I've been busy. But that's no excuse, it just is what it is... I've scoped out the new Defined Benefit set up post McMorgan and you'll hear more about that soon. Stay tooned for the Special Called Meeting on the pension plans for September that was moved and accepted on the floor at the last meeting. This may be the one of the most important meetings in a long time. Spread the word to the members who aren't online...

Back at the ranch.... A coupla three months ago I attempted to finesse the post earnings pull back/correction of May. I did a pretty good job. I sold up and bought back lower. Then Hizballah got a coupla hostages, the Israeli's did their best to put the fear of consequences back in their opponents and oil prices skyrocketed and everybody started to puke up stocks. Then the long string of interest rate increases finally started to kick in, housing and new mortgages and resetting mortgages slowed and got toppy and earnings and next quarter guidance got squishy and stocks flattened out and went down. Damn. Not what I'd hoped to see.

Early this year I was up 40% since I started managing my self managed 401a. That was then and this is now. I'm still up twice what I'd have earned if I was only in the Balanced Pooled Fund and I'm up 26% over two years. Not as good as I'd have done if I could've predicted the future, but I gotta live in this world where I can't. Being down 13% and still up 13% a year over a two year period makes it hard to whine, so I won't. Now what?

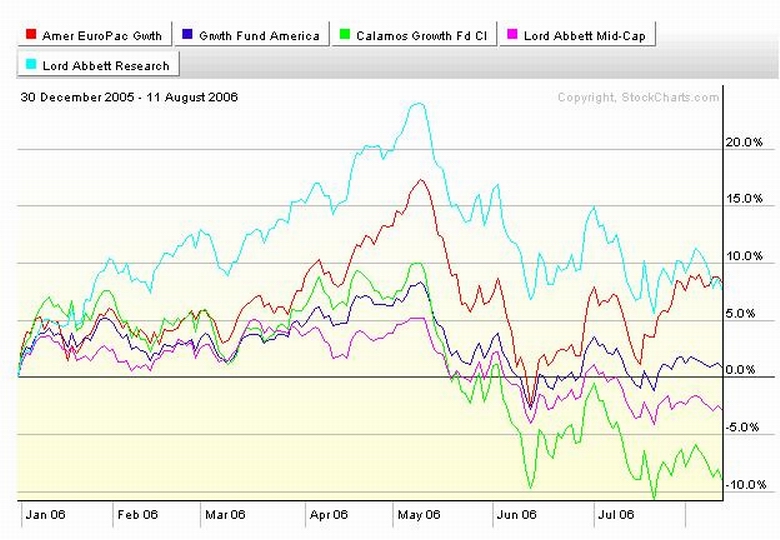

Check it out. CLICK IT for a larger version. CVGRX is pretty volatile. When it's hot, its a good performer. But when it's not, it goes down as hard as it goes up. Like recently. The overall market trend is down. Monday I'm dumping almost all of my Calamos. I can reenter at will and will not be charged a fee under the rapid trading rules. I'm mostly out of Lord Abbett Midcap (LAVLX) because of poor recent performance. And, after all, the overall trend is down. But I can reinvest at will, because my withdrawal(s) did not trigger the rapid trading rules. I've triggered the rapid trading rules in RERFX, so I'm standing pat at 12%. I can withdraw more at will, I can reinvest a limited amount at will, and invest an unlimited amount in a month, but the trend is down, so it's 12% until further notice... I'm at 12% in RGAFX, the rapid trading rules haven't been triggered, so I can reinvest at will if the trend changes, but right now the tr.. you know. I triggered the rapid trading rules in LRSCX, so I can withdraw more at will, but I'm stuck at 13% for 30 days which is not a bad place to be since the trend, you know? And, if the market takes off, I can get exposure to the market elsewhere, if not in LRSCX. I'll be at about 50% in the GIC Monday evening, which is not a bad place to be at a 26% return over two years when the tre....

It's said that 80% of the money is made over 20% of the time. The rest of the time you lose/break even, assuming you don't do anything stupid. That's the task in front of me now; Avoid Stupidity. It'll be hard, but I'll try. It ain't pushing the envelope, but 50% cash and an eye on the exit while watching the trend is aggressive enough for me here and now. Because, after all, ta da, ta da, ta da. If it gets as bad as the bears say it could be, I'll go to almost all cash when I figure it out. If the downtrend ends and is replaced with an uptrend, I'll probably buy some stocks and try to figure out if it's a bear market rally or the resumption of a bull market. You'll read about it here

There's issues to deal with though, in the meantime. Think about this prior to the Sept meeting; The GIC was great when rates were low. Would we get a better return if we had a Money Market Fund option open to us? And as working men and women, we need the KandG.com site up on weekends when we have the time and inclination to use it. Dead from Friday until Monday ala last weekend isn't acceptable.

See ya at the hall.....

Back at the ranch.... A coupla three months ago I attempted to finesse the post earnings pull back/correction of May. I did a pretty good job. I sold up and bought back lower. Then Hizballah got a coupla hostages, the Israeli's did their best to put the fear of consequences back in their opponents and oil prices skyrocketed and everybody started to puke up stocks. Then the long string of interest rate increases finally started to kick in, housing and new mortgages and resetting mortgages slowed and got toppy and earnings and next quarter guidance got squishy and stocks flattened out and went down. Damn. Not what I'd hoped to see.

Early this year I was up 40% since I started managing my self managed 401a. That was then and this is now. I'm still up twice what I'd have earned if I was only in the Balanced Pooled Fund and I'm up 26% over two years. Not as good as I'd have done if I could've predicted the future, but I gotta live in this world where I can't. Being down 13% and still up 13% a year over a two year period makes it hard to whine, so I won't. Now what?

Check it out. CLICK IT for a larger version. CVGRX is pretty volatile. When it's hot, its a good performer. But when it's not, it goes down as hard as it goes up. Like recently. The overall market trend is down. Monday I'm dumping almost all of my Calamos. I can reenter at will and will not be charged a fee under the rapid trading rules. I'm mostly out of Lord Abbett Midcap (LAVLX) because of poor recent performance. And, after all, the overall trend is down. But I can reinvest at will, because my withdrawal(s) did not trigger the rapid trading rules. I've triggered the rapid trading rules in RERFX, so I'm standing pat at 12%. I can withdraw more at will, I can reinvest a limited amount at will, and invest an unlimited amount in a month, but the trend is down, so it's 12% until further notice... I'm at 12% in RGAFX, the rapid trading rules haven't been triggered, so I can reinvest at will if the trend changes, but right now the tr.. you know. I triggered the rapid trading rules in LRSCX, so I can withdraw more at will, but I'm stuck at 13% for 30 days which is not a bad place to be since the trend, you know? And, if the market takes off, I can get exposure to the market elsewhere, if not in LRSCX. I'll be at about 50% in the GIC Monday evening, which is not a bad place to be at a 26% return over two years when the tre....

It's said that 80% of the money is made over 20% of the time. The rest of the time you lose/break even, assuming you don't do anything stupid. That's the task in front of me now; Avoid Stupidity. It'll be hard, but I'll try. It ain't pushing the envelope, but 50% cash and an eye on the exit while watching the trend is aggressive enough for me here and now. Because, after all, ta da, ta da, ta da. If it gets as bad as the bears say it could be, I'll go to almost all cash when I figure it out. If the downtrend ends and is replaced with an uptrend, I'll probably buy some stocks and try to figure out if it's a bear market rally or the resumption of a bull market. You'll read about it here

There's issues to deal with though, in the meantime. Think about this prior to the Sept meeting; The GIC was great when rates were low. Would we get a better return if we had a Money Market Fund option open to us? And as working men and women, we need the KandG.com site up on weekends when we have the time and inclination to use it. Dead from Friday until Monday ala last weekend isn't acceptable.

See ya at the hall.....

Calendar

Calendar