"The primary objective of leadership is to help those who are doing poorly to do well and to help those who are doing well to do even better."

-- Jim Rohn

Chartz and Table Zup on www.joefacer.com

UPDATED 10/13

CLICKIT!!!!

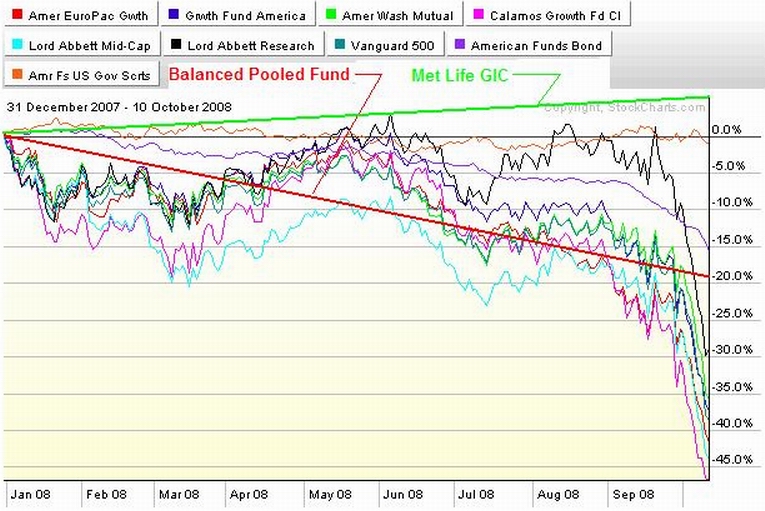

The Funds In The 401a

My Account

OUCH!!!!!

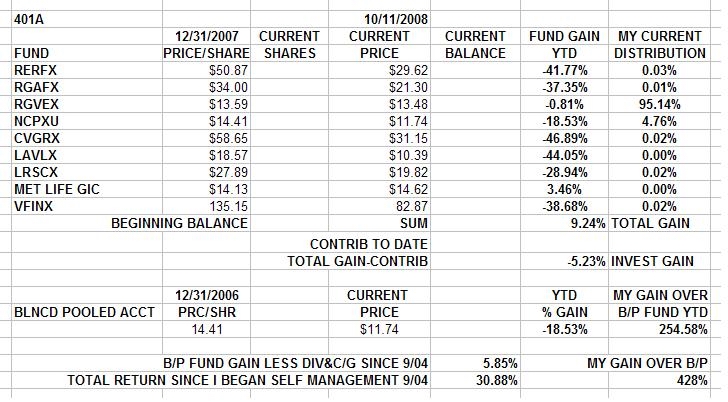

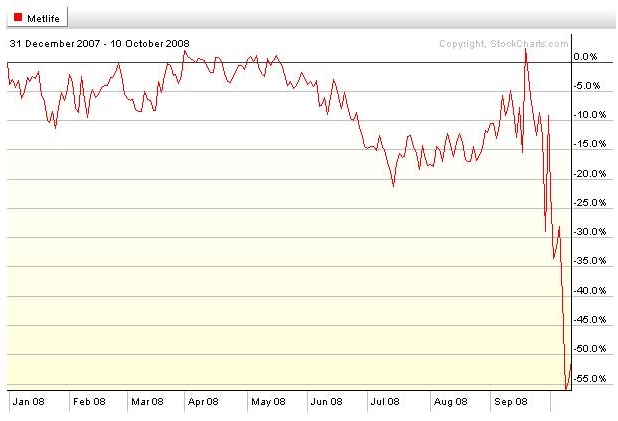

On the one hand, I've stayed informed and done the right things. The charts and tables tell the tale. I've played with an open hand and anybody who wanted to follow along could do so in almost real time. I've averaged just under 8% return over four years and I'm down a little over 5% this year in my investment gains. This is mostly 'cuz I tried to pick up pennies in front of a steamroller during the first half of the year and I'm also stuck with a minimum in the B/P Fund which is puking money. Overall, including contributions I'm up 9%+ in the 401a Year To Date. Look at the individual funds numbers. A modicum of caution makes me look like a genius. But that's compared to the brain dead "Just put the money in and don't even look at it more than once a year." strategy of total disregard and complete carelessness. So I wasn't really so much brilliant, as I was sensible. The sense of accomplishment and satisfaction is good, kinda. But I sure as hell ain't smug about it. Because on the other hand is the smoking ruin of many a brother's and sister's 401a account. That's just sad and takes all the thrill away.

But being ahead is not the same as winning by any means. There is always more to stay informed of and there are always more decisions to be made and always more opportunities to do the right or the wrong things. There's 401a money to be kept safe and more 401a money to be earned and put to work.

The past is over. Book it, move on, look back on it when ya feel like it, and put your head down, twist the wrist and ride on. Stay tooned for more posts including time permitting, how I do what I do, as the weekend progresses...

IN CASE YOU MISSED THIS FROM LAST WEEK...

IT'S NOT GETTING ANY BETTER....AND I'M NOT GETTING PAID ENOUGH TO STICK AROUND IN THE MET LIFE GIC. ALL OUT OF THE MET LIFE GIC AND ALL IN TO THE AMERICAN FUNDS GOV'MENT SECURITY FUND(RGVEX). THE TREASURIES THAT MAKE UP HALF OF RGVEX ARE GOOD AS IT GETS. THE GOV'MENT HAS SAID THEY'LL SUPPORT THE MORTGAGE AND AGENCY PAPER IN IT. I DON'T LIKE IT, BUT I CAN ACCEPT IT. MET LIFE RESERVES THE RIGHT TO NOT MAKE GOOD ON THE GIC IF THEY DECIDE NOT TO DO SO. IT'S ON THE K AND G WEBSITE. AND THE POLITICAL ENVIRONMENT IS NOT GOOD FOR THE GOV'MENT SUPPORTING THE UNINSURED PAPER OF A PUBLIC INSURANCE COMPANY IN FREEFALL. I BELIEVE MET LIFE'D TOSS THE GIC OVER THE SIDE BEFORE THEY DEFAULT ON THE POLICIES THEY'VE MADE. TOO MUCH STRESS IN THE FINANCIAL MARKETS, AND MAKE NO MISTAKE; MET LIFE IS A FINANCIAL STOCK, AND MET LIFE WILL NOT PAY INTEREST ON THE GIC. WAY TOO MUCH STRESS AND WE CAN GET IN LINE WITH ALL THE OTHER CREDITORS FOR OUR PIECE OF THE CARCASS. FOUR PERCENT RETURN IS TOO LITTLE RETURN FOR TOO MUCH RISK OF LOSING A CHUNK OF IT AND ACCESS TO ALL OF IT FOR A TIME, SO READ THE TABLE ABOVE TO FIGURE OUT WHAT I DID ABOUT IT... ....

DO I THINK MET LIFE IS GOING UNDER? PROLLY NOT. AGAIN, I'M NOT GETTIN' PAID ENOUGH TO RISK IT. WHEN THE RISK IS GREATLY REDUCED, "AHL BE BACH"

In the meantime, here's some links...

http://bigpicture.typepad.com/comments/ ... tment.html

http://bigpicture.typepad.com/comments/ ... he--1.html

http://bigpicture.typepad.com/comments/ ... e-own.html

http://bigpicture.typepad.com/comments/ ... marke.html

http://bigpicture.typepad.com/comments/ ... nance.html

http://bigpicture.typepad.com/comments/ ... nance.html

http://bigpicture.typepad.com/comments/ ... ecess.html

http://bigpicture.typepad.com/comments/ ... -on-t.html

http://bigpicture.typepad.com/comments/ ... sh-ca.html

http://www.nytimes.com/2008/10/09/busin ... ref=slogin

http://www.msnbc.msn.com/id/27113844/di ... enumber/5/

http://www.msnbc.msn.com/id/27113844/di ... number/13/

http://www.msnbc.msn.com/id/27113844/di ... number/15/

http://bigpicture.typepad.com/comments/ ... rning.html

http://www.sfgate.com/cgi-bin/article.c ... 1396T5.DTL

kickass photos.....

http://www.boston.com/bigpicture/2008/1 ... cycle.html

kinda the ultimate "no shorts". Whaddya think I meant?

http://paul.kedrosky.com/archives/2008/ ... he_la.html

http://www.youtube.com/watch?v=ABXPICWj ... ;eurl=http:

http://paul.kedrosky.com/archives/2008/ ... op_di.html

http://www.nytimes.com/interactive/2008 ... RKETS.html

UPDATED 10/13/08

I like the prices. The market is a smoking crater but the market isn't going to zero. It just feels that way. Caution is the key word. Forget "Buy And Hold". Think "Buy And Profit". It's not day trading, it's position trading....

I think that given the recent freefall, at some point between now and the end of the year, the markets will be enough higher than they are today to allow me to sell for a profit... So...

I pretty much bought and held between 9/04 and 4/08. I refused to hold anything but cash or cash equivalents between 4/08 and now. Now it's time for something in between....

A tiny little 2% of my balance into the Lord Abbett Small Cap Value Fund today to test the waters. If it goes down significantly, I'll sell to minimize a loss. If it goes up, I'll prolly sell to realize a gain. We'll see how it goes....

OUCH!!!!!

On the one hand, I've stayed informed and done the right things. The charts and tables tell the tale. I've played with an open hand and anybody who wanted to follow along could do so in almost real time. I've averaged just under 8% return over four years and I'm down a little over 5% this year in my investment gains. This is mostly 'cuz I tried to pick up pennies in front of a steamroller during the first half of the year and I'm also stuck with a minimum in the B/P Fund which is puking money. Overall, including contributions I'm up 9%+ in the 401a Year To Date. Look at the individual funds numbers. A modicum of caution makes me look like a genius. But that's compared to the brain dead "Just put the money in and don't even look at it more than once a year." strategy of total disregard and complete carelessness. So I wasn't really so much brilliant, as I was sensible. The sense of accomplishment and satisfaction is good, kinda. But I sure as hell ain't smug about it. Because on the other hand is the smoking ruin of many a brother's and sister's 401a account. That's just sad and takes all the thrill away.

But being ahead is not the same as winning by any means. There is always more to stay informed of and there are always more decisions to be made and always more opportunities to do the right or the wrong things. There's 401a money to be kept safe and more 401a money to be earned and put to work.

The past is over. Book it, move on, look back on it when ya feel like it, and put your head down, twist the wrist and ride on. Stay tooned for more posts including time permitting, how I do what I do, as the weekend progresses...

IN CASE YOU MISSED THIS FROM LAST WEEK...

IT'S NOT GETTING ANY BETTER....AND I'M NOT GETTING PAID ENOUGH TO STICK AROUND IN THE MET LIFE GIC. ALL OUT OF THE MET LIFE GIC AND ALL IN TO THE AMERICAN FUNDS GOV'MENT SECURITY FUND(RGVEX). THE TREASURIES THAT MAKE UP HALF OF RGVEX ARE GOOD AS IT GETS. THE GOV'MENT HAS SAID THEY'LL SUPPORT THE MORTGAGE AND AGENCY PAPER IN IT. I DON'T LIKE IT, BUT I CAN ACCEPT IT. MET LIFE RESERVES THE RIGHT TO NOT MAKE GOOD ON THE GIC IF THEY DECIDE NOT TO DO SO. IT'S ON THE K AND G WEBSITE. AND THE POLITICAL ENVIRONMENT IS NOT GOOD FOR THE GOV'MENT SUPPORTING THE UNINSURED PAPER OF A PUBLIC INSURANCE COMPANY IN FREEFALL. I BELIEVE MET LIFE'D TOSS THE GIC OVER THE SIDE BEFORE THEY DEFAULT ON THE POLICIES THEY'VE MADE. TOO MUCH STRESS IN THE FINANCIAL MARKETS, AND MAKE NO MISTAKE; MET LIFE IS A FINANCIAL STOCK, AND MET LIFE WILL NOT PAY INTEREST ON THE GIC. WAY TOO MUCH STRESS AND WE CAN GET IN LINE WITH ALL THE OTHER CREDITORS FOR OUR PIECE OF THE CARCASS. FOUR PERCENT RETURN IS TOO LITTLE RETURN FOR TOO MUCH RISK OF LOSING A CHUNK OF IT AND ACCESS TO ALL OF IT FOR A TIME, SO READ THE TABLE ABOVE TO FIGURE OUT WHAT I DID ABOUT IT... ....

DO I THINK MET LIFE IS GOING UNDER? PROLLY NOT. AGAIN, I'M NOT GETTIN' PAID ENOUGH TO RISK IT. WHEN THE RISK IS GREATLY REDUCED, "AHL BE BACH"

In the meantime, here's some links...

I think that given the recent freefall, at some point between now and the end of the year, the markets will be enough higher than they are today to allow me to sell for a profit... So...

I pretty much bought and held between 9/04 and 4/08. I refused to hold anything but cash or cash equivalents between 4/08 and now. Now it's time for something in between....

A tiny little 2% of my balance into the Lord Abbett Small Cap Value Fund today to test the waters. If it goes down significantly, I'll sell to minimize a loss. If it goes up, I'll prolly sell to realize a gain. We'll see how it goes....

Calendar

Calendar