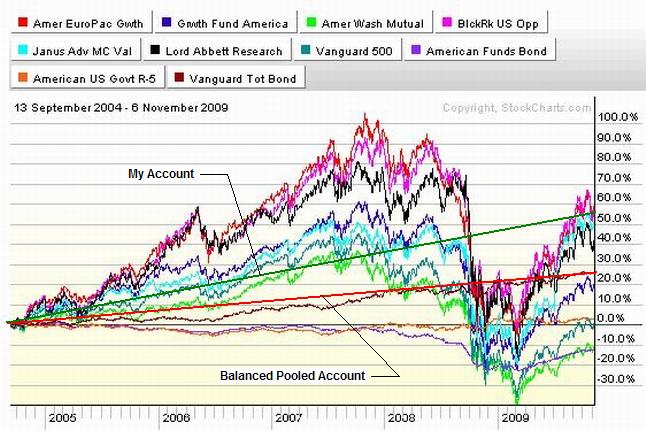

Three years; Up 60%. AGAIN, ya gotta make it when ya can.... Not when you need to. The opportunity ain't necessarily gonna be there just because you need it to be.

"When the facts change, I change my mind. What do you do, sir?"

--John Maynard Keynes

CHARTZ 'N TABLE ZUP!!!!

The charts and tables pretty much tell the tale.

CLICKONNIT

Half bonds/half stocks. Brilliant allocation or kinda dumb? Stocks go up and down a lot. Bonds go up an' down a little. Sometimes they work opposite each other... but not always. So you're pretty much half safe, mostly. Or at least half exposed to danger at all times. Think of it like leaving the house in a swimsuit, flip flops, and a fur-lined parka so you can deal with whatever the weather happens to be. Make sense to you? Me neither.

I time the market. Ignore the crap you always hear about how it can't be done. It is not in the best interests of the mutual funds for you to think that you can time the market. They earn the most when your money lands and stays put where it landed. They earn fees and the lower the costs and the stickier the money, especially during the years when they can't hit their ass with either hand, the more of your money they earn (keep). Pretty sweet deal. I'd like to have one like that too. But I get paid for what I do that day. If I stick, it's 'cause I perform, not because my employer is waiting for me to turn around "in the long run".

It is in my best interests to maximize my earnings. I have a wife and family whose well being supercedes that of the funds I invest in. So I try to put my money where the most money is being/will be made. It's worked for me for three years and counting.

It is also in my best interests to minimize my losses. Ya not only gotta make it, ya gotta keep it. There are times when it is/will be very hazardous not to be in cash or cash equivalents, or when bonds will be the best game in town. That's when I go to bonds or cash. That works for me too.

I got a fur-lined parka and a swim suit and flip flops. I don't wear them all at once. That would be silly.

--John Maynard Keynes

CHARTZ 'N TABLE ZUP!!!!

The charts and tables pretty much tell the tale.

CLICKONNIT

Half bonds/half stocks. Brilliant allocation or kinda dumb? Stocks go up and down a lot. Bonds go up an' down a little. Sometimes they work opposite each other... but not always. So you're pretty much half safe, mostly. Or at least half exposed to danger at all times. Think of it like leaving the house in a swimsuit, flip flops, and a fur-lined parka so you can deal with whatever the weather happens to be. Make sense to you? Me neither.

I time the market. Ignore the crap you always hear about how it can't be done. It is not in the best interests of the mutual funds for you to think that you can time the market. They earn the most when your money lands and stays put where it landed. They earn fees and the lower the costs and the stickier the money, especially during the years when they can't hit their ass with either hand, the more of your money they earn (keep). Pretty sweet deal. I'd like to have one like that too. But I get paid for what I do that day. If I stick, it's 'cause I perform, not because my employer is waiting for me to turn around "in the long run".

It is in my best interests to maximize my earnings. I have a wife and family whose well being supercedes that of the funds I invest in. So I try to put my money where the most money is being/will be made. It's worked for me for three years and counting.

It is also in my best interests to minimize my losses. Ya not only gotta make it, ya gotta keep it. There are times when it is/will be very hazardous not to be in cash or cash equivalents, or when bonds will be the best game in town. That's when I go to bonds or cash. That works for me too.

I got a fur-lined parka and a swim suit and flip flops. I don't wear them all at once. That would be silly.

Calendar

Calendar