BULLS MAKE MONEY, BEARS MAKE MONEY, PIGS GET SLAUGHTERED.

Time to declare victory and bail outta Dodge. It's Time To Go.

To recap for you...

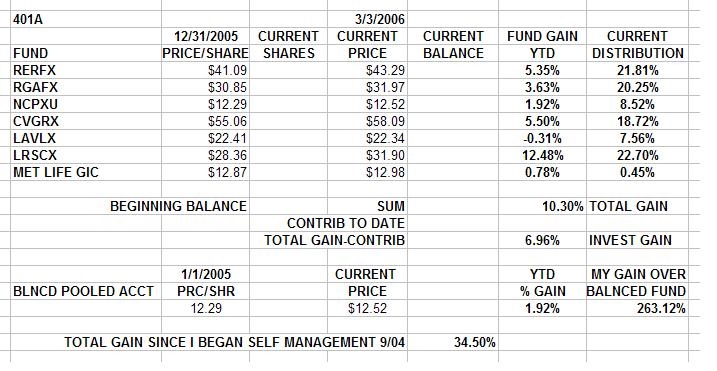

Since 9/04 I've been bullish. Once the 401 plan had a decent selection of investment funds to choose from, I availed myself of the opportunities the very same week they became available. I'd chosen to have my monthly contributions deposited in the Balanced Pooled Fund. I'd decided to review my 401 weekly and decide where to put the monthly contributions to work and where to keep the existing funds working. Using some of the same tools shown on my website, I moved my funds into the top four or five stock funds and kept them there. I've also moved money around from fund to fund in conservative increments. Over the last 18 months, some funds got hot and some did not. So I acted accordingly. Nothing radical, just putting the regular monthly contribution where it suits me best and moving 5% to 10% of my total amount as circumstances and inclination permitted and required. (See the charts and tables on my website and read below.) The object of the exercise has been to catch and ride momentum. Interest rates have been at generational lows since the dot.com crash and corporate profitability has been huge as free money sloshed around. Huge factories with huge payrolls manufacturing things have not been part of this recovery, but it has been a recovery none the less. Check out the charts, check out real estate, check out all the Hummers and other big SUV's, check out all the new homes and new toys. Most of all check out my results. As of last week, I had a gain of 34.5% over 18 months. This was an annual gain of over 20%. This is smokin'! This is great! In Mutual Funds no less! This is also absolutely unsustainable. This is just plain an accident waiting to happen.

Eighteen months ago, interest rates were still heading down/at rock bottom. Oil was $30+ a barrel, and commodities were cheap. There was little or no political risk to the economy, we were 18 months from the economic bottom, and the Fed was shoveling cheap money out the door to stave off deflation. Now interest rates which have seen 1%, are on their way to 5%+. Japan is about to forego 0% interest rates and rates are rising in Europe. Oil has seen $70 a barrel and may see it again. Iran, Nigeria, and Venezuela are posing a considerable political risk to the energy markets such that storage of oil and gas is way above typical seasonal inventory levels, yet the price won't go down. The energy market is running in place and again, OPEC countries are awash in $$$$. But this time instead of building mansions and buying toys, they're buying up businesses the world over. And we're 39 months into a recovery and recoveries usually last about 36-38 months plus or minus.

BULLS MAKE MONEY, BEARS MAKE MONEY, PIGS GET SLAUGHTERED

Here's where I was; (click it...it's live)

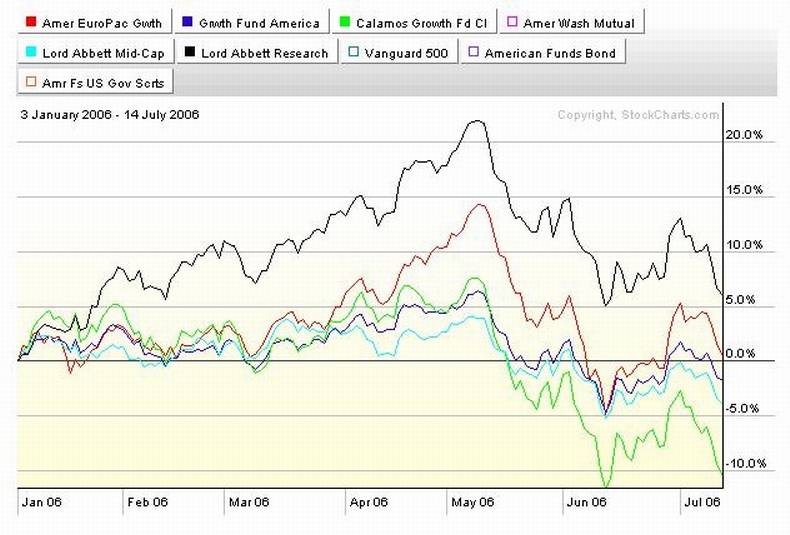

Here's what I'm lookin' at; (click it...it's live)

Time to take some money off the table. Things are probably topped out and rolling over for the moment. Or maybe for longer. Maybe we're replaying last year. Since 3/6 I've been selling winners and losers in my trading account and IRA's and I've made the changes in my 401 allocation now shown back on my worksheet page. I've gone from 0% cash to 28% cash in my 401 and I may not be done with the move to cash. I worked hard, took a risk, did something smart at the right time, hung out there in the breeze a while, and made a dollar

BULLS MAKE MONEY, BEARS MAKE MONEY, PIGS GET SLAUGHTERED

Now it's time to do something smart again. Ya gotta learn to buy smart. That's the easy part. Ya gotta learn to sell smart. That's really hard. Learning to sell smart is a lot harder because you've got to give up on a winner or take a loss. But it's part of the game. It's defense and it's stepping up to take a charge. YOU are the offense. You are ALSO the defense and you can lose the game for the whole team with lousy defense. The biggest and hardest lesson that I've ever learned about investing is "THOU SHALT NOT LOSE MONEY. If you start with money and lose it all, you're out of the game. If you bleed money all the time or earn money and lose it back, you're wasting your time and money and incidently, your future. It doesn't mean that you sell everything the next day after you drop a little over a few days or weeks. After all, stocks go up and stocks go down. Both sides get a chance at bat, and the forces of darkness and destruction and poverty are going to have good innings too. You just gotta build a lead, maintain it, and add to it as you can. And ya GOTTA keep an eye on the scoreboard. So I'm getting reasonable and pulling back some, and maybe more than some, maybe a lot... I'll think about it.

But what if I'm wrong. What if this is only a quick hiccup and stocks continue to climb? What if I'm out of the market for a week, a month, or a month or two and I leave money on the table and everybody else makes money and I don't and and andandand???

Then I lose a week or month or two of performance and I have to put the money back to work. It's not like I'm behind. AND, it'll be good practice for if and when the time comes to grab the parachute and play DB Cooper. That's how the game is played. Know what I mean, Vern?

Time to declare victory and bail outta Dodge. It's Time To Go.

To recap for you...

Since 9/04 I've been bullish. Once the 401 plan had a decent selection of investment funds to choose from, I availed myself of the opportunities the very same week they became available. I'd chosen to have my monthly contributions deposited in the Balanced Pooled Fund. I'd decided to review my 401 weekly and decide where to put the monthly contributions to work and where to keep the existing funds working. Using some of the same tools shown on my website, I moved my funds into the top four or five stock funds and kept them there. I've also moved money around from fund to fund in conservative increments. Over the last 18 months, some funds got hot and some did not. So I acted accordingly. Nothing radical, just putting the regular monthly contribution where it suits me best and moving 5% to 10% of my total amount as circumstances and inclination permitted and required. (See the charts and tables on my website and read below.) The object of the exercise has been to catch and ride momentum. Interest rates have been at generational lows since the dot.com crash and corporate profitability has been huge as free money sloshed around. Huge factories with huge payrolls manufacturing things have not been part of this recovery, but it has been a recovery none the less. Check out the charts, check out real estate, check out all the Hummers and other big SUV's, check out all the new homes and new toys. Most of all check out my results. As of last week, I had a gain of 34.5% over 18 months. This was an annual gain of over 20%. This is smokin'! This is great! In Mutual Funds no less! This is also absolutely unsustainable. This is just plain an accident waiting to happen.

Eighteen months ago, interest rates were still heading down/at rock bottom. Oil was $30+ a barrel, and commodities were cheap. There was little or no political risk to the economy, we were 18 months from the economic bottom, and the Fed was shoveling cheap money out the door to stave off deflation. Now interest rates which have seen 1%, are on their way to 5%+. Japan is about to forego 0% interest rates and rates are rising in Europe. Oil has seen $70 a barrel and may see it again. Iran, Nigeria, and Venezuela are posing a considerable political risk to the energy markets such that storage of oil and gas is way above typical seasonal inventory levels, yet the price won't go down. The energy market is running in place and again, OPEC countries are awash in $$$$. But this time instead of building mansions and buying toys, they're buying up businesses the world over. And we're 39 months into a recovery and recoveries usually last about 36-38 months plus or minus.

BULLS MAKE MONEY, BEARS MAKE MONEY, PIGS GET SLAUGHTERED

Here's where I was; (click it...it's live)

Here's what I'm lookin' at; (click it...it's live)

Time to take some money off the table. Things are probably topped out and rolling over for the moment. Or maybe for longer. Maybe we're replaying last year. Since 3/6 I've been selling winners and losers in my trading account and IRA's and I've made the changes in my 401 allocation now shown back on my worksheet page. I've gone from 0% cash to 28% cash in my 401 and I may not be done with the move to cash. I worked hard, took a risk, did something smart at the right time, hung out there in the breeze a while, and made a dollar

BULLS MAKE MONEY, BEARS MAKE MONEY, PIGS GET SLAUGHTERED

Now it's time to do something smart again. Ya gotta learn to buy smart. That's the easy part. Ya gotta learn to sell smart. That's really hard. Learning to sell smart is a lot harder because you've got to give up on a winner or take a loss. But it's part of the game. It's defense and it's stepping up to take a charge. YOU are the offense. You are ALSO the defense and you can lose the game for the whole team with lousy defense. The biggest and hardest lesson that I've ever learned about investing is "THOU SHALT NOT LOSE MONEY. If you start with money and lose it all, you're out of the game. If you bleed money all the time or earn money and lose it back, you're wasting your time and money and incidently, your future. It doesn't mean that you sell everything the next day after you drop a little over a few days or weeks. After all, stocks go up and stocks go down. Both sides get a chance at bat, and the forces of darkness and destruction and poverty are going to have good innings too. You just gotta build a lead, maintain it, and add to it as you can. And ya GOTTA keep an eye on the scoreboard. So I'm getting reasonable and pulling back some, and maybe more than some, maybe a lot... I'll think about it.

But what if I'm wrong. What if this is only a quick hiccup and stocks continue to climb? What if I'm out of the market for a week, a month, or a month or two and I leave money on the table and everybody else makes money and I don't and and andandand???

Then I lose a week or month or two of performance and I have to put the money back to work. It's not like I'm behind. AND, it'll be good practice for if and when the time comes to grab the parachute and play DB Cooper. That's how the game is played. Know what I mean, Vern?

Calendar

Calendar