"The art of investment is the art of selling. Buying is a lesser skill and holding requires no skill at all."

-- Harry Schultz

Chartz and tablez nowhere. For once it is not K and G hangin' me up. This time my charting service is installing a new UPS for their servers.

CHARTS AND TABLES UP!

A buddy of mine went to about 90% cash in mid Feb. Another buddy went to cash on the first bounce. I went partially to cash Jan 10 and then in and out for a while and finally all the way to cash on 2/28, the first big LOOOK OOUT BEELOooow!!!!!.... I've been basically all cash since 2/28 and as a result I missed some of the downside and all of the bounce. It's cost me between $60 and $100 in lost opportunity as of today. It bought me at least a coupla grand worth of peace of mind.

Every day you hold cash or bonds, you shoulder inflation risk as the return on your money does battle with inflation and fees. Every time you own stock, you shoulder investment risk as your stocks might go down and fees eat at your balance. Every time you are out of the market, you shoulder opportunity risk as what you could have had if you had made more right than wrong decisions is lost forever. It gets really hairy if you invest in offshore stuff.

But ya ain't gonna live happily now and happily ever after on passbook rates unless you're already retired and well off, so you have to choose what risk you want to shoulder and when it makes sense.

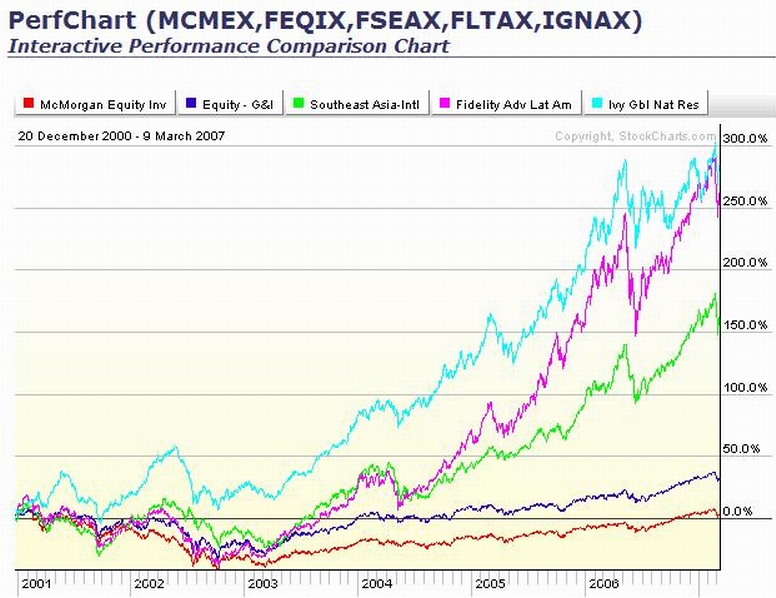

So if you follow what I post, you'll see that I have tended to be fairly overweight in the RERFX foreign stock fund choice in our 401a. In fact when I started to go to cash the first time this year, at one time the RERFX was the only fund I kept. Here's why; AMG Data Services provided fund flows for the week ending 1/31/07 record that domestic equity funds excluding ETF's had a net cash outflow of $55 billion dollars and non domestic funds had a net cash inflow of $2.56 billion. This is not atypical. I've been watching money flow overseas for a while now. Big money and smart money and hot money has been in natural resources and the hottest international economies since the dotcom crash. You don't think they rode out the crash all the way to the bottom here, did you? That's the little guy's job. Check out the chart of the McMorgan big cap equity fund vs a Fidelity big cap, South East Asia and Latin America funds, and a natural resources fund...

CLICK ONNIT!!

First off, finding that the Fidelity fund is a better preforming fund than McMorgan is no surprise. Second, check out this chart and the ones on my website. The action has been better some places than others. Specifically, and until recently, away from the big caps. That's why the American Funds EuroPacific and the Lord Abbet Small Cap have excelled. And that's where I've been leaning the hardest. But that's not the only place I'm putting my money down. The word risk is all over the page here and I try to listen to people I respect. That's why I've avoided the losers and underperformers and put my money in more than one winner. I'd have made more if I only had money in the best performing fund. Instead, I've trailed the very best two funds despite being heavily invest in them. That's the price of discipline and diversification. And discipline is why I'm in cash now.

Another key to what I'm doing is the word "flow" as in "fund flows". Fund flows in drives up prices and create a self reinforcing dynamic. Think homes in Palm Beach.

http://www.palmbeachpost.com/business/c ... _0226.html

Fund flow statis creates a whole lot of tension and pretty quickly creates flow out. Fund flows out drive prices down and create their own dynamic. Every game comes to an end. There will come a time when the flow of funds out will scragmaul what they built up in a relative eyeblink. Think homes in Palm Beach. So you get while the getting is good and look away from your money at your risk. You can't do that with your home. Some things ya gotta ride out the ebb and flow. But depending on circumstances and inclination, and little time and energy reacting to the ebb and flow in the 401a can be well spent.

I'm kinda expecting some more downside. But cash is for buyin' so I'm looking for an opportunity to do so. It's the ebb and flow thing, ya know? If we don't go to zero, we'll go up and there'll be an other opportunity to make money. And then when they go down, we'll get an opportunity to sell and keep some money.

The wheels on the bus go 'round and 'round.....

See ya at the hall.

-- Harry Schultz

CHARTS AND TABLES UP!

A buddy of mine went to about 90% cash in mid Feb. Another buddy went to cash on the first bounce. I went partially to cash Jan 10 and then in and out for a while and finally all the way to cash on 2/28, the first big LOOOK OOUT BEELOooow!!!!!.... I've been basically all cash since 2/28 and as a result I missed some of the downside and all of the bounce. It's cost me between $60 and $100 in lost opportunity as of today. It bought me at least a coupla grand worth of peace of mind.

Every day you hold cash or bonds, you shoulder inflation risk as the return on your money does battle with inflation and fees. Every time you own stock, you shoulder investment risk as your stocks might go down and fees eat at your balance. Every time you are out of the market, you shoulder opportunity risk as what you could have had if you had made more right than wrong decisions is lost forever. It gets really hairy if you invest in offshore stuff.

International diversification, which I recommend for the sheer thrill of losing money around the clock in all sorts of different countries for reasons you cannot articulate, inevitably involves currency risk.

--Howard Simons

But ya ain't gonna live happily now and happily ever after on passbook rates unless you're already retired and well off, so you have to choose what risk you want to shoulder and when it makes sense.

So if you follow what I post, you'll see that I have tended to be fairly overweight in the RERFX foreign stock fund choice in our 401a. In fact when I started to go to cash the first time this year, at one time the RERFX was the only fund I kept. Here's why; AMG Data Services provided fund flows for the week ending 1/31/07 record that domestic equity funds excluding ETF's had a net cash outflow of $55 billion dollars and non domestic funds had a net cash inflow of $2.56 billion. This is not atypical. I've been watching money flow overseas for a while now. Big money and smart money and hot money has been in natural resources and the hottest international economies since the dotcom crash. You don't think they rode out the crash all the way to the bottom here, did you? That's the little guy's job. Check out the chart of the McMorgan big cap equity fund vs a Fidelity big cap, South East Asia and Latin America funds, and a natural resources fund...

CLICK ONNIT!!

First off, finding that the Fidelity fund is a better preforming fund than McMorgan is no surprise. Second, check out this chart and the ones on my website. The action has been better some places than others. Specifically, and until recently, away from the big caps. That's why the American Funds EuroPacific and the Lord Abbet Small Cap have excelled. And that's where I've been leaning the hardest. But that's not the only place I'm putting my money down. The word risk is all over the page here and I try to listen to people I respect. That's why I've avoided the losers and underperformers and put my money in more than one winner. I'd have made more if I only had money in the best performing fund. Instead, I've trailed the very best two funds despite being heavily invest in them. That's the price of discipline and diversification. And discipline is why I'm in cash now.

Another key to what I'm doing is the word "flow" as in "fund flows". Fund flows in drives up prices and create a self reinforcing dynamic. Think homes in Palm Beach.

http://www.palmbeachpost.com/business/c ... _0226.html

Fund flow statis creates a whole lot of tension and pretty quickly creates flow out. Fund flows out drive prices down and create their own dynamic. Every game comes to an end. There will come a time when the flow of funds out will scragmaul what they built up in a relative eyeblink. Think homes in Palm Beach. So you get while the getting is good and look away from your money at your risk. You can't do that with your home. Some things ya gotta ride out the ebb and flow. But depending on circumstances and inclination, and little time and energy reacting to the ebb and flow in the 401a can be well spent.

I'm kinda expecting some more downside. But cash is for buyin' so I'm looking for an opportunity to do so. It's the ebb and flow thing, ya know? If we don't go to zero, we'll go up and there'll be an other opportunity to make money. And then when they go down, we'll get an opportunity to sell and keep some money.

The wheels on the bus go 'round and 'round.....

See ya at the hall.

Calendar

Calendar