The title bar says it. Weeping and wailing and gnashing of teeth. I lost too much money Monday for being 75% cash and my only remaining sizeable stock exposure in LRSCX was the culprit. The fear on the Street is huge. Stocks are a sea of red. I suspect that scared investors still holding stocks will shovel them out on any bounce up. Compound that with the typically slow summer season, the withdrawal of liquidity from markets worldwide, and the possibility of a recession and continued high energy prices bleeding away discretionary spending and I'll risk getting stuck in cash if the markets bounce, cuz I don't have any idea how far down a bottom is. I've got the bulk of my remainng stock exposure set to exchange for the GIC Tuesday when the market closes. I check the market midday and if it looks bad, I'll let the exchange happen. I may let it happen regardless. Cash is a good place to be.

6/13/06;

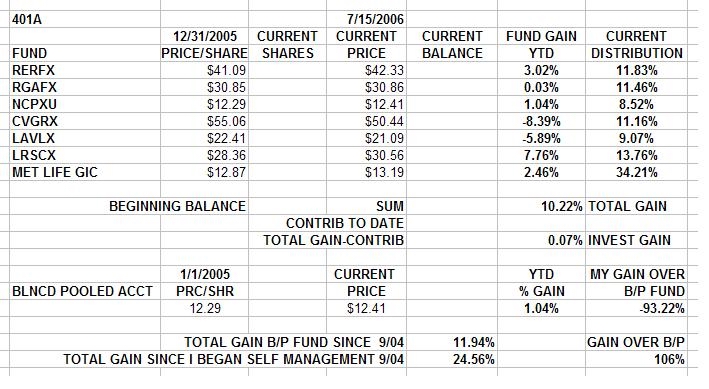

It went through: Screw it. Cash is NOT trash. Here's what I've got; I'm holding less than 6% stock funds not including the B/P Fund. I'm at 85% GIC, tracking positions in the investible funds, and the rest is the B/P Fund, which is more bonds than stocks.

CLICK ONNIT...

I'm just flat ....' amazed. The market is cascading down seemingly without pause. I've been selling losers and holding on to winners in my trading account and I've still been ....' hammered flat. It feels like stocks are going to zero. Check this out;

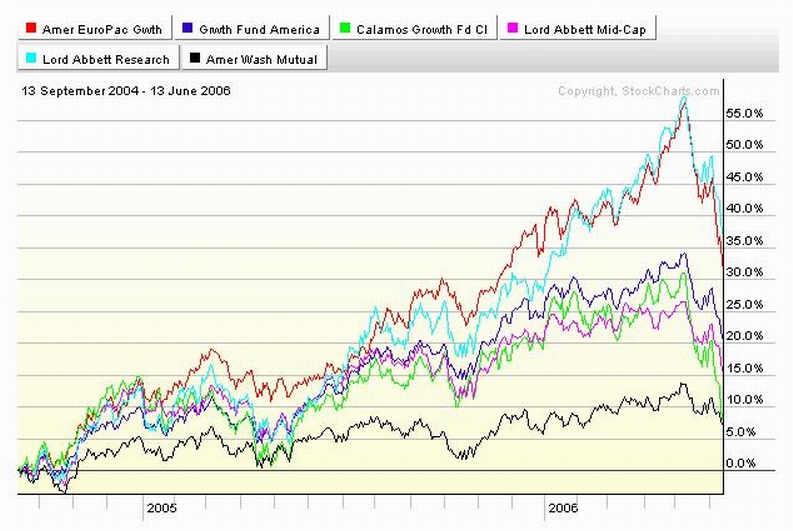

CLICK ON DE CHART

Six months to a year's gains gone in almost all the funds in 3 weeks. AMAZING! Bob Mamini was right that RWMFX is stable and highly resistant to price movement under almost any circumstances. I'm still not clear how a stock fund that won't go up OR down is a good thing. Twenty nine percent up in 20 months and feelin' like the work really paid off.

Stay tooned....

6/13/06;

It went through: Screw it. Cash is NOT trash. Here's what I've got; I'm holding less than 6% stock funds not including the B/P Fund. I'm at 85% GIC, tracking positions in the investible funds, and the rest is the B/P Fund, which is more bonds than stocks.

CLICK ONNIT...

I'm just flat ....' amazed. The market is cascading down seemingly without pause. I've been selling losers and holding on to winners in my trading account and I've still been ....' hammered flat. It feels like stocks are going to zero. Check this out;

CLICK ON DE CHART

Six months to a year's gains gone in almost all the funds in 3 weeks. AMAZING! Bob Mamini was right that RWMFX is stable and highly resistant to price movement under almost any circumstances. I'm still not clear how a stock fund that won't go up OR down is a good thing. Twenty nine percent up in 20 months and feelin' like the work really paid off.

Stay tooned....

Calendar

Calendar