These Damn Once in A Lifetime Market Crashs, Events, Flash Crashes etc, like '29, '87, '97, '02, '08, '10 And Maybe This Weekend Seem Be To Happening A Lot More Often Than Once A Lifetime.....

Friday, November 26, 2010, 07:16 PM

I am not a Democrat, because I have no idea what their economic policies are; And I am not a Republican, because I know precisely what their economic policies are.

-- Barry Ritholtz

Chartz and Table Zup @ www.joefacer.com

iTunes has da Bee-atles. The COFGBLOG Has the KNICKERBOCKERS!!!!!!

http://www.bloomberg.com/news/2010-11-2 ... bonds.html

http://www.bloomberg.com/news/2010-11-2 ... tners.html

http://www.bloomberg.com/news/2010-12-0 ... -plan.html

http://www.msnbc.msn.com/id/39435196/ns ... ws-europe/

I hung wit the long side an hadda good day.....a really good day.

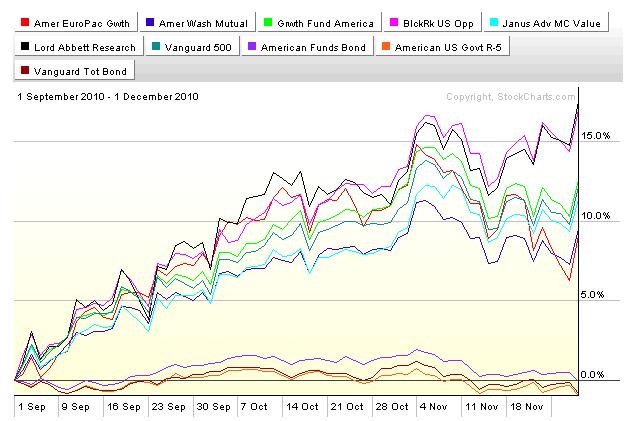

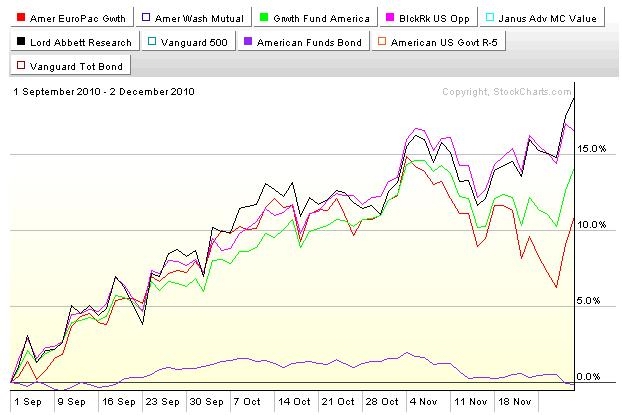

There is a possibility of a ramp up into year end as those who live by the returns YTD, are lookin at dyin' by the returns YTD, unless they save a mediocre year by goin' all out for the last two weeks. There are fundz who are having visions of their client's bailing out. They will try to manufacture performance and the sharp guys are ready and waiting for it... I stick wit what I got for now..... I'm heavy in the aggressive funds and no place no place else. Let's see if they can pile on to the momentum plays and do me some good. Do I got my mojo workin'?

These are my horses...Ride Sally, Ride.....

Stay tooned....

Comments are not available for this entry.

Calendar

Calendar