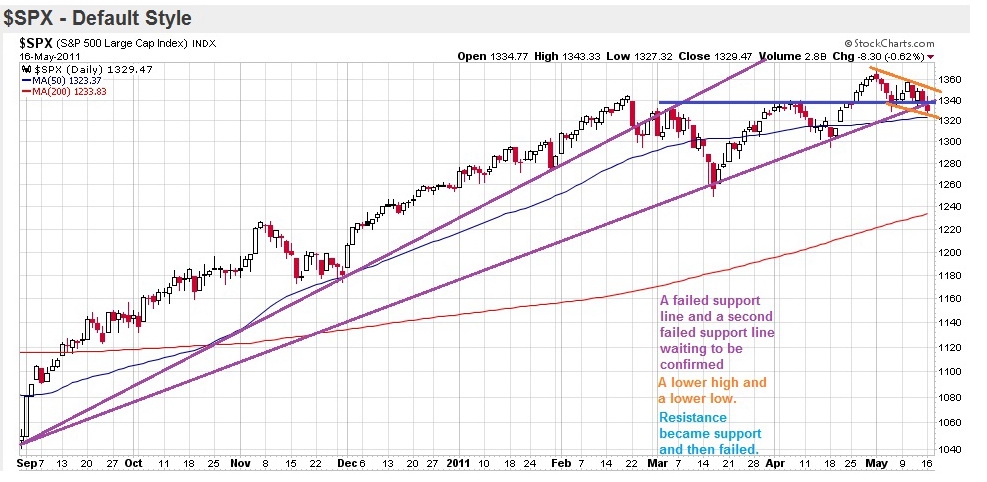

What Happens To The Party (The Markets) When The Fed Takes Away The Punch Bowl (Zero Interest Rate Policy [ZIRP] )?

Saturday, May 14, 2011, 01:51 PM

Just remember one thing: there are no good stocks. They all suck. Even those that are making you money are going to turn on you sooner or later. The only stock you should say anything good about is the one you no longer own that made you money.

--Reverend Shark

What Happens When The Fed Takes Away Free Money (ZIRP)? It Really Ain't That Hard To Figure Out...

http://www.youtube.com/watch?v=UtsClj04 ... re=related

http://www.youtube.com/watch?v=K5IS45jT ... re=related

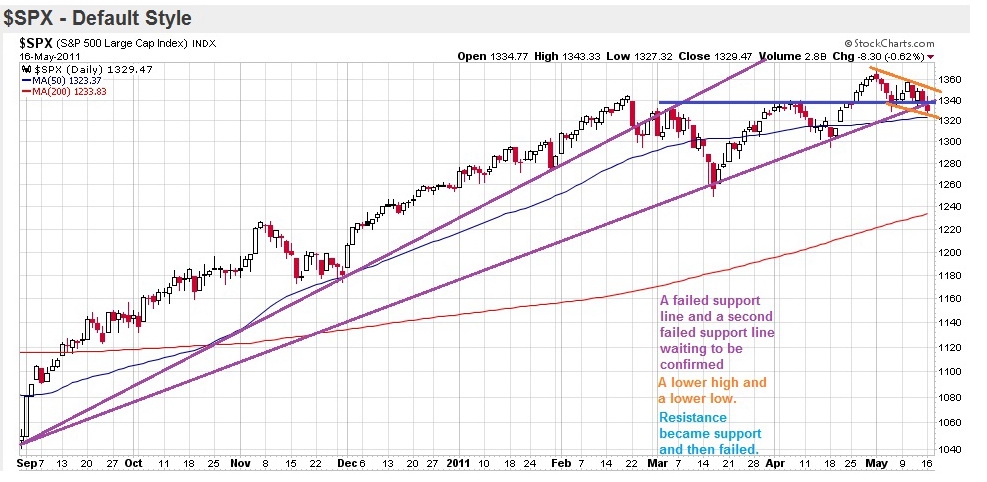

Pretty radical change in posture over the last month:

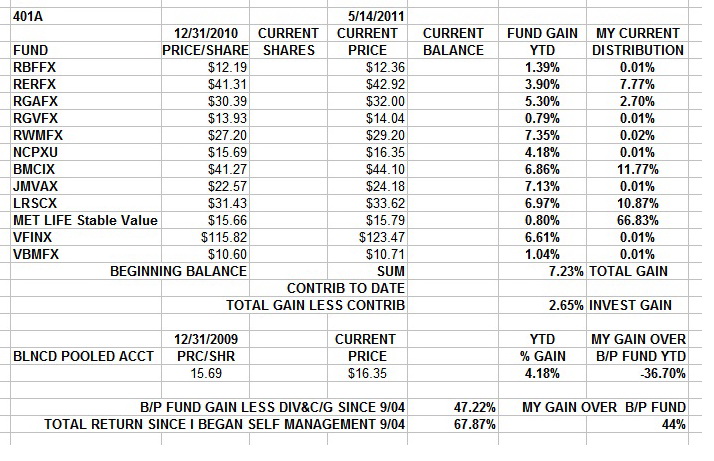

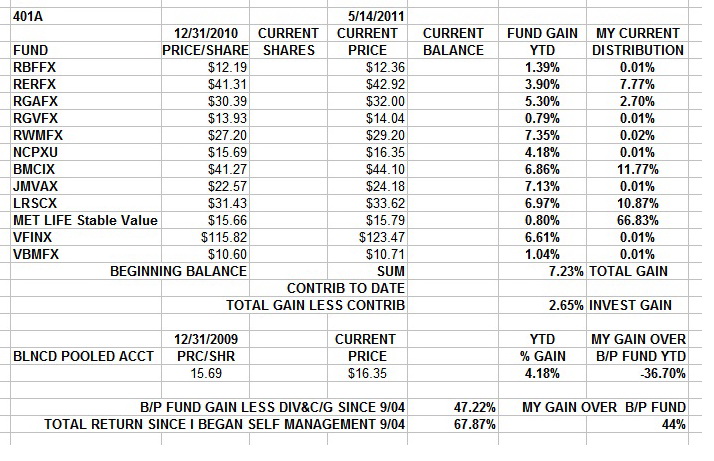

I'm down from 90% stocks just weeks ago to 33% this weekend, to anywhere from 20% to 0% anytime this week depending on how urgent I feel the need to get ultra defensive is....

It's a risk/reward thing, see? I been way long for a while, since 9/10. I made some serious coin last year. But there's limits. Making money was easy between late '04 and late 2008. I went 100% stocks, checked everything every Saturday morning and every so often trimmed my allocation toward the hot fundz. I was onna sidelines in cash during the 08/09 WHOOSH down. I read enough to make me certain that it was all risk and no reward so I cashed outa stocks into the GIC. I made money by not losing money. I mean I actually made money in 08. Coupla hundred simoleans beats a gaping smokin' pit inna 401a. I was late rejoining the party in the spring of 09. I let a lot of gains go bye bye because caution had served me so well previously. I didn't really understand the new religion of free money from the FED until 9/10. But there ain't no true believer like a recent convert so I got wit it. All stocks alla time.

That was then an' this is now. I'm gonna play onna other side of the street for a while. Yeah, I'm really aggressive when it comes to reachin' out for gains. It's what I do. But I balance that by being really aggressive protecting gains. I risk serious losses by being all the way long when I think the markets are goin' up. If the market turns against me, I can get roughed up onna way out. The rapid trading restrictions means there is a price to bailing out inna hurry. Ya gotta be smart aggressive; listen for the sirens and move closer to the door.

The other side of that is that caution and getting out early can leave you looking in the windows at the party. Coupla three four days of upward whoosh watched through the windows can sting hard enough to make yer eyes water. But, Oh Well! you never go broke realizing gains and booking profits. And a few dollars left onna table can be thought of as insurance premiums or the cost of admission. I can live with that. What's made me cautious over the last six weeks is starting to wear on me. Time for some fresh air and a rest. Nothing clears the head and resets the game like the view from the sidelines.

There is nothing that will benefit your portfolio more than avoiding losses when the market is acting poorly. If you can keep from incurring losses in your portfolio as the market falls, you avoid the very unproductive task of recouping losses once the market is more favorable.

James “Reverend Shark” DePorre

http://www.ritholtz.com/blog/2011/05/lo ... economics/

http://alephblog.com/ Check out "The Impossible Dream Part 2"

http://www.irishtimes.com/newspaper/opi ... 23_pf.html

http://www.platts.com/weblog/oilblog/20 ... y_gen.html

Damn!! Meant to lighten up onna stocks today. Forgot to enter the orders. Got 'em entered for tomorrow.

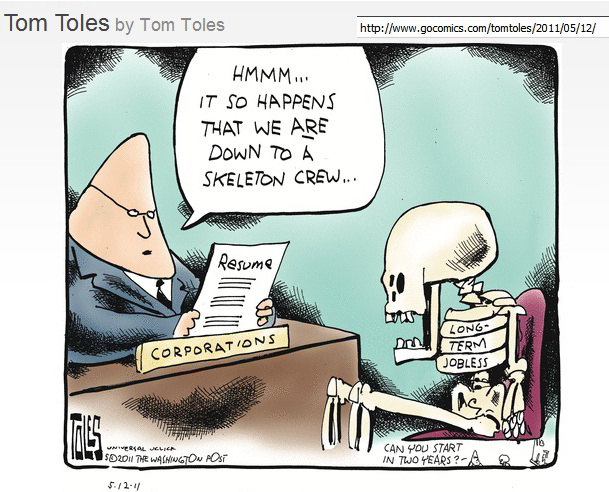

I'm a trend and momentum investor. I see damn little momentum and the trend looks to be rolling over. If I can pick up a majority of the up and miss out on summa da down, I figure that's pretty copacetic. Bull markets are a much easier environment to invest in and I'd rather just go long and hang on. But that's a recipe for disaster during certain times.... like this one.. .

WED EVE

Up day inna market and I'm pretty much a day or two from an all cash position (Met Life Stable Value). I'll write more as to how and why this weekend. For now, I'm banking gains from the first four months of the year, stepping back from risks I identify in the market technicals, acknowledging concerns identified by what I consider to be reliable and informed sources, and taking a breather. Should we get yet another "V" shaped bounce, I'm in a position to go long as fast as I wanna without triggering rapid trading restrictions penalties... If we go down big time, an all cash is a good thing indeed...

A coupla moves still to go, done by next Monday, and then I wait. A day, A week, A month, Or three.

Stay Tooned....

Comments are not available for this entry.

Calendar

Calendar