"You may have a fresh start any moment you choose, for this thing that we call 'failure' is not the falling down, but the staying down."

--Mary Pickford

CHARTZ AND TABLE ZUP @ www.joefacer.com

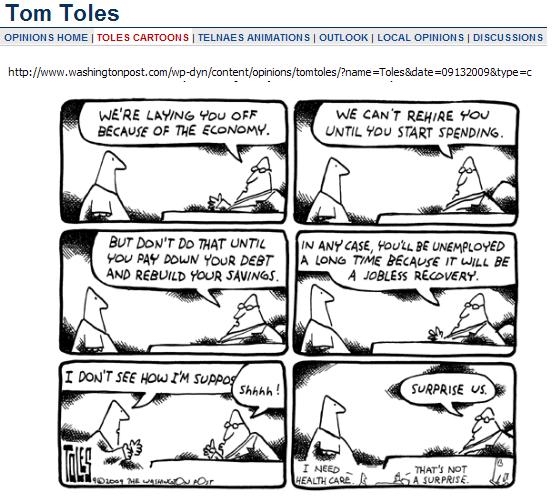

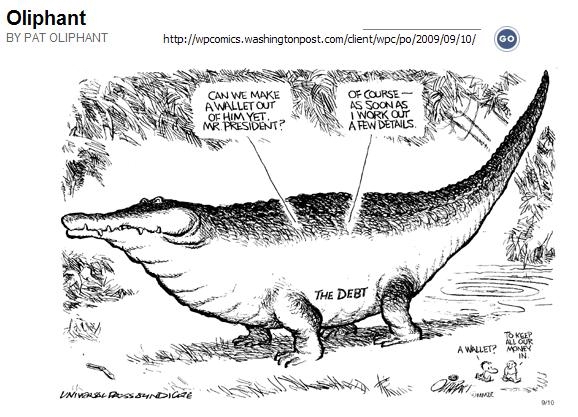

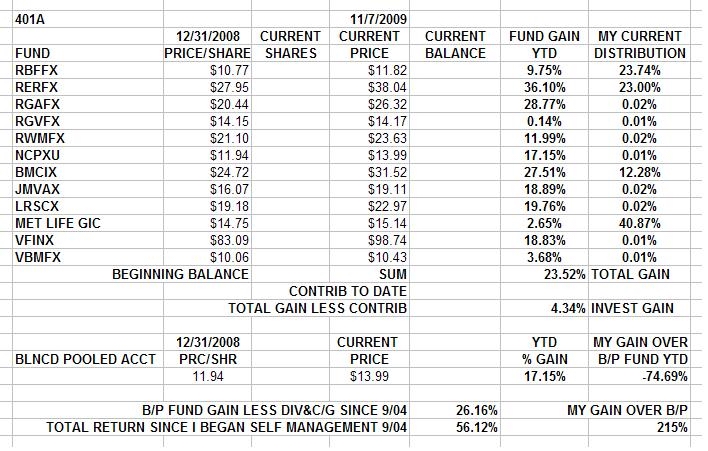

I kinda went nuclear on dis arm. Posting will be slow and sparse. And painful. That said, if you have been following the links I post here, you know that I think that I can see behind the curtain and see government men pulling the levers trying to prevent the painful deflation of the risk and real estate bubble by creating the third bubble of the decade; the taxpayer's debt bubble. That has kept me out of the market for most of the 50% bounce since the March lows. I'm grudgingly adding exposure now for the possible end of the year run up. My caution will undoubtedly be proven right at some point. But 50% early means the same as WRONG. The fact that '04 to '08s results give me an excellent record does not excuse my substituting my reliance on my intellectual biases for listening what the market has to say. Check out my 401a funds distribution table on joefacer.com for details. And Stay Tooned....

http://www.youtube.com/watch?v=DDOIL5Oq ... re=related

http://www.msnbc.msn.com/id/32722194/ns ... gton_post/

http://www.theonion.com/content/news/na ... nt_outlook

http://www.cnn.com/2009/WORLD/europe/09 ... index.html

http://www.ritholtz.com/blog/2009/08/fdic-low-on-funds/

http://www.ritholtz.com/blog/2009/09/th ... -us-terms/

http://www.bloomberg.com/apps/news?pid= ... gnqYrMSrtI

http://www.bloomberg.com/apps/news?pid= ... gnqYrMSrtI

http://www.bloomberg.com/apps/news?pid= ... UTn7JFw1qk

http://www.telegraph.co.uk/finance/comm ... ssion.html

http://www.ritholtz.com/blog/2009/09/da ... -agencies/

http://www.boston.com/bostonglobe/ideas ... ism_fails/

http://www.ritholtz.com/blog/2009/09/ra ... sner-says/

http://www.ritholtz.com/blog/2009/09/am ... n-hostage/

http://widerimage.reuters.com/timesofcr ... ce=reuters

Only if you have an hour or two to spare and the interest in the minutae....

http://www.forbes.com/2009/09/14/lehman ... ssler.html

http://www.forbes.com/2009/09/14/lehman ... ssler.html

http://www.ritholtz.com/blog/2009/09/da ... -agencies/

http://www.ritholtz.com/blog/2009/09/pe ... ew-normal/

http://www.ritholtz.com/blog/2009/09/a- ... f-bankers/

http://www.ritholtz.com/blog/2009/09/we ... es-we-can/

http://www.boston.com/bostonglobe/ideas ... ism_fails/

http://www.ritholtz.com/blog/2009/09/ra ... sner-says/

[h/4]

I GIVE UP!!! FUNDAMENTALS AND TECHNICALS DON'T MATTER. CHARTS DON'T MATTER. KNOWING WHAT IS REALLY HAPPENING IN THE ECONOMY AND FINANCIAL CIRCLES DOESN'T HELP. WHAT MAKES YOU A GENIUS IS TO BUY SOMETHING THAT IS ALREADY SKY HIGH AND HOLD IT. NEVER LET IT BE SAID THAT I'M TOO OLD AND STOOPID TO LEARN.

Here's where I stand this evening. I'm cultivating obliviousness so's I can make some money.

I ain't gettin' TOO loose, though. My finger is on the eject button and the ripcord is tied to my other wrist...

I ain't happy about leavin' money on the table this year......

But up almost 8% this year and averaging 13% over 5 years is none too shabby either.

Stay tooned....

I GIVE UP!!! FUNDAMENTALS AND TECHNICALS DON'T MATTER. CHARTS DON'T MATTER. KNOWING WHAT IS REALLY HAPPENING IN THE ECONOMY AND FINANCIAL CIRCLES DOESN'T HELP. WHAT MAKES YOU A GENIUS IS TO BUY SOMETHING THAT IS ALREADY SKY HIGH AND HOLD IT. NEVER LET IT BE SAID THAT I'M TOO OLD AND STOOPID TO LEARN.

Here's where I stand this evening. I'm cultivating obliviousness so's I can make some money.

I ain't gettin' TOO loose, though. My finger is on the eject button and the ripcord is tied to my other wrist...

I ain't happy about leavin' money on the table this year......

But up almost 8% this year and averaging 13% over 5 years is none too shabby either.

Stay tooned....

Calendar

Calendar