"Character consists of what you do on the third and fourth tries."

Chartz And Table Zup @ www.joefacer.com

Bonamassa. 'nuff said.

Links

Home

Contact Me

Stats

MY WEBSITE

joefacer.com

NEWS AND VIEWS

TheStreet.com

Money

CHARTS

Stockcharts.com

Big Charts

DATA

Morningstar

BLOGS

The Big Picture

Shark Investing

The Reformed Broker

Dash of Insight

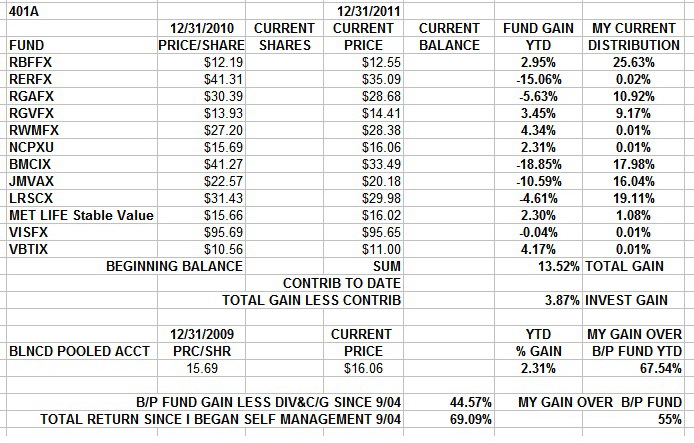

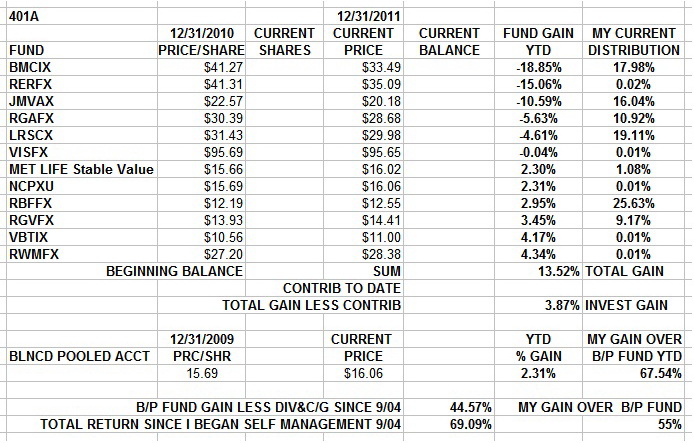

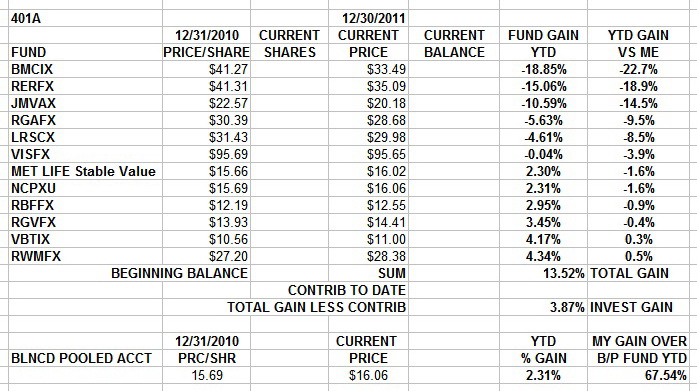

This a BLOG about my Union 401 Defined Contribution Plan.

Login

Contact Me

Stats

MY WEBSITE

joefacer.com

NEWS AND VIEWS

TheStreet.com

Money

CHARTS

Stockcharts.com

Big Charts

DATA

Morningstar

BLOGS

The Big Picture

Shark Investing

The Reformed Broker

Dash of Insight

This a BLOG about my Union 401 Defined Contribution Plan.

Login

| « | March 2017 | » | ||||

| Sun | Mon | Tue | Wed | Thu | Fri | Sat |

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | 31 | |

| 02/22/2026 | ||||||

I Moved Some 401a Money Around. When You're Not Happy With Any Of The Choices, How Can You Be Happy With The Decision?

Gonna post midweek....

Dare I Say It Out Loud? ................ Ya Know.....I Really Don't Care Much For Long Emotional Goodbyes........... SO....... ADIOS, MOTHERFUCKERS!! ... THIS IS IT!!!! .....I'M PULLING THE PIN!!!... I'M OUTAHERE!!!!!!! I'm Retiring As Of This Week. The Paperwork Is Inna Works. Now....About The Blog And Whom So Ever Read Or Might Wanna Continue To Read It... Hmmm.... Stay Tooned.

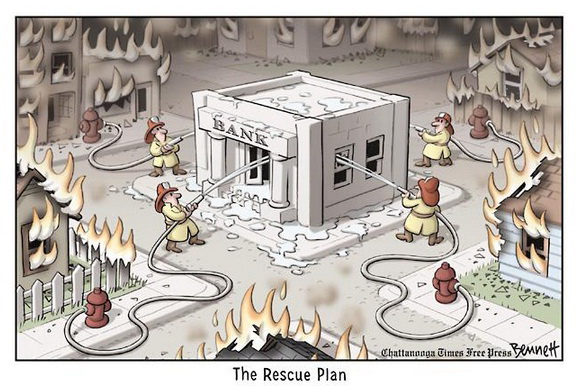

Potential War In The Mid East, Financial And Economic Collapse In Europe, Recession Looming In SA, India And China, Major Unemployment Issues In The US Long After What Passes As A Recovery Has Taken Place. Still It's A Beautiful Sunny Day Today And Father's Day Is Happening Today And Tomorrow. Grab The Good Times Even While You Sweat The Bad Times. Life Is A One Act Play. Enjoy All Of It.

Live Every Day Of Your Life Like It's Gonna Be The Last And Your Life Will Be Judged By It. Opportunity Comes Once In A While. Regrets Can Come All Day Every Day.

Gonna post midweek....

Dare I Say It Out Loud? ................ Ya Know.....I Really Don't Care Much For Long Emotional Goodbyes........... SO....... ADIOS, MOTHERFUCKERS!! ... THIS IS IT!!!! .....I'M PULLING THE PIN!!!... I'M OUTAHERE!!!!!!! I'm Retiring As Of This Week. The Paperwork Is Inna Works. Now....About The Blog And Whom So Ever Read Or Might Wanna Continue To Read It... Hmmm.... Stay Tooned.

Potential War In The Mid East, Financial And Economic Collapse In Europe, Recession Looming In SA, India And China, Major Unemployment Issues In The US Long After What Passes As A Recovery Has Taken Place. Still It's A Beautiful Sunny Day Today And Father's Day Is Happening Today And Tomorrow. Grab The Good Times Even While You Sweat The Bad Times. Life Is A One Act Play. Enjoy All Of It.

Live Every Day Of Your Life Like It's Gonna Be The Last And Your Life Will Be Judged By It. Opportunity Comes Once In A While. Regrets Can Come All Day Every Day.

Total: 803

Today: 83

Yesterday: 116

Today: 83

Yesterday: 116

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Defined Benefit Plan.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Defined Benefit Plan.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

joefacer.com/pblog - Page Generated in 0.019 seconds | Site Views: 803

Calendar

Calendar