Charts and tables up. I've got a full plate for the weekend. There may be more posted here.....but no promises. My 401 account is long and strong, the return is smokin' and if I keep my head screwed on and don't get greedy, I'll keep most of it if the market starts to go south. I'll keep an eye on it all and let you know.

So at the meeting last week, Mike Mammini, the head honcho at our 401 plans showed how it makes very good sense to commit a substantial portion of your savings to the 401 plan. For late starters like me, it makes sense to commit the max. On a good year, that comes out somewhere between $15K and $25K placed in the 401a. He also says that you probably should look at it at least once a year, but probably not more often. After 5 years, that's about $80K to $140K that you've invested in financial instruments that are not guaranteed and have a history of going way up and way down real suddenly over the past coupla centuries. During that time, investing in stocks and bonds has made some people fabulously wealthy and beggared others. What makes YOU more uncomfortable, the thought of having to do a half hour a week of homework to make sure that that nothing bad happens to $100K plus of your money, or the thought that you might not catch a bad thing happening in time to save a substantial portion of your savings from going away forever? Is once a year often enough to look at something so important? If once a year isn't often enough to get your teeth checked, why is it often enough to look at your 401a?

The guy from McMorgan tried to scare members with TALES FROM THE STOCK MARKET, stories of tech investments gone bad. His example was PALM, where an investor could have lost 99% of his investment. SCARY!!!!! it's a good thing that McMorgan resisted requests to give us a tech fund to invest in...or maybe not...

Check out the charts of Palm and Apple below...CLICKONNIT

Put all your money in PALM and lose 98% of your money. Put 5% of your money in PALM and 5% of your money in AAPL, lose all the money in Palm provided you go deer in the headlights for the two years it takes PALM to go from $1000 to $3, and make 1000%+ (ten times your original investment) in AAPL by holding on for four years. I'll do that any day. It's called diversification and reducing risk to match the reward. It's what a smart mutual fund manager does. And a smart mutual fund manager wouldn't have ridden PALM all the way down FROM $1000 TO $3 and lost all the OPM (Other People's Money) along the way, charging them a fee to do so. Click on the link below.

http://bigpicture.typepad.com/

and then click on "Protect Your Assets" under "The Apprenticed Investor" section on the right. Learn how it's done. In 50 years of reading a lot of disparate stuff, reading this article is one of the best spent chunk of time I can remember. CHECK IT OUT!

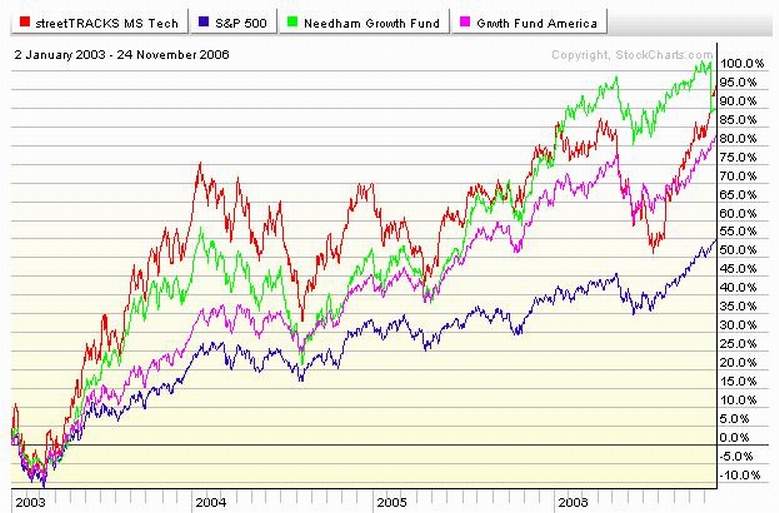

Check out the chart below. CLICKONNIT!

Shown is a tech Exchange Traded Fund (ETF) and a tech mutual fund vs our 401a growth fund and the S&P 500. I'm still not clear why we can't have a good tech fund available rather than tech funds used as something to be taken out of the closet every so often to scare us with.

And we gotta reconcile Kim asking us to double check our hours monthly because it is the responsible thing to do, and Mike telling us to look away from our investments for year at a time or longer because .... Well I can't figure out why because.

So at the meeting last week, Mike Mammini, the head honcho at our 401 plans showed how it makes very good sense to commit a substantial portion of your savings to the 401 plan. For late starters like me, it makes sense to commit the max. On a good year, that comes out somewhere between $15K and $25K placed in the 401a. He also says that you probably should look at it at least once a year, but probably not more often. After 5 years, that's about $80K to $140K that you've invested in financial instruments that are not guaranteed and have a history of going way up and way down real suddenly over the past coupla centuries. During that time, investing in stocks and bonds has made some people fabulously wealthy and beggared others. What makes YOU more uncomfortable, the thought of having to do a half hour a week of homework to make sure that that nothing bad happens to $100K plus of your money, or the thought that you might not catch a bad thing happening in time to save a substantial portion of your savings from going away forever? Is once a year often enough to look at something so important? If once a year isn't often enough to get your teeth checked, why is it often enough to look at your 401a?

The guy from McMorgan tried to scare members with TALES FROM THE STOCK MARKET, stories of tech investments gone bad. His example was PALM, where an investor could have lost 99% of his investment. SCARY!!!!! it's a good thing that McMorgan resisted requests to give us a tech fund to invest in...or maybe not...

Check out the charts of Palm and Apple below...CLICKONNIT

Put all your money in PALM and lose 98% of your money. Put 5% of your money in PALM and 5% of your money in AAPL, lose all the money in Palm provided you go deer in the headlights for the two years it takes PALM to go from $1000 to $3, and make 1000%+ (ten times your original investment) in AAPL by holding on for four years. I'll do that any day. It's called diversification and reducing risk to match the reward. It's what a smart mutual fund manager does. And a smart mutual fund manager wouldn't have ridden PALM all the way down FROM $1000 TO $3 and lost all the OPM (Other People's Money) along the way, charging them a fee to do so. Click on the link below.

http://bigpicture.typepad.com/

and then click on "Protect Your Assets" under "The Apprenticed Investor" section on the right. Learn how it's done. In 50 years of reading a lot of disparate stuff, reading this article is one of the best spent chunk of time I can remember. CHECK IT OUT!

Check out the chart below. CLICKONNIT!

Shown is a tech Exchange Traded Fund (ETF) and a tech mutual fund vs our 401a growth fund and the S&P 500. I'm still not clear why we can't have a good tech fund available rather than tech funds used as something to be taken out of the closet every so often to scare us with.

And we gotta reconcile Kim asking us to double check our hours monthly because it is the responsible thing to do, and Mike telling us to look away from our investments for year at a time or longer because .... Well I can't figure out why because.

Calendar

Calendar