"No one that ever lived has ever had enough power, prestige, or knowledge to overcome the basic condition of all life -- you win some and you lose some."

-- Ken Keyes, Jr.

Charts and Tables up. I talked to some brothers and sisters at the Union meeting and got some input. I've edited some of the pages slightly, no biggie. But the site IS a constantly evolving work. Take a spin through it once in a while and see what's new.

Continued from 5/27/06

..... Then I noticed something very interesting. Maybe the answer to all these questions had been right under my nose all the time. Every so often, I'd ask Jack if he had any other names like Bill Sams and Paramount. He'd give me the name of a different fund in a different sector, a quality fund from a well known investment house, and I'd put some money in. They'd do OK, Bill'd do as well, they'd have a so-so stretch and I'd put the money back in Paramount. The latest fund was IDEX JCC Growth (IDETX). Suddenly, the money there had doubled. Click on the picture below.

Between '96 and '98, IDETX had doubled my money. I took everything out of Paramount and put it in IDEX JCC Growth. Between 1998 and the first quarter of 2000, IDEX made back the money lost in FPRAX and then some; it doubled again. In the meantime I'd read an article called "New Paradigm or Mean Reversion?" by Jeremy Grantham & Jack Gray. Sep/Oct 1999; Investment Policy Magazine. Go ahead and Google it. It's archived and still available and free besides. The article predicted the mechanism of the downfall and end of the dot com era. I'd been around long enough to have witnessed the 1980's end of the energy and real estate/savings and loan eras and I knew that it was only a matter of time until the same thing happened again to the dot coms. Obviously the JCC advisors of the IDEX Fund were smart guys and they would ride the bubble to the top and step off the elevator when it started to go down.(I love to sprinkle mixed metaphors willy skelter.) Here's what happened to my investment in the IDEX JCC Growth Fund, Click onnit;

My wife and I took some of the FPRAX/IDETX money and bought our house in mid 2000 on the first leg down of the collapse of the Dot Com bubble. We got a really lucky break on a house and we had the money thanks to IDETX and we moved on it. We weren't about to let that opportunity go away. I rode the rest of the IDETX money part way down and I bailed out of a one time winning mutual fund that was now in the process of destroying my savings. AGAIN. Now I was REALLY pissed. There was something going on that was giving me excellent gains and then taking them away and I didn't understand why. So I got busy. Next week; Some of what I learned about mutual fund investing. (To be continued)

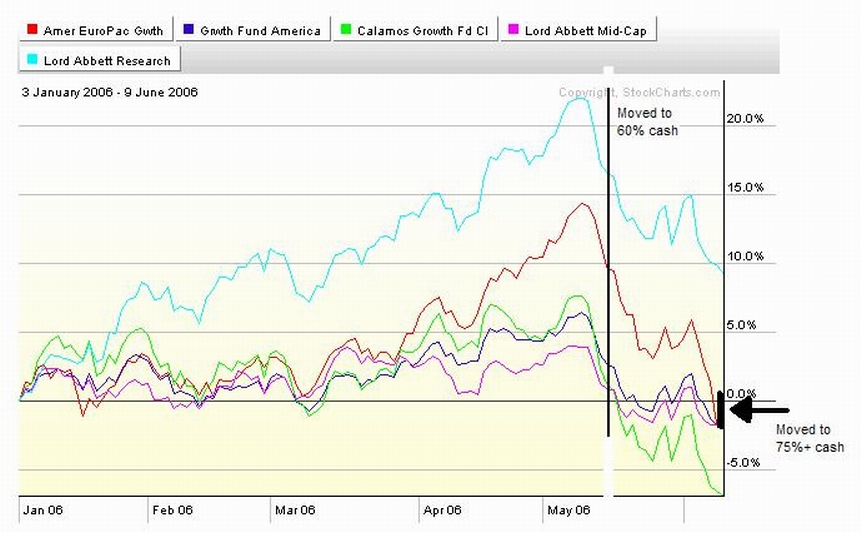

This week I went from 60% cash to 76% cash by putting this month's contribution in LRSCX and clearing out of RERFX. Click on the chart.

I had pretty much moved to cash except for LRSCX, RERFX, and RGAFX as of 5/15 because:

1)The American Funds have limitations on withdrawals and reinvestments. I withdrew what I could without triggering the rapid trading restrictions.

2)I thought the foreign markets would be insulated somewhat.

3)I think that LRSCX could still do well, relatively.

But RERFX reaccelerated down and Friday I bailed out most of the rest of the way, trading restrictions be damned. I suspect that a significant amount of the money out there in euro/asian land may be US in origin and on its way home, markets are determined at the margin and a US slow down may be more feared than I thought, and the foreign markets appear to be going through their own rough patches. So I'm frozen out of the RERFX fund for 30 days as the price of holding on to what I've made in the last 20 months. I can tolerate that.

To recap; I've declared victory and gone substantially to cash a second time this year; I was early the first time and close enough the second time. I've got 30% gains over 20 months, 3.86% YTD, and I'm 252% up on the Balanced Pooled Fund. I was up 40% over 19 months and up 11% from Jan 1st YTD, but my inability to predict the future resulted in giving part of my gains back. Again, I can tolerate that.

"The first step to making money is not losing it."

-- Ed Easterling

"It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong."

George Soros

I currently have residual amounts (tracking positions) in the funds that I see as investable at this time. I'm frozen out of one of the funds for the next 30 days. The economy remains stronger than most people realize and especially strong in the sector we work in. The markets may be predicting a recession. They predict more recessions than occur. This may only be a correction in a demonstably overheated market with a resumption of the market as usual just down the pike. Or not. Regardless, there has been an unholy carnage in the market as a whole that is masked by the popular indices. That will take a while to unwind. Trapped longs, levered positions being unwound by margin clerks, hedge fund closures, and mega mutual fund pull backs and redeployment in alternative sectors accomplished, in process or still to come? You can make a case a buncha different ways. Recession ahead or correction mostly accomplished, I'm way ahead and as safe as I can be. Seventy six percent of my funds earning four percent annual return with no downside has a possible recession covered. The GIC is ahead of the Balanced Pooled Fund at this point. Pretty Cool. I've got time to grab a figurative samich and brew. I've also got the flexibility to watch for the possible end of the short sharp shock of an overdue 10% correction instead of an upcoming recession because I've made five years progress during the last two. What's not to like?

Special called meeting very likely in the next three weeks. Contract Time. See ya at the hall.

-- Ken Keyes, Jr.

Charts and Tables up. I talked to some brothers and sisters at the Union meeting and got some input. I've edited some of the pages slightly, no biggie. But the site IS a constantly evolving work. Take a spin through it once in a while and see what's new.

Continued from 5/27/06

..... Then I noticed something very interesting. Maybe the answer to all these questions had been right under my nose all the time. Every so often, I'd ask Jack if he had any other names like Bill Sams and Paramount. He'd give me the name of a different fund in a different sector, a quality fund from a well known investment house, and I'd put some money in. They'd do OK, Bill'd do as well, they'd have a so-so stretch and I'd put the money back in Paramount. The latest fund was IDEX JCC Growth (IDETX). Suddenly, the money there had doubled. Click on the picture below.

Between '96 and '98, IDETX had doubled my money. I took everything out of Paramount and put it in IDEX JCC Growth. Between 1998 and the first quarter of 2000, IDEX made back the money lost in FPRAX and then some; it doubled again. In the meantime I'd read an article called "New Paradigm or Mean Reversion?" by Jeremy Grantham & Jack Gray. Sep/Oct 1999; Investment Policy Magazine. Go ahead and Google it. It's archived and still available and free besides. The article predicted the mechanism of the downfall and end of the dot com era. I'd been around long enough to have witnessed the 1980's end of the energy and real estate/savings and loan eras and I knew that it was only a matter of time until the same thing happened again to the dot coms. Obviously the JCC advisors of the IDEX Fund were smart guys and they would ride the bubble to the top and step off the elevator when it started to go down.(I love to sprinkle mixed metaphors willy skelter.) Here's what happened to my investment in the IDEX JCC Growth Fund, Click onnit;

My wife and I took some of the FPRAX/IDETX money and bought our house in mid 2000 on the first leg down of the collapse of the Dot Com bubble. We got a really lucky break on a house and we had the money thanks to IDETX and we moved on it. We weren't about to let that opportunity go away. I rode the rest of the IDETX money part way down and I bailed out of a one time winning mutual fund that was now in the process of destroying my savings. AGAIN. Now I was REALLY pissed. There was something going on that was giving me excellent gains and then taking them away and I didn't understand why. So I got busy. Next week; Some of what I learned about mutual fund investing. (To be continued)

This week I went from 60% cash to 76% cash by putting this month's contribution in LRSCX and clearing out of RERFX. Click on the chart.

I had pretty much moved to cash except for LRSCX, RERFX, and RGAFX as of 5/15 because:

1)The American Funds have limitations on withdrawals and reinvestments. I withdrew what I could without triggering the rapid trading restrictions.

2)I thought the foreign markets would be insulated somewhat.

3)I think that LRSCX could still do well, relatively.

But RERFX reaccelerated down and Friday I bailed out most of the rest of the way, trading restrictions be damned. I suspect that a significant amount of the money out there in euro/asian land may be US in origin and on its way home, markets are determined at the margin and a US slow down may be more feared than I thought, and the foreign markets appear to be going through their own rough patches. So I'm frozen out of the RERFX fund for 30 days as the price of holding on to what I've made in the last 20 months. I can tolerate that.

To recap; I've declared victory and gone substantially to cash a second time this year; I was early the first time and close enough the second time. I've got 30% gains over 20 months, 3.86% YTD, and I'm 252% up on the Balanced Pooled Fund. I was up 40% over 19 months and up 11% from Jan 1st YTD, but my inability to predict the future resulted in giving part of my gains back. Again, I can tolerate that.

"The first step to making money is not losing it."

-- Ed Easterling

"It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong."

George Soros

I currently have residual amounts (tracking positions) in the funds that I see as investable at this time. I'm frozen out of one of the funds for the next 30 days. The economy remains stronger than most people realize and especially strong in the sector we work in. The markets may be predicting a recession. They predict more recessions than occur. This may only be a correction in a demonstably overheated market with a resumption of the market as usual just down the pike. Or not. Regardless, there has been an unholy carnage in the market as a whole that is masked by the popular indices. That will take a while to unwind. Trapped longs, levered positions being unwound by margin clerks, hedge fund closures, and mega mutual fund pull backs and redeployment in alternative sectors accomplished, in process or still to come? You can make a case a buncha different ways. Recession ahead or correction mostly accomplished, I'm way ahead and as safe as I can be. Seventy six percent of my funds earning four percent annual return with no downside has a possible recession covered. The GIC is ahead of the Balanced Pooled Fund at this point. Pretty Cool. I've got time to grab a figurative samich and brew. I've also got the flexibility to watch for the possible end of the short sharp shock of an overdue 10% correction instead of an upcoming recession because I've made five years progress during the last two. What's not to like?

Special called meeting very likely in the next three weeks. Contract Time. See ya at the hall.

Calendar

Calendar