I Moved Some 401a Money Around. When You're Not Happy With Any Of The Choices, How Can You Be Happy With The Decision?

The long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is past the ocean is flat again.

— John Maynard Keynes

UPDATED CONSTANTLY....OR NOT.

LOOK FOR THE DAY OF THE WEEK FOR NEW ADDITIONS.

I'M INCAPABLE OF NOT EDITING AND REWRITING WHAT'S ALREADY POSTED IF I THINK I CAN SAY IT BETTER. SO IT GOES...

Chartz and Table Zup on www.joefacer.com

I'll get back witcha Saturday (it's Friday night) about my choices and why I moved some money even though I didn't think much of where it was to start with and where it ended up. The 401a site ain't updated and I gotta go....

Friday, (it's Saturday morning) I went off to the GAMH for the first time in a decade or so. Where I had seen Freddie Hubbard, Chick Correa, Jack DeJohnette, Brownie Terry and Sonnie McGhee, David Bromberg, Bobby "Blue" Bland, Tania Marie, Larry Coryell, Bob Segar, Buddy Rich, Billy Cobham, Pat Methany, and Maynard Ferguson, the ownership and management is now from "Slim's" and very much SOMA. Slim's is aka Boz Skaggs'. Culture shock. I saw Still Time, Kapakahi, and Forest Day. Gonna have to stop listening to my 8 tracks and check out what's happenin' in the here and now. There is some interesting music bein' made someplace other than the past.

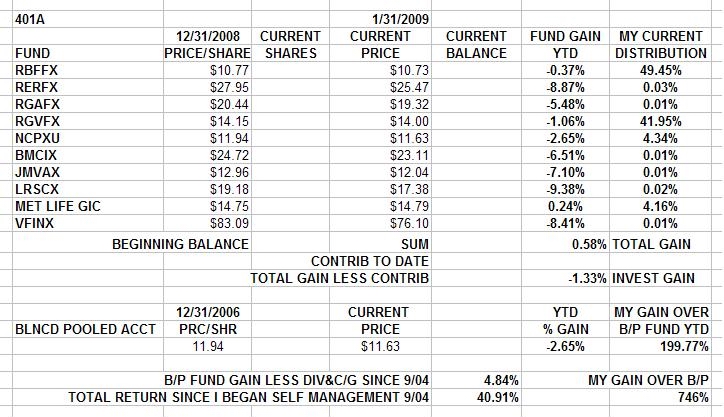

Check out the tablez below. Before and after. This is very likely to change Monday. Or not.

Here's what led to the distribution among funds as of 1/31.....

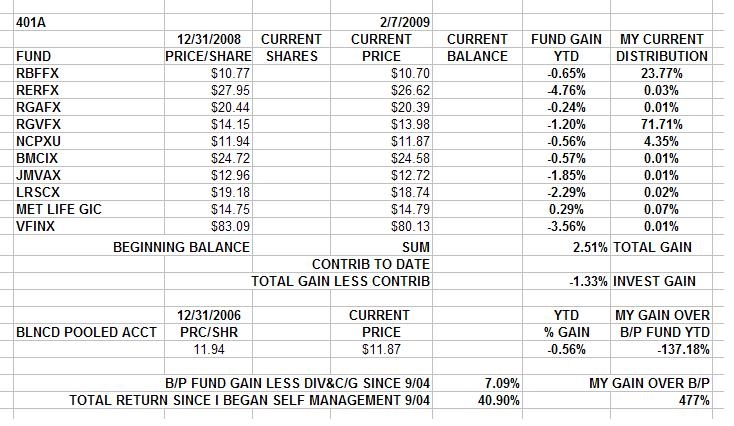

Starting back in '07, stocks, represented by the S&P 500 Fund VFINX, started to crater. By Spring I had given up on stocks and gone all in to the Met Life GIC/Stable Value Fund. The promised return was above what the bond funds (RGVFX & RBFFX) were paying and MET Life was not Lehman Bros or Bear Stearns. That worked well until late in the Fall (Oct 08) when suddenly things went critical. Check out MET on the chart. The only thing that stands behind the GIC/SVF is MET's promise to return all of the money invested in the fund plus guaranteed interest. Met's assets and worth back up that promise and the stock price is a measure of the confidence in that ability. The market was rendering a judgement on MET's value and undercutting their ability to pay and I hadda respect that. So in the second week of October I went all in to the Am Funds Gov Securities Fund (RGVFX), strictly for safety. I got more than that... Check this out...

About two weeks after I got nervous, everybody else did and piled in after me, bidding up the price of bonds with Fed backing to below zero yield. Who bids up bonds to where they get less back than what they paid? Someone who holds checks for millions of dollars from moving money around and, given the current state of affairs, probably to meet redemptions. Someone who is afraid to give it to a broker or bank or hold a check from a broker or bank. They want/need cash on demand, no excuses. Anybody who was there first like I was, get the bonds he just bought into bid higher. I made up the losses from hanging around for 3 or 4 months in stocks in a coupla weeks of holdin' bonds. That trade started to unwind after Christmas. I wanted to keep most of what I made, so once I was sure of the trend, I moved some money to the AM Fundz general bond fund. I figured that with the new administration on the way and the debt market starting to show the very first signs of thawing, the RGVFX fund would continue to decline in yield and the corporate fund would start to bounce back. That left me with a RGVEX/RBFFX distribution of 'roun' 40%/50% for most of January.

Here's why I changed that Friday and have my money where the table above sez I do.

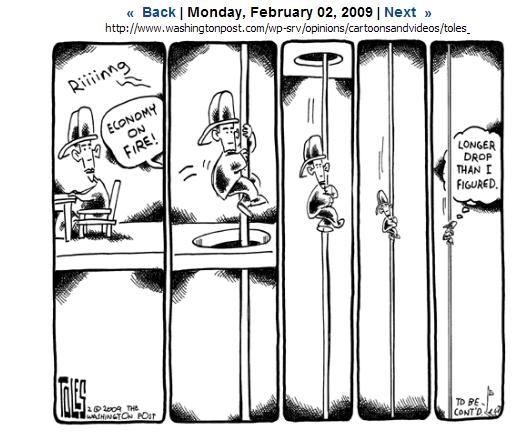

The markets are feeling queasy about the first days of the Obama administration. Three nominations to major posts with tax troubles and two withdrawn. If Geithner had been a later nomination, he'da gone down too. Too much wafflin' and back an' forth on the bank plan and a growing realization that too much time and money were wasted trying to get a clue and that the delay has made the problem REAL serious. There's a growing realization that we've borrowed and spent ourselves into oblivion and as much as we regret that the party has come to an end, we can't borrow more and relight the ashes. Things are worse than you think. Much worse. The Economic Stimulus package is gonna be hugely expensive and pretty ineffective. The numbers aren't there and there will prolly be at least one and maybe two more ES packages within the next 18 months. Earnings reports have been gawdawful and guidance for next quarter looks REALLY bad. Stocks have been going up but future earnings will be worse, so I don't trust that move. I think Geithner is from the same crowd and mindset (Hank Paulson) that figured that raiding the Treasury and exchanging trash for cash to prop up his contemporaries was an answer to the current debacle. So I want to position myself for a "sell the news" reaction sometime this upcoming week. I would prefer to miss a week or two of the big turn up if I'm totally out of touch as the price of avoiding a possible falling to new lows if I'm right.

What to do? What I did Friday.

Forget the MET Life GIC/SV for now. They look to be the strongest of the big life insurers, but... Put all my money in the hands of ONE company? With no explicit federal backup or something like the FDIC or SPIC? What kinda smart is that? Things gotta work and work out for a while before I trust.

RBFFX?

16% Government bonds

25% mortgage "bonds"

36% corporate bonds

16% foreign bonds

Money here is at risk.... But. One sixth of the fund is government or agency bonds. Can't do better than that. Thirty six percent is various corporate bonds. I can buy them at roughly a 20% discount to last year. And there is cash flow out of these. Dividends are suspended to keep paying bond coupons. I'm down wid dat. If things stop getting worse, we'll turn the corner. They don't have to get better. Once they stop deteriorating, investors will look to the future and bid these back up. Mortgage bonds? We'll see. I'm still paying my mortgage. I did real well in the 80's with bonds. We'll see... Cash flow for now and a possible stock like appreciation once things turn. If things go all Armageddonly, money in a bond fund will be one of my minor problems. Roll the dice.

RGVFX?

48% Gov paper

43% mortgages

I WANT AN ALL TREASURY FUND!!!! But this is the best I can do for now. Half federal paper and hopefully agency insured mortgages.

If the facts change, I'll change my allocationz. This is where I'm at tonight....

This week will be a circus/bar fight/three wolverines in a dryer. I expect to absorb a lot of info and maybe act on it. Or not. Stay tooned....

http://www.markfiore.com/wall_street_executive_air_0

http://www.ritholtz.com/blog/2009/02/jo ... ecessions/

http://www.ritholtz.com/blog/2009/02/th ... ng-crisis/

http://www.ritholtz.com/blog/2009/02/mo ... s-of-rmbs/

http://www.ritholtz.com/blog/2009/02/la ... e-changes/

http://www.msnbc.msn.com/id/29084713/

http://www.newsweek.com/id/183718

http://www.ritholtz.com/blog/2009/02/wi ... y-recover/

http://www.ritholtz.com/blog/2009/02/mo ... s-of-rmbs/

http://www.bloomberg.com/apps/news?pid= ... dj5yq_WnDI

http://www.economist.com/displaystory.c ... d=13057265

http://www.reuters.com/article/ousiv/id ... CQ20090207

http://www.nytimes.com/2009/02/07/busin ... ARKETWATCH

http://www.slate.com/id/2210619/

http://www.nytimes.com/2009/02/08/business/08split.html

http://www.ritholtz.com/blog/2009/02/st ... s-on-fire/

http://www.ritholtz.com/blog/2009/02/it ... that-hard/

http://www.ritholtz.com/blog/2009/02/%E ... n-january/

Monday

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.ritholtz.com/blog/2009/02/do ... g-america/

http://www.washingtonpost.com/wp-dyn/co ... 02153.html

http://www.washingtonpost.com/wp-dyn/co ... id=artslot

http://www.washingtonpost.com/wp-srv/na ... ble/video/

http://www.washingtonpost.com/wp-dyn/co ... ml?sub=new

http://www.ritholtz.com/blog/2009/02/mr ... the-truth/

http://online.wsj.com/article/SB123420518851764681.html

Back to the planned US rescue packages, and specifically Bill King’s comments: “The main problem plaguing the US economy is too much debt has been accumulated on gratuitous spending and the papering over of declining US living standards. Solons espouse a monstrous surge in debt to fund even more consumer spending. The toxin is not the cure. Inducements to save and invest in production are the remedy. But the welfare state and its ruling class are trying a last grandiose socialist [Keynesian] binge in the hope of salvaging their realm.”

By Prieur du Plessis - February 8th, 2009

http://www.ritholtz.com/blog/2009/02/wo ... se-282009/

In other and unrelated news, I just had a pint of beer with Charlie at the Hawk and Dove, and Michael Phelps was on the television. Charlie and I are in agreement that all this business over Phelps smoking a little weed is stupid and that all the sponsors should have spent their outrage a few years ago when Phelps got caught driving drunk. Now that is something to be punished for. Smoking weed at a private party, while stupid, is almost harmless. A**holes driving drunk, by contrast, are what kills single mothers on their way home from working the night shift.

Posted by Abu Muqawama http://abumuqawama.blogspot.com/

MONDAY.

Standing aside and looking for direction. It's very much a news driven market and the news drives the reaction. I gotta guess the news and then guess the immediate action and then the follow up reaction. Blow off thoughts of the economy getting well without wringing out the excesses. The bull market ain't starting tomorrow. If it's an honest to gawd countertrend bull rally in a bear market, it'll have legs and I can climb on it once it is in motion, even given working with the trading restriction on a 401a. If it's a spike and/or whipsaw either direction from a three day bull market last week, and the resumption of the bear, standing aside (and cheeseis) is just alright with me. Stay tooned...

TUESDAY

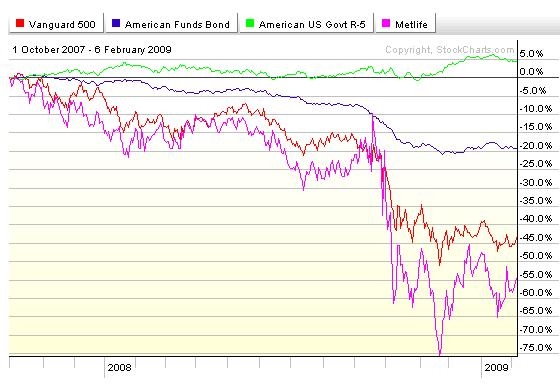

From up above written Sunday....

I think Geithner is from the same crowd and mindset (Hank Paulson) that figured that raiding the Treasury and exchanging trash for cash to prop up his contemporaries was an answer to the current debacle.So I want to position myself for a "sell the news" reaction sometime this upcoming week. I would prefer to miss a week or two of the big turn up if I'm totally out of touch as the price of avoiding a possible falling to new lows if I'm right.

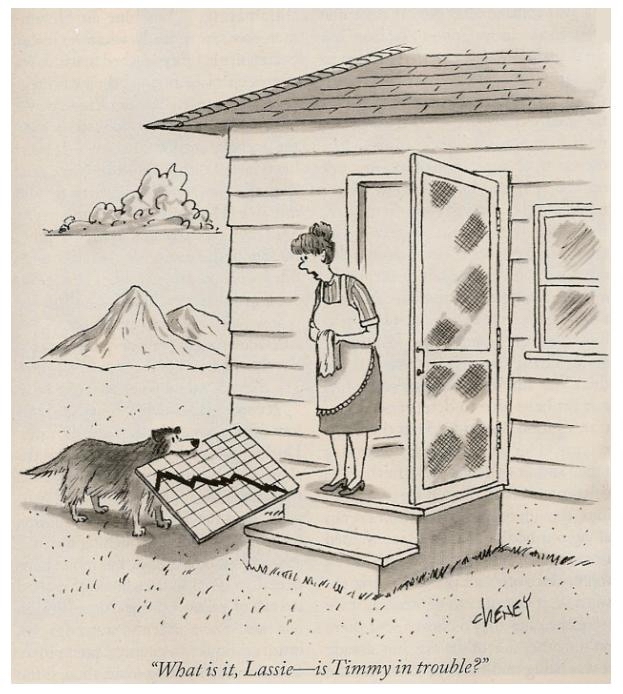

Cash is a good place to be if you can't go short. I was short in my trading account and cash in the 401a when Timmy Geithner announced his plan for the Treasury to save the financial sector. The Treasury plan is like an ice frying pan, toilet paper with holes in it, or a glass hammer. It's a plan because they say it is. It's a plan without details, magnitudes or direction. It is not real clear exactly how well it will work or exactly what they think they will accomplish with it. Or that it'll work at all....... The market hated it. Stay toonicious....

AN CLICKIT!!!!!!

I think Geithner is from the same crowd and mindset (Hank Paulson) that figured that raiding the Treasury and exchanging trash for cash to prop up his contemporaries was an answer to the current debacle.So I want to position myself for a "sell the news" reaction sometime this upcoming week. I would prefer to miss a week or two of the big turn up if I'm totally out of touch as the price of avoiding a possible falling to new lows if I'm right.

Calendar

Calendar