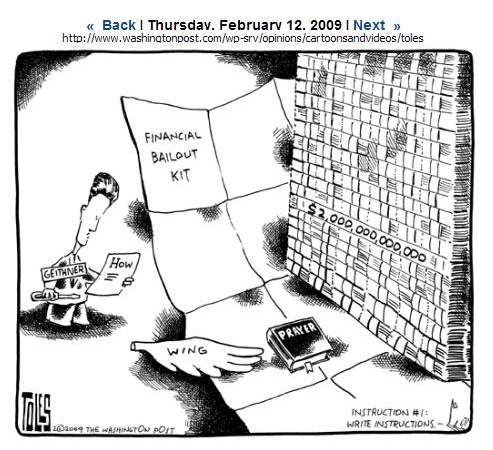

It Is Now Beginning To Dawn On All And Sundry That The Banks Are Toast. Do We Toss Them And Start Over Or Spend Our Children's Future Trying To Untoast Them. Can Fire Burn Backward?

In general, your target is not to beat the market. It is to beat zero. As I have written for years, the investors who win in this market are the ones who take the least damage.

-- John Mauldin

Chartz and Table Zup @ www.joefacer.com

UPDATED CONSTANTLY....OR NOT.

LOOK FOR THE DAY OF THE WEEK FOR NEW ADDITIONS.

Stay Tooned. Long Weekend an' I'll have something to say toward the end of it. There's a ton o' "stuff" happening. It's all important. But when you get to the end of learning and thinking and planning, the 401a investor in me says "Cash Is King And Think Carefully About The Risk Of Even Thinking About Trying To Catch A Bear Market Rally". The Trader in me sez, "The Trend Is Down And You Can't Imagine Holding A Position Overnight. Roadracing Motorcycles Was An Excellent Preparation For Trading In This Environment."

I love reading Barry Ritholtz' THE BIG PICTURE blog. You can't live this stuff and not have strong opinions. You always know where Barry stands...

from the link below

Time Magazines "25 People To Blame For The Economic Crisis" ...

http://www.ritholtz.com/blog/2009/02/25 ... al-crisis/

A few strange issues with the list: Why is Bernie Madoff here? He is a common thief (perhaps uncommon thief given the amounts he claimed to have stolen) but he had nothing whatsoever to do with the Financial crisis afflicting the global economy. What journalist would add him to the list of causes of the crisis? (Strike that moron from your reading list).

The American Consumers are on the list, but not the irresponsible home buyers? Isnít painting with an overly broad brush ? And Wen Jiabao, the premiere of China? How dare you buy our debt! Its all your fault!

Regular readers of this blog know I think former NAR chief economist David Lereah is a lying jackass, a festering hemorrhoid on the fields of both economics and real estate. But he was merely a lying cheerleader. As much as I detest his syphilitic-addled unfunctional brain, I cannot blame him for what happened.

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

I hate the thought that taxpayer money will go to redeem the bad financial decisions of banks and homebuyers who cheerfully made/took loans that were going to take 100% plus of the buyer's income in a matter of two years. I'm uncomfortable with the idea of trying to stand in the way of a flood, or tornado, or negate gravity; Did anyone really think that 10% a year housing appreciation would go on forever and not unwind at some point? Can we borrow enough money to support all the banks and real estate prices at their current level? Will we sell our souls to the treasury bond holders who finance this mess? How much will we have to pay to get somebody to gamble that we can fix this mess without devaluing the dollar? And who will have the money available to by US bonds? Check out the "Time For A Reality Check" link below. Do we saddle everyone who never had a mortgage or just paid off a 30 year mortgage or has 50% equity in their home with years of higher taxes to roll the dice that in the face of a huge economic contraction, the reworked, barely supportable or underwater mortgages don't default again? After mortgaging everyone's future to try prevent the Great Unwind, do we take a second mortgage if it doesn't work? I think we're gonna have our hands full keeping it together so that once the storm is past, we can start the next cycle again. I'm absolutely sure we can't avoid the body of the Great Unwind. I'm in that head space. I hope I'm wrong, but hope ain't no strategy...

I'm not real confident about any of this. The nation needs triage but the politicians ain't gonna tell you that anything is needed beyond first aid. I've got no confidence in the judgement displayed by either administration, so far. Do you?

Why the hell should I be the only one to lose sleep....here's some of what I'm readin'. There's some ticking time bombs in here......

http://www.investorsinsight.com/blogs/t ... check.aspx

http://www.theatlantic.com/doc/print/20 ... -geography

http://www.reuters.com/article/GCA-auto ... 0G20090213

http://www.telegraph.co.uk/finance/comm ... tdown.html

http://www.telegraph.co.uk/finance/econ ... l-out.html

http://www.telegraph.co.uk/finance/comm ... tdown.html

http://www.nytimes.com/2009/02/15/books ... wanted=all

http://www.economist.com/finance/displa ... d=13110352

http://www.reuters.com/article/innovati ... Q120090214

http://blogs.reuters.com/great-debate/2 ... ank-on-it/

http://www.economist.com/specialreports ... d=13063298

http://www.ft.com/cms/s/2/45a7ebca-f712 ... fd2ac.html

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

I can't figure out how to invest in this market and it sure seems like no one else can either. Until something changes, the 401a is gonna stay as per the tablez on my website. Nothing ventured everything safe.

A few strange issues with the list: Why is Bernie Madoff here? He is a common thief (perhaps uncommon thief given the amounts he claimed to have stolen) but he had nothing whatsoever to do with the Financial crisis afflicting the global economy. What journalist would add him to the list of causes of the crisis? (Strike that moron from your reading list).

The American Consumers are on the list, but not the irresponsible home buyers? Isnít painting with an overly broad brush ? And Wen Jiabao, the premiere of China? How dare you buy our debt! Its all your fault!

Regular readers of this blog know I think former NAR chief economist David Lereah is a lying jackass, a festering hemorrhoid on the fields of both economics and real estate. But he was merely a lying cheerleader. As much as I detest his

Calendar

Calendar