? How could I sell something that was so far down and admit/accept/lock in the loss? What if it came back after I sold it? What if it came back but it put me 6 years in the hole? WHAT IF IT KEPT GOING DOWN? Then I noticed something very interesting. Maybe the answer to all these questions had been right under my nose all the time. (To be continued.)

Here's a chart from elsewhere on my site. Stocks have bounced and so have the funds that are fully invested in them. Is this the all clear for me to pile back in? I dunno. There are always questions about the future and here's some of the ones that are bothering me now. The American Funds are huge. Does the sudden down draft indicate a change of leadership in the market? Can the large funds we have available to us respond quickly if the funds need to change direction? Is that why my two American Funds funds are 10% cash? Or will it take a year to bleed the out of style stocks from the portfolio and replace them with better performing stocks? Is this the beginning of a bear market and will we be faced with a year long erosion of stock prices? Or is/was this just a quick correction and moving stocks from weak hands to strong hands and are prices going back up? Will the government's useless rigged measures of inflation finally start to unwind and show inflation as bad as it truly is? Are interest rates about to spike up and then hang up there? Or not? How will politics affect the economy. I've got a 30% investment return in my 401 in less than two years. Do I really need to make a decision about what to do here and now for my 401a to stay on track? Finally a question I can answer here and now. Nope. The snap decison to sell big time was a good one. I think a carefully considered decision about when and where to reinvest will be a good one too. Stae tooned.

Oh yeah. American Funds, provider of some of the funds in our 401a plan , is materially involved in a class action lawsuit. I'll keep you posted about what I find out.

Calendar

Calendar