This Week's Post Is What Shoulda Appeared In Last Week's Post. That's Why The Quote At The Top Is The Same. I Couldn't Find A Better One For The Purpose.

The one great certainty about the market is that things will always change. When we lose sight of that fact and dig in our heels on a particular viewpoint or thesis, it can create tremendous stress as we deal with an environment that may not appreciate our great insight.

Reverend Shark

Chartz and Table Zup @ www.joefacer.com

Lemme dig my way from outa a big pile of offput chores/obligations/ behests an' other crap an' I'll tell ya why I've averaged 11% return plus or minus since 9/04 an' why I'm up 55% plus or minus since 9/04 an' why IT PISSES ME OFF!!!!!

From MSNBC, Bloomberg, and Big Picture links below

“I suspect that we will continue to need a trillion dollars' worth of deficit financing, fiscal stimulation, for several years at least," said Bill Gross, managing director of Pimco, which runs the world's largest bond fund. "This economy is still de-levering. It is still at the whim, so to speak, of savings vs. consumption. It is deglobalizing. It is reregulating. These are forces that slow growth."

“I don't see where the second half recovery is coming from,” said David Rosenberg, chief economist at Gluskin Sheff, a Toronto–based investment firm. “Until employment stops falling, this recession is still intact."

The government probably wants to win time for the banks, keeping them alive as they struggle to earn their way out of the mess, says economist Joseph Stiglitz of Columbia University in New York. The danger is that weak banks will remain reluctant to lend, hobbling President Barack Obama’s efforts to pull the economy out of recession.

Citigroup’s $1.6 billion in first-quarter profit would vanish if accounting were more stringent, says Martin Weiss of Weiss Research Inc. in Jupiter, Florida. “The big banks’ profits were totally bogus,” says Weiss, whose 38-year-old firm rates financial companies. “The new accounting rules, the stress tests: They’re all part of a major effort to put lipstick on a pig.”

Further deterioration of loans will eventually force banks to recognize losses that their bookkeeping lets them ignore for now, says David Sherman, an accounting professor at Northeastern University in Boston. Janet Tavakoli, president of Tavakoli Structured Finance Inc. in Chicago, says the government stress scenarios underestimate how bad the economy may get.

Citigroup also increased its loan loss reserves more slowly in the first quarter, adding $10 billion compared with $12 billion in the fourth quarter, even as more loans were going bad. Provisions for loan losses cut profits, so adding more to this reserve could have wiped out the quarterly earnings.

Wells Fargo

Without those accounting benefits, Citigroup would probably have posted a net loss of $2.5 billion in the quarter, Weiss estimates. In the five previous quarters, Citigroup lost more than $37 billion.

Wells Fargo also took advantage of the change in the mark- to-market rules. The new standards let Wells Fargo boost its capital $2.8 billion by reassessing the value of some $40 billion of bonds, the bank said in May. And the bank augmented net income by $334 million because of the effect of the rule on the value of debts held to maturity.

Wells Fargo spokeswoman Julia Tunis Bernard declined to comment, as did Citigroup’s Jon Diat.

The higher valuations Wells Fargo put on its securities probably won’t last, as defaults increase on home mortgages, credit cards and other consumer and corporate lending, Northeastern’s Sherman says.

Fed’s Optimism

“These changes will help the banks hide their losses or push them off to the future,” says Sherman, a former Securities and Exchange Commission researcher.

The Federal Reserve, which designed the stress tests, used a 21 percent to 28 percent loss rate for subprime mortgages as a worst-case assumption. Already, almost 40 percent of such loans are 30 days or more overdue, according to Tavakoli, who is the author of three primers on structured debt. Defaults might reach 55 percent, she predicts.

At the same time, the assumptions on how much banks can earn to offset their losses are inflated, partly because of the same accounting gimmicks employed in first-quarter profit reports, Weiss says.

“There’s a chance that it might work,” Columbia’s Stiglitz says of the government’s attempt to boost confidence. “If it does, then they’ll look like the brilliant general. But all these efforts also bank on the economy recovering and housing prices not falling too much further. Those are not safe assumptions.”

The package the White House hammered together to convert big, old, dying Chrysler into a smaller, healthier car company looks a lot like a massive violation of bankruptcy law. A few dissident creditors, namely three Indiana pension funds that banded together, remain defiant enough to say so.

The Chrysler plan “seeks to extinguish the property rights of secured lenders, trampling the most fundamental of creditor rights in disregard of over 100 years of bankruptcy jurisprudence,” the funds argued in bankruptcy court papers.

http://www.msnbc.msn.com/id/31121449/

http://www.newsweek.com/id/200991

http://www.msnbc.msn.com/id/31127909/

http://www.msnbc.msn.com/id/31143910/

http://www.msnbc.msn.com/id/31150694/

http://www.msnbc.msn.com/id/31110346/

http://www.bloomberg.com/apps/news?pid= ... _5hvV_xqHM

http://www.bloomberg.com/apps/news?pid= ... C3LxSjomZ8

http://www.bloomberg.com/apps/news?pid= ... iTT6yxgHSE

http://www.bloomberg.com/apps/news?pid= ... eYe_j75qvM

http://www.bloomberg.com/apps/news?pid= ... 2TV3oJtap4

http://www.bloomberg.com/apps/news?pid= ... tKbzvooAy0

http://www.ritholtz.com/blog/2009/06/it ... one-trade/

http://www.ritholtz.com/blog/2009/06/ho ... d-minuses/

http://www.ritholtz.com/blog/2009/06/pa ... rate-fell/

http://www.ritholtz.com/blog/2009/06/an ... ent-truth/

http://www.ritholtz.com/blog/2009/06/a- ... les-ahead/

http://www.ritholtz.com/blog/2009/06/th ... more-28300

http://www.ritholtz.com/blog/2009/06/tr ... licyuh-oh/

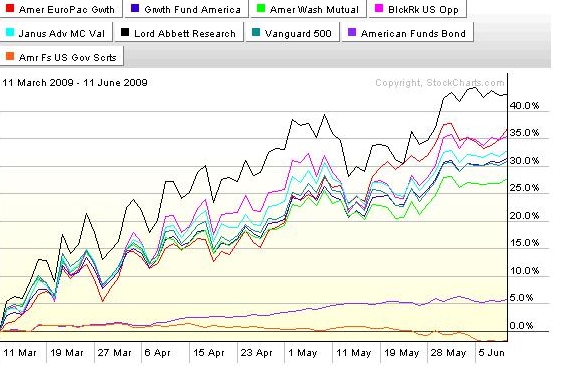

This is what the Funds available to the 401a have done since the time they became available (Since I got serious about 401a investing).

This is the period in which I went long and strong in stocks, at times almost 90% to 95% stocks.

This is the time period during which I was in cash (GIC) or bonds. Pretty kool so far.

This is the three month time period during which I was partially invested in stocks for about 4 or 5 weeks. IT PISSES ME OFF. For a trend follower intent on finding a trend and riding it as long as I could, I left WAY too much on the table when stocks turned up and kept going up. Lesson learned. I just moved a significant amount of my 401a back into stocks. Not because I think that there is a lot left to this move or that the market owes me what I missed out on. Rather, I did really well in a bull market 'cuz ya can't tell the idiots from the geniuses when everything is goin' up. I also did really well in a bear market because when hunkering down and playing possum is a brilliant strategy, it's really easy too. But now I expect a very volatile and range bound market. And that is a very different animal. It might be a bloody and frustrating market for an extended period. It also might offer the opportunity to make some aerious bucks with effort, smarts and luck. So i tossed some serious money into the action. Nothing quite like skin in the game to dial the focus and intensity up.

Stay tooned

“I suspect that we will continue to need a trillion dollars' worth of deficit financing, fiscal stimulation, for several years at least," said Bill Gross, managing director of Pimco, which runs the world's largest bond fund. "This economy is still de-levering. It is still at the whim, so to speak, of savings vs. consumption. It is deglobalizing. It is reregulating. These are forces that slow growth."

“I don't see where the second half recovery is coming from,” said David Rosenberg, chief economist at Gluskin Sheff, a Toronto–based investment firm. “Until employment stops falling, this recession is still intact."

The government probably wants to win time for the banks, keeping them alive as they struggle to earn their way out of the mess, says economist Joseph Stiglitz of Columbia University in New York. The danger is that weak banks will remain reluctant to lend, hobbling President Barack Obama’s efforts to pull the economy out of recession.

Citigroup’s $1.6 billion in first-quarter profit would vanish if accounting were more stringent, says Martin Weiss of Weiss Research Inc. in Jupiter, Florida. “The big banks’ profits were totally bogus,” says Weiss, whose 38-year-old firm rates financial companies. “The new accounting rules, the stress tests: They’re all part of a major effort to put lipstick on a pig.”

Further deterioration of loans will eventually force banks to recognize losses that their bookkeeping lets them ignore for now, says David Sherman, an accounting professor at Northeastern University in Boston. Janet Tavakoli, president of Tavakoli Structured Finance Inc. in Chicago, says the government stress scenarios underestimate how bad the economy may get.

Citigroup also increased its loan loss reserves more slowly in the first quarter, adding $10 billion compared with $12 billion in the fourth quarter, even as more loans were going bad. Provisions for loan losses cut profits, so adding more to this reserve could have wiped out the quarterly earnings.

Wells Fargo

Without those accounting benefits, Citigroup would probably have posted a net loss of $2.5 billion in the quarter, Weiss estimates. In the five previous quarters, Citigroup lost more than $37 billion.

Wells Fargo also took advantage of the change in the mark- to-market rules. The new standards let Wells Fargo boost its capital $2.8 billion by reassessing the value of some $40 billion of bonds, the bank said in May. And the bank augmented net income by $334 million because of the effect of the rule on the value of debts held to maturity.

Wells Fargo spokeswoman Julia Tunis Bernard declined to comment, as did Citigroup’s Jon Diat.

The higher valuations Wells Fargo put on its securities probably won’t last, as defaults increase on home mortgages, credit cards and other consumer and corporate lending, Northeastern’s Sherman says.

Fed’s Optimism

“These changes will help the banks hide their losses or push them off to the future,” says Sherman, a former Securities and Exchange Commission researcher.

The Federal Reserve, which designed the stress tests, used a 21 percent to 28 percent loss rate for subprime mortgages as a worst-case assumption. Already, almost 40 percent of such loans are 30 days or more overdue, according to Tavakoli, who is the author of three primers on structured debt. Defaults might reach 55 percent, she predicts.

At the same time, the assumptions on how much banks can earn to offset their losses are inflated, partly because of the same accounting gimmicks employed in first-quarter profit reports, Weiss says.

“There’s a chance that it might work,” Columbia’s Stiglitz says of the government’s attempt to boost confidence. “If it does, then they’ll look like the brilliant general. But all these efforts also bank on the economy recovering and housing prices not falling too much further. Those are not safe assumptions.”

The package the White House hammered together to convert big, old, dying Chrysler into a smaller, healthier car company looks a lot like a massive violation of bankruptcy law. A few dissident creditors, namely three Indiana pension funds that banded together, remain defiant enough to say so.

The Chrysler plan “seeks to extinguish the property rights of secured lenders, trampling the most fundamental of creditor rights in disregard of over 100 years of bankruptcy jurisprudence,” the funds argued in bankruptcy court papers.

Calendar

Calendar