"Sometimes I lie awake at night, and I ask, 'Where have I gone wrong?' Then a voice says to me, 'This is going to take more than one night.'"

-- Charles M. Schulz

CHARTZ AND TABLE ZUP @ WWW.JOEFACER.COM

UPDATED CONSTANTLY....OR NOT.

LOOK FOR THE DAY OF THE WEEK FOR NEW ADDITIONS.

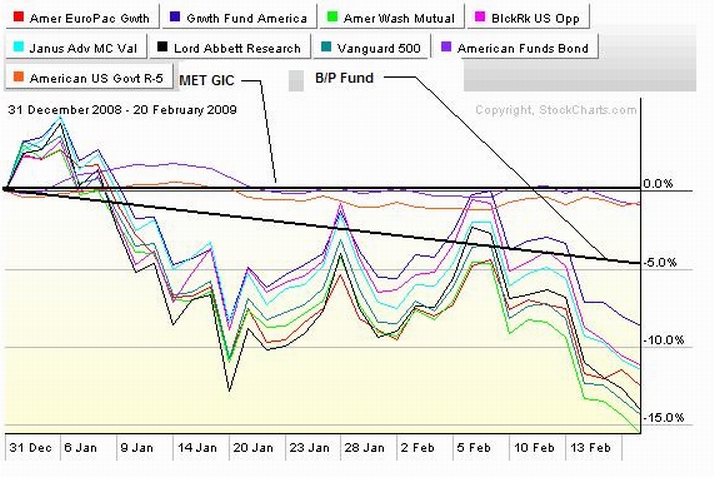

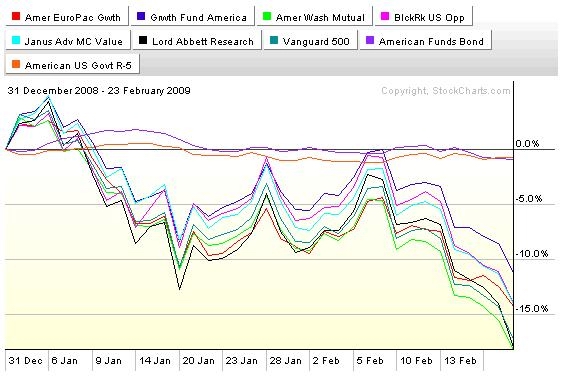

Learning to sell is a great exercise. It sets you up with the mindset that investing has two polarities in a number of parameters. Prices go up and down, Investing time is made up of today and all the tomorrows. You can buy and sell to increase or decrease your investment in any position. Time and price happen happen pretty much on their own. Buying and selling are up to you. Pretty kool..... Especially since I sold long ago and the chart below, while ugly beyond belief, will only be relevant when I buy back in. JEEZUS!!! THE CHART BELOW COVERS 35 DAYS!!!! OUCH!!!!!

MONDAY

JEEZUS!!! THE CHART BELOW COVERS 36 DAYS!!!! OUCH!!!!!

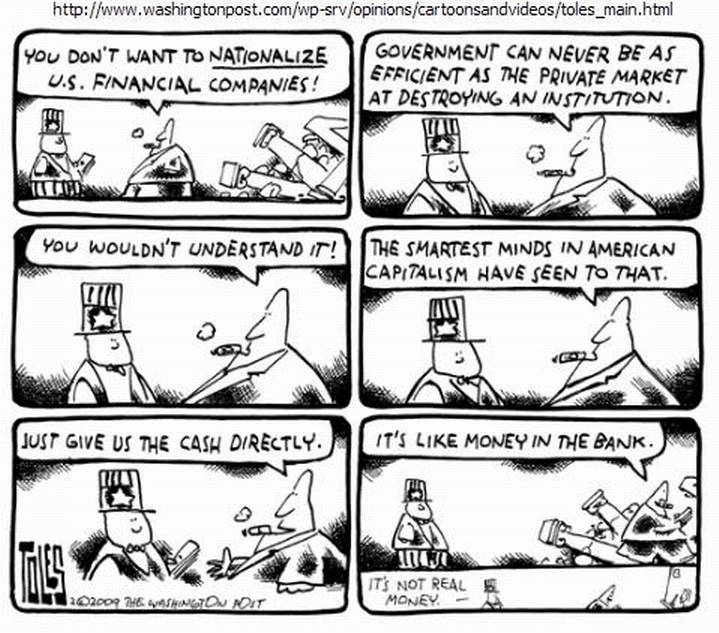

http://www.ritholtz.com/blog/2009/02/while-rome-burns/

http://www.ritholtz.com/blog/2009/02/while-rome-burns/

http://www.investorsinsight.com/blogs/j ... stone.aspx

Further, most investors rely on research that always touts winners. Where stock researchers might say there is nothing worth buying or holding during a terrible market, the most popular and relied-upon fund research doesn't work that way, because it's more a description than a recommendation. Thus, 10 percent of all funds in an asset class will get Morningstar's top five-star rating, regardless of market conditions. Another 22.5 percent get a four-star rating. And 20 percent of every peer group earns Lipper's top marks for total return, consistent return and preservation of capital.

Chuck Jaffe

The whole article is here.... Yup, You want 5 star funds that're down 10% YTD? Got a handfull available @ Morningstar......goin' DOWN!!!

http://www.sfgate.com/cgi-bin/article.c ... mp;sc=1000

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.sfgate.com/cgi-bin/article.c ... amp;sc=254

Further, most investors rely on research that always touts winners. Where stock researchers might say there is nothing worth buying or holding during a terrible market, the most popular and relied-upon fund research doesn't work that way, because it's more a description than a recommendation. Thus, 10 percent of all funds in an asset class will get Morningstar's top five-star rating, regardless of market conditions. Another 22.5 percent get a four-star rating. And 20 percent of every peer group earns Lipper's top marks for total return, consistent return and preservation of capital.

Chuck Jaffe

Calendar

Calendar