"There are three stages of a man's life: He believes in Santa Claus; he doesn't believe in Santa Claus; he is Santa Claus."

-- Author Unknown

“Buy-and-hold has been a jumbo money-loser this year,” argues (Barry) Ritholtz, the subject of a recent Barron’sQ&A (”A Leading Bear Turns Bullish, Sort Of,” Dec. 8). “You can’t just sit around and say, ‘Bear Stearns and AIG are great companies, and I’m a long-term investor.’ ”

Barron's

CHARTS AND TABLE ZUP @ WWW.JOEFACER.COM

I read ....a lot. You shouldn't have to. Barry Ritholtz covers so much in one place (The Big Picture) that I figure that this will get you most of the way across The Street while I'm still busy elsewhere... Here's a pull quote, typical of Barry layin' it down so it stays there.......

Office of Thrift Supervision: Asshat Central

By Barry Ritholtz - December 24th, 2008, 3:30AM

I am trying to figure out who is the biggest jerk in this story. It is a challenge, given the collection of utter clowns and ne’er-do-wells that run that office.

First, you have some moron who helped cost the taxpayers a hundred large ($100B) back in the 1980s. How this idiot ever ended up in a position of responsibility in any regulatory agency again is beyond my comprehension....

http://www.ritholtz.com/blog/2008/12/ot ... t-central/

http://www.bloomberg.com/apps/news?pid= ... ZJOwI&

http://www.ritholtz.com/blog/2008/12/pi ... -treasury/

http://www.ritholtz.com/blog/2008/12/ho ... g-off-106/

http://www.ritholtz.com/blog/2008/12/ny ... ng-things/

http://www.ritholtz.com/blog/2008/12/ji ... deflation/

http://www.nytimes.com/2008/12/26/world ... .html?_r=1

http://www.ritholtz.com/blog/2008/12/cl ... -comments/

http://www.ritholtz.com/blog/2008/12/ch ... pudiation/

http://www.ritholtz.com/blog/2008/12/ch ... deflation/

http://www.ritholtz.com/blog/2008/12/re ... -the-fact/

http://www.ritholtz.com/blog/2008/12/qu ... more-13509

http://www.ritholtz.com/blog/2008/12/se ... ince-2000/

http://www.ritholtz.com/blog/2008/12/au ... ack-dolan/

http://www.ritholtz.com/blog/2008/12/ba ... borrowing/

http://www.ritholtz.com/blog/2008/12/re ... s-weekend/

http://www.ritholtz.com/blog/2008/12/de ... complaint/

http://www.ritholtz.com/blog/2008/12/au ... ack-dolan/

http://www.ritholtz.com/blog/2008/12/ja ... f-meeting/

http://www.ritholtz.com/blog/2008/12/ba ... l-bailout/

http://finance.yahoo.com/news/Whered-th ... 90568.html

CLICKIT....

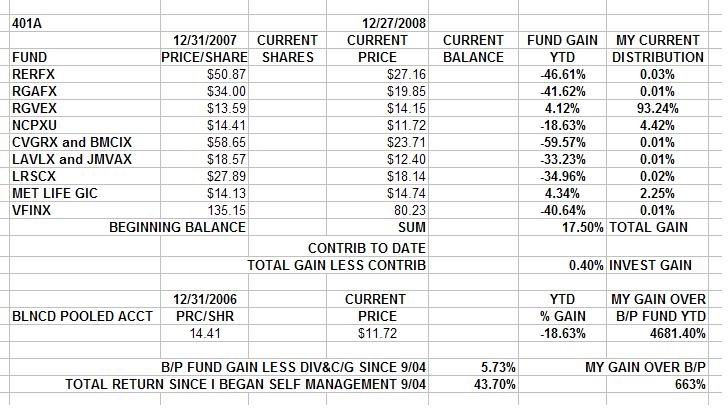

End o' da year. I'd REALLY like to break even, I could use the money. Check out the table above. (Do yer own using the template I got on my site....) AGAIN, ignore percentages when the numbers don't fit. I'm up from 2300% better than the Balanced Pooled Fund last week, to up 4600% plus even though I lost a few dollars last week. Gotta understand how to lie with numbers in order to determine when they are indeed, truthy. Here's what I see in the table....

Nummer one is that like the McMorgan years, contributions pre and tax deferred, are what make the nummers " Awright!" (to channel Janis J.) That is not insignificant, given that I've upped my contribution over the last few years and now have some coin in hand. The biggest return this year was from tax savings on contributions.

Nummer two is that unlike the McMorgan years, havin' the Internet an' all the sites like TheStreet.com,Stockcharts.com, joefacer.com and FundAlarm.com means that I have the tools to know when to step aside when a freight train o' misery is aimed right troo my 401a. The result is not half shabby. When pros are goin' down in flames, for the moment, I, (and those who're doing similar things), are up. Day and a half to go..... I think I'll get there to the end of the year in good shape...... then I'll work on next year.....

Nummer tree, there's more an' one way to cook a goose. (We did our Christmas geese w/ cornbread and sausage stuffin', hickory smoked.) Going to the GIC early woulda got me 4% at the end o' da year. I got there anyway with RGVEX. It's just that I dug myself a hole to climb outa, first. So, it's not all that difficult, I'm up a skosh, an' up a skosh and up 4% look the same compared to stayin in the Balance/Pooled Fund an bein' buried deep inna red......BUT IT IS IMPERATIVE THAT YOU MANAGE YOUR SELF MANAGED RETIREMENT FUND, know what I mean, Vern?

Save de best fer last....

http://www.ritholtz.com/blog/2008/12/so ... -holidays/

http://ie.youtube.com/watch?v=kIjbMRU1EgU

http://themessthatgreenspanmade.blogspo ... mists.html

Office of Thrift Supervision: Asshat Central

By Barry Ritholtz - December 24th, 2008, 3:30AM

I am trying to figure out who is the biggest jerk in this story. It is a challenge, given the collection of utter clowns and ne’er-do-wells that run that office.

First, you have some moron who helped cost the taxpayers a hundred large ($100B) back in the 1980s. How this idiot ever ended up in a position of responsibility in any regulatory agency again is beyond my comprehension....

Calendar

Calendar