Forty Years Ago, I Didn't Understand Why All The Old Timers Ever Talked About Was Retiring. It Gets Clearer Every Year....

Friday, September 30, 2011, 05:42 PM

Risk Management and Capital Preservation is often confused with Market Timing, and therefore is frowned upon.

-- Barry Ritholtz

Marshall Tucker Was A Rock Band Before They Were Country. I Saw 'em Open For The Allman Bros New Years Eve Show Inna 70's. SMOKIN'....

http://www.youtube.com/watch?v=VEOV5vWfSgI

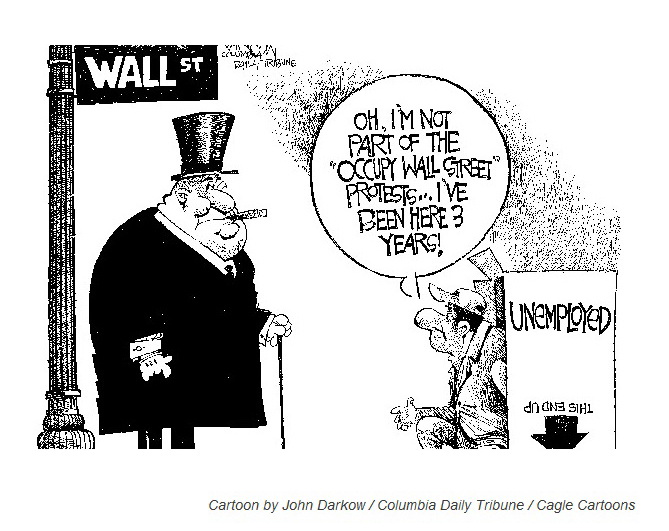

It's Been A Rotten Week Inna Market... But There Is An Answer To The Social Security Problem.

http://www.ritholtz.com/blog/2011/09/so ... e-younger/

I Have half A Dozen Go to Guys...Lakshuman Is One...

http://www.ritholtz.com/blog/2011/09/le ... recession/

http://www.ritholtz.com/blog/2011/10/ec ... escapable/

http://www.ritholtz.com/blog/2011/09/mo ... x-changes/

http://www.ritholtz.com/blog/2011/09/su ... s-9-30-11/

http://www.thereformedbroker.com/2011/0 ... ucktember/

http://www.ritholtz.com/blog/2011/09/mo ... x-changes/

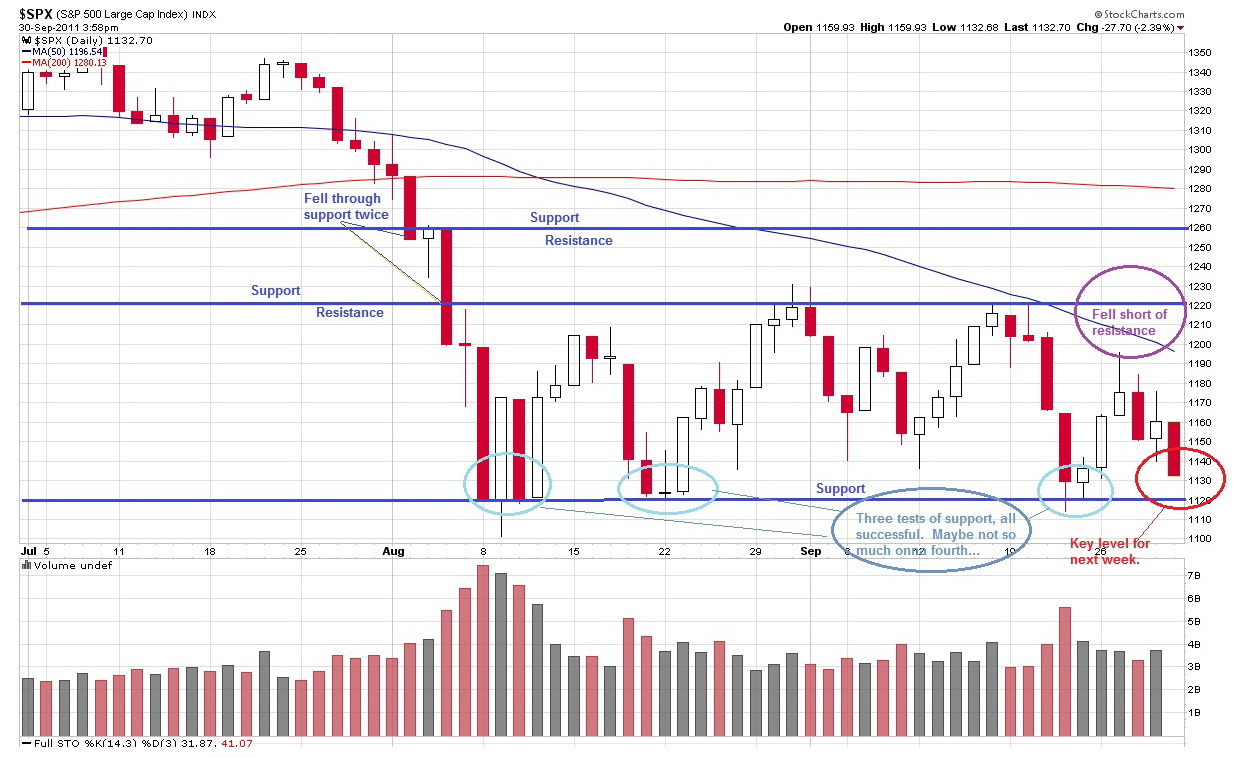

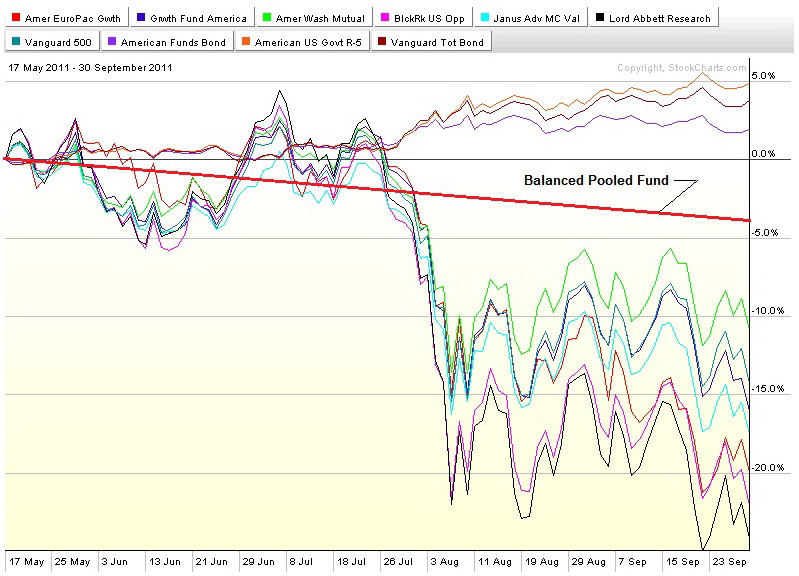

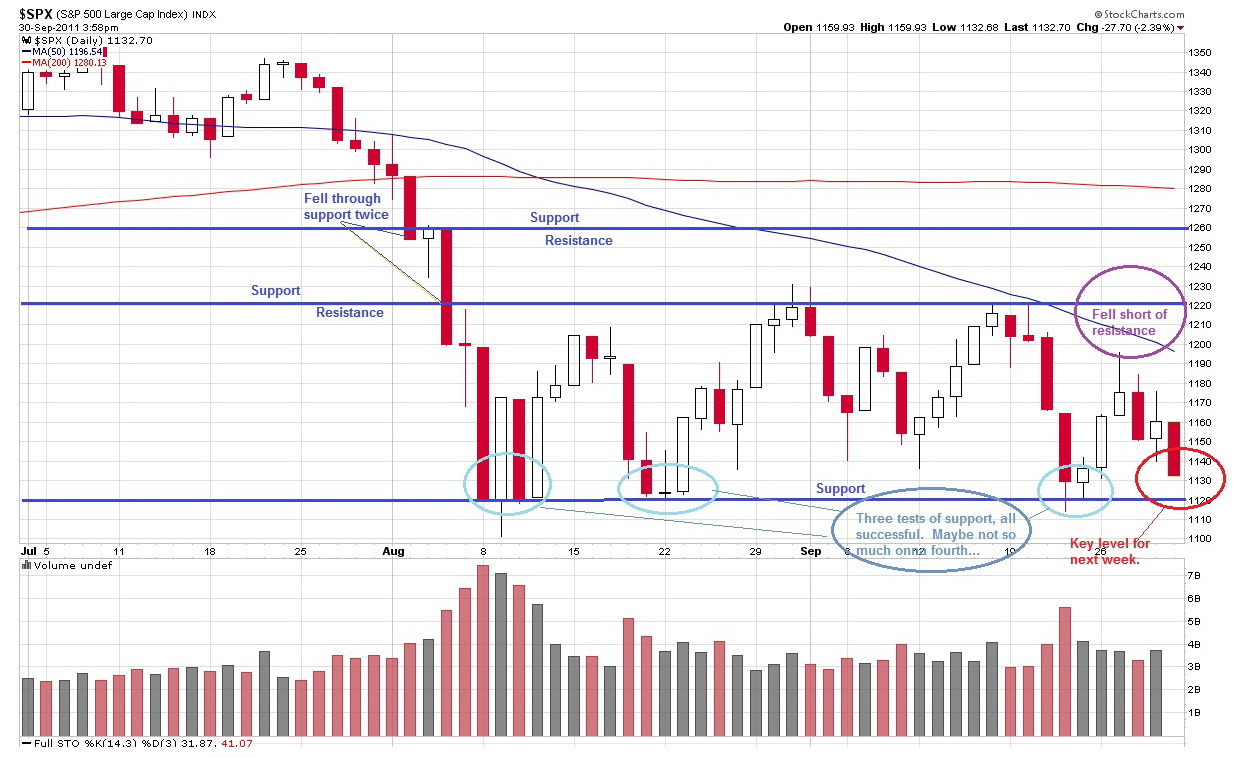

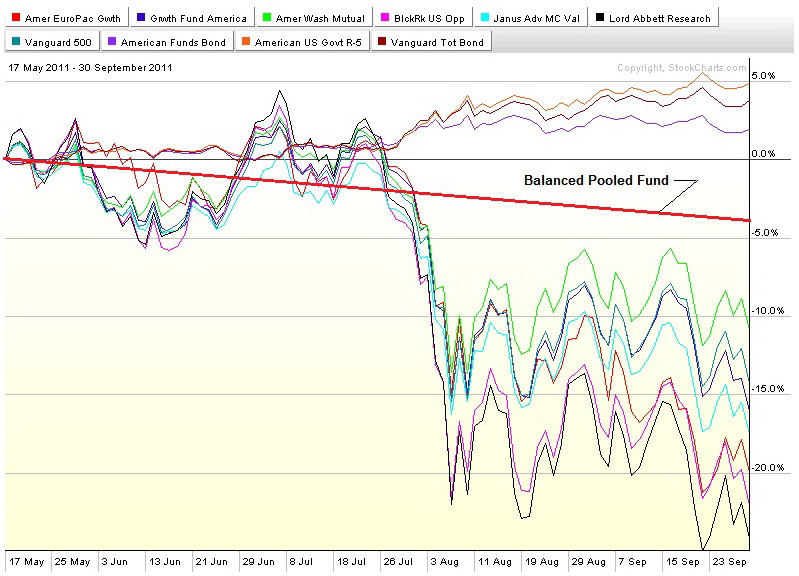

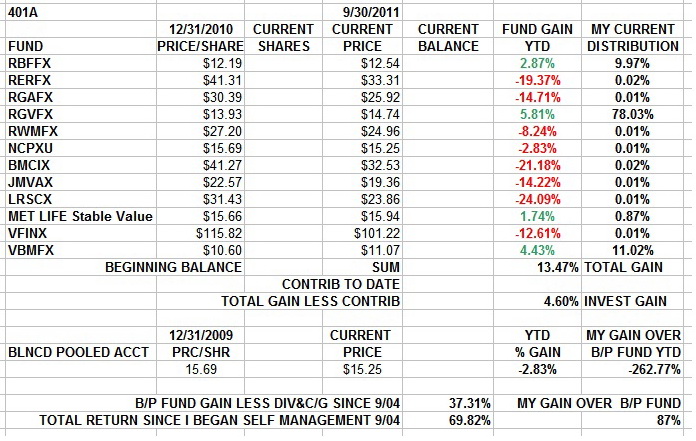

It's complicated. I got outta stocks going into the third week of May. By the end of June,I'd left 4% on the table vs if I'd stayed all in in the best stock funds. By last Friday, I was ahead by about 20% vs if I'd stayed all in in the best stock funds. If I was a set and forget kinda guy inna Balanced Pooled Fund, you could reduce those swings by about 75%, to 1% and -4%.numbers. Sounds like not a big deal. But when the swings are on the upside, those figures work the other way. So it sounds like a big deal. But it depends. Back inna early 90's, the mandatory minimum contribution was less, I was a traveler in another local where money was better, the reciprocity was lower, I contributed the minimum, and the money in the account was not enough to make the swings up and down very significant. Now, I'm back home, I've bumped my contribution up over the years, it's almost two decades later, and I got some coin in the account. Now, when the market is raging up or down, I can make or lose significantly more in a week in the 401 than I can at work. I see why some guys and gals are all in in the Stable Value Fund. They bust their balls and ovaries at work and make or lose in a week twice what they show on the check. Down sides can be vicious and you can lose inna week what took 6 weeks to make onna upside. That can make you crazy. But the swings now are the same as a decade two ago. It's where you are that makes the difference.

And where I'm at, makes me hyper. The wife's retired and I'm last one standing. I've decided to put my head down (motorcycle racing term) because the finish line is in sight. If this was a bull market, I'd check the balances once a week, and once a month, I'd allocate that month's contributions and maybe reallocate between funds a skosh. And if I'd been putting in the max for 20 years, I'd be in maximum conservation mode, maximally risk adverse. I'd have the job done already. But I got stuff left to do. And we're in a bear market. So I watch like a hawk. And like a hawk, I do nothing if there isn't anything there. And there hasn't been, nothing but down side. There will be upside, but I don't want to waste time and energy trying to move on something that is not real. A lotta lookin' and analysing and no action. But I'm months ahead of bein' all in in stocks and when the time comes, if I'm smart and lucky, I'll be all in for the up side. For the 75% greater gain of risk management that you don't think about when you hear the term "risk management".... I'll let you know as it develops...

http://blogs.telegraph.co.uk/finance/am ... cal-union/

MONDAY MONDAY....

A Most Thoroughly Unpleasant Day.

Comments are not available for this entry.

Calendar

Calendar