The Eye Of The Storm... Waiting For Your Dad To Get Home Like Your Mom Said You'd Hafta... Free On Bail... Seems Not So Bad At The Moment, But It's Lookin' Bad For The Future. I Think There Is Still Some Serious Shit Gonna Happen Soon Regardless of The Present Calm. What I'm Doin' 'bout It.

Change hurts. It makes people insecure, confused and angry. People want things to be the same as they've always been, because that makes life easier.

--Richard Marcinko

CHARTZ AN' TABLE ZUP @ WWW.JOEFACER.COM

The GM/Ford/Chrysler debacle reverberates through our society. At the end of 2008, Prez Bush signed the Workers, Retirees, Employers Recovery Act of 2008. It was not because Workers, Retirees, and Employers could get something really good for almost nothing. It was because the fecal material hit the rapidly rotating oscillating rotary air mover.

Single employer pension plans were in large part, the sole responsibility of the employer to manage. They had good years and bad years in terms of money going into the plan and gains on the plan's investments. During bad years for the businesses, they wanted to be able keep some of the money that would have otherwise gone into the plan to make the current year's operating results look better. So rules were put in place that allowed them to project better investment gains for the plan in the future and project more contributions to the plan in the future so as to justifying cutting the current year's contributions to the plan.

Voila!!!

The companies books looked better businesswise and you were required to have more faith in the future pensionwise 'cuz you blew off takin' care of business this year. 'Course if and when you push too hard, and the company goes down in flames, the pension plan is really left in a huge hole. Like now. A lot of companies besides the car makers wanted short term relief last year. Last year's once in a lifetime crash (apparently "lifetime" means about 5 years) blew holes in everything financial and business and since the subprime thing was going to be contained to just one company or so, since the price of real estate only goes up, since the rest of the world would keep buying American stuff regardless of what happened here, since we were all safely diversified by being in stocks and bonds, tech and commodities, among different investment plans, since the government would keep everything afloat with the printing press, (pick your favorite discredited mantra) once things picked up by Summer of 09, everything would be kool. Pension funding would look good again and it would be back to business as usual.

It's not. Check out the links I've posted here in the past year.

Thursday I received a letter from a pension plan I'm a participant in. It went like this;

Federal Pension law divides pension plans into three categories;

Plans in the "Green Zone" are considered "Healthy". They are 80% or better funded and other conditions in the plan are supportive of the continued health and viability of the plan. All is cool and under control.

Plans in the "Yellow Zone" are "Endangered". They are less than 80% funded and there is nothing positive or supportive about the concept of "Endangered". By my understanding, Federal pension law prior to the Workers, Retirees, Employers Recovery Act of 2008 requires that the Trustees immediately improve the funding status of the plan. This can be done by adopting a higher level of funding (more money from the participants) or cutting the benefit accruals (less benefits allocated per dollar contributed).

Plans in the "Red Zone" are considered "Critical". They are funded at a level of 65% or less. Federal law requiring action in the case of "Critical" is not considered "Improvement", but "Rehabilitation".

If "Endangered" sounds bad, "Critical" sounds worse. Everybody like "Improvement". "Rehab" is pejorative. In both cases, there is a structure and benchmarks that must be met per a timetable to improve the pension plan's conditions until it is again sound.

The pension plan I'm a participant in was certified as "Green Zone" for the 2008 year. Their actuary has certified the plan a "Yellow Zone" plan for 2009.

The Workers, Retirees, Employers Recovery Act of 2008 allows the Trustees to "freeze" a plan's status at the 2008 level for the 2009 year, making this year's problem something that can be legally ignored. Like pinning the thermometer at 98.6. No fever, no problem. The pension fund can wait until 2010 to deal with the issue , if it doesn't go away on its own when you ignore it....

Unless the law is changed. To postpone doing what should be done immediately, which got GM to where it is now. Let's not go there until we get further down the page...

Anyway, the Trustees of the "Yellow Zone" pension plan intend to freeze the status and act on the shortfall in 2010.

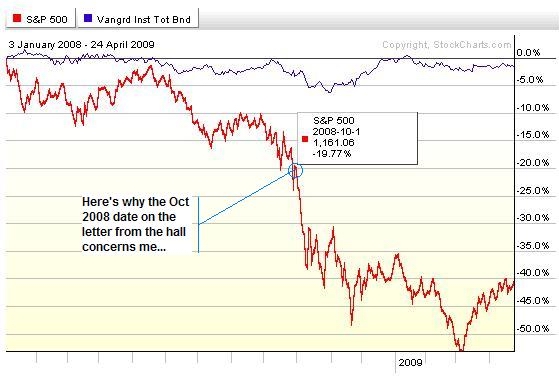

In a mailing dated October 2008, I was informed by another pension plan's Trustees, my main pension plan that I participate in, that the 94% funding of the 2007 year was no longer current. It further stated that the situation had deteriorated to the point that additional contributions to the plan would likely have to be made in 2009. I'm gonna guess that the language suggests that the plan went "Yellow Zone" in 2008, possibly earlier than the first plan mentioned. A lot has happened since October 2008 and not much of it has been good. I think I'm ready to hear more specifics from the Trustees on the matter.

A "freeze" in the status of the plan is like a "moratorium" on foreclosures. If things are going to get clearly better immediately, no problem. It's a good thing. If they are not going to get better, there's nothing like letting the problem build some momentum. Kinda like the gazillion dollars of taxpayer money that was shoveled into Wall Street to keep Brokers like Bear Stearns and Lehman Bros and banks like Citibank and Indy Mac and government agencies Ginnie Mae and Freddie Mac and insurance companies like AIG afloat. Uunh... they are still afloat...aren't they??!!? I mean it's not like we poured taxpayer money in and they went belly up anyway, except taking a lot of taxpayer money down with them... Is it???!!??!!?

I feel like I and anyone else like me interested in their pension need some current information from the Trustees.

Now.

Do we have a problem? If we do, how big is it and how do we fix it and when do we start?

It's not like we can rely on anyone else...

$20 Billion Short

$20 Billion Short

...GM’s pension system had a $20 billion shortfall as of Nov. 30, 2008, based on numbers the company provided the PBGC, said Jeffrey Speicher, a PBGC spokesman. (PBGC is the PENSION BENEFIT GUARANTEE CORP...jf) By law, the agency would be able to make up only $4 billion of that, he said.

“The rest would be lost,” Speicher said in an interview....

http://www.bloomberg.com/apps/news?pid= ... zS4bEfFmzs

http://www.1853chairman.com/2009/04/24/ ... ptcy-risk/

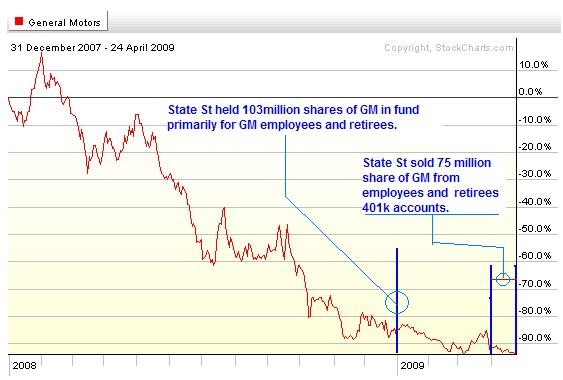

Of course, maybe the GM pension plan is in a lot better shape than it was in Nov 30 2008. Wanna bet that way? Just last week, the Trustee for GM's 401k announced that they had pretty much blown the GM stock from GM employees accounts...

April 25 (Bloomberg) -- State Street Bank and Trust Co., manager of a 401(k) investment fund for General Motors Corp. employees, has sold the majority of its shares in the automaker on concern that the stock could lose all value in a bankruptcy.

State Street sold 75 million shares, or about 12.4 percent of GM outstanding common stock, between March 31 and yesterday, Julie Gibson, a GM spokeswoman, said yesterday in an interview. It held most of those shares in a 401(k) fund for 29,800 employees and retirees. The fund is one of several options available in the GM employee-retirement savings plan.

http://www.bloomberg.com/apps/news?pid= ... 9lbsWMauyw

...GM’s pension system had a $20 billion shortfall as of Nov. 30, 2008, based on numbers the company provided the PBGC, said Jeffrey Speicher, a PBGC spokesman. (PBGC is the PENSION BENEFIT GUARANTEE CORP...jf) By law, the agency would be able to make up only $4 billion of that, he said.

“The rest would be lost,” Speicher said in an interview....

http://www.bloomberg.com/apps/news?pid= ... zS4bEfFmzs

http://www.1853chairman.com/2009/04/24/ ... ptcy-risk/

April 25 (Bloomberg) -- State Street Bank and Trust Co., manager of a 401(k) investment fund for General Motors Corp. employees, has sold the majority of its shares in the automaker on concern that the stock could lose all value in a bankruptcy.

State Street sold 75 million shares, or about 12.4 percent of GM outstanding common stock, between March 31 and yesterday, Julie Gibson, a GM spokeswoman, said yesterday in an interview. It held most of those shares in a 401(k) fund for 29,800 employees and retirees. The fund is one of several options available in the GM employee-retirement savings plan.

http://www.bloomberg.com/apps/news?pid= ... 9lbsWMauyw

Calendar

Calendar