Charts and tables up. I've been locked in a death struggle with a virus or two for the last two weeks. I'm still alive AND slightly less miserable. So there may be a future in which I can see across the room and get up and walk there without taking a nap before and after. Or maybe not. Screw it. I'll have all the time in the world to rest in about 45 years. I'll catch up then. In the meantime, there's a ton of updating and new stuff to do on the site for the new year. I'll post updates here as I make progress. There's a new entry on the COFGBLOG ESSAYS page of the site, there'll be an update to the downloadable EXCEL spreadsheet, more stuff on the REFORMING A PENSION FROM THE INSIDE page, and I gotta get together a primer on HOW TO FIGURE OUT WHAT JOE FACER'S DOING AND WHY IT WORKS FOR HIM (and what makes you different and how that would affect what you'd do if you wanted to do something like it). Stay tooned for more stuff to appear this weekend.

I've gotten a lot of housekeeping stuff done as of 1/1/06 noonish. I've editted almost every page. There's more to come...

Cap gains have been paid and posted to the 401a accounts. The charts have dealt with it and they look like they are supposed to without the cliffs at the end of the year. The B/P Fund did pretty well this year and set the crossbar up pretty high for self management. I'm pleased with where I stand. But I'm not that pleased...

Goals in investing can be dangerous. That's how all these famous hedge fund blow ups like Long Term Capital and Amarenth happen. Someone figures out a system to make money regardless of how the market does, they open up a hedge fund, and they promise high returns to smart money(meaning BIG money that demands quality active investment and real returns rather than excuses). They either name a figure or their strategy gives them superb results for a while. The funds seem to end up levering up big at some point because they either sense the chance to score big or because otherwise they won't meet their promises or match their records and smart money does't stick around to hear the excuses, it walks. And the hedge funds get handed their head by the market just like it does to everyone every so often. The hedge fund and the partners lose money, the partners take their money, if there's any left and walk, the funds close up shop and careers end. The markets are like the ocean. You can be smart about currents and winds and you can make the most of what you've got to work with and at times shine like a star. But you always have to remember that there will be times when being still afloat with almost all of what you had last year will be a brilliant victory. Take it and be proud of still being in the game. The goal I have is to do the smart thing as often as I can and make good progress whenever the wind is at my back, and if what I'm doing isn't working, stop doing it before I get hurt too badly and figure out what will work. I try hard to make money and I try hard to break even as the alternative. I try to be allergic to losing any money When I first looked at this year's numbers, I was disappointed.

So after all that setup, was last year a huge disaster? Nah. Over the last two and a quarter years, I've gotten 9%,13% and 11% returns. The 9% return over 4 months was not half shabby. The other two full year's returns were pretty damn good. The Balanced Pooled Fund did 5%,5%, and 9% over that same period. So I didn't double what the B/P Fund did this time like I've done twice before. I'm still up around 40% over the 2-1/4 years and way ahead of the B/P Fund. I was up 19% over what the B/P Fund did in '06. I just got a lesson in perspective. I did good. So'd the B/P Fund. You just don't stand as tall when the other guy ain't lying down...

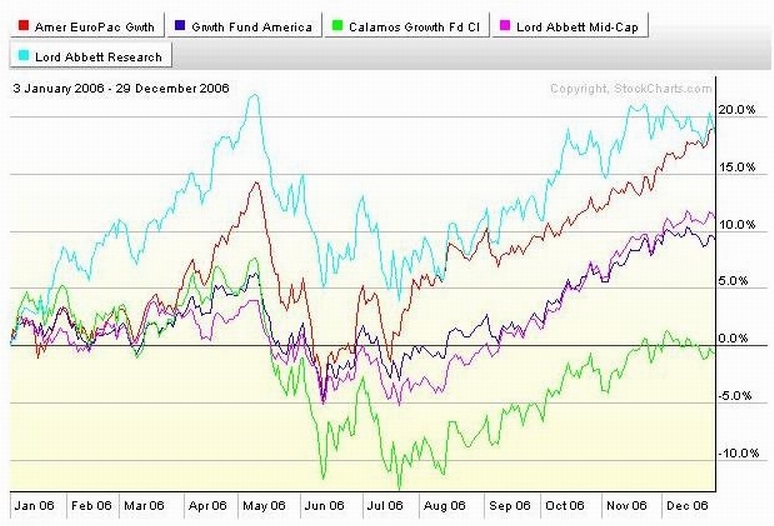

Could I've done way better? Sure. Check out (Click On) the chart.

If I'd been 100% in the top two funds and I'd played the May/Aug hiccup better, I'd a been up around 40% for the year. So what. That stuff happens only a coupla three four times in a decade and it involves real risk. I've done it before. But I didn't do it here this year. I didn't even try. I'm my own client and I know what's possible and what's smart. Up 40% in two and a quarter years is good enough. If I don't give it back and I can do well enough in future years, that kind of performance will be huge for me compounded 10 or 20 years out.

On to next (this) year. I've gotta figure what to do next (now) about my 401a and about the Defined Benefit Plan. Stay tooned. See ya at the Hall...

I've gotten a lot of housekeeping stuff done as of 1/1/06 noonish. I've editted almost every page. There's more to come...

Cap gains have been paid and posted to the 401a accounts. The charts have dealt with it and they look like they are supposed to without the cliffs at the end of the year. The B/P Fund did pretty well this year and set the crossbar up pretty high for self management. I'm pleased with where I stand. But I'm not that pleased...

Goals in investing can be dangerous. That's how all these famous hedge fund blow ups like Long Term Capital and Amarenth happen. Someone figures out a system to make money regardless of how the market does, they open up a hedge fund, and they promise high returns to smart money(meaning BIG money that demands quality active investment and real returns rather than excuses). They either name a figure or their strategy gives them superb results for a while. The funds seem to end up levering up big at some point because they either sense the chance to score big or because otherwise they won't meet their promises or match their records and smart money does't stick around to hear the excuses, it walks. And the hedge funds get handed their head by the market just like it does to everyone every so often. The hedge fund and the partners lose money, the partners take their money, if there's any left and walk, the funds close up shop and careers end. The markets are like the ocean. You can be smart about currents and winds and you can make the most of what you've got to work with and at times shine like a star. But you always have to remember that there will be times when being still afloat with almost all of what you had last year will be a brilliant victory. Take it and be proud of still being in the game. The goal I have is to do the smart thing as often as I can and make good progress whenever the wind is at my back, and if what I'm doing isn't working, stop doing it before I get hurt too badly and figure out what will work. I try hard to make money and I try hard to break even as the alternative. I try to be allergic to losing any money When I first looked at this year's numbers, I was disappointed.

So after all that setup, was last year a huge disaster? Nah. Over the last two and a quarter years, I've gotten 9%,13% and 11% returns. The 9% return over 4 months was not half shabby. The other two full year's returns were pretty damn good. The Balanced Pooled Fund did 5%,5%, and 9% over that same period. So I didn't double what the B/P Fund did this time like I've done twice before. I'm still up around 40% over the 2-1/4 years and way ahead of the B/P Fund. I was up 19% over what the B/P Fund did in '06. I just got a lesson in perspective. I did good. So'd the B/P Fund. You just don't stand as tall when the other guy ain't lying down...

Could I've done way better? Sure. Check out (Click On) the chart.

If I'd been 100% in the top two funds and I'd played the May/Aug hiccup better, I'd a been up around 40% for the year. So what. That stuff happens only a coupla three four times in a decade and it involves real risk. I've done it before. But I didn't do it here this year. I didn't even try. I'm my own client and I know what's possible and what's smart. Up 40% in two and a quarter years is good enough. If I don't give it back and I can do well enough in future years, that kind of performance will be huge for me compounded 10 or 20 years out.

On to next (this) year. I've gotta figure what to do next (now) about my 401a and about the Defined Benefit Plan. Stay tooned. See ya at the Hall...

Calendar

Calendar