I'm still addin' to last week's post. But this needs to get posted here. Check 'em all out...

How Saudi Arabia is running our economy

http://www.thestreet.com/_tscs/newsanal ... 60736.html

AND

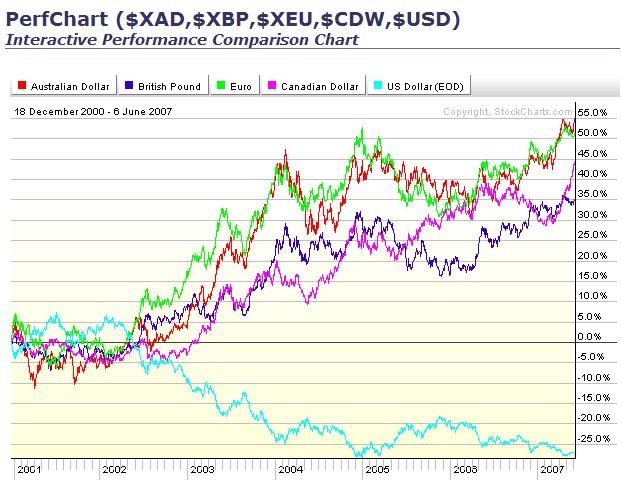

Here's why ya gotta be (shoulda been) thinkin' offshore investments. CLICKONNIT!

.

.

It's great for exporters, it's why we had a greater quarter in the indexes. Our stuff is cheap overseas. The dollar worth o' stuff sent over is sold and if it take 4 months between shipping and payment, the drachmas we get for the merchandise buys more (cheaper dollars)when it comes back to the USA. But it also means that we are buying stuff overseas with constantly depreciating dollars. It makes imports really expensive. Why is oil REALLY at $60 plus and steel so expensive?

It also works for investing. It's why I'm/have been overweight euroasia. there's more....but not here not now...

Wed the 6th I went to 28% GIC (Met Life)and I may go a lot more. I think stocks are going to be in free fall for a while. A day, a week, a month, a little bit all at once, a lot over a long period. Or maybe not. There is a growing awareness that as rates rise in the rest of the world (ROW) and the dollar depreciates (see the charts above), we're screwed (a technical term that condenses too much stuff to cover here). But it means that we might have to pay the piper for the last 6 years of methamphetamine/monetary run. I'm up 50% over 2-1/2 years and there is a feeling of a seasonal turning point on/over the horizon.

There's still the presidential cycle, the inventory cycle, the information revolution, ROW growth etc. But my favorite bright sunny days are in the fall when oncoming winter crispens up the morning and makes for cold clear nights, and it ain't no secret what's on the horizon... Of course I could be wrong and imagining ghosts in the shadows... or not. Heightened caution about whats going on in the other rooms at the party and a heightened awareness of where the door is, is how I'm going to play it.

How Saudi Arabia is running our economy

http://www.thestreet.com/_tscs/newsanal ... 60736.html

AND

Here's why ya gotta be (shoulda been) thinkin' offshore investments. CLICKONNIT!

It's great for exporters, it's why we had a greater quarter in the indexes. Our stuff is cheap overseas. The dollar worth o' stuff sent over is sold and if it take 4 months between shipping and payment, the drachmas we get for the merchandise buys more (cheaper dollars)when it comes back to the USA. But it also means that we are buying stuff overseas with constantly depreciating dollars. It makes imports really expensive. Why is oil REALLY at $60 plus and steel so expensive?

It also works for investing. It's why I'm/have been overweight euroasia. there's more....but not here not now...

Wed the 6th I went to 28% GIC (Met Life)and I may go a lot more. I think stocks are going to be in free fall for a while. A day, a week, a month, a little bit all at once, a lot over a long period. Or maybe not. There is a growing awareness that as rates rise in the rest of the world (ROW) and the dollar depreciates (see the charts above), we're screwed (a technical term that condenses too much stuff to cover here). But it means that we might have to pay the piper for the last 6 years of methamphetamine/monetary run. I'm up 50% over 2-1/2 years and there is a feeling of a seasonal turning point on/over the horizon.

There's still the presidential cycle, the inventory cycle, the information revolution, ROW growth etc. But my favorite bright sunny days are in the fall when oncoming winter crispens up the morning and makes for cold clear nights, and it ain't no secret what's on the horizon... Of course I could be wrong and imagining ghosts in the shadows... or not. Heightened caution about whats going on in the other rooms at the party and a heightened awareness of where the door is, is how I'm going to play it.

Calendar

Calendar