Forty Years Ago, I Didn't Understand Why All The Old Timers Ever Talked About Was Retiring. It Gets Clearer Every Year....

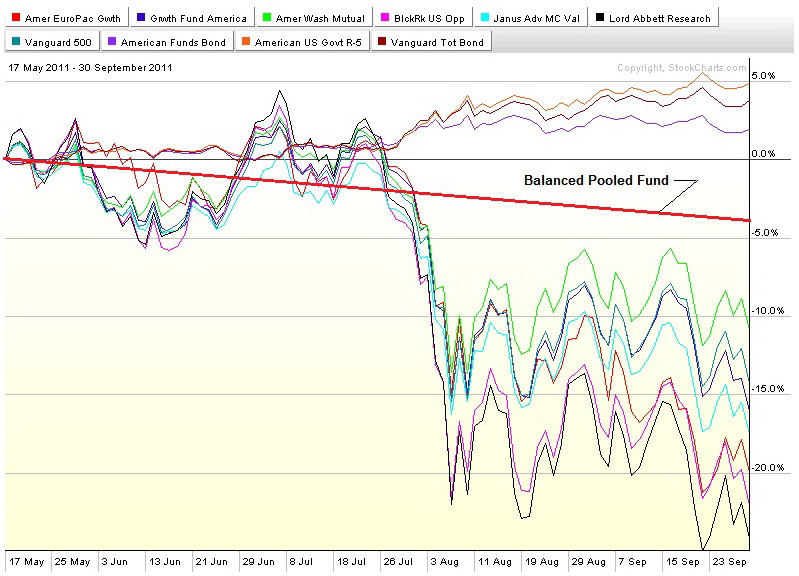

Risk Management and Capital Preservation is often confused with Market Timing, and therefore is frowned upon.

Chartz and Table Zup @ www.joefacer.com

Links

Home

Contact Me

Stats

MY WEBSITE

joefacer.com

NEWS AND VIEWS

TheStreet.com

Money

CHARTS

Stockcharts.com

Big Charts

DATA

Morningstar

BLOGS

The Big Picture

Shark Investing

The Reformed Broker

Dash of Insight

This a BLOG about my Union 401 Defined Contribution Plan.

Login

Contact Me

Stats

MY WEBSITE

joefacer.com

NEWS AND VIEWS

TheStreet.com

Money

CHARTS

Stockcharts.com

Big Charts

DATA

Morningstar

BLOGS

The Big Picture

Shark Investing

The Reformed Broker

Dash of Insight

This a BLOG about my Union 401 Defined Contribution Plan.

Login

| « | March 2017 | » | ||||

| Sun | Mon | Tue | Wed | Thu | Fri | Sat |

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | 31 | |

| 02/10/2026 | ||||||

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Plan. Catch up around the house edition...

Yes.... I'm back. Between the holidays and family and work and fun and just plain goofing off and getting my daily adult requirement of sitting and staring, I've blown away two/three weeks of time. Back inna traces agin, par'ner.

Hangin' Out With Iron Man In The Late 60's And Early 70's....

Jes' Annuder Ol' Broked Down Retahrd Union Pipefitter And His 401 Defined Contribution Plan....

Earning Interest And Clipping Coupons In Bonds And Cash Is Always Better Than Watching Stocks Go Down.... Unless You Can Short.

Yes.... I'm back. Between the holidays and family and work and fun and just plain goofing off and getting my daily adult requirement of sitting and staring, I've blown away two/three weeks of time. Back inna traces agin, par'ner.

Hangin' Out With Iron Man In The Late 60's And Early 70's....

Jes' Annuder Ol' Broked Down Retahrd Union Pipefitter And His 401 Defined Contribution Plan....

Earning Interest And Clipping Coupons In Bonds And Cash Is Always Better Than Watching Stocks Go Down.... Unless You Can Short.

Total: 309

Today: 61

Yesterday: 138

Today: 61

Yesterday: 138

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Defined Benefit Plan.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Defined Benefit Plan.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

joefacer.com/pblog - Page Generated in 0.0698 seconds | Site Views: 309

Calendar

Calendar