"Fear is an insidious virus. Given a breeding place in our minds it will eat away our spirit and block the forward path of our endeavors."

--James F. Bell

Chartz and Table Zup on

www.joefacer.com

HERE'S WHAT'S ON MY MIND...

I GOT THE FOLLOWING FROM THE HALL.

CLICKIT!!!!!

THE OTHER SHOE HAS FALLEN. WHAT HAS HAPPENED TO THE 401A HAPPENED TO THE DEFINED BENEFIT (what many call the "real pension")

Here's what I see...

My pension has been poorly managed for over a decade. You know all about that by now. Compared to the better managed pensions of other unions in the area, I don't have nearly what I should have. Therefore it is important to maximize what I do have, and to above all, not put myself further behind than I am already. So I gotta plan to avoid or minimize anything negative that could affect the plan.

What's the worst that could happen? From the mailing from the hall, excerpted above, if the defined benefit pension plan fails, the PBGC will provide roughly a third of my former pension dollars less all other benefits than the monthly check. That's assuming that they are capable of doing so. http://www.bloomberg.com/apps/news?pid= ... w3FJ3Nhf1Q Note that Fed and the treasury are already supporting the housing market, insurers, providing currency swaps to foreign central banks, funds to prime brokers, public corporations, private corporations, insurance companies, investment banks, retail banks, foreign owned banks, individual borrowers, hedge funds, mortgage holders and who the hell knows who else until we read the morning news. If the government is considering floating GM (public corporation) and Chrysler/Cerberus (private company/hedge fund)big bucks to close down half the jobs and support all the pensions of both companies in a bid to avoid the bankruptcy of both parties, which it is, the PGBC is likely going to be under major stress in the near future from this and similar events. If we can't make our defined benefit pension plan work, we'd risk being just another pension plan in a long line of plans in trouble looking for our fraction of a share from the taxpayers through the Fed/Treasury/PGBC.

The health of our defined benefit plan comes FIRST!!! Stay tooned...

Second comes the 401a plan. The defined benefit plan may require more funding to meet what has already been promised us. Greater contributions without increased benefits is a real possibility for the defined benefit plan. However, any additional funds going into the 401a plan go straight to the individual account holder's pocket. In an environment where EVERYTHING is going down, ya start of with a substantial tax savings equal to a coupla VERY good years of investment appreciation. And you have room to maneuver to eliminate or minimize risk. I work with a number of individuals with very substantial balances who lost at most a thousand or two dollars this year because they practiced risk control as I suggested. Being insanely aggressive and an active trader myself, I'm down less than $4K along with keeping my substantial profits from the good years. I practice risk control too. But I do lean to he long side. I'm comfortable with a little more exposure to risk in order to expose myself to a lot more upside.

So...As part of that, I've upped my 401a contributions the final two notches to the max available...I think it's the smartest move possible.

Clickit!!!!!

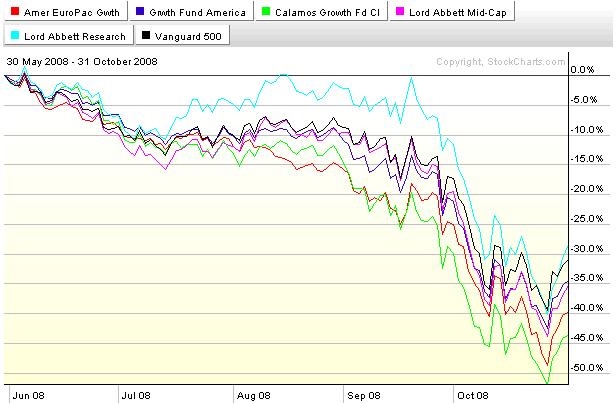

The intention not to lose my money in a VERY dangerous investment environment has kept me leanin' toward cash for much of the year. The chart above of the progress of the investable funds in the 401a shows the good sense of that. Avoiding losses is good. But...

There was a very nice bounce at the end of the month. I left a 10% gain on the table. I'd prefer not to do that... This weekend I'm going to have to think about that. I'll prolly write about that here.....

Like now.

CLICKIT!!!

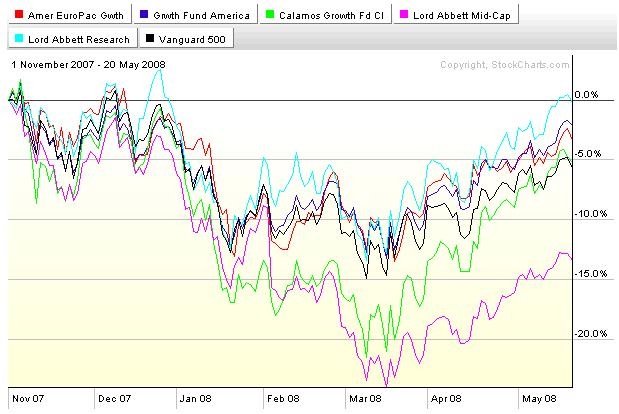

The bull market rolled over in November of '07. But we had a very nice bear market rally between mid March and May of '08. Everything was on the way to hell but the market went up 10%-15% anyway. Is the week long upturn of last week another of the same? Will it last long enough to play? How risky is it? Can it be played? How about rapid trading restrictions? Stay tooned...

CLICKIT!!!!

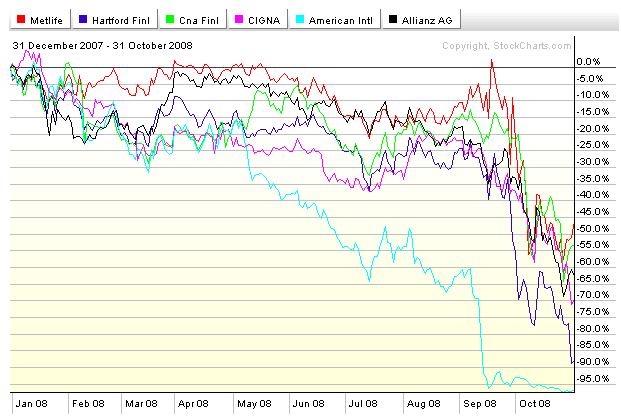

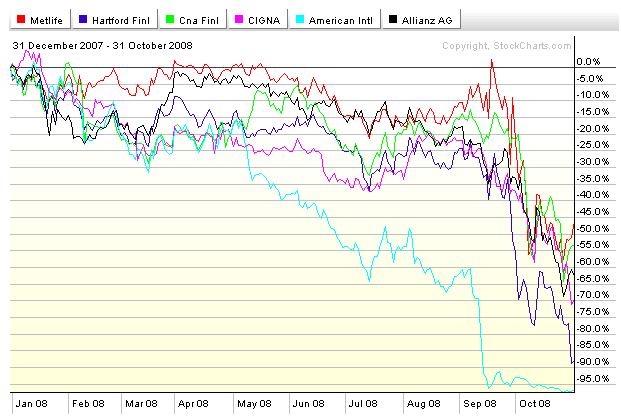

All the insurance companies are in the toilet. They are FINANCIAL companies. That has kept me out of the GIC for a coupla weeks. The RGVEX (treasuries and mortgage bonds)that I'm using instead is somewhat volatile and has cost me some bucks over the GIC. With the FED and the Treasury using the taxpayer to rescue the whole goddamned world, why not MET? The gov WILL support mortgages and treasuries. It MAY support MET. At some point this gets to be like the early/mid 80's. Either we're all going back to living in caves or we'll mostly make it through. At somepoint in the near future I MAY put some money back in the GIC on faith.......

My daughter in law won't open up her 401k. A buddy's wife logs on to her Schwab account every Saturday and screams, "STOP DOING THAT!!!" at the screen. You learn about risk control the hard way, if at all.

Clickit!!!!

'mazing!!!

http://www.ritholtz.com/blog/2008/10/whassup/

http://www.nbc.com/Saturday_Night_Live/ ... en/805381/

http://www.nbc.com/Saturday_Night_Live/ ... in/805401/

http://money.cnn.com/2008/10/30/real_es ... tm?cnn=yes

http://bigpicture.typepad.com/comments/ ... oneta.html

http://bigpicture.typepad.com/comments/ ... ve-03.html

http://bigpicture.typepad.com/comments/ ... -da-z.html

http://www.bloomberg.com/apps/news?pid= ... w3FJ3Nhf1Q

The intention not to lose my money in a VERY dangerous investment environment has kept me leanin' toward cash for much of the year. The chart above of the progress of the investable funds in the 401a shows the good sense of that. Avoiding losses is good. But...

There was a very nice bounce at the end of the month. I left a 10% gain on the table. I'd prefer not to do that... This weekend I'm going to have to think about that. I'll prolly write about that here.....

Like now.

CLICKIT!!!

The bull market rolled over in November of '07. But we had a very nice bear market rally between mid March and May of '08. Everything was on the way to hell but the market went up 10%-15% anyway. Is the week long upturn of last week another of the same? Will it last long enough to play? How risky is it? Can it be played? How about rapid trading restrictions? Stay tooned...

CLICKIT!!!!

All the insurance companies are in the toilet. They are FINANCIAL companies. That has kept me out of the GIC for a coupla weeks. The RGVEX (treasuries and mortgage bonds)that I'm using instead is somewhat volatile and has cost me some bucks over the GIC. With the FED and the Treasury using the taxpayer to rescue the whole goddamned world, why not MET? The gov WILL support mortgages and treasuries. It MAY support MET. At some point this gets to be like the early/mid 80's. Either we're all going back to living in caves or we'll mostly make it through. At somepoint in the near future I MAY put some money back in the GIC on faith.......

My daughter in law won't open up her 401k. A buddy's wife logs on to her Schwab account every Saturday and screams, "STOP DOING THAT!!!" at the screen. You learn about risk control the hard way, if at all.

Clickit!!!!

'mazing!!!

http://www.ritholtz.com/blog/2008/10/whassup/

http://www.nbc.com/Saturday_Night_Live/ ... en/805381/

http://www.nbc.com/Saturday_Night_Live/ ... in/805401/

http://money.cnn.com/2008/10/30/real_es ... tm?cnn=yes

http://bigpicture.typepad.com/comments/ ... oneta.html

http://bigpicture.typepad.com/comments/ ... ve-03.html

http://bigpicture.typepad.com/comments/ ... -da-z.html

http://www.bloomberg.com/apps/news?pid= ... w3FJ3Nhf1Q

Calendar

Calendar