Nothing Sharpens Your Appreciation Of Life And Clarifies The Difference Between Fear And Respect Like Looking Over The Edge. But That's A Third Beer Story....

"Worry does not empty tomorrow of its sorrow; it empties today of its strength."

Chartz And Table Zup @ www.joefacer.com.

Links

Home

Contact Me

Stats

MY WEBSITE

joefacer.com

NEWS AND VIEWS

TheStreet.com

Money

CHARTS

Stockcharts.com

Big Charts

DATA

Morningstar

BLOGS

The Big Picture

Shark Investing

The Reformed Broker

Dash of Insight

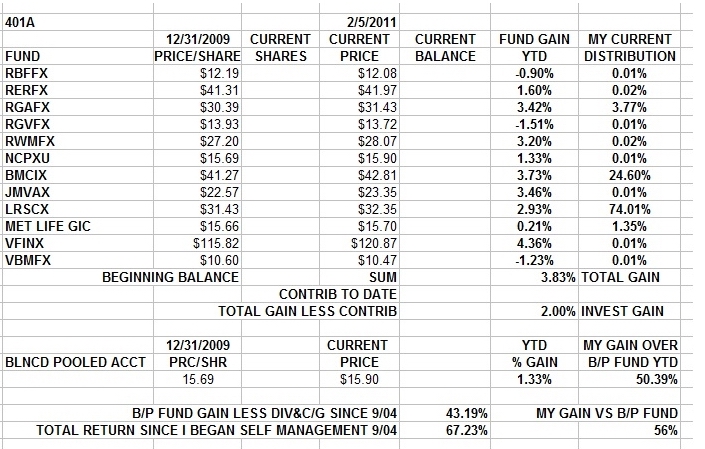

This a BLOG about my Union 401 Defined Contribution Plan.

Login

Contact Me

Stats

MY WEBSITE

joefacer.com

NEWS AND VIEWS

TheStreet.com

Money

CHARTS

Stockcharts.com

Big Charts

DATA

Morningstar

BLOGS

The Big Picture

Shark Investing

The Reformed Broker

Dash of Insight

This a BLOG about my Union 401 Defined Contribution Plan.

Login

| « | March 2017 | » | ||||

| Sun | Mon | Tue | Wed | Thu | Fri | Sat |

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | 31 | |

| 02/02/2026 | ||||||

Ya get to my age, you get used to losing the old timers. You become an old timer and you get used to losing your contemporaries; I went to my first High School reunion this year and I was surrounded by geezers, and not as many as there shoulda been. But when you lose one of the younger guys, it ain't expected and it stings. RIP Redbone.

Market Forces...Like My Daddy Always Used To Tell Me, "Son, The Bigger They Are, The Harder They Hit..."

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

That Hoo Doo That You Do So Well.....

tick..tick..tick..tick..tick..tick..tick..tick..tick..tick..tick..tick..tick..tick..tick..tick.. you hear somethin'?

Market Forces...Like My Daddy Always Used To Tell Me, "Son, The Bigger They Are, The Harder They Hit..."

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

That Hoo Doo That You Do So Well.....

tick..tick..tick..tick..tick..tick..tick..tick..tick..tick..tick..tick..tick..tick..tick..tick.. you hear somethin'?

Total: 106

Today: 4

Yesterday: 102

Today: 4

Yesterday: 102

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Defined Benefit Plan.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Defined Benefit Plan.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

joefacer.com/pblog - Page Generated in 0.0272 seconds | Site Views: 106

Calendar

Calendar