Last week I wrote about increasing political and economic dangers. This week Al Queda got way too close to a major source of petro product for much of the world. The world exists in a big tank of oil and if someone pokes a hole in it, all the oil in the tank starts to head for the low spot. Oil prices are up and there is a sea change under way. More and more people know what the Hubbert Peak is. State owned oil companies are buying up fields in foreign countries and it looks like a national security move to me. Major oil companies are starting to unobtrusively count tar sands and liqufiable natural gas as oil reserves. The money and oil industries are chattering about increased drilling but there is not a whole lot of talk about anything but incremental additions to reserves. And the work of fiction that is the Consumer Price Index, that is carefully constructed to delay and minimize signs of inflation, is starting to show signs of inflation as rising energy prices and interest rates begin to leak through the barriers. Finally, the same idiot that told Michael Brown of FEMA that, "You're doing a hell of a job, Brownie." during the Katrina/New Orleans imbroglio, reads in the newspaper about the transfer of administrative control of six of our seaports to an Arab country owned company and rushes to insist that he's satisfied that there are no security risks to the deal. This guy is a uniter, not a divider. He's got all the Republicans and all the Democrats united against him. Will wonders never cease. So what about my 401a?

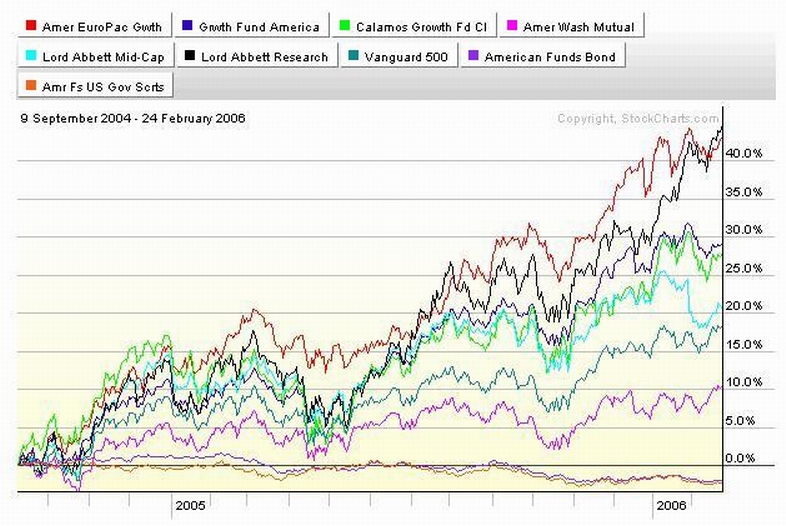

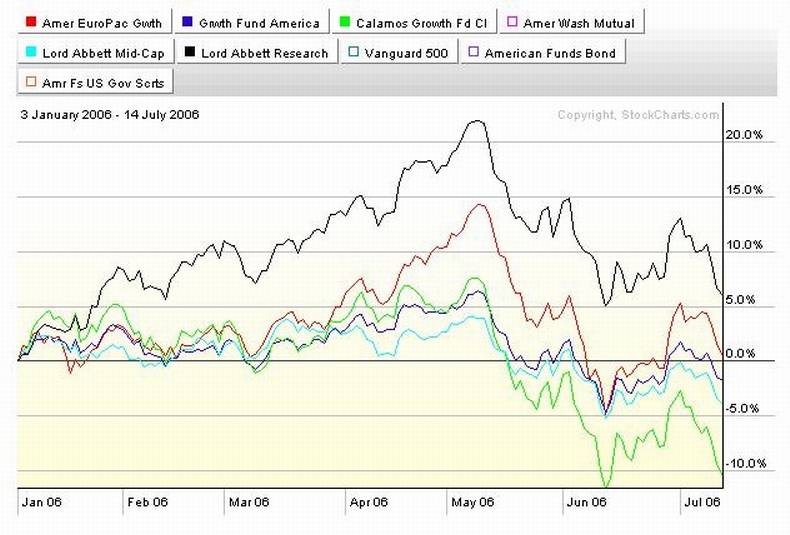

Steady as she goes. Refer to the charts. ....click on them if ya feel lucky....punk:

In the first chart, look at the progress I've made by being in stocks. Last week I made money in my 401a, my IRA's and my trading account by being in stocks, so that's still working for me. So I'm going to stay in stocks. Look at the second chart; big gains in the first two weeks in all the funds, and since then three maintained, one dropped, and one continued to rise. I've picked up some gains in the Balanced Pooled Fund as the stocks in it appreciated. I'm stuck with the $5K minimum there but anything over that can find its way elsewhere. This week I'll shift some of the excess over $5K over to the Calamos Growth fund because I think I'm a little too light there. The Lord Abbett Research Fund guy appears to have the hot hand and it's weighted right about at where I want it to be, so if nothing changes, I'll put next month's contribution there. These are incremental changes, nothing more. I'm still more or less equally represented in four of the five best stock funds available to me and I've got a small stake in the fifth fund as a place holder. I'm one day from safety at any time (see last week's post), I'm making money while I can, and I'm going with what got me here; up 32% in 18 months. See ya at the hall.

Steady as she goes. Refer to the charts. ....click on them if ya feel lucky....punk:

In the first chart, look at the progress I've made by being in stocks. Last week I made money in my 401a, my IRA's and my trading account by being in stocks, so that's still working for me. So I'm going to stay in stocks. Look at the second chart; big gains in the first two weeks in all the funds, and since then three maintained, one dropped, and one continued to rise. I've picked up some gains in the Balanced Pooled Fund as the stocks in it appreciated. I'm stuck with the $5K minimum there but anything over that can find its way elsewhere. This week I'll shift some of the excess over $5K over to the Calamos Growth fund because I think I'm a little too light there. The Lord Abbett Research Fund guy appears to have the hot hand and it's weighted right about at where I want it to be, so if nothing changes, I'll put next month's contribution there. These are incremental changes, nothing more. I'm still more or less equally represented in four of the five best stock funds available to me and I've got a small stake in the fifth fund as a place holder. I'm one day from safety at any time (see last week's post), I'm making money while I can, and I'm going with what got me here; up 32% in 18 months. See ya at the hall.

Calendar

Calendar