Charts and tables up at joefacer.com. Fund Alarm tables too.....

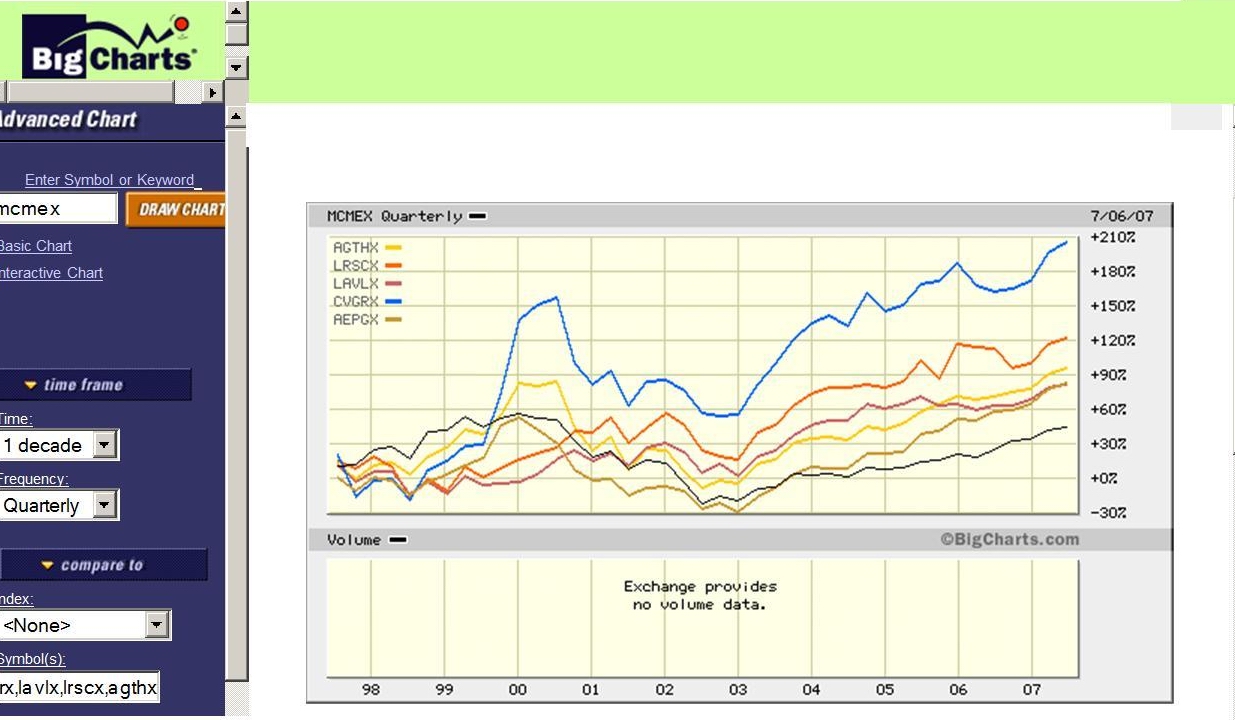

Here's a BIGCHARTS chart showing the past ten years performance of:

1) A McMorgan stock fund (mcmex) representing the performance of the equity portion of our pension funds from '93 to 2005.

and

2) The different mutual funds which became available to our 401a in 2004.

Clickonnit;

Three sets of questions.

1)What did it cost us to be undiversified with all our equity exposure in both the 401a and the main pension fund limited to one manager and one portfolio?

We can do a quick first order estimate from the charts that our equity return from McMorgan was roughly eight percent over the period of mid 1997 to 2005, or about 1% per year. If we had $60 million in the main pension fund invested in equities in '97, that would have given us about $68 million on our original principal plus earnings after 7-1/2 years .

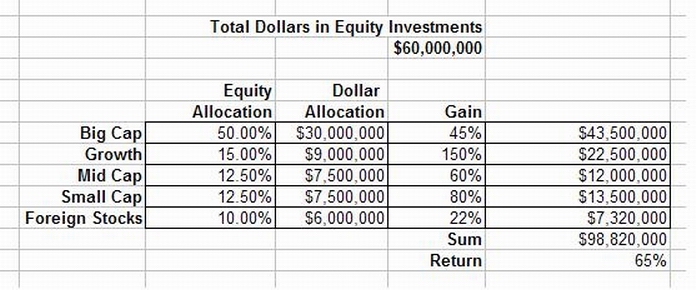

The worst performing fund of the group of funds now available to our 401a managed about 20% return during that period, and the best performing fund did about 150%. Again assuming $60 million in pension equity funds and a conventional distribution of the pension monies among funds as shown below and the rates of return on the funds as shown above, we would have had roughly $38 million in earnings as shown below. Or stated another way, we would have had a 65% return instead of a 8% return (eight times better) in both the main pension and the 401a Supplemental pension, with much better diversification and safety. It appears to me as though a case could be made that the cost of an undiversified investment strategy and reliance on a single poorly performing investment manager is approximately 25% to 50% of the amount in your 401a and the defined benefit pension fund. This is only an estimate and a rough one at that, but it certainly justifies looking deeper into this.

Clickonnit!

2) Given that the stock funds that the Board of Trust made available to us in 2004 to replace the poorly performing McMorgan Funds were available to us in 1997, why did it take so long to diversify from a single advisor for both stocks and bonds and both the 401a and the main pension? Was this a matter of a single decision being made in 1993 without any subsequent review? Was it consciously and deliberately kept this way? Was this a prudent course of action and fiduciarily responsible? How were these things managed and are they being properly managed now and will they be managed in the future for our interests?

3) What assurance do we have that this is not happening again? As of 2004 we have a new investment arrangement in the 401a Supplemental Pension Plan and as of 2005 we have a new arrangement in the Primary, ie Defined Benefit Pension Plan.

Did we choose two severely underperforming investmemt management firms and an unacceptably high cost index fund manager for the defined benefit? Will the 401a arrangement pass review?

All good questions.

Finally, food for thought; Did the godawful 401a pension performance during the late 90's and early 2000's keep you from allocating more than the minimum amount to the 401a? Did the pension plan's sticking with an underperforming equity manager cost you while they were in place and is it still costing you even after they are long gone from the 401a?

About my current asset allocation in the 401a....it's kinda wheels within wheels right now.... My asset allocation is somewhat idiosyncratic. I'm avowedly and demonstratibly aggressive. I'm up 50% in the 401a in three years and 45% YTD in my trading account. And I've little confidence that it can continue. On the one side is my aggressive nature and some luck and smarts. On the other side is what I see as the start of a radical change in the place of the USA in the world. We've gone from the premier manufacturing nation in the world to a place where it's REALLY REALY hard to find something at the store that's not made in China in less than a decades time. We've had a recession in most of the economy in the late 90's disguised by a tech/fraud bubble in a corner of the economy, historically low short term interest rates at 1% in order to save us from worldwide depression, a jobless recovery off of bigtime unemployment, low life lying statistics on inflation about the part of the economy that does not eat or stay warm or stay cool or drive or get sick, full employment without wage pressure, the start of what happened to the air traffic controllers happening to the UAW at Chrysler, the end of Ford and GM as we have known them,and an off budget sheet war we gave away while we won it. There's more, but that's enough for now. Housing, which drove our economy for 5 years, has fallen off the map. The hope is that it won't matter. I'll have to see it to believe it.

The USA looks to be on it's way to becoming Britain; a one time numero uno economic and military power caught in the historical imperative of the world around it. Want a taste? Crude prices at the world level are higher than in the US. We have all the crude we can use at the oil terminals in TX/OK. We don't have the refineries to process what we have so the bids are weak for crude. Demand continues to grow so we have to import gasoline. At some point we may have to export low margin crude because we have too much while we import high margin gasoline and refined products because we don't have enough.

In the world I knew, the collapse of housing and higher rates would mean lower prices as the word economy chilled 'cuz we cooled. The world goes as the main producer/consumer goes. In this world, China, India , South America, and Eastern Europe could fill in the hole in demand that we leave and prices might not miss a beat. It's called stagflation and I have some very ugly memories of the last time it came around.

I'm concerned and I'm staying long and strong in the 401 for now, mostly cuz' I'm ready and capable of stepping aside at the drop of the hat. i just dunno about the hat, who's it is and what direction it's coming from.

Here's a BIGCHARTS chart showing the past ten years performance of:

1) A McMorgan stock fund (mcmex) representing the performance of the equity portion of our pension funds from '93 to 2005.

and

2) The different mutual funds which became available to our 401a in 2004.

Clickonnit;

Three sets of questions.

1)What did it cost us to be undiversified with all our equity exposure in both the 401a and the main pension fund limited to one manager and one portfolio?

We can do a quick first order estimate from the charts that our equity return from McMorgan was roughly eight percent over the period of mid 1997 to 2005, or about 1% per year. If we had $60 million in the main pension fund invested in equities in '97, that would have given us about $68 million on our original principal plus earnings after 7-1/2 years .

The worst performing fund of the group of funds now available to our 401a managed about 20% return during that period, and the best performing fund did about 150%. Again assuming $60 million in pension equity funds and a conventional distribution of the pension monies among funds as shown below and the rates of return on the funds as shown above, we would have had roughly $38 million in earnings as shown below. Or stated another way, we would have had a 65% return instead of a 8% return (eight times better) in both the main pension and the 401a Supplemental pension, with much better diversification and safety. It appears to me as though a case could be made that the cost of an undiversified investment strategy and reliance on a single poorly performing investment manager is approximately 25% to 50% of the amount in your 401a and the defined benefit pension fund. This is only an estimate and a rough one at that, but it certainly justifies looking deeper into this.

Clickonnit!

2) Given that the stock funds that the Board of Trust made available to us in 2004 to replace the poorly performing McMorgan Funds were available to us in 1997, why did it take so long to diversify from a single advisor for both stocks and bonds and both the 401a and the main pension? Was this a matter of a single decision being made in 1993 without any subsequent review? Was it consciously and deliberately kept this way? Was this a prudent course of action and fiduciarily responsible? How were these things managed and are they being properly managed now and will they be managed in the future for our interests?

3) What assurance do we have that this is not happening again? As of 2004 we have a new investment arrangement in the 401a Supplemental Pension Plan and as of 2005 we have a new arrangement in the Primary, ie Defined Benefit Pension Plan.

Did we choose two severely underperforming investmemt management firms and an unacceptably high cost index fund manager for the defined benefit? Will the 401a arrangement pass review?

All good questions.

Finally, food for thought; Did the godawful 401a pension performance during the late 90's and early 2000's keep you from allocating more than the minimum amount to the 401a? Did the pension plan's sticking with an underperforming equity manager cost you while they were in place and is it still costing you even after they are long gone from the 401a?

About my current asset allocation in the 401a....it's kinda wheels within wheels right now.... My asset allocation is somewhat idiosyncratic. I'm avowedly and demonstratibly aggressive. I'm up 50% in the 401a in three years and 45% YTD in my trading account. And I've little confidence that it can continue. On the one side is my aggressive nature and some luck and smarts. On the other side is what I see as the start of a radical change in the place of the USA in the world. We've gone from the premier manufacturing nation in the world to a place where it's REALLY REALY hard to find something at the store that's not made in China in less than a decades time. We've had a recession in most of the economy in the late 90's disguised by a tech/fraud bubble in a corner of the economy, historically low short term interest rates at 1% in order to save us from worldwide depression, a jobless recovery off of bigtime unemployment, low life lying statistics on inflation about the part of the economy that does not eat or stay warm or stay cool or drive or get sick, full employment without wage pressure, the start of what happened to the air traffic controllers happening to the UAW at Chrysler, the end of Ford and GM as we have known them,and an off budget sheet war we gave away while we won it. There's more, but that's enough for now. Housing, which drove our economy for 5 years, has fallen off the map. The hope is that it won't matter. I'll have to see it to believe it.

The USA looks to be on it's way to becoming Britain; a one time numero uno economic and military power caught in the historical imperative of the world around it. Want a taste? Crude prices at the world level are higher than in the US. We have all the crude we can use at the oil terminals in TX/OK. We don't have the refineries to process what we have so the bids are weak for crude. Demand continues to grow so we have to import gasoline. At some point we may have to export low margin crude because we have too much while we import high margin gasoline and refined products because we don't have enough.

In the world I knew, the collapse of housing and higher rates would mean lower prices as the word economy chilled 'cuz we cooled. The world goes as the main producer/consumer goes. In this world, China, India , South America, and Eastern Europe could fill in the hole in demand that we leave and prices might not miss a beat. It's called stagflation and I have some very ugly memories of the last time it came around.

I'm concerned and I'm staying long and strong in the 401 for now, mostly cuz' I'm ready and capable of stepping aside at the drop of the hat. i just dunno about the hat, who's it is and what direction it's coming from.

Calendar

Calendar