Chartz and table ZUP!!!

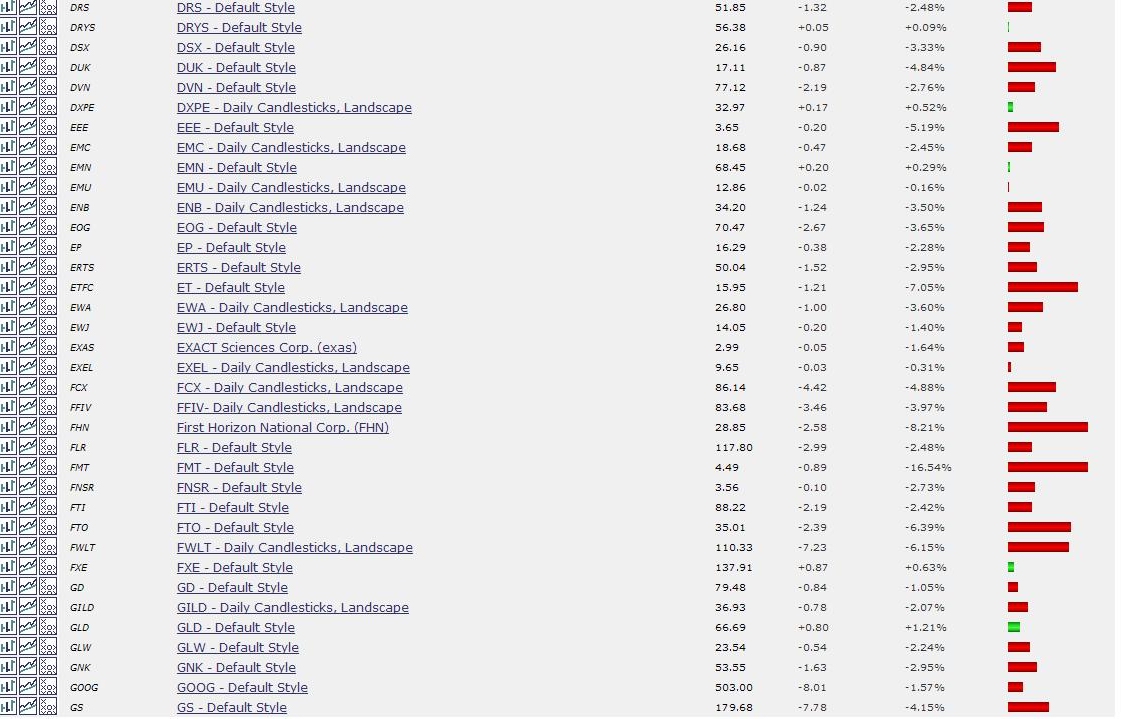

Bloody week in the market, Behind the indices and headlines, it's a lot worse than that. I use Stockcharts.com to track some stocks I may be interested in. Here's what part of a page looked like....

Clickit!!!

My plan for the 401a and my other accounts is in place, activated and working. Next time, it will work better. Once taught, these lessons stay learned.

What started me down this road in the first place was the dotcom crash. The destruction of my IRA's and my mutual fund investment set me off on a search for why and how it happened and how to fix it. That set me up to recognize that there were even bigger problems going on in my pension plan and 401a plan. In large part, some things got fixed on the stock side in time to take advantage of the next cycle up and we've sure as hell been on an upcycle since '03. Now it looks like it may be time for the next cycle down; we may be witness to the Mortgage Backed Security (MBS) crash. And the same outfit that screwed things up in stocks in 2000-2002 appears to have has increased our ownership of MBS's right into the teeth of the crash. What is the quality of the CDO's we've bought and paid for? What is the current market price? Why does McMorgan classify FNMA paper under both Government Agency and MBS? How does the model and the marks square with the market? Inquiring minds wanna know.

I read. A lot. Stuff like this...

From the Street.com sites:

Bill O'Connor;

Low grade ABX (asset backed securities) indices all hit new record lows and AHM news came out that they were shutting the doors (7000 employees last week, 700 this week) and i watched as i saw the single biggest one-day drop in AAA MBS bonds i can remember...

One final note : For all you youngsters who weren't around back in the late 80's when Drexel Burnham imploded , it was their inability to place their commercial paper that was the coup d'etat . The bulls yesterday claimed that CFC rumors of CP problems was nonsense and just a little haggling between buyers and sellers over a few basis points that delayed paper getting sold . I don't know about you but i would find it virtually irresponsible of any money markets manager to buy CFC 90 day commercial paper for a mere few bps over LIBOR .

Speaking of which : how many of you out there have had a good look of late as to what your broker is putting your cash in ? You might be shocked at some of the corporate names you are getting paid 5% to give them short term loans . Buying some 3 month riskless T-Bills at 4.75% area (tax free at state level too) sure sounds smarter to me than giving yourr cash to ANY mortgage lender for the next 90 days .

Doug Kass

IndyMac (IMB) in a death spiral.

(IndyMac is a mortgage originator)

Doug Kass

…And so did Bear Stearns' (BSC) CFO tell the truth on the conference call. I just got off.

He said that the fixed-income markets have seized up and are in the worst condition he has seen in over 20 years.

Tom Au

As reported on the Street.com site, Bear Stearns finally 'fesses up and says that certain market conditions "are as bad as I have seen in 22 years." …

"Subprime" was just the thin end of a mortgage industry that had gotten out of hand. Like games of musical chairs, hot potato, and old [person, usually female], subprime was set up to fail, because inevitably someone would be left holding the bag

Some links…..

]pid=20601087&sid=avZr736O8xUw&]

[url=http://www.bloomberg.com/apps/news?pid=20601087&sid=avZr736O8xUw&]http://www.bloomberg.com/apps/news?pid=20601087&sid=avZr736O8xUw&

News about how the subprime mess will ripple through the economy.

http://alephblog.com/2007/07/30/specula ... me-part-3/

Check out #7 ,#8,#10

http://epicureandealmaker.blogspot.com/ ... -sand.html

“That means that on the rare occasions that instruments (CDO’s,MBS’s) are traded, a large gap can suddenly emerge between the market price and its book value. This week Queen’s Walk Fund, a London hedge fund, admitted it had been forced to write down the value of its US subprime securities by almost 50 per cent in just a few months. That was because when it was forced to sell them, the price achieved was far lower than the value created with the models the fund had previously used – which had been supplemented with brokers’ quotes.”

http://www.econbrowser.com/archives/200 ... s_the.html

More primer material on CDO’s

http://www.msnbc.msn.com/id/20079844

London hedge funds AND German Banks? The subslime contagion is NOT contained.

http://www.telegraph.co.uk/money/main.j ... ebt103.xml

The Bear Stearns leveraged subslime hedge funds spreads up into the prime areas of the economy and across the oceans…

http://alamedalearning.com/reality/2007 ... is-moment/

Rats in the crack house cellars in Watts, rats in the wine cellars of Beverly Hills. If subslime melts away a strata of the economy, will the layers above ignore it?

http://www.slate.com/id/2171235/

Subprime loans on million dollar houses? Dude….Way!!

http://www.bloomberg.com/apps/news?pid= ... 1pp7slShC8

Why it's not just a subprime problem....or even just a a housing problem..

dyn/content/article/2007/08/04/AR2007080401418.html?hpid=topnews

http://www.nytimes.com/2007/08/05/weeki ... orris.html

Walking the tightrope. Our pension fund’s commercial paper is industrial properties, retail properties, hotels and resorts, apartment houses and complexes. The economy is what keeps them afloat. Watch where you step….

We've got a lotta money at risk. And it is not unreasonable to ask some questions about it.

But first I'm going to do something research into it. I've got a lawyer I'm working with and I'm communicating directly with some Wall Street and CNBC sources on the matter.

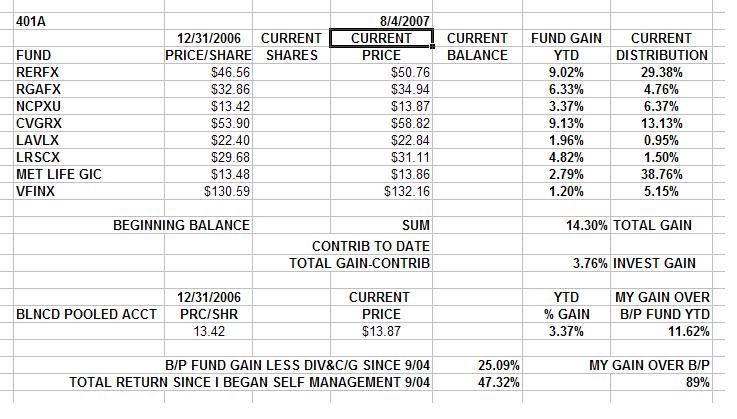

Second, I'm going to keep on doing something with my 401a account. Here's where I stood on Friday evening...CLICKIT!!!!

The Europacific fund is kinda hanging in there and I'm down with it.

The American Growth is down but I'm trimmed pretty tight and watching it closely. We'll see.

The Calamos Growth is also kinda hanging in there and I'm down with it too.

I'm not so sold on the Lord Abbett Funds so I sold them and I'm an interested bystander.

The cash went into the GIC.

I hate the rapid trading terms of the Vanguard, I don't have much there and that's OK. If I was a buy and hold, that'd be different.

US Bonds go up while bonds in general go down. I like the looks of RGVEX

The direction of the US market is down and I've felt the pain and I see more of it. Cash is good. The market HATES uncertainty and I'm irked by it to. It's why if I were to make a move , it would likely be into US Gov bonds.

More To Come, here and on my website in Reforming A Pension Plan From The Outside and COFGBLOG ESSAYS .... Did you expect anything less?

Bloody week in the market, Behind the indices and headlines, it's a lot worse than that. I use Stockcharts.com to track some stocks I may be interested in. Here's what part of a page looked like....

Clickit!!!

My plan for the 401a and my other accounts is in place, activated and working. Next time, it will work better. Once taught, these lessons stay learned.

What started me down this road in the first place was the dotcom crash. The destruction of my IRA's and my mutual fund investment set me off on a search for why and how it happened and how to fix it. That set me up to recognize that there were even bigger problems going on in my pension plan and 401a plan. In large part, some things got fixed on the stock side in time to take advantage of the next cycle up and we've sure as hell been on an upcycle since '03. Now it looks like it may be time for the next cycle down; we may be witness to the Mortgage Backed Security (MBS) crash. And the same outfit that screwed things up in stocks in 2000-2002 appears to have has increased our ownership of MBS's right into the teeth of the crash. What is the quality of the CDO's we've bought and paid for? What is the current market price? Why does McMorgan classify FNMA paper under both Government Agency and MBS? How does the model and the marks square with the market? Inquiring minds wanna know.

I read. A lot. Stuff like this...

From the Street.com sites:

Bill O'Connor;

Low grade ABX (asset backed securities) indices all hit new record lows and AHM news came out that they were shutting the doors (7000 employees last week, 700 this week) and i watched as i saw the single biggest one-day drop in AAA MBS bonds i can remember...

One final note : For all you youngsters who weren't around back in the late 80's when Drexel Burnham imploded , it was their inability to place their commercial paper that was the coup d'etat . The bulls yesterday claimed that CFC rumors of CP problems was nonsense and just a little haggling between buyers and sellers over a few basis points that delayed paper getting sold . I don't know about you but i would find it virtually irresponsible of any money markets manager to buy CFC 90 day commercial paper for a mere few bps over LIBOR .

Speaking of which : how many of you out there have had a good look of late as to what your broker is putting your cash in ? You might be shocked at some of the corporate names you are getting paid 5% to give them short term loans . Buying some 3 month riskless T-Bills at 4.75% area (tax free at state level too) sure sounds smarter to me than giving yourr cash to ANY mortgage lender for the next 90 days .

Doug Kass

IndyMac (IMB) in a death spiral.

(IndyMac is a mortgage originator)

Doug Kass

…And so did Bear Stearns' (BSC) CFO tell the truth on the conference call. I just got off.

He said that the fixed-income markets have seized up and are in the worst condition he has seen in over 20 years.

Tom Au

As reported on the Street.com site, Bear Stearns finally 'fesses up and says that certain market conditions "are as bad as I have seen in 22 years." …

"Subprime" was just the thin end of a mortgage industry that had gotten out of hand. Like games of musical chairs, hot potato, and old [person, usually female], subprime was set up to fail, because inevitably someone would be left holding the bag

Some links…..

]pid=20601087&sid=avZr736O8xUw&]

[url=http://www.bloomberg.com/apps/news?pid=20601087&sid=avZr736O8xUw&]http://www.bloomberg.com/apps/news?pid=20601087&sid=avZr736O8xUw&

News about how the subprime mess will ripple through the economy.

http://alephblog.com/2007/07/30/specula ... me-part-3/

Check out #7 ,#8,#10

http://epicureandealmaker.blogspot.com/ ... -sand.html

“That means that on the rare occasions that instruments (CDO’s,MBS’s) are traded, a large gap can suddenly emerge between the market price and its book value. This week Queen’s Walk Fund, a London hedge fund, admitted it had been forced to write down the value of its US subprime securities by almost 50 per cent in just a few months. That was because when it was forced to sell them, the price achieved was far lower than the value created with the models the fund had previously used – which had been supplemented with brokers’ quotes.”

http://www.econbrowser.com/archives/200 ... s_the.html

More primer material on CDO’s

http://www.msnbc.msn.com/id/20079844

London hedge funds AND German Banks? The subslime contagion is NOT contained.

http://www.telegraph.co.uk/money/main.j ... ebt103.xml

The Bear Stearns leveraged subslime hedge funds spreads up into the prime areas of the economy and across the oceans…

http://alamedalearning.com/reality/2007 ... is-moment/

Rats in the crack house cellars in Watts, rats in the wine cellars of Beverly Hills. If subslime melts away a strata of the economy, will the layers above ignore it?

http://www.slate.com/id/2171235/

Subprime loans on million dollar houses? Dude….Way!!

http://www.bloomberg.com/apps/news?pid= ... 1pp7slShC8

Why it's not just a subprime problem....or even just a a housing problem..

dyn/content/article/2007/08/04/AR2007080401418.html?hpid=topnews

http://www.nytimes.com/2007/08/05/weeki ... orris.html

Walking the tightrope. Our pension fund’s commercial paper is industrial properties, retail properties, hotels and resorts, apartment houses and complexes. The economy is what keeps them afloat. Watch where you step….

We've got a lotta money at risk. And it is not unreasonable to ask some questions about it.

But first I'm going to do something research into it. I've got a lawyer I'm working with and I'm communicating directly with some Wall Street and CNBC sources on the matter.

Second, I'm going to keep on doing something with my 401a account. Here's where I stood on Friday evening...CLICKIT!!!!

The Europacific fund is kinda hanging in there and I'm down with it.

The American Growth is down but I'm trimmed pretty tight and watching it closely. We'll see.

The Calamos Growth is also kinda hanging in there and I'm down with it too.

I'm not so sold on the Lord Abbett Funds so I sold them and I'm an interested bystander.

The cash went into the GIC.

I hate the rapid trading terms of the Vanguard, I don't have much there and that's OK. If I was a buy and hold, that'd be different.

US Bonds go up while bonds in general go down. I like the looks of RGVEX

The direction of the US market is down and I've felt the pain and I see more of it. Cash is good. The market HATES uncertainty and I'm irked by it to. It's why if I were to make a move , it would likely be into US Gov bonds.

More To Come, here and on my website in Reforming A Pension Plan From The Outside and COFGBLOG ESSAYS .... Did you expect anything less?

Calendar

Calendar